New York's Single-Payer Health Care Plan Would Be More Expensive Than New York's Entire State Government

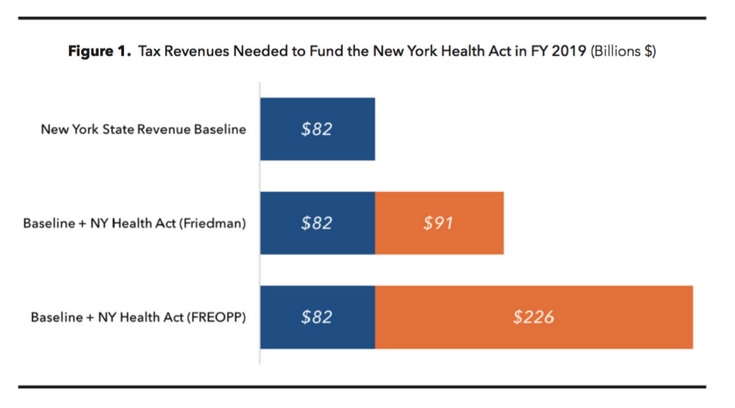

New York collects about $80 billion in revenue annually, but the health care plan passed Tuesday would cost at least $91 billion every year (and probably more).

The single-payer health care plan that cleared the lower chamber of New York's state legislature on Tuesday would require massive tax increases to double—or possibly even quadruple—the state's current annual revenue levels.

The state Assembly voted 87-38 on Tuesday night to pass the New York Health Plan, which would abolish private insurance plans in the state and provide all New Yorkers (except those enrolled in Medicaid and Medicare) with health insurance through the state government. The same proposal cleared the state Assembly in 2015 and 2016, but never received a vote from the state Senate.

The bill might get a vote in the state Senate this year—for reasons that I'll get into a little later—but the real hurdle for New York's single-payer health care plan, like similar efforts in other states, is a fiscal one.

New York collected about $71 billion in tax revenue last year. In 2019, when the single-payer plan would be enacted, the state expects to vacuum up about $82 billion. To pay for health care for all New Yorkers, though, the state would need to find another $91 billion annually.

And that's the optimistic view. In reality, the program is likely to cost more—a lot more.

Gerald Friedman, an economist at UMass Amherst and longtime advocate for single-payer health care, estimated in 2015 (when the New York Health Act was first passed by the state Assembly) that implementing single-payer in New York would cost more than every other function of the state government. Even if New Yorkers benefit from an expected reduction of $44 billion in health spending, which Friedman says would be the result of less fraud and less administrative overhead, the tax increases would cancel out those gains.

To pay for the single-payer system, Friedman suggested that New York create a new tax on dividends, interest, and capital gains that would range from 9 percent to 16 percent, depending on how much investment income an individual reports, and a new payroll tax that would similarly range from 9 percent to 16 percent depending on an individual's income.

It was a similar prescription for massive tax hikes that sank Vermont's experiment with single-payer health care in 2014. Funding it would have required an extra $2.5 billion annually, almost double the state's current budget, and would have required an 11.5 percent payroll tax increase and a 9 percent income tax increase. Voters in Colorado rejected a proposed single-payer health care system when they found out how much it would raise their taxes, and efforts to pass a single-payer plan in California (being championed by U.S. Sen. Bernie Sanders, the Vermont progressive) are facing similar financial troubles.

Back in New York, a second analysis of the single-payer health care plan, suggests that Friedman's projections significantly underestimate the cost of single-payer in New York (while overstating the savings).

According to the Foundation for Research on Equal Opportunity, a Texas-based free market think tank, the annual price tag for the New York Health Act could be as high as $226 billion. In other words, it would require quadrupling the current tax burden in New York.

"While the New York Health Act would expand coverage to the uninsured in the Empire State, it would do so at a staggering cost that would drive hundreds of thousands of jobs out of the state," wrote Avik Roy, who authored the FREOPP study. "The resulting economic crash would cause far more harm for lower-income New York residents than they would gain from acquiring state government-run health insurance."

The gains would be quite limited, as Roy points out. In 2014, only 8.7 percent of New York's population lacked health insurance. Transitioning to a single-payer system would disrupt coverage for millions of people—potentially forcing them to find new doctors and accept coverage that differs from what they would otherwise choose—in the name of extending coverage to that group of uninsured. Providing health insurance to those who cannot afford it is a noble goal, but there are less disruptive, less expensive ways to pursue that goal, Roy argues.

