Congressional Republicans Introduce a Trump-Pleasing Tax Hike

If you send money to friends and relatives abroad, the GOP wants more of it to go to Washington.

Q: What kind of tax hike can 21st century Republicans get behind?

A: One that pays for a border wall, and can be sold, inaccurately, as an "Illegal Immigrant Tax."

Rep. Mike Rogers (R-Ala.) yesterday introduced the Border Wall Funding Act, imposing what he describes as a "2% fee on remittances sent south of the border." The bill has yet to be posted online as far as I can tell, but according to The Plainsman of Auburn the tax would apply to monies sent to "more than 40 Latin American countries." Rogers's sales pitch: "This bill is simple – anyone who sends their money to countries that benefit from our porous borders and illegal immigration should be responsible for providing some of the funds needed to complete the wall. This bill keeps money in the American economy, and most importantly, it creates a funding stream to build the wall."

Traditionally, nationalistic controls on capital flows have not been associated with liberal democracy and the rule of law. According to a skeptical analysis published last week by the World Bank, other countries currently considering such a levy include "Bahrain, Kuwait, Oman, Saudi Arabia…and the United Arab Emirates." Previous efforts in Gabon (2008) and Palau (2013), "have not worked," World Bank author Dilip Ratha asserted, because the "tax collections were found to be insignificant."

As Nick Gillespie pointed out a year ago, after then-candidate Donald Trump proposed cracking down on remittances to pay for his wall, the idea is fundamentally corrupted by "the assumption that the government has the right to unilaterally stop people from spending the money they earn and possess; that the feds have a right to tell you where you can and cannot go or even send checks." That has not stopped the likes of National Review from editorially endorsing such a nationwide tax.

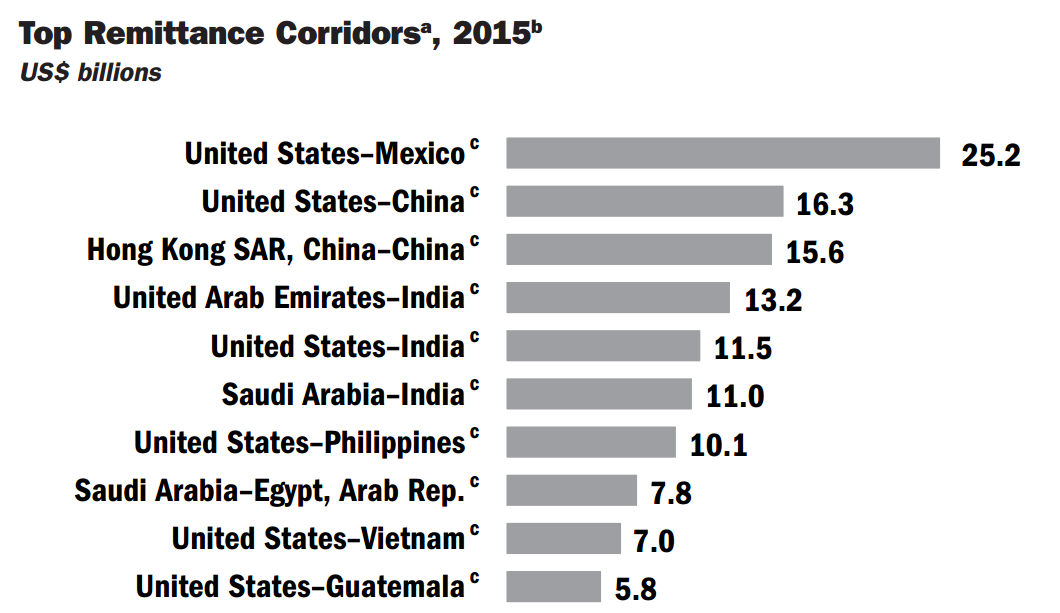

The United States is by far the leading source of remittances in the world, with its residents sending to other countries $135 billion in 2015, some 23 percent of the global total, according to research published this month by the international banking conglomerate BBVA. Monies sent to Latin America and the Caribbean accounted for 38.5% of the U.S. total, BBVA estimated, led by Mexico ($27 billion, or more than the country's annual oil revenue), then Guatemala ($7 billion) and the Dominican Republic ($5 billion). As a percentage of the host-countries' GDP, however, Mexico's 2.6 percent lags far behind Haiti (24.7 percent), Honduras (18.2 percent), and Jamaica (16.9 percent).

