Obamacare Inflicts IRS Paperwork on New Victims

People who have rarely had to deal with the calculations required by tax forms may find this a bit...challenging.

Forget the incompetent launch of the Healthcare.gov website. Forget the soaring costs of coverage under Obamacare. Forget what the healthcare scheme's impositions have wrought upon employment. Perhaps the Affordable Care Act's most-resented wrong against the American people will be initiating those previously exempt to the dull, often incomprensible grind of Internal Revenue Service paperwork.

Since the tax agency is tasked with enforcing compliance with Obamacare, it is responsible for figuring out, after the fact, whether the people who received subsidies for their coverage—really, advance tax credits—received too little, too much, or just enough. Actually, it leaves the calculations to the recipients, many of whom are low-income and so have previously avoided the mental and logical gymnastics inherent in IRS forms. Well, aren't they in for fun!

According to Kathy Kristof of CBS's MoneyWatch:

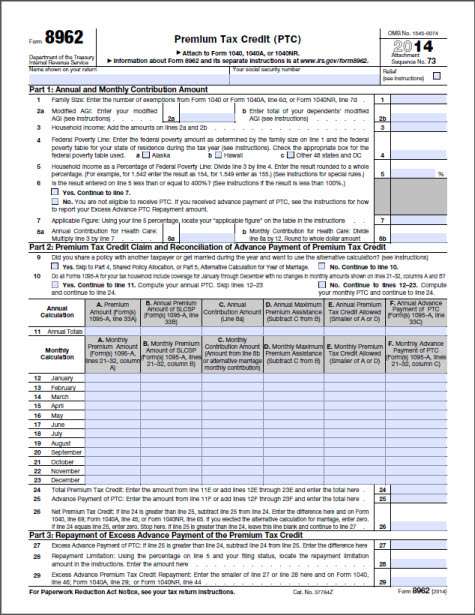

If you received discounted insurance through a health exchange, you'll need to fill out the mind-boggling Form 8962. Although this two-page form officially has just 36 lines, there are actually 90 spaces on just the first page that need to be filed in -- up to six spaces for each official "line."

To put the correct figures in several of these spaces, you'll need to complete charts and worksheets found elsewhere in the 20-page instruction booklet. If you are, say, divorced and sharing expenses with your ex-spouse, you'll also need to fill out the second page of the form. Though this page has just seven lines, there are 37 spaces. Worse yet, according to the IRS, completing that page requires cooperating and sharing both insurance and tax information with your ex-spouse -- not exactly a walk in the park for those with acrimonious splits.

The actual form is here (PDF). While I've (occasionally) seen worse, I pay an accountant to deal with that crap now. People who have rarely if ever had to deal with the calculations within calculations required by tax forms may find this a bit…challenging (as I would without my accountant). And then about half of them will have to cough up part of that healthcare coverage subsidy to the government at the end.

Does anybody think this will end well?

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Does anybody think this will end well?

Sure! It'll force people to become more literate, mathematically competent, and compassionate!

MULTIPLIER EFFECT!

"Does anybody think this will end well?"

There's a lying turd who posts here...

The PPACA barely affects 8% of the population. There will be no "blowback" on the Dems.

Also, BOOOOOOOOOOOOOOOOOOOSHROMNEYDIDITFIRST!

How'd I do?

I think it ended well.

I give it at least an "8" (%)

On a serious note, how did Romneycare enforcement work?

If you didn't have insurance, you would be stuck in a room for a day with a Bostonian speaker Bostonese.

*speaking /derp

180 hours of Nickelback, please.

Is death an option?

Cake please.

Depends ... Aren't 100% of these 8% fully included in Romney's 47% ?

"How'd I do?"

Standing O!

THIS IS WHAT THE FREE MARKET IN HEALTHCARE LOOKS LIKE!

Bah.

Welcome to the world of the self employed. S-C and a lot of other forms . More paper work for the regular people. Enjoy dumb asses.

That form just makes my eyes glaze over.

The administration had jolly well better be ramping up a shitload of Navigators.

Well the good news is that they can enforce it via arbitray audits.

Think of the JOBS!

Call 1-800-IRS-JERB!

"Ever want to audit an enemy? An ex? Now is your chance to achieve a position of power over thine enemies, and make a footstool of them!"

I have an acquaintance who thinks that Obamacare is just peachy, except for the aspects that inconvenience him personally. If I weren't such a sweet and angelic person, I'd hope that those aspects come crashing down on his head with full force.

I'll help you out, Doc...