Despite Friedman's promises of savings from less fraud and fewer administrative costs, the FREOPP study suggests that both costs would increase, as has historically been the case in government-run health care programs. (Read the rest of Roy's detailed analysis here.)

Regardless of who is correct, one thing is clear: The New York Health Plan will be devestatingly expensive for the state, and for anyone who lives or works there.

Setting aside the important policy questions for a moment, the politics of passing single-payer in New York's state Senate could get really whacky.

There are 63 seats in the upper chamber, so 32 votes are necessary to get anything passed. Right now, no one has 32 votes. Republicans hold 31 seats and Democrats hold 31, with one vacant seat in a heavily Democratic district set to be filled with a special election on May 23. It might seem like that would give Democrats the majority they need. But Senate Democrats are split into three factions, one of which—the Independent Democratic Conference, which has eight members—is part of the majority coalition supporting Republican leadership in the chamber.

Assuming there will be no Republican votes for it, passing the single-payer bill in the state Senate would require getting all Democrats to vote "yes," despite the ongoing schism between the mainstream Democrats and the more moderate IDC members. There's at least a pretty good chance that moderate Democrats will take a look at the cost of the health care plan and decide they can't stomach it. The question is whether they will have a more powerful incentive to distance themselves from Republicans—either because of Trump's down-ballot toxicity or because of the GOP's floundering health care effort at the federal level, or for any other reason—and throw away an oddly compelling experiment in legislative politics in the process.

State Sen. Jeffrey Klein (D-34), the head of the Independent Democratic Conference, told The Huffington Post that he would support the single-payer plan because it would provide "peace of mind" for New York residents.

Doubling, or quadrupling, his constituents' taxes might not have the effect that Klein thinks it will, but that's between him and the people who elect him. There's no timetable for the state Senate to take up the bill.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

less fraud and less administrative overhead

Just like the VA!

Surely the great state of New York would have much less fraud and graft and be much more efficient.

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.webcash10.com

Yes the single payer plan for Vets. Or Medicare the single payer plan for seniors whose own Trustees say is 65% short of money needed to pay promised benefits. What a deal?

Hey, does anyone who doesn't live in New York need a roommate? I can cook, and clean, and I look positively radiant in a French maid's outfit.

Aren't you banned in like 45 other states? My thoughts and prayers are with you.

Aren't you banned in like 45 other states?

He refuses to rest until the other 12 follow suit.

You can be my maid, but you must agree BEFORE you see what you will be cooking and cleaning.

Everyone is welcome to come sleep on my couch. Even you.

You can stay with me for a small fee. Consult AirBnb

Help offered like a true Randroid.

Nothing's free.

Ass, Grass, or Cash.

With Crusty, it's ALWAYS ass.

sorry.

Ass && (Grass || Cash)

bonus points because the syntax kinda looks like an ass too.

I choose to outsource rather than assume the liability fully on my shoulders - which is a cost.

Providing health insurance to those who cannot afford it is a noble goal

The nobility of the act is negated by the involuntary nature good is provided by.

There's nothing noble about a policy that would lead to more people dying in the streets in the long run. Socialism works until you run out of other people's money.

After all, Hugo Chavez provided health care to those who cannot afford it. Just because it is provided doesn't mean the proles get to receive it.

Yeah, there is absolutely nothing "noble" about the State providing anything for anyone. It may be noble for the private sector which is kind of funny because that is pretty much exactly where we are now. That 8.7 percent lacking insurance aren't dying on the streets, are they.

I knew two people that had no insurance and one had Medicare only and the other was on SSI and both had operations and plenty of medicines. Both abused alcohol heavily and did not stop after ops. Neither had anything and never paid for any care. People were not dying in the streets before Obamacare.

Also, there's no way in most cases to differentiate between those who allegedly "cannot afford it" and those who can, but just flat out don't want to pay for it.

Your single prayer pran racks disiprine.

They're gonna need to build a big, beautiful wall around New York to keep the rich jerks from leaving en masse once they realize they'll be paying for it. Or a crippling exit tax.

And then, if Air Force One crashes in there, we've still got Kurt Russell around to get the president out.

Can we just have Kurt be president?

Can we just have Kurt be president?

I predict a lot of new investment banking "field offices" in Hoboken.

