Congressional Republicans Introduce a Trump-Pleasing Tax Hike

If you send money to friends and relatives abroad, the GOP wants more of it to go to Washington.

Q: What kind of tax hike can 21st century Republicans get behind?

A: One that pays for a border wall, and can be sold, inaccurately, as an "Illegal Immigrant Tax."

Rep. Mike Rogers (R-Ala.) yesterday introduced the Border Wall Funding Act, imposing what he describes as a "2% fee on remittances sent south of the border." The bill has yet to be posted online as far as I can tell, but according to The Plainsman of Auburn the tax would apply to monies sent to "more than 40 Latin American countries." Rogers's sales pitch: "This bill is simple – anyone who sends their money to countries that benefit from our porous borders and illegal immigration should be responsible for providing some of the funds needed to complete the wall. This bill keeps money in the American economy, and most importantly, it creates a funding stream to build the wall."

Traditionally, nationalistic controls on capital flows have not been associated with liberal democracy and the rule of law. According to a skeptical analysis published last week by the World Bank, other countries currently considering such a levy include "Bahrain, Kuwait, Oman, Saudi Arabia…and the United Arab Emirates." Previous efforts in Gabon (2008) and Palau (2013), "have not worked," World Bank author Dilip Ratha asserted, because the "tax collections were found to be insignificant."

As Nick Gillespie pointed out a year ago, after then-candidate Donald Trump proposed cracking down on remittances to pay for his wall, the idea is fundamentally corrupted by "the assumption that the government has the right to unilaterally stop people from spending the money they earn and possess; that the feds have a right to tell you where you can and cannot go or even send checks." That has not stopped the likes of National Review from editorially endorsing such a nationwide tax.

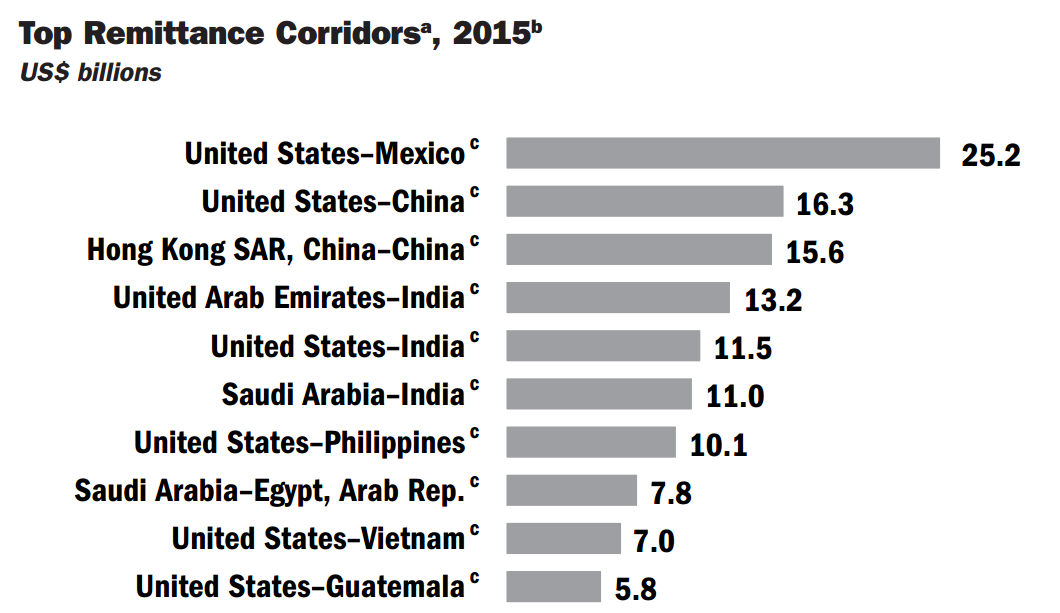

The United States is by far the leading source of remittances in the world, with its residents sending to other countries $135 billion in 2015, some 23 percent of the global total, according to research published this month by the international banking conglomerate BBVA. Monies sent to Latin America and the Caribbean accounted for 38.5% of the U.S. total, BBVA estimated, led by Mexico ($27 billion, or more than the country's annual oil revenue), then Guatemala ($7 billion) and the Dominican Republic ($5 billion). As a percentage of the host-countries' GDP, however, Mexico's 2.6 percent lags far behind Haiti (24.7 percent), Honduras (18.2 percent), and Jamaica (16.9 percent).

