A Troubling Number of Young People Expect Social Security To Be a 'Major Source' of Retirement Income

Twenty-five percent of young adults anticipate paying for retirement with Social Security benefits. The number should be zero.

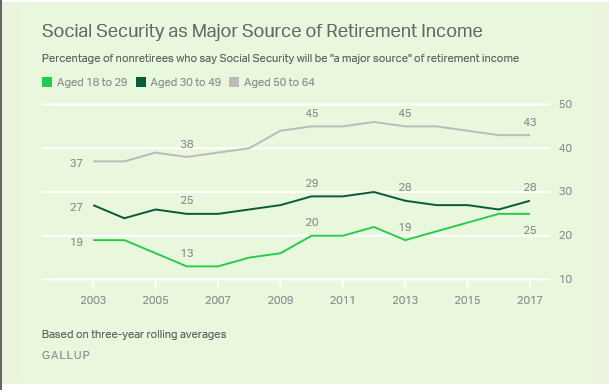

The prognosis for Social Security has not improved one bit since Vice President Al Gore promised to put it in a lockbox nearly two decades ago, yet 25 percent of Americans between the ages of 18 and 29 expect to rely on Social Security benefits in retirement. According to Gallup, which released this survey data late last month, 25 percent represents an all-time-high display of confidence for that age bracket since the group began polling on the question:

"This has occurred even as Congress and previous presidents have taken no significant steps to address the looming issue of projected shortfalls in Social Security funds," Gallup notes. So what phenomenon has convinced 25 percent of young people to believe Social Security will be there when they retire, when realistically the number should be zero?

Gallup's data tracks pretty neatly with the national conversation about Social Security's long-term viability. The decline in 25-to-35-year-olds' confidence in Social Security began in 2005, when President George W. Bush announced Social Security reform would be his top domestic priority. Faith in the program bottomed out during Bush's promotional tour for personal retirement accounts. By 2007, when young people's confidence began to climb back up, Bush's reforms were dead and buried. That confidence continued to climb through the financial crisis, and aside from a brief dip in 2013, has steadily increased since then. (Whatever financial anxiety President Trump has inspired with his erratic behavior, he has promised not to touch Social Security.)

It doesn't necessarily follow from this that young people are opposed to reforming the program. In May 2009, the Center for American Progress (CAP) released survey data collected from 915 Americans aged 18 to 29. "What is most important about these voters is not their current predilection for Democratic candidates," the survey authors wrote, "but rather the deeply held progressive beliefs underlying their voting preferences."

One of those beliefs: that "Social Security should be reformed to allow workers to invest some of their contributions in individual accounts," a "conservative position" (in CAP's words) that garnered support from 64 percent of the young people they surveyed.

Now is an excellent time to remind working age Americans that Social Security is not a sufficient primary income for today's retirees, and likely won't be for future retirees. While very few Americans of any age are prepared for retirement, millennials are better positioned than most to set up alternate streams of retirement income. As of right now, most of us aren't saving nearly enough using tax-advantaged savings accounts, but we have time. We should not spend it waiting for decisive action on Social Security, be it Bush-style reform or the opposite.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Who says government propaganda doesn't work?

Most. Gullible. Generation. Ever.

... if the 18-30 cohort is the "Most. Gullible. Generation. Ever." for having 25% expect Social Security to be a major part of their retirement income, what does that make every older cohort that has even higher expectations?

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.webcash10.com

What I'd like to see is an income breakdown for that group. Because I doubt they are paying much (if anything) in the form of FICA anyway.

They are the people who were always going to be on the dole. The problem is, that percentage is only growing.

Actually I am surprised that the number isn't higher. Now that both tribes have completely accepted perpetual and endless Social Security forever and ever, why wouldn't people's expectations rise even further?

I was thinking the same thing. Maybe millenials are alright after all.

That's why the numbers are up. It's no longer a political football, so people have gone back to sleep on the issue.

Meh. When we have the Guaranteed Basic Income we won't need Social Security.

If we put everybody on Social Security, we wouldn't need a Guaranteed Basic Income.

When we have GBI old people will still demand SS "because they've paid into it they're entire lives and promises were made."