I am surprised that hasn't already happened, but I guess those guys really like being around the city. Or, they will just invade Connecticut en masse.

My guess is that the state offers all kinds of incentives to keep them there even with the onerous taxing and regulations. They are giving away all kinds of tax deals and cheap land to companies to re-establish in new york state.

Stamford already has more Fortune 500 companies based in it than any city except NY for probably similar reasons. Maybe they'll take the top spot now.

The back offices have all moved to NJ already. The only workers left in Manhattan are executives and the restaurant workers that feed them.

They're gonna need to build a big, beautiful wall around New York to keep the rich jerks from leaving en masse once they realize they'll be paying for it. Or a crippling exit tax.

Yeah. Nobody wants those idiots to ruin other states with their asinine policy preferences.

"Yeah, my last state is an overtaxed shithole. Let's move to this nice, smaller state...and turn it into an overtaxed shithole!"

I often see more license plates from Massachusetts and NJ where I live in Northern Virginia than I see Virginia plates. The worst though are the people who insist on adorning their cars with Red Sox/Patriots flare.

Isn't that what happened to Vermont? At one time I wanted to move back there. Not anymore. As for NYState, I think there would be a lot of god for the majority of the state (landmass-wise) if we kicked NYC out of the state. It's that dangly cesspool down there that ruins things for the rest of us.

If a small-scale, rural, hyper-left hippie burnout reservation like Vermont couldn't figure out how to make single-payer work, the New York legislature is truly off the bend if they think they can do the same system there without dramatically ramping up the tax burden on the fine residents of NEW YORK CITY where most of the money and population reside.

Everybody's pushing small town rural.

And don't forget New York just passed that whole 'free college for people making less than $100,000 a year' (or something to that tune.) just a few weeks or months ago.

New York City is going to bust the entire State's budget all on it's own, methinks, but I'm sure it's only because they couldn't loot the rest of the country. Nevermind that if it can't succeed on the income of the people who use it in a state, than logically the entire country couldn't do it either even if it's a wider tax base.

I imagine in 100 years time New York will be a cool place to go Urban exploring in since everyone will have moved elsewhere by then, one way or another.

Stop calling it 'single payer', its the taxpayers will get the bill and it appears even they don't have enough money.

They are paying for it now. Just that the way that its being paid for now is same flat-fee for everybody rather than percent of income. And the more expensive medical care gets, the more the current system will be viewed as just another form of poll tax.

Your inability to see the conceptual difference between people paying for goods and services they themselves consume and some people having to pay for goods and services consumed by other people explains a lot.

Really. So please do explain how 85% of people pay the medical expenses of 15% of people - NOW. Their insurance costs are NOT based on what they consume AT ALL. They are NOT based on any actuarial likelihood/risk of what they MIGHT consume in THAT year. And since the risk pool has to reset every year with mandated annual enrollments; there is ZERO possibility that health insurance can ever be anything but - a flat capitation tax on everyone with the money used for goods and services consumed by a very tiny subset of people.

Further - most medical goods/services with the exception of prescription drugs are actually quite income elastic - ie the demand for specialists/etc rises with income comparable to apparel/entertainment/restaurants. It is the main reason that life expectancy for lower income quintiles is comparable to Third World - actually 'going to the doctor' is a luxury that can't be afforded by the poor because 'insurance' also has a flat deductible that it doesn't cover. Yet everyone is expected to pay the same dollar amount for the insurance that supposedly 'covers everything'. It's a complete scam.

What explains a lot is how much you want pretend that 'health insurance' can actually be the basis for a free market. Maybe it can - but not as it exists in the US with the medical system structured the way it is structured.

Except it isn't. Different policies at different companies for example have different costs and benefit levels. Even in the same company multiple policy options are offered and in my company in particular employee contributions kick in at different rates depending on income levels. That doesn't even get into the fact that a family of 3 pays the same monthly rate as a family of 7.

That said in addition to being wrong on the basic facts you miss the real issue. The real issue is that these government programs are not voluntary. I never ceased to be amazed at the way progressives react in shock when they learn some people don't like a gun being held to their head.

I spent 20 years structuring benefits plans for companies and - you're generally wrong.

First, employer plans cover a declining portion of the 18-64 population - 68% is most recent. So as a rough guess 50%+ of the lowest half doesn't get employer subsidy cuz no employer plan. Maybe they are in the individual market (mostly a scam). At any rate - bankruptcy court is where the bigger bills get 'resolved'.

