What It's Like To Be in Debt to the State

Inside the lives of five people who have served their time, but are still paying for their crimes

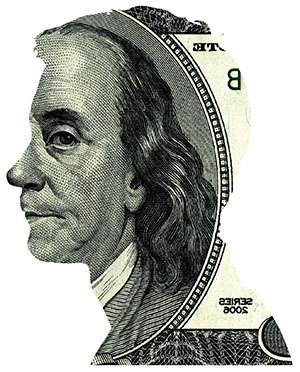

What if you committed a crime, got caught, and served time? Most people would say you had paid your debt to society. But for certain drug, property, and violent crimes, incarceration is frequently accompanied by a fine—with the first payment typically due right after you walk out of prison.

In Florida, for instance, an individual caught selling just seven grams of oxycodone (the equivalent of roughly 14 five-milligram Percocet pills) can receive a three-year mandatory minimum prison sentence and a $50,000 fine. Fifty five-milligram Percocet pills—less than a month's prescription in some cases—will set you back 15 years and an extraordinary $500,000.

Legal financial obligations, which include fines, court user fees, restitution, and collection charges, exist in every state, in Washington, D.C., and at the federal level. These fines and fees were built into state and federal laws for a variety of reasons: sometimes to serve as a deterrent, sometimes to provide compensation for victims, and sometimes purely because someone thought incarceration wasn't punishment enough. According to sociologist Alexes Harris, author of A Pound of Flesh (Russell Sage Foundation), legal debts are also imposed on people "to help reimburse the state for costs resulting from their criminal behavior, including the costs of arresting, prosecuting, and punishing them." That's right: individuals are sometimes forced to pay the state for nabbing them and locking them up.

Jurisdictions across the United States typically base monetary sanctions on offense type—either set by statutes or through judicial discretion—and do not take a defendant's ability to pay into consideration; the same $10,000 fine could be a slap on the wrist for a rich man, but a harsh sentence for a poor one.

In many states, legal debtors are also charged for the privilege of making payments on what they owe. In Virginia, state law requires individuals to pay a $100 fee to initiate a payment plan, as well as a 6 percent annual fee. In Texas, individuals are charged a 4 percent credit card convenience fee on each payment they make. These numbers might seem small, but they can add up over time—especially for people who are barely holding on.

When a person misses a payment, many states tack on additional sanctions—monetary or otherwise. Some charge late fees. Others, such as Pennsylvania and West Virginia, suspend driver's licenses. In 44 states and D.C., judges may order jail or prison time for individuals with unpaid debts.

People newly released from prison already have bleak employment prospects. It's challenging enough for someone with minimal skills to find work. Imagine how much more difficult it becomes when you have a felony record, a 10- to 20-year gap in employment, and no place to live—and you know you'll have to return a significant portion of what you manage to earn to the state, probably for the rest of your life. The most recent survey data show more than half of the formerly incarcerated remain unemployed for up to a year after their release. Roughly 40 percent return to prison within three years.

For many folks caught up in the criminal justice system, especially those who are poor or who have spent years or decades in prison, coming up with the money to pay off their legal debt can be an insurmountable task—a life sentence.

What follows are edited excerpts from reporting in Alexes Harris' A Pound of Flesh: Monetary Sanctions as Punishment for the Poor (Russell Sage Foundation).

Kathie owed over $20,000. That figure started at $11,000, but after accruing interest and additional fees for years, the total had nearly doubled. The 49-year-old was disabled and living with her three children, her ex-husband, and her father-in-law in a three-bedroom apartment. Although she was employed, her job did not bring in enough to pay her debts—let alone to afford her own housing:

"Oh my God, I'm going to get emotional…I really feel like it's time for me to move on. I'm going to be 50 years old next year, it's just time for me to have my own life again. And the financial obligations are, I mean it's something I think about every single day. I mean, there's not a day that goes by that I don't think, 'OK, what can I do today to try and figure this out?' And then there are days that I do everything in my power—OK, it's there, but I have other things to focus on today."

Scott owed $100 but only had $35 on hand at the time of his hearing. He was accompanied by his employer, who ultimately agreed to make up the difference—for self-serving reasons:

Clerk: You were supposed to pay $100. You were in for sentencing. You were released from the jail and told to pay $100. Do you have $65 more?

Scott: No.

Clerk: You will have to wait for the judge.

Employer: What happens if he doesn't pay the $65?

Clerk: He could go to jail. Do you have a credit card with $65?

Scott: No, it's all I got.

Employer: Will the judge give me time to scrounge around for more money?

Clerk: No.

Employer: So I have to go to the ATM right now?

Clerk: Yes.

[Scott and his employer leave and return later with a payment receipt.]

Clerk: Are you related?

Employer: No, I have a vested interest. As of today I own him. He is one of my mechanics.

Steve was convicted of a victimless crime, but he was charged a "victim penalty assessment" anyway:

"I feel like, my crime was, like, you know, selling. I was selling crack. So, I didn't really—I wasn't stealing money. So I still don't understand how that fit together. So, and then I think sometimes—and for myself it wasn't really a high amount, but I've seen amounts that are just, like, ridiculous, and where a person, they'll probably never pay it off, and I just don't think that's fair, to hold it over a person's head for the rest of their life, you know?"

Mike, a legal debtor, fretted that the system encourages people like him to return to crime when they get out of prison:

"I understand you have to pay your way, and the court has to pay its way, and they got to collect off somebody. But it seems to me like the way our criminal justice system works, you know, there's too many people making money out of corrections, and the corrections isn't correcting anything. It's more creating people who are unable to get jobs, who are unable to deal in society…So they work outside the block, and those kinds of things that they do, which are illegal, it just kind of compounds it."

In order to be released from James County jail, Patricia was told she had to commit to paying a monthly fee, something she knew she would not be able to do:

"[The clerk is] saying, 'OK, you can't pay $25, you have no income at all.' 'That's right, I have no income whatsoever—don't have any income.' And yet I'm not going to be released until I sign that paper and set myself up for a violation [by] saying I'll pay $25 a month. 'I can't'…'Well, there's no way you can get?'…Yeah, OK, if I whore myself on the corner, I can get it…

This article originally appeared in print under the headline "What It's Like To Be in Debt to the State."

Show Comments (50)