Damn right, sonny boy! And we will use our assault canes to enforce our rights on you slackers if you don't pay enough taxes to honor the bonds our taxes are invested in. (assuming our power wheelchairs can catch you)

It's troubling that the number is going up, yes, but the young are still the most skeptical of all three groups, and the fact that 64% are willing to consider privatizing the system, at least partially, even though most think of themselves as "progressives" is actually kind of encouraging.

As always, I would love extended answers sampled from them asking what that question even means to them.

This is what I find fascinating and somewhat encouraging, as a lot of youngins' seem to take the word scramble the public schools have given them and reasoned with it anyway.

This is the generation that likes "Socialism" and dislikes "Capitalism," but likes "free markets" and dislikes "top-down government control."

I think if you asked a "typical millennial" what they think of privatizing Social Security, they would scream "Evil! Evil!" But allowing people to divert that withholding into a privately held, interest-bearing retirement account, why that's just smart government.

Talking to a millennial is like walking on eggshells, isn't it. So many trigger words.

'trigger' is the most brutal of all trigger words, because - guns.

What's discouraging is the change over time. Of the 30-49 group where 28% believe it will be a major part of their retirement, presumably about half of them were in the 18-29 group where 13% agreed with that statement 11 years ago. That suggests that in another 11 years, we may see something like 40% of 30-49 group believes it will be a major part of their retirement. Probably not that big a jump, but the older groups are increasingly likely to believe it. So when will we actually see reform? The inevitable failure of this ponzi scheme is constantly becoming more obvious, but yet the expected reliance on it also continues to grow.

The 30-49 group should be at the point where they are making adult money and are less dependent. The blissful ignorance of their youth should have been burned away by now. Unfortunately, they are probably at the point of realizing that they're halfway through their career, have no savings, and are screwed without SS.

I suspect because as with global warming, those of us who are currently in our 40s have been told periodically all our lives that Social Security will run out by date x.

The closer you get to actually collecting, the more likely it seems that you will.

This sort of gets back to what I was saying above - I won't be surprised if the name "Social Security" eventually gets applied to a heavily re-tooled program where you essentially get a pre-tax deposit in an IRA. As long as it can happen without any politicians having to admit to privatizing social security, it should be fairly uncontroversial.

Good point re: global warming. I suppose that there's ample evidence that our government will borrow as much as possible to keep it going indefinitely. I still don't see anything in the near term that will force the gov't to address the problem.

But, I wouldn't say that SS will be a "major source" of retirement income for me. I assume that over the next twenty years, what I would get will steadily be reduced, so I don't consider it a big part of my retirement planning. Also, I expect one of the first reforms would be means-testing. So the 20% or so of the population with a retirement account balance that exceeds about $5k will probably be means-tested out of SS.

I was annoyed reading the article by the author going back and forth about acknowledging the "major source" part of the survey results.

I'd be happy with a congressman's pension and health care. So would 99.9999% of Americans.

You're going to max out at about 30 percent of your final income with Social Security. So that's 70 percent you gotta supply your own bad self.

Get to saving.

Well that won't happen since current homeowners are busy with their own cronyist snouts in the trough making sure savers get killed.

Negative real interest rates can't continue forever can they?

A decade and counting. And ACTUAL negative interest rates are on the table once they ban cash.

Only until the end of forever and/or the end of bureaucrats' and their families' lives.

Uh, when not saving for oneself. and paying taxes on income that is being used to live on - to say nothing about spending money on kids or on trying to impress potential mates - one can live on a lot less.

As of right now, most of us aren't saving nearly enough using tax-advantaged savings accounts, but we have time.

Can someone make the case for putting anything more than an employer match in a 401k? I've always seen it as keeping me from having access to my money for decades while trusting that the feds won't decide to change the rules on these accounts that whole time.

Buy houses.

So what happened when 3D printing makes housing dirt cheap?

what *happens*

If the money is just sitting there, gov thieves will have a hard time keeping their filthy mitts off of it.

Is this an argument for or against keeping money in a 401k? You can have money "just sitting there" or not in both cases....

There has already been preliminary discussions about changing the status of 401(k) accounts across the board. There's enough money involved to make raiding them worthwhile.

I would like to see them try. We haven't had a revolution in a while.

Yeah, I think that 401ks and IRAs will be left alone for the same reason nothing is ever done about Social Security. Way too many people have an interest in it staying the way it is.

