How the Feds Screw Small Business

Regulations that are merely an inconvenience to a large corporation may be a matter of life or death to a small firm.

Say "the land of opportunity," and you call forth the rich image of the independent business—run by those who want to go it alone, do it their own way; who have their own ideas about what other people want or need. The endemic failure of such enterprises is legendary, but the appeal remains: there is nothing that can stop such go-getters except their own mistakes. Increasingly, however, there are plenty of roadblocks on that traditional path to success, and it's showing up in the vital statistics. Small business is ailing, even if the dream is alive and well.

A VITAL LINK

There is ample reason for concern over the health of American small business. Although these enterprises are rightly called small, their cumulative contribution to the economy is far from paltry. There are over 13 million small businesses (excluding family farms), comprising more than 95 percent of all private enterprises in the United States. They employ over 40 million persons and produce 43 percent of the gross national product. While small retail outlets (the so-called mom-and-pop stores) represent a large segment of these businesses, small enterprises are a vital element of nearly every segment of the American economy.

Another reason for concern about small business is the vital role that the individual entrepreneur plays in the area of innovation and in competition. Not too many people are aware of this, but air conditioning, Bakelite, automatic transmissions, stereophonic sound systems, air brakes, plain-paper copiers, and instant photography were all breakthroughs initially made by small entrepreneurs. Economic effectiveness is well served when barriers to entry into markets are at a minimum. The cornerstone of private enterprise or capitalism rests on efficient markets and vigorous competition.

Yet another reason for consideration of the future of small business is simply that the future does not look bright for many of these firms. For example, a relative shift in technological innovation from small business to large firms appears to have occurred in the late 1960s. According to one research report published by the American Association for the Advancement of Science, small firms (those with fewer than 1,000 employees) produced the greatest number of major innovations from 1953 to 1966, but large manufacturing companies (those with 10,000 or more employees) led in innovation in the 1967-73 period. To be sure, many factors are at work here, including the effects of inflation, changing economies of scale, international competition, union wage rates, and all manner of government factors ranging from taxation and credit policy to regulation. Of this host of factors, perhaps none is more perverse than the latter.

The recent expansion of federal government regulation of business has been particularly severe on smaller companies. Large capital expenditure requirements to meet environmental or job safety standards above those that would be followed voluntarily may represent merely an uneconomic application of resources for a large firm; but for the small firm, it may literally be a matter of the enterprise's life or death. While surely there has been no deliberate intent on the part of the regulation writers to bring about the demise of small business firms, little if any consideration has been given to the economic impact of regulation on the small firm.

SMALL IS VULNERABLE

We need look at only a few examples of the effect of government regulation on the small firm in order to see that it disproportionately hampers small business.

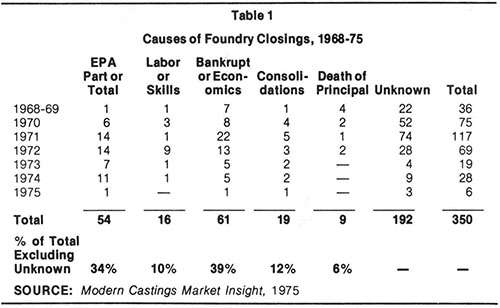

Case: The foundry industry includes approximately 4,200 foundries; 82 percent of these firms employ fewer than 100 people and 75 percent employ fewer than 50. The total industry employs approximately 375,000 workers. In the late sixties this industry began to lose small plants—those that specialized in small orders of less than 500 pieces a year—due to a combination of economic recession and EPA regulation. The castings produced by these foundries are critical for production of limited-quantity capital equipment. For many of the foundries that closed, the size of the EPA-mandated emission control expenditures exceeded the net worth of the entire operation. From 1968 through 1975 there were 350 verified foundry closings. Table 1 summarizes the results of a follow-up study conducted to determine the causes of these foundry closings.

Case: The impact of proposed standards for air-lead exposure levels promulgated by the Occupational Safety and Health Administration has been examined in a recent study by Charles River Associates. The consulting firm estimates that the total compliance cost would be approximately $416 million (in 1976 dollars) with annual costs of $112 million. The predicted result in the battery industry, which is made up of 143 firms, is as follows:

OSHA lead regulations would result in much larger per unit production costs for smaller plants than for larger plants. Because of large differential costs and the fact that battery prices would only rise to cover the unit costs of the larger firms…smaller plant operators would be forced to absorb the differential in costs. In many cases the amount absorbed would…eliminate entirely the plant's profitability and about 113 single plant battery firms would be forced to close…[this] would eliminate half of the productive capacity not operated by the five major battery companies.

There is not enough information in this report to assess the merits of alternative OSHA standards for measuring the hazard posed by working in these firms. It is quite clear, however, that the predicted impact of the proposed standard indicates the need for further study prior to its final issuance.

