Breaching Debt Ceiling Will "Not Be a Catastrophe," Says Nobel Prize-Winning Economist, and May Have an Upside

Politicians and establishment figures warn that, with the goverment spending far more than it takes in in the form of tax revenues, the leviathan on the Potomac will not only be unable to pay its bills if the debt ceiling isn't raised—further partially shutting down an already slightly closed for business establishment—but that it could default on payments on its existing debt and cause an international financial crisis. President Obama claims "every economist out there is saying" that "millions of Americans—not just federal workers—everybody faces real economic hardship" if the debt ceiling isn't raised.

Well…Maybe not every economist out there.

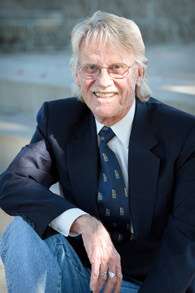

Vernon L. Smith, professor of economics at Chapman University's Argyros School of Business, and 2002 co-winner of the Nobel Prize in Economics (he's also a Trustee Emeritus of the Reason Foundation, which published Reason), takes the prospect of a frozen debt ceiling, and even a debt default, in stride.

Reason asked Dr. Smith his take is on the consequences of breaching the debt ceiling. Will it be a catastrophe or not? He responded:

No, it will not be a catastrophe. The U.S. is one of the few countries in the world and in history that has NOT defaulted on its debt; consequently we suffer the consequences of the curse of a reserve currency. The great housing-mortgage market bubble, 1997-2006, was fueled by a massive inflow of foreign investment funds. This is the other side of our deficit on trade account which looks like a sweet deal in which foreigners send us more goods and services value than we send them. But it has negative consequences and cannot be sustained indefinitely.

By Smith's take, making the United States less attractive as a destination for foreign investment might spare us future bubbles, and so have an upside.

Show Comments (95)