Agreed. I am in favor of Guaranteed Income, but there would be h3ll to pay if my Roth IRA is taxed!

It's politically untenable to raid 401Ks. Not because a majority of people have sizable 401K balances, but because the people who do are also the people who vote regularly and contribute to politicians. We may get some forced contributions into government bonds and some stingier contribution limits, but they're not stealing the money.

We may get some forced contributions into government bonds and some stingier contribution limits, but they're not stealing the money.

You're kidding, right?

That statement is Social Security. The so called trust is backed by bonds, backed by fiat currency, backed by the full faith and credit.

They won't 'raid' the actual accounts, for all the reasons you noted. But they will skim off an ever increasing percentage of the money you inevitably take out of those accounts.

If it ever comes to that, the country will be so far gone it would be prudent to retire elsewhere.

I'm sure the citizens of Argentina thought that too.

And don't think it hasn't crossed the thieving bastards minds before.

And may still be on their minds.

I can't. I diversify in retirement accounts. All retirement savings after the employer match is reached go into a Roth IRA and savings for a down payment on a second house (so we can rent the first). I know, there's nothing saying Congress won't change the law so they can tax Roth disbursements in the future, but I think it's worth it to put some in there just in case.

Instead of taxing Roth accounts in the future, I think they'd be more likely to demand that a certain portion of a standard 401K contribution instead be directed to a Roth account so they can tax that up front.

That would certainly end with fewer congressmen being voted out of office, until they phased out 401k's altogether... Then what?

The case for tax deferred accounts is that you can take it out when your income and your tax bracket are lower. That's a couple of big ifs, but if you live in a high tax state like California, you can shelter some of the money from their grasp and then retire somewhere with no state income tax when you take it out.

I called it correct - I took advantage of converting my TIRA into a Roth because I could see that the future was in a higher *implicit* tax rate. The 20% or so implicit tax rate due to ObamaRomneyHeritageCare proves it.

*correctly*

Since the returns compound tax free, money invested in a 401k/IRA will grow significantly faster than the same amount of money invested in a regular investment account.

Irrelevant since the tax is linear. The only thing that matters is the effective rate you'll pay. If you expect to be high income in retirement then a 401k is a bad deal relative to just paying a 20% cap gains.

So long as you plan, and stick with, a buy and hold approach over that term.

Become even a slightly active trader and those cap gains can eat your long term lunch.

Depends on your expected tax rates. For most ppl they will have a lower rate in retirement, so a 401k deferral is good. For high earners it might make more sense to go with a roth, but of course they don't allow that except thru the stupid 2 step of std ira converted to a roth.

I love negative interest rates. They remind me of decades ago backpacking in in Brazil.

FTFY.

The other 75% are dullards.

Why is the age group LEAST likely to believe the troubling thing the one that gets called out in the headline? Why not title the article "75% of young people have accepted that they are getting robbed blind by the Baby Boomers"?

Two reasons:

1) Beating up on the "stupid millennials" is a time honored pastime here at H&R. I engage in the practice myself quite a bit to be honest. It's fun and they're an easy target.

2) 18-29 year olds are young enough to have heard almost their entire lives about how "Social Security is in trouble" and "the 'trust fund' is going to run out in a few short years" blah, blah, blah. You can't entirely blame older generations, especially boomers, who were lied to their whole lives about how they were "paying into SS" and it was "their money, the government's just holding onto it for you so it will be there to help you out when you retire" and all the other horseshit they were fed. But the millennials and whatever they're calling the next generation behind them? They've been warned their entire lives, yet apparently 1 out of 4 of them still think it's going to be there for them. That's really fucking stupid.

18-29 year olds are young enough to have heard almost their entire lives about how "Social Security is in trouble"

So are 30-49 year olds at this point.

Gallup has data showing that as far back as '89 about half of non-retirees believed that Social Security would not be able pay them a benefit when they retire.

So sure, back when I was in elementary school we were hearing how bad-off Social Security was. But my parents were as old as I am now and heard the same thing.

Which actually is part of people near retirement age today think it'll be fine. Because they've been hearing "it's all coming down" for the past 30+ years. And it keeps not happening.

Maybe because this group is at its LOWEST level of disbelief since they've asked the question.

Finally, definitive proof that youth ARE getting stupider.

It will be a major source for many.