To the degree that they have employer plan, the chances are their employment is more erratic so they more often pay 100% of a FLAT cost (no subsidy) via COBRA. To the degree that employers are self-insured (more than a couple thousand employees); they can know utilization by both income and age. NO company out there skews their employee contributions by income as much as utilization is skewed - and the age-related utilization is a major reason why older workers are fired more often. Executives at public companies get supplemental non-ERISA plans (100% subsidized) that you don't even know about.

Employer plans stopped working as a 'health care access solution' when one-company careers ended in the 1980's. And the more expensive medical gets - the more it will reinforce the growth of erratic employment.

This would make more sense if anything you said had anything to do with what I said.

I thought the 'single' referred to their plan for a society consisting entirely of single, welfare-dependent moms

(single? pay 'er...I'll be here all week)

I hope they go all in so once again another socialist experiment will fail in a spectacular crash.

As long as they don't do this stuff in the southeast which is about the last chance for the US economy. Less union domination, less insane leftists group think, less overt government controls. At least for now, that is why the southeast and Texas are still doing well.

Let the northeast rot since they went left so very long ago.

And, on the bright side, all of those evil profiteering doctors, nurses, staff, ambulance drivers, janitors, florists, maintenance companies, insurance company employees, etc... will finally have to go out of business and they won't have anymore jobs or income.

Then the Marxists who support socialized medicine will finally get their utopia of desperation, starvation, and misery just like in Venezuela.

Why? because this time we will do socialism correctly and it will work, right?

Arizona is doing okay now too. Jeez.

OK. Add Arizona. I can only pay attention to what the statists are trying to do in southeast. I do not hold much optimism that the class warfare bolsheviks will not continue gain traction here too.

After all, that is the central tenant of all politics. Foment ager between labor and employers, i.e. smart people. The age old envy trick is a standard that will never go away. It took 100 years of brainwashing to make the majority of the population into zombies for "the little guy". The little guy who would be toiling in misery and stagnation were it not for the smart guy who became the big guy.

If you don't count Pima county

It would be easier living here if Tucson would fix their roads. Marana fixes theirs. Come on.

They'll complain that it didn't work because it didn't go far enough and they couldn't force other states to go along with it to save money with economies of scale.

Just need the right Top Men

Just need the right Top Men

Don't lump NH into the Northeast states. We have a weird but somewhat effective government, in that things move pretty slow due to the size of our House of Representatives and Senate. The highest per capita representation in the world and the third largest Congressional body (behind the US federal government and British Parliment).

I support this experiment on one condition. When the people who elected the proponents of Single Payer in NY flee from their socialist utopia, they are prohibited from voting in their new state of residence. Don't let the cancer spread.

Right now employers pay for a big chunk of health insurance costs. When private insurance goes away, where do those payments go? Is that burden then shifted to individuals? Or do companies have to pay that to the government now?

They will always ago after the evil corporation first in what will obviously be passed onto the customers and the employees.

Marxists are the dumbest of dumb assholes They are just smart enough to know that the class warfare language works just fine for them to bilk the system long enough and get out of dodge when the shit hits the fan.

The only way to fix our broken system is to hold politicians liable for their actions for about 20 years after they pass a bill. Won't happen but would be awesome to see Bush, Obama, Clinton all brought to trial for programs that turn out to be wasteful and thieving.

"Right now employers pay for a big chunk of health insurance costs."

Nope. Right now employees directly transfer money to health insurance companies that otherwise would go into employees' paychecks.

less fraud and less administrative overhead

Because adding more bureaucracy does these things......

*sigh*

You know the saying, "less is more"?

They'll make it up in volume.

Maybe they can pay for it with a tax on hospital administrators.

Or a tax on the machine that goes "Ping!"

Oh please pass this. I will be on the first bus out of here.

You're the first person I thought of when I read this post and that is exactly what I expected to hear. On your way out, spray paint the sign to read: "Welcome to New Detroit".

It's a shame because I like the city. But the city doesn't like me.

That would be Poughkeepsie.

Do the progs want to drain the coastal states of voters so they won't even have the "we won the majority" argument any more?

What makes you think they won't go to other states and vote the same way? If they flee you are just spreading the cancer.

Hi everybody. Long time reader, first time poster.

Just wanted to say "what could go wrong?"