There is no reason to assume that the bulk of these funds derive from illegal immigrants. Of the 41 million or so foreign-born residents of the United States, an estimated 11 million are not authorized to be here, and are probably less likely than their legal brethren to use money conduits that are traceable by the feds. (And as any Cuban can tell you, there are plenty of U.S.-born hyphenated-Americans who wire money back to the island, further broadening the pool of donors, and again underscoring the truism that measures taken against illegal immigrants also pinch the freedom of natural-born citizens.) The money they send back is critical in ameliorating poverty and jump-starting economic activity. In other words, it helps create the kinds of conditions that may keep an increasing number of would-be migrants at home.

According to the World Bank analysis, "In 2016, migrant remittance flows to developing countries amounted to $440 billion, more than three times the size of official development aid flows. In many countries, remittances are the largest source of foreign exchange. In India and Mexico, they are larger than foreign direct investment; in Egypt, they are larger than the revenue from Suez Canal; and in Pakistan, they are larger than the country's international reserves."

For this reason, the G20, the global club of rich nations led by the United States, agreed in September 2014 on a "Plan to Facilitate Remittance Flows," with the intention to reduce the worldwide average tax on remittances from 8 percent down to 5 percent. From that (jargon-flecked) document:

The Group of Twenty (G20) recognises the value of remittance flows in helping to drive strong, sustainable and balanced growth. Remittances represent a major source of income for millions of families and businesses globally, and are an important avenue to greater financial inclusion. For the poorest and most vulnerable, access to remittance flows provides a sustainable path out of poverty, as more than half the world's adult population have limited access to finance. In 2014, remittances to developing countries are expected to reach $436 billion, far exceeding Official Development Assistance. Remittances to and from G20 countries account for almost 80 per cent of global remittance flows.

OK, so maybe a remittance tax is a philosophically suspect idea that hampers global anti-poverty efforts. Still, would it work? Preliminary studies and anecdotal behavior patterns point to no.

Candidate Trump's somewhat convoluted plan from a year ago tying remittances to the wall involved basically threatening Mexico with such a tax in order to extract a lump-sum payment, and when that fails amend the Patriot Act to make wire transferrers prove their citizenship or else face taxes on their shipments. Though the idea faded, it was treated seriously enough that the Government Accountability Office (GAO) released an exhaustive analysis that guesstimated the wide band of potential effects like this:

one scenario with no change in the amount of remittances and low administrative and enforcement costs could provide $0.41 billion in potential net revenue for border protection. In contrast, another scenario with a 75 percent reduction in remittances after the fine and high administrative and enforcement costs would generate potential net revenue of only $0.01 billion. In some cases, the cost incurred by CFPB could be more than the revenue from the fine.

So best-case scenario, $410 million in pocket change. That's not much of a wall.

Granted, the 2 percent south-of-the-border remittance tax is a much broader and cleaner proposal, but it faces many of the same potential pitfalls, namely that only around half of money transfers as it is go through regulated channels, which means making that more expensive will drive more people to black market solutions like Bitcoin, as in Venezuela.

Republicans once believed as a matter of bedrock faith that the free flow of capital, goods, and humans across the southern border was the best way to produce the kind of economic development that depresses illegal border crossings. The loss of that faith, which predates the rise of Donald Trump, has been one of the most disturbing spectacles in American politics.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Various governments, including the US, seem determined to make Bitcoin a success.

Naomi Brockwell will make Bitcoin a success.

I didn't know about her relationship to Bitcoin.

Who Is Bitcoin Girl?: A Conversation with Naomi Brockwell

I keep tabs on all the attractive libertarians, Charles - it's what I do.

And yes, Matt Welch, I keep tabs on you, too.

That's a wig, right?

Whatever it is, it makes him look kind of like a penis.

He looks like a very poor man's Doug Llewelyn.

Clearly, the Freedom Caucus is to blame

..., then Guatemala ($7 million) and the Dominican Republic ($5 million).

Shouldn't that be billions, not millions?

Goddammit yes, thanks. Was just telling Mangu yesterday I make that error more than any other one (besides breathing).

TIL Matt Welch calls her Mangu

I'm curious to know what the argument against the tax the Democrats are crafting.

