High-Tax Connecticut Plans to Mug Its Residents Even Harder

It's an experiment in economic self-immolation that's absolutely fascinating to watch-from a distance.

Connecticut, where residents worked until May 9 last year just to feed the maws of government officials (the latest Tax Freedom Day in the country) is poised to stick it to its residents even harder. Given that the state's high-tax status is already driving people and wealth elsewhere, this is a strategy that just can't fail—to depopulate and impoverish the joint. I used to live there and, like most people, I hate the place where I attended high school, but I think the Nutmeg state has punished itself sufficiently for the sins of my teenage years. It should stop.

According to the CT Mirror's Keith M. Phaneuf:

Now that Gov. Dannel P. Malloy's campaign pledge not to raise taxes is in the political rearview mirror, the Democratic governor's political base is seeking to widen the tax debate in hopes of averting some painful spending cuts.

Higher income tax rates on the wealthy, restoration of the capital gains levy, an extra $1.50 per pack on cigarettes and expanding sales taxes on business are among the ideas circulating at the Capitol.

The proposed cigarette tax hike would make the state's levy on smokes the most onerous in the union. That couldn't possibly fuel smuggling and have an unintended consequence for revenues, could it?

Even the governor "cautioned against pushing the top marginal rate much higher, arguing that the wealthy would flee the state in that event." He's actually a voice of moderation relative to labor unions and social services groups who seem to think Connecticut taxpayers are milking cows with no recourse except to moo.

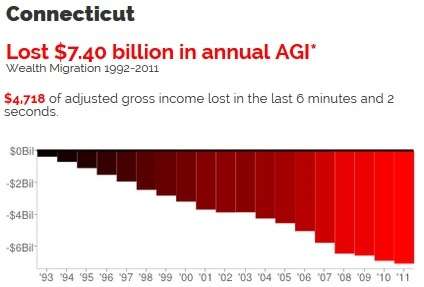

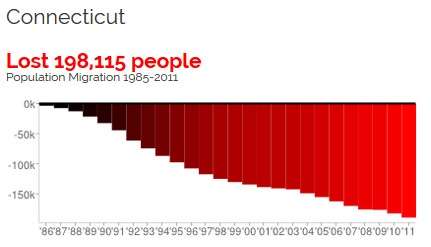

But Travis Brown's How Money Walks website documents an outflow of $7.4 billion from 1992 to 2011, and a migration of 198,115 people away from the state during the same years.People do have options: they can leave and take their cash with them.

The state government's brilliant plan to drive the once-thriving firearms industry elsewhere just emphasizes officials' total dedication to an experiment in economic self-immolation that's absolutely fascinating to watch—from a distance.

Connecticut residents curious about life under less parasitic regimes may want to plug their options into the Laffer Center's Save Taxes by Moving calculator.

Update: Not only is Connecticut losing cash and people, but Gallup reports it had the worst job creation environment in the country in 2014, and has consistently ranked toward the bottom for years.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

the Democratic governor's political base is seeking to widen the tax debate in hopes of averting some painful spending cuts.

Something, Something...running out of other people's money.

I make up to usd90 an hour working from my home. My story is that I quit working at Walmart to work online and with a little effort I easily bring in around $40h to usd86h Someone was good to me by sharing this link with me, so now i am hoping i could help someone else out there by sharing this link......... Try it, you won't regret it!... http://www.wixjob.com

Where did you live and go to school, JD? As a fellow CT "native" I'm curious.

Greenwich High School--I lived in Cos Cob in the era of Izod.

Ah, I was at EO Smith on the UConn campus. Totally opposite ends of the state.

Nicole is from more your area.

So...thirty miles apart.

I blame you Epi for the Whalers moving to Carolina and for Bad Joe Hall's Death. No NHL Hockey for you!

True, lots of tax money goes to cronies and deputy this-that-the-other.

Nevertheless, I'm not ready to throw the baby out with the bath water.

Just as libertarians generally harp on the fact that capitalism has some negatives yet it's the best system we have (and I agree), we need taxes.

What we need is to weed out corruption. And, not with more cronies and government. But with citizen action and transparency.

I get the distinct impression that reading comprehension is not your strong suit.

I started reading at ten.

Well, I guess your doing your best then. Bless your heart.

You started reading in 4th grade, or were you just a very old kindergartner?

I was pushed through catholic school until the 5th grade.

I was left back, and that new teacher did wonders.

I still read rather slowwww. But my comprehension is just fine.

The unicorns will save us!

^^^This^^^

When your dumb policies cause economic pain, double down on more dumb policies. That's the mantra of the left when it comes to economic issues. This delusional adherence to dogma over reality, all so the oligarchs in charge can keep feeding at the trough, is why my state is doomed.