I HOPE THE O!CARE COMES A CRASHING ON DOWN!

They will.

"If I weren't such a sweet and angelic person"

You should seek professional help for that.

Hanging around here will erode that. No worries.

Jesus Christ on a Crutch! If I were on the exchanges, I'd be *so* fucked!

More money for lawyers. Why do you hate lawyers, tarran?

Because they infest our economy like so many Guinea Worms?

Hey, wait a minute...I have a law license!

*runs from the room, weeping tears of shame*

Narrows gaze!

"And then about half of them will have to cough up part of that healthcare coverage subsidy to the government at the end."

So, who wants to put money on how long it takes before someone proposes a bailout for these folks?

I'll put 100 quatloos on 2 weeks from now.

+1 There is no topic that a quatloos reference does not make better.

Poor people don't do their own taxes. They mostly use places like H&R Block or Jackson Hewitt where they get shaken down for fees and additional products. Doing your own taxes is a purely middle class activity.

"Liberty Tax" around here - they Habla Espanol and they often have temps out front dancing in Statue of Liberty (not weeping) outfits. They used to have a big sign proclaiming they will do your 1040EZ!

Man, the 1040ez. Haven't filled out one of those since high school.

I see more of that "prosecutorial discretion" coming.

He has erected a multitude of New Offices, and sent hither swarms of Officers to harrass our people, and eat out their substance.

When the GOP re-takes the executive branch, they will seek revenge on the IRS by directing all IRS audits to be ONLY those people receiving Obamacare tax credits.

This is why the GOP has no intent on repealing Obamacare, it's another tool with which to bludgeon potential enemies.

"I pay an accountant to deal with that crap now."

You know who else paid an accountant to deal with that crap?

Does anybody think this will end well?

If you subscribe to the brilliant prescience of Mencken,

"Democracy is the theory that the common people know what they want and deserve to get it good and hard."

Then yes. It will eventually end well, good, and hard.

Growing up, my old man always told us there's no such thing as a free Obamacare tax subsidy. Pay the piper folks!

If you're a bank, you need FDIC insurance. If you have a car, you need auto insurance. If you're making a movie, you need completion insurance. If you have a business, you need liability insurance. If you are a physician, you need malpractice insurance. If you have a body, you need health insurance. Otherwise, it's fun to hate Obama and tell lies about Obamacare.

You like all the gum-ment have to have laws don't cha. Your type of government sucks, if you don't believe me just ask Europe.

Not true.

1. Banks are not required to be FDIC insured.

2. Most states that I am aware of do not actually require that you BUY auto insurance. You can post a bond, you can deposit money in an account with the state, or you can self-insure in many cases.

3. Few businesses that I am aware of are required to have liability insurance. I used to deliberately not have liability insurance for my business because the first question out of most lawyers mouth's was who my insurance was with, and when i said I had none they went away.

4. Physicians do not have to carry malpractice insurance.

5. I have lived most of my life with no health insurance and have never needed it.

What nanny state were you raised in to believe all these things?

Most likely CA.

A physician without insurance will not be allowed to practice in hospitals. Most doctors, in small towns, have to buy it to survive! I had a company go into receivership and lost my privileges to practice in hospitals. But, one is right when he says you won't get sued! You just have to be broke! By the time you get in that situation, they have broken you and you are broke, too!

Does anyone think this will end well?

^^There's your cue, Tony.

Anyone who voted for more big government gets just what they deserve, big brother at its best. The defenders of this "stuff" are the best entertainment going since the fall of the Roman Empire.

ROFL

I am so glad I emigrated out of the USA. Where I live, I have no insurance at all. If something happens, I pay out of pocket into a free-enterprise system. Private medical/dental services, auto-mechanics, everything capitalistic simple and CHEAP. Most people here just ignore the govt.

Where do I live? It is south of where you gringos live!

Oh, but that's not all! What if you're self-employed, so you can deduct on Schedule C the part of your premiums that isn't paid by the Premium Tax Credit -- only doing so changes your income and thus changes the amount of the credit! It's an infinite loop!

But wait! There's good news! They've gone out of their way to provide two new alternative methods to calculate your credit in this situation:

http://www.irs.gov/irb/2014-33_IRB/ar10.html

This comment is absolutely serious. I'm a tax professional, and this is some of the most fun I've gotten to have in YEARS!!! ;-?

Some Republicans say get rid of the IRS, altogether. I think a consumption tax would be the most fair for poor people!

When it is all worked out and no more glitches, the American public will love having been lied to and screwed beyond belief.