I'm sure it will be similar to Br'er Rabbit's argument against being thrown into the brier patch.

Normally a tax on capital flows would be right up the D's alley...hell, they'd be chomping at the bit to tax foreign investments and foreign exchange.

But this one is easy...the tax is specific to Latin America, so you know if will be teh RACIST!11!!**

**Disclaimer that the tax is monumentally stupid and shortsighted, from the libertarian perspective because it is forced confiscation of capital, and from a practical perspective, even accepting the premise, because it fails to target the capital flows most likely to generate the amount of money needed to pay for the stupid wall.

This bill keeps money in the American economy, and most importantly, it creates a funding stream to build the wall.

For particularly bizarre definitions of "American," "economy," "stream," "most importantly," and "the."

But at least we know what the meaning of "is" is.

Yeah, fuck those people working hard to help their families out. If they didn't want their money stolen, they shouldn't have tried to improve their lives and those of their families back home. Morons.

This is what seriously pisses me off. So my wife, a US citizen, is being told that she has to pay a special tax for a wall she doesn't want just because we'd like to help her mom in central america live out her elderly years with slightly more dignity. Fuck Fuck Fuckity Fuck you Mr. Mike Rogers.

Same here. I'm paying my godchild's school tuition and food expenses overseas, and it's already tough enough to earn the extra cash needed to do so. Increase the tax and it gets much harder.

I might be able to dodge this particular bullet if the target is only the Latin American countries, but I won't stay quiet even if the taxman's gun is aimed at someone else.

Forgot to mention that both my godchild and I are US citizens by birth. We didn't sneak into the US, and neither did our parents, who are legal immigrants.

This is what seriously pisses me off. So my wife, a US citizen, is being told that she has to pay a special tax for a wall she doesn't want just because we'd like to help her mom in central america live out her elderly years with slightly more dignity. Fuck Fuck Fuckity Fuck you Mr. Mike Rogers.

This is what seriously pisses me off. So my wife, a US citizen, is being told that she has to pay a special tax for a wall she doesn't want just because we'd like to help her mom in central america live out her elderly years with slightly more dignity. Fuck Fuck Fuckity Fuck you Mr. Mike Rogers.

It pissed the squirrels off, too.

It's a bad idea, but a 2% tax is low enough to not have major consequences or force most transfers to go underground, and as pointed out in the article, is substantially lower than the worldwide average. If it's going to pass, can we at least get a sunshine clause on it?

I wish we had a constitutional amendment that automatically sunsets any act of congress after a certain number of years, let's say 5, and it has to be reauthorized by vote to keep it active. The only shit that lasts is the shit that a seemingly true majority of representatives want time after time. I mean, the entire US military has to be reauthorized every 2 years and it makes it through every time. Why can't the Patriot Act have to do the same?

I rise to propose an amendment to the motion, to set the period of time to two years, or the next election, whichever is shorter.

If the tax only targets remittances to certain countries, why wouldn't an enterprising bank just set up accounts where remittances first go to a low or no tax, no disclosure country like Switzerland, then on to Mexico?

How the hell do the feds think they are going to collect this tax? Are they going to force Western Union to file special forms?

If you're an American living in Mexico, the banks there don't want anything to do with you--generally speaking. They won't even let you open a checking account without getting permanent residency status. My understanding is that's mostly because the rules on South American banks operating in the United States are so onerous in regards to Americans. U.S. law is about them facilitating tax cheating, concerns about cartels and money laundering, etc. If their sister units want to function in the U.S., . . .

And I believe the Patriot Act made anonymous transactions across the U.S. border even more complicated using above the board services.

Incidentally, this stuff can really creep out fundamentalists and evangelicals.

"And [the Beast] causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

----Revelation 13: 16-17

Not being free to make transactions without the government's approval is a sign of the end times.

I'm just sayin'.

Ken -- That's almost certainly the product of FATCA, which has drafted foreign banks to being IRS collections agents for expat American customers, and so they're choosing instead to just not serve any.

Many banks are now complying, especially if they have enough green card/citizen clientele. At least in Taiwan they are complying.

That's good point, but even if it is above the board, it still seems hard to collect. If a Mexican citizen in the US goes down to Chase and instructs them to wire a small amount of money to an account with BBVA in Spain, then instructs BBVA to wire the money to his BBVA account in Mexico, how are the feds going to collect the tax?