They may be living in trailers and eating ramen noodles, but Social Security is still going to be a major, if not primary, source of income.

You know my father-in-law?

Yes. The guy down the road with a large vegetable garden and a chicken coop. He has a sign out front that says "Night Crawlers For Sale".

That, and twice a year junkets to exotic destinations is pretty much my dream retirement.

Actually, living in a trailer has its advantages. For instance, I can afford to eat steak instead of noodles, because I paid cash and have no debts (OK, technically, part of my cell phone bill is buying a phone).

I get by on social security and just over $500.00 a month pension. I have a modest 401k for emergencies, but live on the social security cash flow.

The 'trailer park' has three pools, basketball courts, tennis courts, a fitness center (glorified gym), volleyball courts, the obligatory shuffleboard and bingo, and lots and lots of shade trees around the lakes.

Thanks for having a job paying taxes.

I require a nearby trout stream or bass lake. And forests that aren't posted.

Both available nearby, but arthritis makes it not so much fun anymore.

I bet you can find a trailer park like that though - - - -

The Fruit of Public Education rots on Vine.

"If you like your social security, you can keep your social security."

All of my retirement planning assumes I will get nothing from SS or my pension. In reality I expect to get something from both, but only a fraction of what is currently being promised. Either way it will be treated as a windfall and nothing more.

This guy gets it.

That is my assumption as well. The truth is, if/when SS collapses, it won't be a real collapse. Everyone will just take a "haircut" either via an actual reduction in benefits to match the SS fund income (currently forecast to be 79% by 2034: http://money.cnn.com/2016/06/2.....index.html ), or via borrowing/printing money to make up the difference.

No they won't. It will be a race to see which happens first: removing the income cap or means testing. In either case we will continue to gratify the grasshoppers by eating the ants.

I think it will be an "all of the above" approach. Means testing will decide how much of a haircut you take, but everyone will continue to get something back because the whole reason SS was passed and continues to be popular is the idea that we're all in it together. Removing the income cap will probably be the easiest thing to pass, so I expect that to happen first. Printing money is sort of always happening so I don't know that that even counts as being specific to handling the SS liability.

Just cover them in chocolate.

Historically speaking the solution to these 'problems' has always been inflation.

There is no valid reason to think otherwise this time around.

It's not that surprising. Most people now retire with little net worth outside of their house, and rely on SS to subsist. That probably won't change for people who are young today.

I would say just privatize the system and let 2 or 3 big insurance companies run it, but then it would be illegal to pay out benefits to people using contributions from others. I believe the correct term is "Ponzi scheme".

The best bet is probably to go to Bush-style private accounts over time, but Trump doesn't want to touch SS and the Democrats just want to raise taxes to keep the corpse funded for a while longer.

It's not illegal when the government does it.

Most people now retire with little net worth outside of their house, and rely on SS to subsist. That probably won't change for people who are young today.

Except that they won't have any net worth in a house either.

It's amazing how little has changed in 120 years. In 1900, more people owned their home free-and-clear than today (with the possible exception of Jim Crow South and the Northeast). The entirety of the 'homeownership' debt scam has resulted in damn near nothing except the embedding of permanent inflation and the creation of serfdom via rent/mortgages. And back then they didn't have SS either - but they were paid in gold coins and (outside Jim Crow South and Northeast) could bury them somewhere to fund a relatively short retirement.

Unfortunately because gold standard is actually always a banknote standard, they deposited them gold coins into banks. Then got screwed by the banks predictable failure to pay them back in gold. Then both the banks and the retirees got 'bailed out' by the govt - via govt letting banks off the hook for their gold deposit promises and mortgage subsidies and giving retirees a SS promise. And after 80 years, everyone (except the banks and pols) is worse off than before.

I'm trying to figure out why burying gold wouldn't work in the South or Northeast. Soil too rocky?

Uh - the land wasn't theirs. Renters/sharecroppers can't bury their valuables.

"Except that they won't have any net worth in a house either."

Yep, ten or twenty years from now most homeowners will be lucky to break even (and that's not including upkeep expenses.)

Owning a house right now is more of a lifestyle choice than anything else.

And buying a house right now, in any sort of 'hot' market is the definition of insanity.

We have yet to face the full brunt of the baby boomer generation retiring and dying off - it's only just starting.