I need to look at somewhere else to move to.

"Just as libertarians generally harp on the fact that capitalism has some negatives yet it's the best system we have (and I agree), we need taxes.

What we need is to weed out corruption. And, not with more cronies and government. But with citizen action and transparency."

You don't seem to understand the difference between business and government. I'm not surprised.

It's bound to work this time!

That link to the If I Moved site is worthless. It showed me saving money on taxes moving from VA to MD. I've actually done that and paid a crapload more in taxes in MD. It did show me saving money going from MD to FL, which is accurate. But it doesn't take into account the massive increase in homeowners insurance in FL. I know they aren't taxes, but they're state mandated. Not very worthwhile.

Apparently moving from CT to MD saves you some on taxes, or so one of my recently moved from CT neighbors told me. When you have to move to MD to save money on taxes, you must have really been hurting from that bent over position. They did say weather was a factor also and asked me what is up with that. We've had the coldest winter on record, but I still assume it was a lot worse in CT.

The funny and idiotic thing is that CT used to specifically have no (and then lower) income tax and other taxes specifically to court very wealthy people who worked in NYC but wanted to escape its tax regime. And businesses too. The proximity to NYC, but a much better tax regime, was pretty appealing. And that was still going strong up until recently (Stamford was the fastest growing city in the US for quite a while, it might even still be, plus...VINCE MCMAHON), and it's just moronic to lose that. CT has an extremely high standard of living.

CT has an extremely high standard of living.

So does most of MD. Except for the ghettos of Balmer, of course.

I think that Howard County is the 2nd or 3rd wealthiest county in the US, for a number of years now.

Looks like we're about to open up Fracking now also, and the new R gov has already started trying to get rid of some taxes, including the idiotic rain tax. The proggies and greenies are crying a river already, I guess we can tax that shit.

I moved from DC to MD and my taxes increased. Yup. If I had known that it would happen I would likely not have moved. I thought they would go down because "hey they can't be higher than DC" and I looked up the state income tax rate but didn't even know that a county income tax exists. Oh, but I lucked out and live a few yards from the city line. If I was in the city I would have to pay an income tax to the city. Ever heard of such shit?

County and city income tax? Holy shit! I still remember the first year my parents had to pay property taxes. My Dad was mad as hell.

Which city? Remember that Baltimore City is its own county, and Baltimore County exists around it (except for where it hits the Bay).

Also, as for hearing of such shit, NYC has its own income tax, plus state and federal. It's essentially a city and county tax in one because each borough of NYC is also a county. Greater NYC is composed of five counties.

Yea, the MD country tax,which based on your state income tax x 1.5 or so (varies by location).

"Apparently moving from CT to MD saves you some on taxes"

If you want to save the most on taxes, move to Wyoming.

I believe that state is rated #1 as the lowest tax state.

I plugged in from NYC to Cleveland just to see what it would be like to move to the headquarters of my new employer. Of course I would save buckets of money BUT it doesn't account for salary. Naturally I would demand my current salary or more in such a scenario but the site does seem kind of pointless if you don't account for that variance.

"But it doesn't take into account the massive increase in homeowners insurance in FL. I know they aren't taxes, but they're state mandated. Not very worthwhile."

I don't live in Florida but I have been looking into various aspects of moving there. Homeowners insurance costs are high near the coasts but would be somewhat lower if you lived in Central Florida.

The rates also depend on what type of home you have. Homes built of concrete - concrete block, insulated concrete forms, etc. have lower insurance rates than wood frame homes. They can take a lot more punishment from hurricanes.

"Democratic governor's political base is seeking to widen the tax debate in hopes of averting some painful spending cuts."

Isn't it just fascinating that politicians think spending cuts are painful, but not tax increases?

That's assuming politicians actually think about anything other than the next election.

Makes sense. Taxes line the pockets of them and their cronies. Spending cuts reduce their influence, and therefore power. So it makes perfect sense from their perspective.

OT: Found this tidbit last night and thought it might be interesting:

I've got Boswell's biography of SJ sitting on my shelf -- I've yet to tackle it. I hope it's an easier read than your sample paragraph.

Just have a drink on hand when you hit Johnson's most famous quote about how "the loudest yelps for liberty come from the drivers of negroes" in the colonies.

How do cigarette taxes raise money and convince people to stop smoking? Doesn't one effect negate the other? No wonder governments hate electronic cigarettes with a fiery red passion. They don't want smokers to quit, they want smokers to pay.

Lowering smoking rates lowers health care spending and improves the budget. Either way, it's a win.