Do they force Chase to collect it, even though Chase is not wiring it to Latin America? Do they somehow force BBVA to collect it or turn over the transaction information? Are the feds really going to comb through millions of transaction records for $500 transfers to collect $10 each? Are they going to make it illegal then spend thousands to prosecute people for failure to pay that $10?

"If a Mexican citizen in the US goes down to Chase and instructs them to wire a small amount of money to an account with BBVA in Spain, then instructs BBVA to wire the money to his BBVA account in Mexico, how are the feds going to collect the tax?"

There is no doubt that some Mexican citizens will seek to skirt the tax. The tax is low enough that doing something like what you're describing may be more expensive than simply paying the tax. International money transfers are not free of charge.

I should add that although the fees come down per dollar as you get to higher dollar transfers, at some point, the amounts and patterns become obvious enough to draw the scrutiny of regulators. People are prosecuted for making transactions of less than $10,000 to escape scrutiny.

You're looking for a series of banks that are reputable enough to do business with in Mexico, have an international presence, but aren't so large that they care about regulators in the U.S. I'm not sure that bank exists.

And I'm not sure skirting the law is worth the risk of drawing the scrutiny of law enforcement.

Maybe try Bitcoin. Even then, there are going to be exchange costs going into and out of the currency at different times.

As a US citizen with a permanent resident visa in Mexico, I can say that (most?) Mexican banks are complying with US regulations and accepting deposits from the US. My concern is that US citizens in Mexico are also going to be taxed. US citizens (probably?) receive more money from the US that Mexicans. If and how US regulations target remittances from Mexicans and not US citizens is a question unanswered.

We let the government monitor our financial transactions because of terrorism and to because we hate them over the financial meltdown of 2008, and then we're surprised when it becomes difficult to escape government scrutiny over simple financial transactions. Headlines change, crises change, the nature of crises change, but the principles behind our privacy rights remain the same.

Innocent people get swept up in the NSA tracking our phone calls ostensibly because of terrorism. You don't think somebody's watching our financial transactions, and they won't come after people who aren't legally "innocent" but are actively seeking to perpetrate tax evasion?

There will be some subversion, but the tax is low enough that most people will probably just pay it. Western Union fees used to be higher when they had less competition, and people still sent remittances all over the world. The CIA World Fact Book says 18% of Honduras' GDP is from foreign remittances. Hondurans in the U.S. will mostly keep sending the riches to their relatively destitute Honduran relatives despite the tax.

That sounds about right - even if the tax to be collected is so small that it outweighs the cost to collect it, the byproduct of a small tax is that most people will pay it.

My example would be more applicable to very large transactions by wealthy individuals and companies. Would the proposed remittances taxes apply to, say, an American company wiring money to Mexico to buy Mexican-made equipment? How will the feds distinguish between money sent as a remittance and money sent for some legitimate business purpose? Because if you're sweeping in business transactions, that would have a pretty dire effect on pretty common cross-border transactions.

Maybe I should read the bill....

Already when you go to a bank, they must ask you if its for personal or business reasons.

This is due to CFTPB (sp?) regulations. Its also why wire when from $25 to $60 at my bank.

The bank must now also give you the amount in foreign currency, and you have one hour to regret and call back the wire. this means wires for personal use have to be done during East Coast hours, and no more Saturday service.

A lot of this is because of Nigerian scammers. Yeah, its absolutely horrible regs, but its because oldsters were sending $100k to Nigerians.

If you say the wire is for business, its a lot easier to do.

Just saying, there are already a lot of regulations in play for wire transfers.

"They won't even let you open a checking account without getting permanent residency status. "

I'm sure if you make it clear that you're planning to use their bank to launder millions, they'll make an exception.

Politicians don't think of or care about consequences until the citizens are screaming about them or the gov can grab more money.

The GOP simply needs to outlaw cash.

FWIW, Western Union charges $4.99 to send $300 to Mexico, which is a little over 1.5%.

http://tinyurl.com/n33zunb

"MEXICO CITY (AP) ? The central bank reported Tuesday that money sent home by Mexicans overseas hit nearly $24.8 billion last year, overtaking oil revenues for the first time as a source of foreign income.

----U.S. News & World Report

http://tinyurl.com/n3e2dtr

2% of $25 billion is $500 million a year.