There is no reason to assume that the bulk of these funds derive from illegal immigrants. Of the 41 million or so foreign-born residents of the United States, an estimated 11 million are not authorized to be here, and are probably less likely than their legal brethren to use money conduits that are traceable by the feds. (And as any Cuban can tell you, there are plenty of U.S.-born hyphenated-Americans who wire money back to the island, further broadening the pool of donors, and again underscoring the truism that measures taken against illegal immigrants also pinch the freedom of natural-born citizens.) The money they send back is critical in ameliorating poverty and jump-starting economic activity. In other words, it helps create the kinds of conditions that may keep an increasing number of would-be migrants at home.

According to the World Bank analysis, "In 2016, migrant remittance flows to developing countries amounted to $440 billion, more than three times the size of official development aid flows. In many countries, remittances are the largest source of foreign exchange. In India and Mexico, they are larger than foreign direct investment; in Egypt, they are larger than the revenue from Suez Canal; and in Pakistan, they are larger than the country's international reserves."

For this reason, the G20, the global club of rich nations led by the United States, agreed in September 2014 on a "Plan to Facilitate Remittance Flows," with the intention to reduce the worldwide average tax on remittances from 8 percent down to 5 percent. From that (jargon-flecked) document:

The Group of Twenty (G20) recognises the value of remittance flows in helping to drive strong, sustainable and balanced growth. Remittances represent a major source of income for millions of families and businesses globally, and are an important avenue to greater financial inclusion. For the poorest and most vulnerable, access to remittance flows provides a sustainable path out of poverty, as more than half the world's adult population have limited access to finance. In 2014, remittances to developing countries are expected to reach $436 billion, far exceeding Official Development Assistance. Remittances to and from G20 countries account for almost 80 per cent of global remittance flows.

OK, so maybe a remittance tax is a philosophically suspect idea that hampers global anti-poverty efforts. Still, would it work? Preliminary studies and anecdotal behavior patterns point to no.

Candidate Trump's somewhat convoluted plan from a year ago tying remittances to the wall involved basically threatening Mexico with such a tax in order to extract a lump-sum payment, and when that fails amend the Patriot Act to make wire transferrers prove their citizenship or else face taxes on their shipments. Though the idea faded, it was treated seriously enough that the Government Accountability Office (GAO) released an exhaustive analysis that guesstimated the wide band of potential effects like this:

one scenario with no change in the amount of remittances and low administrative and enforcement costs could provide $0.41 billion in potential net revenue for border protection. In contrast, another scenario with a 75 percent reduction in remittances after the fine and high administrative and enforcement costs would generate potential net revenue of only $0.01 billion. In some cases, the cost incurred by CFPB could be more than the revenue from the fine.

So best-case scenario, $410 million in pocket change. That's not much of a wall.

Granted, the 2 percent south-of-the-border remittance tax is a much broader and cleaner proposal, but it faces many of the same potential pitfalls, namely that only around half of money transfers as it is go through regulated channels, which means making that more expensive will drive more people to black market solutions like Bitcoin, as in Venezuela.

Republicans once believed as a matter of bedrock faith that the free flow of capital, goods, and humans across the southern border was the best way to produce the kind of economic development that depresses illegal border crossings. The loss of that faith, which predates the rise of Donald Trump, has been one of the most disturbing spectacles in American politics.

Show Comments (62)