Lower smoking rates increases health care spending because smokers tend to die before collecting medicare. Look at the decrease in smoking over the past few decades and compare with the increase in health care spending. Do I need to draw you a graph?

Medicare is federally funded. It saves the state money, as there is less unfunded treatment. It helps the state budget. Do I need to draw you a graph?

The graph might help you understand how you just made waffles's point for her.

Please? I love graphs!

You know, Medicaid, which is a state-funded program in part (and probably either the largest or second largest chunk of your state budget), is also affected by smoking. As is your state's pension obligations, and miscellaneous other welfare programs.

And that's the dirty little secret about smoking. By shortening lives (to the extent it does), it saves the states money on pensions and other welfare programs.

By causing people to die faster (not just earlier, but faster), it saves health costs that would otherwise be borne in part by Medicaid and Medicare. Most people use the majority of their lifetime healthcare spend while they are dying. Faster deaths are cheaper.

The idea that more Medicare spending results in less state spending is utterly fallacious. There's really no connection between the two. Why would there be?

Assumes facts not in evidence.

It's because they're control freaks. They've pretty much moved on to the war on vaping. They'll never be satisfied, it's all about control and they don't want anyone escaping their control fetish.

I'm in a meeting with one of Ct.'s R state legislators on Monday. I'll lobby him against these tax increases but the D's pretty much have their own way in the Nutmeg state.

Yet somehow Connecticut has the highest per-capita income in the country, and the financial services has a hub of extremely high income earners in Greenwich. Maybe these taxes aren't driving away all the rich?

You can even raise it to 75% if you want to, nothing can possibly go wrong. Just ask Francois Hollande about that, he can provide you with the details about how to make that happen.

Maybe these taxes aren't driving away all the rich?

Maybe you can make an intellectually honest argument, too. Who knows?

Give it time, Happy. Give it time. They aren't all going to leave over a long weekend.

The charts seem to show a pretty serious trend. One that will only accelerate as financial services firms leave NYC (which they have already started doing).

You're right, it doesn't drive away the super wealthy. It just drives away the upper and middle classes, especially in Fairfield County - the country closest to NYC. CT has followed the same trend as NYC - an exodus of the middle income leaving behind the liberal gentry and the serfs (the rich and the poor). Good luck with that.

"Maybe these taxes aren't driving away all the rich?"

Less than 10 percent of humans are actually curious. Those few want to know how things are, what actually is and what it means. They want truth. These are the same people who actually improve the world, who make it a better place.

The rest don't give a shit about any of that. They only want to improve their personal lot while pretending the world is what they wish it was.

Sure Slappy, high taxes don't drive people away, and it is perfectly ok to steal from people who have more than you do. In fact, it is only right to do so.

No, just the middle class. But who gives a shit about them anyway.

Or, what Lady said.

Piffle.

The 1% are out of control in CT, even higher high taxes is the only way to bring them down, or make us equal, make things fairer, or whatever.

http://blogs.wsj.com/economics.....od=WSJBlog

The road to hell is now paved with "whatever".

Serious question... why would anyone move to Connecticut? I can see people who were born there living there, but why would someone from somewhere else say, "Yeah, Connecticut..." and pack up the UHaul?

There are lots of reasons other than economics to live somewhere, you know. Weather, culture, family, job... to name a few.

Your answer only adds to the mystery. I can think of a dozen states that are standouts for Weather... CT would not be one. Culture, same thing, I can think of maybe five states that are standouts, CT not one. Family, absolutely, no question. Job... sure... I've never met someone in my 40 hmmhmm years that moved to CT for a job. I'm not saying it doesn't happen, it just doesn't seem to be a job destination.

Understand, I'm not trying to insult CT, I really don't know anything about it. Because it doesn't stand out in any particular category to me. Lots of states (that I wouldn't want to live in necessarily) stand out for very specific reasons-- especially in the realm of weather and culture. Remanfms below gave a good technical breakdown.

I moved here for a job and because the ex-wife wanted to...

Wish i hadn't, and as soon as my kid is set and on his own feet, I am gonna look at my options elsewhere.

NYC.

Where else you gonna move? Jersey?

Also, CT outside the NYC diaspora counties is really, really pretty and you can be to Manhattan to go shopping or see a show from pretty much anywhere in CT in 3 hours. It's like Vermont, but without the "ass-end of fucking nowhere" feel that Vermont has.

I think this was the answer I was looking for.

The GOP Governor in Alabama is calling for higher taxes in the state. Jacking up property taxes and cigarette taxes to make up for a 700 million dollar shortfall. Hey, piss off Bentley. Cut spending, you schmuck!