Everything. Everything could go wrong. ^_^

So, looks like we aren't going to need that earthquake to use as an excuse to wall off Manhattan then.

This is the curse when so many people in a city decide that a liberal arts degree is a great idea and not one in accounting or the like.

So with all the hipsters covered by their parents' insurance, all the CEOs whose residences are officially out of state, and all the wealthy progs moving to Canada/Finland/France, who exactly will be left for NY to squeeze the tax revenue out of?

The rest of the country with a financial transaction tax for trading on the exchange, of course.

Do you really think they'd do that? I mean - it's bad enough to cripple your local economy, but to drive out the only non-local thing that would still make money....

Granted, I bet London would be all for this.

Don't give them ideas.

I look forward to the Kansas City (KS) Stock Exchange

Those of us in the State of New Jersey, who will benefit from the massive outflow of employers and others seeking to escape from the ridiculous tax burden this law will impose, fully support its immediate passage. After all, I am looking to sell my late father's home, and a massive influx of tax refugees from New York can only increase the property value.

Realizing it won't actually work the way it is supposed to, how is this supposed to even work if someone from New York goes outside the state and gets injured?

Or lives in NY and works in NJ, as I do?

Supposed to work? Work is an oppressive manifestation of the patriarchy. It just supposed to feel good.

"The state Assembly voted 87-38 on Tuesday night to pass the New York Health Plan, which would abolish private insurance plans in the state and provide all New Yorkers (except those enrolled in Medicaid and Medicare)"

Why throw the poor under the bus, or is the implication that their single-payer program will be at or around the same level of service as Medicaid? I think we all know the answer.

"Even if New Yorkers benefit from an expected reduction of $44 billion in health spending, which Friedman says would be the result of less fraud and less administrative overhead, the tax increases would cancel out those gains."

When was the last time something was rolled into a State or Federal bureaucracy and it had less Administrative costs? Or are they admitting that after the State takes control they're going to 'loosen' those regulations that are currently on the books? Not that they would need to, mind you, since they are the regulatory body and so therefore they have no reason to comply with themselves.

I hope New York does it though, or California. Then we'll all see how insolvent the entire premise is, but so far Leftist America is unwilling to put their own money where their mouth is. Typical.

Bold strategy, Cotton. Let's see if it pays out for 'em.

"And that's the optimistic view. In reality, the program is likely to cost more?a lot more."

This is a government cost prediction for a government program.

The operation you use to approximate the real cost is multiplication, not addition.

It reminds me of the quote by PJ O'Rourke - 'If you think health care is expensive now, wait until you see what it costs when it's free.'

But the point is that you will not e able to see what it costs "when it's free".

I'd say you could under it from the generalized misery, but history and current events show that people are experts at not connecting the dots.

Infer, not under. Stupid autocorrect.

The prog-tards infesting Vermont and California (and significant parts of Colorado - looking at you, Boulder and Denver) weren't even willing to swallow the tax hikes required for single payer to work. That should tell you something. Unfortunately all it tells the prog-tards is that they need to prog-tard harder.

No way! Shocked face.

Notice that NY voters don't get a direct say in this.

I sometimes wonder if the progs do realize this won't work, but they don't care. They're cool with standing in line for 12 hours to get one aspirin just so long as they know "hehe I'm in line ahead of that rich bastard!"

It's more like the people who are for this type of insanity are well off enough that they will never wait in a line. Most of them are probably unaware that lines even exist. It's the modern day equivalent of Marie Antoinette's 'let them eat cake' showing in our political class.

Worked out great for Cuba and North Korea...

Look, if forcing the healthcare industry underground is the only way to reintroduce upfront pricing and cash payments.....

This was my first thought when reading this. Maybe this is the libertarian moment we've all been waiting for. 300 dollar broken bone visits for all!!

The only way they could make this better is by barring NY licensed practitioners from accepting private payment for goods or services.

HA HA HA HA HA HA HA HA

They could start saving money from fraud by getting rid of this fraudulent study. That howler alone oughta disqualify it and lock its author up in the loony bin.

Here is an example of state spending in action - I've been watching this saga unfold almost the entire time I've been living here; literally, during the seven years I lived an Astoria and traveled over the construction site every day.

""HA HA HA HA HA HA HA HA""

Claiming that it will save money when it obvously will not, worked for the ACA. The people will fall for it again.

You'll be able to go with the (Sheldon) Silver plan, where if you like your doctor you can keep your doctor, long as you bribe enough assemblymen.

