Neither Clinton Nor Trump Would Reduce the National Debt

Clinton's policies would increase the debt less-but would still leave the budget on an unsustainable path.

Tonight's Democratic National Convention featured a brief video starring former Obama administration economic adviser Gene Sperling. Sperling brought up a topic we haven't heard a whole lot about at this year's DNC: the federal debt. His point was that GOP presidential nominee Donald Trump would be far worse for the national debt than Hillary Clinton.

By all accounts, Sperling was right: Although Trump's economic plans are frustratingly vague and difficult to pin down, every credible attempt to estimate has found that his plans would massively increase total debt.

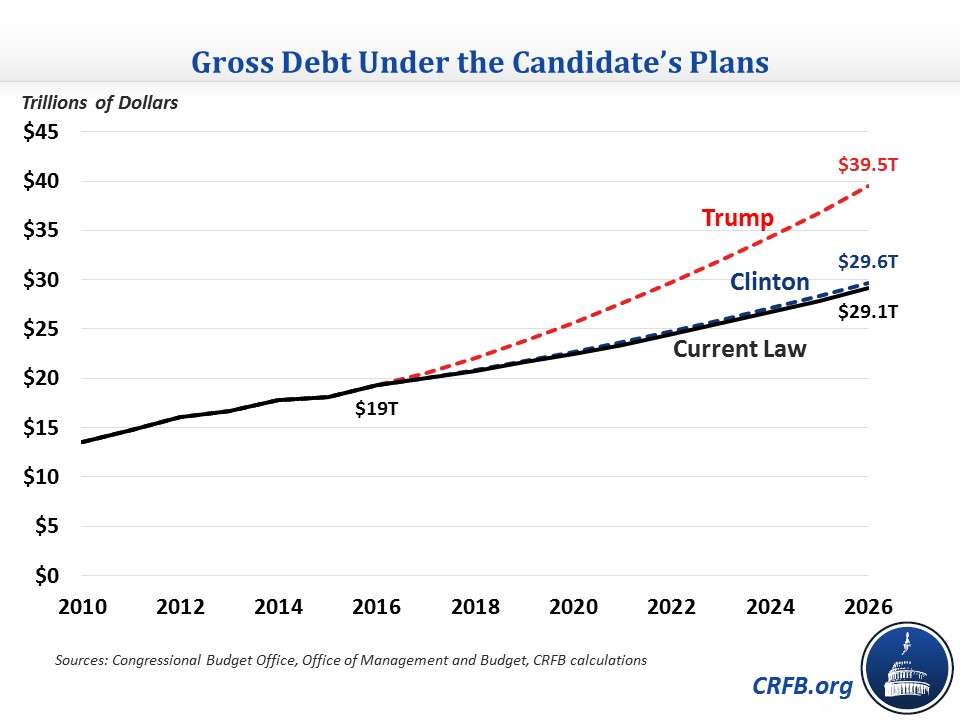

Just today, for example, the Committee for a Responsible Federal Budget (CRFB) estimated that under Trump's plans, debt held by the public would rise from $14 trillion now to a little more than $35 trillion over the next decade. Gross national debt—the measure more commonly used—would rise from about $19 trillion now to $39.5 trillion by 2026.

This isn't surprising. Trump has expressed concern about federal debt levels, but his plans to reduce debt have never added up. His proposed Social Security reform would attempt to cover a $150 billion fiscal gap by cutting waste, fraud, and abuse—which only amounts to about $3 billion. Trump has also suggested that the government could save $300 billion through savings in a program that only spends $78 billion. It's total nonsense, and Trump shouldn't be trusted at all on the issue.

But here's the thing: Hillary Clinton would also let the debt rise substantially. Under her plans, according to the same CRFB analysis, debt held by the public would rise from $14 trillion to $23.9 trillion over the next decade. Gross national debt would rise from $19 trillion to more than $29 trillion.

It's true, as the CRFB report shows, Clinton's increases would track pretty closely with debt increases that already expected under current law—increasing it only slightly over today's trajectory. That's better than what we could expect under Trump, but it's far from what's necessary. The nation's debt trajectory is, in its current state, unsustainable in the long term.