. . . but that assumes people don't find ways to avoid the tax over time.

Bitcoin anyone?

Couldn't Western Union route cash through another country prior to it going to Mexico? Would that avoid the tax?

Alternately, could the person sending the money route it through an intermediary in another country, accomplishing the same thing?

Western Union isn't going to risk criminal prosecution or outrageous fines for skirting U.S. banking laws.

These laws were put in place to fight money laundering by the cartels and to prevent sleeper cells like the 9/11 hijackers from getting financing from abroad.

Also, routing to two countries is going to cost them more. They'd do better just to charge the extra 2% and give it to the government--even if there were not threat of being criminally charged and fined for tax evasion.

I'm from the U.S. and live and work in Mexico now. My parents send me birthday and Christmas money through Western Union. I seriously hope we won't be contributing to an idiotic wall.

What's the matter? You don't want to Make America Grate Again??

I lived in Merida down in the Yucatan for more than a year.

PayPal was always better than Western Union. Do you still have a U.S. bank account? Have your parents email money to your PayPal account. From there, you can either use your PayPal MasterCard for purchases in Mexico, or you can have PayPal transfer the money to your U.S. bank account and use your debit/credit card from there.

When I was in Mexico, I used my PayPal MasterCard exclusively--since I didn't want anyone having my real credit card numbers.

P.S. Bitcoin.

I don't have a U.S. bank account any more, so I suppose that's not an option unfortunately. I think PayPal has also gotten kind of weird in Mexico recently.

I guess I could always just get the cash when I go to visit and then exchange it down here after getting back.

Get a bank account in the U.S.

Do you still reside with your parents when you're in the U.S.?

Do you still have a U.S. drivers' license with a U.S. address on it?

Do you still have a U.S. social security number?

Of course you do.

You can probably open a U.S. account online.

"fundamentally corrupted" that is a matter of opinion and not a fact please stop with the outlandish claims, they only diminishes all further arguments.

That said since you won't be able to target illegals transfers specifically it punishes the other legal citizens making it a bad tax just like gun laws punish legal gun owners and not offenders.

Shit, I'm going to go hang out at the wall and pick up all the money that it prevents from moving across the border.

Like a lot of expats abroad, I live in Colombia, and collect my social security through a US bank. I then use a local ATM with my debit card for cash when I need it. Now, how is this going to work?

Governments tax transactions and enforce borders.

Anarchists object. Call it a moral outrage.

Yawn.

Go back to The Federalist with the other Con-Flake assholes, ByeByebirdie.

I'm still waiting for an answer on who Dan Davis is and why we need to buy him.

Because of his Dan Davisy goodness?

410million *per year* would pay for a lot of border guards.

Of course this is dwarfed by the savings for public services for illegals.

A few thousand of the useless dipshits, dipshit.

my neigbour recently purchased Infiniti FX SUV just by part time work from a laptop. try this site ======== https://qr.net/eyGRuC

Remittances that are derived from un-taxed earnings certainly should be taxed - otherwise you're allowing international money-laundering. Perhaps to avoid this, those wishing to send remittances could structure them through the Clinton Crime-Family Foundation/Global Money-Laundering Initiative?

Oklahoma has a tax like this. But they credit you back the amount when you file state taxes.

So, effectively only non-taxpayers pay that tax.

Not so sure if this tax is like that or not. Probably not...too smart.

Who really wants a country where you have the right to do what you please with your own stuff?

I mean really! Did Hillary run in vain? Has Nancy been lecturing all these years to no avail?

Previous efforts in Gabon (2008) and Palau (2013), "have not worked," World Bank author Dilip Ratha asserted, because the "tax collections were found to be insignificant."

I have a feeling that remittances from the U.S. to Central/South America are many orders of magnitude larger than remittances from Gabon and Palau to ... anywhere.

As Nick Gillespie pointed out a year ago, after then-candidate Donald Trump proposed cracking down on remittances to pay for his wall, the idea is fundamentally corrupted by "the assumption that the government has the right to unilaterally stop people from spending the money they earn and possess; that the feds have a right to tell you where you can and cannot go or even send checks." That has not stopped the likes of National Review from editorially endorsing such a nationwide tax.

It would seem to me that transferring large amounts of money out of the nation would fall well within any reasonable interpretation of "To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes."