HHS Predicted Much Employer-Backed Health Coverage Wouldn't Survive Obamacare, Either

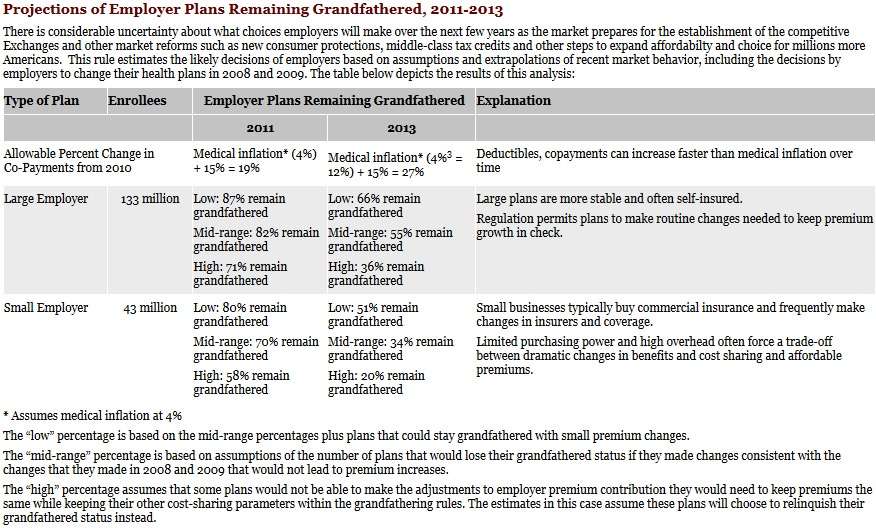

Back in 2010, when the Department of Health and Human Services projected that "40 to 67 percent" of individual customers will not be able to keep their existing health coverage because of the tight requirements for grandfathering policies, HHS made similar projections for health coverage offered by employers. As it turns out, many of those comfortably ensconced in jobs at large and small firms were projected to lose their health plans, too. Courtesy of the Wayback Machine, we can review that now-offline document. At that time, HHS estimated that 34 to 64 percent of large employer (100 or more workers) plans would lose grandfathered status by 2013, and that 49 to 80 percent of small employer (under 100 workers) plans would lose grandfathered status by 2013.

You can click the image below for a larger and more readable version, but there are the projections from the HHS document.

The reason for the high projections for the loss of grandfathered status are no surprise, The regulations for retaining that status are tight—so tight they raised repeated complaints.

Again, from the HHS document:

Compared to their polices in effect on March 23, 2010, grandfathered plans:

- Cannot Significantly Cut or Reduce Benefits. For example, if a plan decides to no longer cover care for people with diabetes, cystic fibrosis or HIV/AIDS.

- Cannot Raise Co-Insurance Charges. Typically, co-insurance requires a patient to pay a fixed percentage of a charge (for example, 20% of a hospital bill). Grandfathered plans cannot increase this percentage.

- Cannot Significantly Raise Co-Payment Charges. Frequently, plans require patients to pay a fixed-dollar amount for doctor's office visits and other services. Compared with the copayments in effect on March 23, 2010, grandfathered plans will be able to increase those co-pays by no more than the greater of $5 (adjusted annually for medical inflation) or a percentage equal to medical inflation plus 15 percentage points. For example, if a plan raises its copayment from $30 to $50 over the next 2 years, it will lose its grandfathered status.

- Cannot Significantly Raise Deductibles. Many plans require patients to pay the first bills they receive each year (for example, the first $500, $1,000, or $1,500 a year). Compared with the deductible required as of March 23, 2010, grandfathered plans can only increase these deductibles by a percentage equal to medical inflation plus 15 percentage points. In recent years, medical costs have risen an average of 4-to-5% so this formula would allow deductibles to go up, for example, by 19-20% between 2010 and 2011, or by 23-25% between 2010 and 2012. For a family with a $1,000 annual deductible, this would mean if they had a hike of $190 or $200 from 2010 to 2011, their plan could then increase the deductible again by another $50 the following year.

- Cannot Significantly Lower Employer Contributions. Many employers pay a portion of their employees' premium for insurance and this is usually deducted from their paychecks. Grandfathered plans cannot decrease the percent of premiums the employer pays by more than 5 percentage points (for example, decrease their own share and increase the workers' share of premium from 15% to 25%).

- Cannot Add or Tighten an Annual Limit on What the Insurer Pays. Some insurers cap the amount that they will pay for covered services each year. If they want to retain their status as grandfathered plans, plans cannot tighten any annual dollar limit in place as of March 23, 2010. Moreover, plans that do not have an annual dollar limit cannot add a new one unless they are replacing a lifetime dollar limit with an annual dollar limit that is at least as high as the lifetime limit (which is more protective of high-cost enrollees).

- Cannot Change Insurance Companies. If an employer decides to buy insurance for its workers from a different insurance company, this new insurer will not be considered a grandfathered plan. This does not apply when employers that provide their own insurance to their workers switch plan administrators or to collective bargaining agreements.

That's a lot of hoops through which to jump, and many health plans were never expected to make it.

Show Comments (249)