In a report on the long-term debt issued earlier this month, the Congressional Budget Office laid out the stakes if the debt trajectory isn't significantly altered: "Large and growing federal debt over the coming decades would hurt the economy and constrain future budget policy. The amount of debt that is projected in the extended baseline would reduce national saving and income in the long term; increase the government's interest costs, putting more pressure on the rest of the budget; limit lawmakers' ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis." Clinton's plans would merely leave us on the same troubled fiscal path we're already on.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

because gigantic hells solve nothing in all the countries

You got a 1st AC!

until I looked at the bank draft ov $9106 , I have faith that my neighbour was like they say trully bringing home money in their spare time from their computer. . there aunt had bean doing this for less than 10 months and recently cleared the debts on their appartment and bought a great new Lancia . Learn More Clik This Link inYour Browser.

???????? http://bit.ly/2abXTUQ

Start making cash right now... Get more time with your family by doing jobs that only require for you to have a computer and an internet access and you can have that at your home. Start bringing up to $16000 a month. I've started this job and I've never been happier and now I am sharing it with you, so you can try it too. You can check it out here... Read More This Website... http://www.Trends88.com

Boy, this Democratic convention sure does have a lot of the techno-pop optimism that you all at Reason.com have been expressing. Ladies and gentleman, I present to you the candidate most consistent with modern libertarian optimism and can-do spirit: Barack Hussein Obama.

Libertarians are well known for valuing style over substance.

All 3 of us!

Take your salty crocodile tears to DU, berniebro.

See...there's this issue with the bombs. He keeps dropping them.

That's pretty much there message I'm hearing:

You can accomplish anything, as long as you cock block the dirty Jew commie atheists that stand in your way! Look what we did to Bernie Sanders!

There is no such thing as modern libertarian optimism.

I consider myself to be a libertarian optimist.

also hummingbirds fix loneliness

but tanks never care about this

clearly we need some genetically engineered attack hummingbirds

Hey Suderman, when are you going to write a hard hitting piece on the sexual undertones of the Clinton - Kaine logo.

I mean just to be fair, you hack.

vigorous religions erupting volcanic

outreach break down locks and wings imagined

in the humans caught in the streams of lost moonlights

Debt is screams in dreams....

please let me run in the closets of this house

Debt is screams in dreams....

please let me run in the closets of this house

The broken smashing rainbows of cosmic dreams are prepared to be smashed upon the dreams of vegan gains.

Vegan Gains in goddamn Reason acid trip.... I fucking love my beasty gods bro and sis ... but agile is fall tripping super down into crater alley where all fuck shit is gone, and so on an in and oelie

Is "crater alley" a euphemism for what Agile is up to tonight? Is there a Mrs. Agile?

I believe so. And maybe Mini-Agile(s)?

mountains felled on the spirits of reactions in the green valleys

grandmama still makes apple pies after all the lost spirits.

agile eats dead mountaineer souls all the time and

he will also avoid god's heart spear from the chemical palace...

i will rum from the rocket gods and avoid the brain pianos until i am safe

Agile I hope you never leave us and never change

Alt text: I got yer deficit hanging.

Looking at the cfrb numbers, it seems like the main cause of the higher Trump deficit is the reduction in immigration. The basic argument is that more immigrants means more people paying into SS security and Medicare. While that may help, that's a temporary a fix at best, since most of those new workers will have to be paid back 20~40 years down to the road.

It also says that Trump's plan to repeal the ACA will increase deficits, without taking into account that Clinton is also likely to tinker with the ACA, and it is unlikely be in a more market oriented direction.

An actual repeal of aca would reduce defecits.of courses, not sure the gop will do that.

The CFRB is anything but "non-partisan". Friggin Clinton-lacky Panetta is a co-chair. The CFRB gives every appearance of being a retirement community for establishment hacks who couldn't find something more personal to do.

Is it any surprise that they 'estimate' a deficit higher under Trump. As if either candidate has given anywhere close to enough detail to actual base on estimate on.

