The Disastrous Consequences of Unbridled Democratic Rule in Illinois

Will voters keep the status quo or take a gamble on a Republican promising to cut taxes and squeeze $1 billion out of the budget?

With Halloween approaching, the way to scare small children is to conjure up specters of witches and ghosts. Terrifying economists is easier: Just say, "Illinois."

It's been suggested that North Korea and Cuba be preserved in their present form as museums documenting the folly of communism. By that logic, Republicans might want to lose the governor's race in Illinois so it can go on illustrating the dangers of untrammeled Democratic rule.

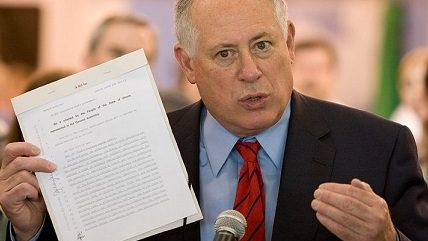

The incumbent is on the ballot, but in an important sense the election is a sham. Though Pat Quinn has taken the oath of office twice, the de facto governor-for-life is Michael Madigan, the Chicago Democrat who has been House Speaker—and dominated state policy—since 1983, except for a two-year interruption when Republicans had a majority. So the choice is really for the state's second most powerful official.

On one side is the incumbent Quinn, an affable Springfield fixture who made his name as a reformer and gadfly, only to become governor when Rod Blagojevich was impeached and removed from office before going to prison. On the other is Bruce Rauner, a private equity magnate who has never run for office before but touts business expertise that produced a net worth he figures at "hundreds of millions of dollars."

Detractors portray Rauner as a charmless bully who doesn't understand the give-and-take of governing. But if a pleasant personality and political savvy were invaluable traits for this office, experts would be flocking to Illinois to learn the secrets to efficient government and economic prosperity.

They aren't, and no wonder. Illinois has the worst public pension debt in the country. Its bonds have been downgraded so far that it faces the highest borrowing cost of any state. The nonpartisan Civic Federation says the state's huge backlog of unpaid bills will grow this fiscal year, lamenting "a return to unsustainable fiscal practices."

In a recent survey, Illinois got an "F" for "small business friendliness." Moody's Analytics predicted that this year it will have the lowest rate of job growth of the 50 states.

Quinn has taken commendable steps to improve the fiscal outlook, like trimming the state payroll, closing prisons and making the state's required contributions to pension plans. But by raising the state personal income tax rate to 5 percent from 3 percent and the total corporate rate to 9.5 percent from 7.3 percent, he chilled an economic climate that was already locked in a polar vortex.

In its latest report, the Tax Foundation says Illinois' state and local tax burden is the 13th heaviest in the nation, and Quinn would keep it that way. Having sold most of the income tax increase as temporary—on Jan. 1 it is scheduled to fall to 3.75 percent, one-fourth higher than the previous rate —he now proposes to make it permanent.

Rauner pledges to cut tax rates back to the old levels and squeeze $1 billion out of the budget with painless options like selling state airplanes, merging the comptroller and treasurer offices, and forgoing pay as governor. What he downplays is that real fiscal progress requires curbing the cost of Medicaid, the biggest spending item, and reducing the state's crushing pension obligations.

Quinn and other critics contend that Rauner won't reveal or doesn't have a plausible plan to achieve fiscal balance, and they have a point: His chief form of exercise is ducking specifics. But having based his campaign on the promise, Rauner would have no excuses for failure.

The governor of Illinois has a line-item veto, giving him the power to remove any outlay at will. That means Rauner would be free to get rid of spending he doesn't want. It also means he would bear responsibility for any spending he accepts.

To do what he promises, Rauner would have to either persuade Madigan and the Democratic-controlled General Assembly to enact serious cuts or wield his veto like a chainsaw. Either way, he would not be able to escape responsibility.

A Rauner governorship, which could lead to a war with the legislature and public employee unions, would be a gamble on an unknown quantity. With Quinn, by contrast, Illinois voters know what they would be getting—and not getting.

Maybe they will be content to extend a dismal status quo that he seems unable to transform. Or maybe they will embrace the approach of Mae West. "Between two evils," she said, "I always pick the one I never tried before."

Show Comments (12)