Case: Albeit unintentionally, at times regulatory agencies can hurl devastating blows at a small business by simply releasing incorrect information. So it was with Marlin Toy Products. Marlin sales totaled $1.5 million in 1972; the company employed about 85 people in a community of 1,100 people. In November 1972 the Food and Drug Administration notified Marlin that its two main products, the toy balls known as Flutter Ball and Birdie Ball, were going to be banned because the balls contained small noise-making pellets that could be swallowed by a child if the balls cracked. Later Marlin and the FDA agreed that if Marlin would recall the balls on the market and remove the pellets from future balls, they would be removed from future banned lists. Marlin gave rebates totaling $96,000.

In October 1973 the Consumer Product Safety Commission (which had assumed the authority for toy safety) picked up the old ban list from the FDA and reprinted it—inadvertently omitting the fact that Birdie Balls and Flutter Balls were banned only if they were the old version that contained pellets. The company's toy sales plummeted during the vital Christmas season. Marlin had to lay off 75 percent of its workforce and was forced out of the toy business. The CPSC admitted that "the toys were supposed to be deleted from the banned list but weren't and we weren't about to recall 250,000 lists just to take one or two toys off." (Of course, if one or two toys out of 250,000 are found to have hazardous defects.…)

MONEY PROBLEMS

A key to the continued existence of any private enterprise is, of course, its ability to generate a stream of profits sufficient to finance future capital expenditures for replacement and growth. Small firm or large, it doesn't matter—this fundamental economic requirement must be satisfied. There is, though, a basic difference between large firms and small firms faced with "unproductive" capital expenditures required to meet governmental regulatory standards: the large firm is more able to pass along to the consumer the added cost and a reasonable return on that investment.

In 1974 the National Association of Manufacturers surveyed its members and obtained estimates of the costs of meeting existing OSHA standards. The average estimate for firms with fewer than 100 employees was $35,000—a significant demand on the resources of a small firm. It is interesting to note that the only reference to small business in the whole legislative history of the Occupational Safety and Health Act is for the provision for Small Business Administration financial aid to improve workplace safety.

Other regulatory agencies have also created increased capital demands on small business. The Employee Retirement Income Security Act was designed to protect employee pensions. The result? Commissioner of Internal Revenue Jerome Kurtz estimates that, due to a propensity to specify uniform standards for all pension plans, large or small, as much as 30 percent of the nation's private pension plans may have gone out of business. An important contributor to this phenomenon is the estimated 5-10 percent increase in the costs to small business to meet pension law requirements, higher minimum funding, accounting and actuarial services, and insurance for fiduciary liability.

Some government regulations adversely affect the ability of small enterprises to attract investment. The "prudent man" rules included in ERISA, coupled with the focus on personal liability for the "imprudent" pension fund manager, have accentuated the trend to concentrate equity investments in the larger, well-established companies. Changes in these rules to allow up to two percent of a pension fund's portfolio in smaller, more risky firms—while meant to provide some relief for small business—may, unfortunately, merely place a ceiling on these types of investments by the pension funds.

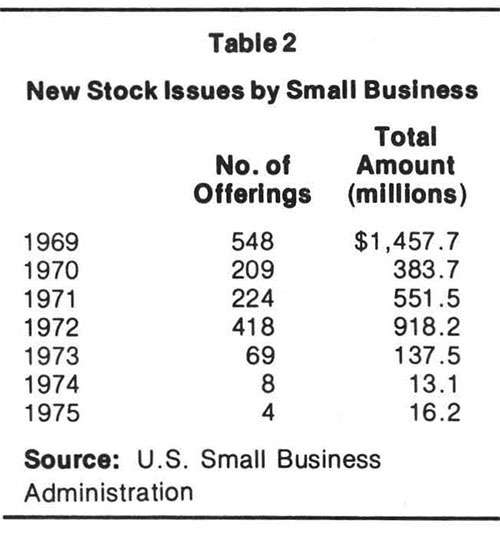

Some of the Securities and Exchange Commission's rules also tend to hem in the small firms. The SEC definition of a "private offering" is the solicitation of no more than 25 potential investors and sale of stock to no more than 10 investors. SEC registration for "public offerings" costs between $100,000 and $150,000 to prepare and takes four to six months. Table 2. from the report of the SBA Task Force on Venture and Equity Capital for Small Business, demonstrates the decline in the new-issue market for small business (those with net worth of less than $5 million).

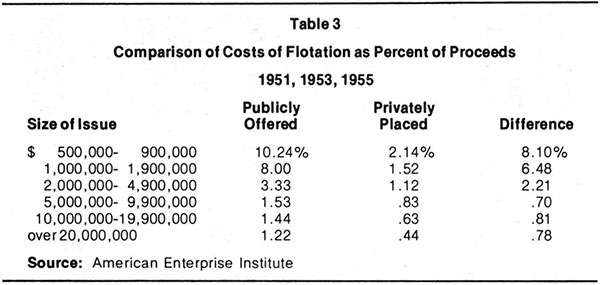

Table 3 compares the estimated cost (in 1969 dollars) of flotation of public and private debt issues for various sizes issue. The difference in the two types indicates, in part, the added cost of meeting requirements imposed by the SEC and ancillary accounting and legal costs associated with public offerings. It is clear that small firms (small issues) bear disproportionate costs whether private or public and that SEC requirements greatly compound the costs for small issues.