I would argue that the boomers are the first generation raised on the expectation that absolutely everything would be taken care of for them, and there would be no need to worry about the future. Many, many of them took this assumption and ran with it for all it was worth.

Over the next 10-20 years we're going to see first hand how that works out, and it's unlikely to be pretty.

We may just end up somewhat transformed as a culture.

Just legalize heroin after retirement. Problem solved.

We have a significant number if millenials who are pollyannish innumerates. But we know that they like Bernie Sanders, so that was obvious.

64% of millennials may support some form of privatization, but I find it hard to believe a similar percentage of them are also actually taking advantage of existing retirement investment opportunities

When you live in your parent''s basement, social security probably will be a major percentage of your retirement income.

Assuming your parents don't go the reverse mortgage route and sell away your planned inheritance.

RE: A Troubling Number of Young People Expect Social Security To Be a 'Major Source' of Retirement Income

Twenty-five percent of young adults anticipate paying for retirement with Social Security benefits. The number should be zero.

Ugly thought for the day.

Privatize SS, or at least allow all the unwashed masses choose the SS they would like, either from our wise, benevolent and oppressive government, or choose a market based form of SS.

Oh never mind.

The masses should never have choice.

That only allows them to think for themselves, and we all know what that leads to!

18 to 29 year olds, or at least 25% of them, also probably haven't had a look at their retirement savings at all so this isn't really that surprising.

When congress passes a law - Does that process meet the definition of conspiracy?

Is Social Security a scheme to defraud investors?

Are some citizens above the law?

What a fine mess we've made.

Remember that the tax part of social security is separate from the payment part. There is nothing in the law requiring them to balance out. What got left out of the equation is us old guys living too long.

What we have is what would come of any 'privatization' scheme. They would write the law so that the investments have to be almost risk free, so it would all go into government bonds. Oh, wait. That is what is happening now.

It's not fraud because, shortly after passage, SCOTUS ruled it was nothing more than a tax.

Your FICA contribution buys you nothing.

Most likely there will still be some benefits, just not as much as they expected. I believe the short fall is about 21%.

The key to living on less is careful planning. Knowing what is necessary and what can be done without. Some parts of the country are a lot more expensive to live in than other parts. TV is still "free" if you can put an antenna. Tracfones don't cost very much. Usually public libraries are free if you get a card for one. Cook your own food. Grow some if you can.

I can't understand how anyone would think social security is still a good idea. You are forcing poor people to put away about 6.5% of their income and that poor person's company to match that amount. Poor people need the money now, but also I would love at least a 6.5% pay boost.

Maybe you would save it. That's a non-starter.

The real problem is you, and too many others, think and talk like that 6.5%, along with the employer match, is actually 'put away' in some tangible, fiduciary form. When in reality it is nothing more than tax receipts used to fund existing operations.

Government coerced savings is not my idea of libertarianism, but it would still be a step up from what we have right now. Which is nothing more or less than generational theft.

The only thing I ever wanted from Social Security was the freedom and independence that was stolen from me. Never wanted it, never needed and in fact would be far better off without it. FDR took a nation of free people and forced them into dependency on a scam he knew was not financially sound the day it was signed into law. He was warned by his Treasury Secretary Morgenthau and Witte, the economist he appointed to head the committee to create Social Security. Ignoring their warnings he flipped the middle finger the children, grandchildren and great grandchildren of those that voted for him.

If I had been able to save the 12% the government claimed and put it into my own saving, based upon it's performance (which really has not been stellar) I'd be looking at retirement in under ten years, not the twenty I'm facing now.

... do you really think your on-paper wages would be 6% higher if the government wasn't collecting Social Security?

Do you really think my employers have been overpaying for my services all this time only because the money went to the government?

Enough millennial bashing, even if the headline about them gets us to click. Looking at the numbers for the other age groups makes the youngsters look pretty smart.

How can more than 40% of the 50-64 year olds expect SS to be a "major source of income"?

What would be a lot more interesting is a cross-tab by age and income. I expect that people in good-paying jobs with retirement benefits and employer-matching in their 401K are less likely to expect that Social Security will be a major part of their retirement then folks that have no job benefits.

It's been the 3rd Rail of politics for generations; the libertarians have failed. And any shortfall in the future will be made up by Guaranteed Income.