Oil Price Super-Cycle Collapse: Party Like It's 1998?

Never bet against human ingenuity operating in free markets.

Crude oil prices continue their collapse, falling to the low $30 per barrel range. How much lower can they go? The world is awash with crude despite the fact that so many exporting countries and their national petroleum companies - Iran, Iraq, Nigeria, Venezuela, Libya - are in turmoil. As it happens, U.S. domestic free market producers can turn the fracking tap on and off pretty much at will which makes them the price setters for the foreseeable future. If other countries choose to frack, oil and natural gas prices will only go lower.

In my book, The End of Doom: Environmental Renewal in the Twenty-first Century, I discuss the theory of commodity super-cycles that describes the boom-bust cycle that has characterized the process of global economic growth for essentially the last two centuries. I suggested the current cycle driven largely by China's blistering economic growth was showing signs of moving toward the downward phase. I noted:

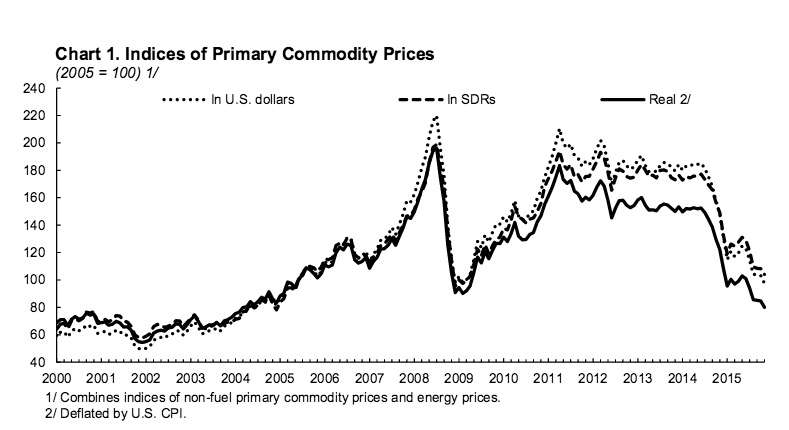

Figuring out when a super-cycle has topped or bottomed out is a fraught exercise. Nevertheless, many researchers believe that the current super-cycle in commodity prices has peaked and will soon move into its downward phase. By February 2015 the International Monetary Fund's commodity index has fallen by about fifty seven percent from its July 2008 peak. If the past is any guide, commodity prices could well fall to levels even lower than the price nadir of the 1990s as the expansionary phase of the current super-cycle begins to fade.

As it happens, by November, 2015 the IMF Commodity Index has continued to drop and is now down from its 2008 peak by more than 65 percent.

Back in 1973, US Foreign Service Officer James Akins dryly observed: "Oil experts, economists, and government ocials who have attempted in recent years to predict the future demand and prices of oil have had only marginally better success than those who foretell the advent of earthquakes or the second coming of the Messiah." Wise words to keep in mind for all commodity price predictions. Nevertheless, betting on human ingenuity operating in free markets is usually a winning strategy.

Oh, just one more thing: Peak oilers please shut up forever!

Show Comments (147)