Key point not in story - will the NY legislature be in the same system? With no special breaks like skipping the lines?

Hear that noise? The rustlings, the thumpings? That's the sound of upper middle class New Yorkers packing up and moving to border states. Ah! Most of them are liberals!

Attempting to push single payer without addressing the underlying reasons behind the high cost of healthcare is truly the height of human stupidity. Single payer (read: taxpayer) is still stupid, but I'd hate it a whole lot less if it were accompanied by serious attempts to address why prices are so distorted

If the State of New York believes that they can offer health insurance for less than what private insurance costs, why doesn't the state go into competition with the private health insurance industry? If single payer is cheaper, the state shouldn't have any trouble competing with the private insurance industry. If the state can't compete with private insurers, this indicates that people are better off with private insurance instead of state insurance.

"No one believes more firmly than Comrade Napoleon that all animals are equal. He would be only too happy to let you make your decisions for yourselves. But sometimes you might make the wrong decisions, comrades, and then where should we be?"

Anyone with half a brain would not support raising taxes that much. I am sure many people would leave the state quickly.

As a combat vet, I have a full ride from the VA for my health care.

I have visited VA facilities before.

If the single payer VA cannot cope with the very small population it has to deal with, what makes people think the state can perform any better with a larger population.

Would rather continue to pay for private insurance.

Kind of like the single payer government run education system.

v

I am making $89/hour working from home. I never thought that it was legitimate but my best friend is earning $10 thousand a month by working online, that was really surprising for me, she recommended me to try it. You will lose nothing, just try it out on the following website.

v

I am making $89/hour working from home. I never thought that it was legitimate but my best friend is earning $10 thousand a month by working online, that was really surprising for me, she recommended me to try it. You will lose nothing, just try it out on the following website.

The sad sad thought about all of this is that the liberals still think they are smarter then everyone else. I hope they do pass it, lessons sometimes have to be learned the hard way. Maybe the idiots will be voted out of office.

I can't envision what could be more regrettable than the human services I as of now get, which is essentially none. Each and every other industrialized nation on the planet gives medicinal services to its residents; there is no reason the US can't do likewise without trading off quality. Video scribing service | Flamingo-Video

"gives"

I don't think you know what that word means.

The persistent ability of the Progressive Left to ignore glaring failures is a constant source of nausea for me. Never mind that so few Commuter Rail systems are anything but rotting money pits, Our New One will be different! Never mind that every single payer health system on earth is a cluster-fuck, Our New One will be different! Never mind that every Communist Revolution is taken over by thugs and psychos who promptly liquidate the Intellectual Class we belong to, Our New One will be different!

At least the stupid vermin deserve what happens to them. I just wish they didn't have to drag the rest of us with them.

Do it you idiots! Do it!

The Vermont comparison isn't valid - they exempted the existing large employer-provided group insurance pools. Single payer won't ever work unless everybody is in one risk pool.

I really want this to be passed in NY or California so people can see what a disaster single payer in America would be. It would be glorious and should shut up the single payer movement for a couple of years at least.

I can't believe we have arrived at the current socialist juncture as a nation: 30 years of currency debauchment await us, as the takedown of our medical system is going to look like war debts on the books when its in the rear view mirror. How many years back was it when we finally paid of WW2 debt? You get the picture.... only this one never goes away on account of population replacement.

They can make up for it by letting all students in the SUNYA system attend for free. Look, if Cuomo raises taxes to 80 or 90% from the first dollar I'm sure they can cover all their actuarial bets. What's to fret about?

California needs to up its game. NY is playing to...not win...what's the word I'm looking for? Oh yeah, implode.

But Bernie Sanders assures us that single-payer is the only economical way to provide healthcare. Just look at Vermont! Oh, wait...

Yeah, how many people in New York pay income taxes?

These big states get tons of revenues from stocks and investments. These aren't some "working class" states. If the tech business went belly up San Francisco will resemble something like Venezuela within 20 years.

Why go out of your way to discourage a big source of your revenue this way?

"Transitioning to a single-payer system would disrupt coverage for millions of people"

As opposed to what? A change in national government leading to the same thing every few years?

If 8.7% are without health insurance under the ACA, then perhaps there does exist money being spent on healthcare in the state of NY to cover it all.

I think getting employers out of the healthcare providing business would be a big improvement over what happens now.