Its all a joke, but of course since it is anti-Trump, Suderman laps it up like nectar from the gods.

I live commented it, bitch

By all accounts, Sperling was right:

I feel terrible that one of my first responses to this was:

"$30 trillion? $40 trillion? What difference, at this point, does this make?"

The deficit really does seem to be just an almost imaginary number at this point. I mean, I know intellectually that those are real dollars in real accounts somewhere that people are earning real returns on, but it just doesn't feel real.

How many Trillion dollar a year deficits have we run so far? And for what? What more am I getting now for the 2 trillion more the fed spends than I was getting in 2000?

Where has all the money gone? It just, doesn't feel like its there.

Unless they are talking gaap numbers, which they never are, your response is correct. The reported debt is a drop in the sea of the real number. $10B hete or there really doesnt matter.

"It's true, as the CRFB report shows, Clinton's increases would track pretty closely with debt increases that already expected under current law?increasing it only slightly over today's trajectory."

Except that net number doesn't tell the whole story.

She will increase taxation and increase spending a whole lot vs the baseline to get to that "slight" increase in trajectory.

That means theft of private property from people who own it to give it to people who don't own it. That is a hugely detrimental outcome vs the baseline.

Angry Libertarian: Hey, Suderman! Think fast!

SUDERMAN looks up. A beer can comes flying out of the latest Reason shitpost and hits him on the head.

A trillion here and a trillion there and pretty soon you're talking real money.

I'm making over $9k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life. This is what I do.... Go to tech tab for work detail..

CLICK THIS LINK=====>> http://www.earnmax6.com/

This all ignores the significant Tax increases Hillary is using to "balance" her budgets. Basically she's planning to implement tax increases while still increasing the deficit.

And this is bogus:

" Trump's policies, on the other hand, would increase gross debt less than public debt, largely due to lower revenue going to the Social Security and Medicare Hospital Insurance trust funds and higher spending from the Hospital Insurance trust fund as a result of repealing the Affordable Care Act."

The idea that repealing the ACA is based upon the ridiculous idea that the ACA reduces the deficit. It does that by paying Medicare providers in the future half the reimbursement rate they got pre-ACA. In the short run, these cuts are being temporarily ameliorated by short term ACA pork spending. For the ACA to actually cut the deficit, these payment cuts will have to take place. That will never happen.

"The idea that repealing the ACA is based upon the ridiculous idea that the ACA reduces the deficit."

Should be: The idea that repealing the ACA increases the deficit is based upon the ridiculous idea that the ACA will reduce the deficit in the future.

FYI:

"Physician payments are scheduled to grow at a very slow pace due to the April 2015 Medicare Access and CHIP Reauthorization Act. Under this legislation, Medicare physician payments are scheduled for only 0.5% growth per year through 2019 and zero growth from 2019 through 2025."

http://www.frbsf.org/economic-.....inflation/

It's fantasy land to believe that Medicare can significantly cut physician payment index inflation for a decade without any effects on the Medical care provided.

"Medicare's hospital payments - Initiated in FY2012 and scheduled to continue indefinitely, this adjustment reduces hospital payment growth in accordance with growth in economy-wide productivity. ... The ACA mandates a third broad-based cut of 0.2 percentage point for FY2015 and FY2016, and 0.75 percentage point per year from FY2017 through FY2019. These legislated changes significantly reduce hospitals' projected payment growth relative to the market basket adjustment. In 2016, for example, they imply a net payment increase of 0.9%, whereas the basket adjustment alone would have called for an increase of 2.4%."

And they are significantly cutting the reimbursement rate for hospitals also.

Hudson . true that Chad `s blurb is flabbergasting... last week I got a gorgeous Alfa Romeo after having made $5229 this last 5 weeks and-over, $10k this past-munth . it's actualy my favourite work I have ever had . I started this three months/ago and immediately started bringin home at least $80, per-hour . pop over to this website .

????????? http://www.maxincome20.com

nice post thanks admin http://www.xenderforpcfreedownload.com/