THE PAPERWORK BURDEN

It is much more difficult to assess the impact of regulations that are merely burdensome to small business—such as meeting paperwork requirements. The Commission on Federal Paperwork reports that five million small businesses spend $15-20 billion, or an average of over $3,000 each, on federal paperwork and that small businesses are relatively harder hit by federal information requirements than larger firms and often lack the necessary expertise to comply.

The latest addition to the power of the Environmental Protection Agency comes from the 1976 Toxic Substances Control Act (Tosca). Typically, the impact on small firms in the chemical industry is given little consideration as regulations are being drafted. The act gives the EPA virtually unlimited authority to require extensive testing—at the firm's own expense—of any new chemical product before it goes on the market. In addition, FPA can take action against as many as 50 existing substances annually and can require almost unlimited data.

Although Congress intended to shield small businesses from many of Tosca's paperwork burdens, the latest proposed regulations define "small manufacturer or processor" as a single-plant manufacturer with annual sales of less than $100,000 or with production of less than 2,000 pounds annually. Under that ruling, a firm such as the Harwicke Chemical Company in Elgin, South Carolina, is classified as big business. Harwicke has less than 75 employees and produces $9-11 million in annual sales out of a single-plant factory. Harwicke's sales manager has become the regulatory expert since he is the only employee besides the president who even holds an advanced degree in chemistry.

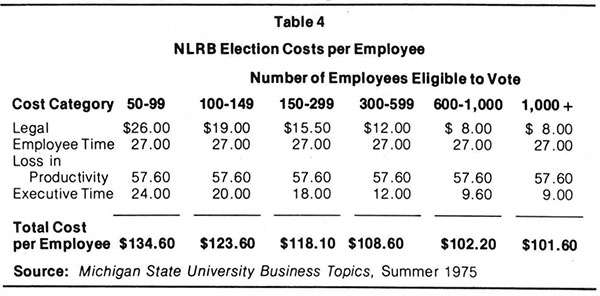

Not all examples of the heavier burden of regulation on small business have to do with the newer regulatory agencies. A National Labor Relations Board election is a good example. Table 4 relates the total estimated cost per employee of an NLRB election to the size of the company work force. Clearly, the unit cost of meeting this regulatory requirement is smaller for the large firm ($101.60 for companies with over 1,000 employees) and larger for the small firm ($134.60 for firms with fewer than 100 workers).

REMEDIES

One of the problems is that small firms have little if any opportunity to influence regulation in the formative stages. Even if individual firms become aware of proposed laws or regulations, by virtue of their smallness they can ill afford to devote precious management time to attempting to alter an only potentially difficult situation. That this problem often has gone unrecognized in the past was aptly expressed by James D. Hutchinson, who headed the Labor Department's pension benefits unit when ERISA was passed. "No one asked" for input from small business during hearings on the legislation, he said.

There are hopeful signs that the regulatory agencies are waking up to the special problems of small business. For instance, seven years after its establishment, OSHA has begun a combined effort with the Small Business Administration—the Small Business Assistance Program (SBAP). This is a pilot program in one of OSHA'S regions, with five federal safety and health officers acting as "contact points" between OSHA and small business. These officers will provide a referral service, directing the businessmen to the appropriate agencies and organizations.

In addition, OSHA has proposed to pay 90 percent of a state's cost to send consultants to visit a workplace and identify unsafe conditions. Sixteen states do not currently provide such service. The consultants cannot issue complaints if an employer is violating safety and health laws, but the consultant must request "immediate elimination" of any hazard posing "imminent danger." If a violation is considered serious, the consultant will give the employer "a reasonable time" to correct the problem, and if the correction is not made the consultant notifies OSHA. The consultant does not levy fines, and thus the small firm can request his assistance without fear of punitive results.

Minor changes have also been instituted in ERISA regulations, such as reduced reporting requirements and a small business participation in its Advisory Council. The Internal Revenue Service and the Labor Department are working together to eliminate duplication of forms associated with ERISA.

These changes have been prompted by public criticism of initial regulatory action. In the scramble to enlist government agencies in the protection of consumers, workers, pensioners, and investors, small business has been sorely neglected. It constitutes a vital segment of the economy, however, and there is a beginning awareness of the need, now, to "counter-protect" small business, to mitigate the harder-hitting consequences of regulation. Perhaps this sequence—protection of some group of citizens by the imposition of regulatory apparatus, then protection of the regulated from the negative side effects—is part and parcel of the whole affair. Even if so, it does not appear that the counterproductiveness of the process is going to be recognized soon. At least, then, the backbone of private enterprise—the small business firm—should be considered at the outset of the regulatory process. If not, that backbone is going to give way under the burden it is being forced to bear, thereby debilitating the entire economy.

Mr. Chilton is assistant director of the Center for the Study of American Business, at Washington University, St. Louis. He has experience in industry, in engineering, management, and business planning and for a brief period was himself a small businessman.

This article originally appeared in print under the headline "How the Feds Screw Small Business."

Show Comments (0)