How Obamacare Made Health Insurance Industry 'Villains' Into White House Partners

Recall, for a moment, how health insurers were treated by Democrats in the Obamacare debate. They were the bad guys, in no uncertain terms. "They've been immoral all along," Rep. Nancy Pelosi (D-CA), then the House Majority Leader said in July 2009, as the debate over the government-run public option raged. "They [insurers] are the villains in this. They have been part of the problem in a major way."

Democrats found some success in casting insurers as the antagonists, and made a show of targeting health insurers. "It is well known to the public that the health insurance companies are the problem," Pelosi said in October as she warned insurers how much the health law would cost them.

So, how did Obamacare end up punishing the big, bad insurance company villains? By creating a federal program to help cover their costs in the event of higher than anticipated spending—and then expanding that program at the request of the insurers following the launch of the health law's exchanges last year.

A report released this week by the House Oversight Committee highlights how, in the months since the exchanges went online, the Obama administration has worked closely with the insurance industry, looking for policy options to assuage insurers' financial woes and feeding talking points to insurance industry officials prior to major media appearances. And even though the administration has stated an intention to run the program in a revenue-neutral manner, the report finds it's likely to cost taxpayers around $1 billion this year.

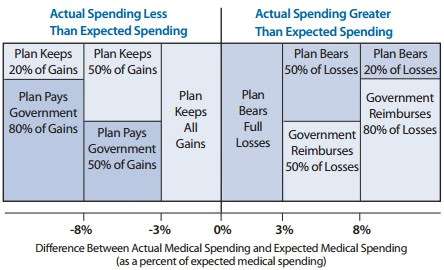

The focus of the White House/ health insurer relationship is Obamacare's "risk corridor" program. Frequently described as a bailout of insurers, it is a symmetrical risk sharing program set to run through 2016: Participating insurance carriers set a target for health spending each year, and if the total amount comes in at 103 percent of the target or more, the federal government kicks in a share of the overage; between 103 and 108 percent, the federal government pays half. Above 108 percent, the federal government pays 80 percent. If spending comes in lower, insurers pay the government.

The thinking when the law was passed was that the program would be revenue neutral; some insurers would pay in, and others would be paid. The payments would even out. But there's no requirement in the law that it be revenue neutral, which means that it's possible for the federal government to pay out a lot more than it takes in.

Earlier this year, the Obama administration indicated that it expected the program to be revenue neutral. But the Oversight Committee report surveyed 80 percent of participating insurers and found that, on net, insurers expect payouts of about $725 million this year. Add in the other insurers who weren't surveyed, and it's possible that risk corridor payouts will end up totaling $1 billion.

Now, it's of course possible the balance could always shift over time, leaving a program that is revenue neutral for its entire three year run. But the early signs aren't promising.

And insurers sure aren't excited about the possibility that the administration might actually decide to operate the program in a revenue-neutral manner. Insurers, who had already expressed concern about Republican opposition to the risk corridors, lobbied against the possibility. At least one even contacted the White House directly.

In early April of this year, the Committee report says, Care First Blue Cross Blue Shield CEO Chet Burrell wrote to Senior Adviser Valerie Jarrett warning that "a brewing issue" could "negatively impact upcoming ACA premium rates" and requesting a conversation. The two spoke on the phone that day, and Burrell followed up with an email warning that a revenue-neutral implementation of the risk corridor rule could push insurers "to increase rates substantially (i.e., as much as 20% or more…)." The letter described Burrell's worries as urgent, and thanked her for understanding. "I am only trying to give a 'heads-up' notice on an issue that could produce an unwelcome surprise."

Jarrett was eager to assuage his concerns. According to the report, Jarrett wrote back saying that the White House "policy team is aggressively pursuing options." Later that month the administration published a memo, titled Risk Corridors and Budget Neutrality, which said that if the program does not take in enough funds to match the required payouts, payments would be reduced accordingly the following year.

Burrell wrote back, still concerned about the policy and warning, again, premium increases would likely appear because the risk corridors program was no longer reliable.

Jarrett's response: "After speaking at length today with Jeanne [Lambrew, Deputy Director of the White House Office of Health Reform] and our other policy folks, I do not think I have any more to add. They seem to have given you 80 percent of what you requested and I am not in a position to second guess there [sic] analysis."

Eventually, though, the administration did second guess the analysis. Insurers pressed on, with increasingly adamant lobbying that the risk corridors program not be operated with "the constraint of budget neutrality," as America's Health Insurance Plans (AHIP), the top insurance lobby group, put it.

When the final rule came out in May, the administration had made a number of changes. Even in the event of a shortfall, it said, the administration would make "full payments" to insurance carriers. If necessary, "HHS will use other sources of funding for the risk corridors payments, subject to the availability of appropriations." The May rule also made additional changes to the payment formula making the risk corridor more generous and increasing the likelihood that insurers would receive payments through the program.

In short, insurers warned that premium hikes were likely under Obamacare, and begged the administration for money. The administration was eager to respond, eventually gave in to the insurance industry's demands, and decided to expand and existing program to minimize insurer losses under the law. The Obama administration isn't treating health insurers like villains. It's treating them like partners.

Show Comments (14)