Why Coal Won't Be America's Energy Salvation

Government policies have locked up nearly all western coal…and the odds aren't good for setting it free

President Carter wants domestic coal production to double—to 1.1 billion tons per year by 1985. Obviously, the President is an optimist—meaning: he's not as well informed as a pessimist.

It took the U.S. coal industry 57 years to increase domestic coal production by about 11.5 percent—from 568 million tons in 1920 to today's level of about 665 million tons. With such a growth record, it would take a few hundred years to boost coal production to the level envisioned by Mr. Carter.

Perhaps we could reach that level by 1985 if we didn't have to worry about the lack of capital, and if we weren't bothered by such trifles as the Mine Health and Safety Act, the National Environmental Policy Act, the Clean Air Act, and the new Surface Mining Act, the pending bills for horizontal and/or vertical divesture, etc. But let's forget about all that. Let's pretend instead that we have lots of money for opening up new mines, that the economy is in great shape, and that the legislative and regulatory orgy of the past 10 years never took place.

Then what?

There would still be one enormous obstacle to any substantial increase in coal production: no land available to mine.

Most of the projected production increase will have to come from the coal-rich deposits of the western states. But the biggest landowner in the West is the federal government. And in recent years, the federal government has been behaving as a deranged landlord by pursuing a no-leasing policy.

The tragedy today is that while energy problems are getting worse, the U.S. coal industry—which could solve most of these government-created problems—is being denied access to more than 99 percent of federal coal lands.

What President Carter does not know, and what virtually no one outside the mining industry knows, is that the non-issuance of competitive leases and preference-right leases for coal and other minerals has resulted in the de-facto nationalization of a large part of the country's mineral resources or, at least, in a gigantic step in that direction.

How the hell did this happen?

The answer has been provided by L. Courtland Lee and David C. Russell in two recent articles, one in Mining Engineering ("Federal Leasing: the Need for a Perspective," May 1977, pp. 23-24) and the other in Coal Mining & Processing ("Whatever Happened to Federal Coal Leasing," June 1977, pp. 60-63). Messrs. Lee and Russell are mineral economists at the U.S. Department of the Interior. In this article, I merely give a synopsis of their findings, before outlining my tentative solution.

HOW TO GET INTO MINING

There are three ways of getting into mining.

1. Land ownership. If you have land of your own, if you have both the surface and mineral ownership rights, if your land acreage is large enough to constitute a "logical mining unit" that will enable you to mine commercially, if you spend a small fortune on geological and mine feasibility studies—and if you invest an indecent amount of time (at least three years) to get the few dozen permits from local, state, and federal authorities—then you might be allowed to mine your own land.

2. Preference right leasing. If you have neither your own land nor the money to buy somebody else's property, you can get into mining by first obtaining a prospecting permit from the U.S. Department of the Interior. The prospecting permit is nothing but a hunting license: with it, you are allowed to search for minerals in those areas where—according to the U.S. Geological Survey (an agency of Interior)—there are no known or workable mineral deposits. Then, in the unlikely event that you find something valuable, you are entitled to a preference-right lease (sometimes also known as a "non-competitive lease") because, after all, you spent your own money in locating the deposit. The government, in effect, gives you the right of first refusal by issuing a preference-right lease; you don't get anything else—and, when you start mining and producing, you must still pay the same leasing fee, mineral royalties, severance taxes, etc., as everybody else.

3. Competitive leasing. If you have money, you can get a competitive lease by bidding successfully against other miners for a piece of land where the U.S. Geological Survey has spent the taxpayers' money to find and identify a "workable mineral deposit."

ZERO LEASING FOR COAL

Though it was never administered to everybody's satisfaction—and though it suffered from the usual government-caused abuses (the most famous of which was the Teapot Dome scandal of 1921, to be discussed later)—the leasing system worked fairly well from the late 1870's to the late 1960's. Since 1968, however, the entire federal leasing mechanism has virtually ceased to function. Today, for all intents and purposes, mineral deposits on federal land are no longer accessible.

The situation is particularly grave where coal is concerned. Briefly, here is a rundown of the main events.

In 1968, the Interior Department began to withdraw more and more land from mining exploration to the point that, today, more than half the country (mostly in the minerals-rich western states) is no longer accessible even for prospecting. Such a massive withdrawal of land from prospecting and exploration, incidentally, is just about as rational as forbidding American physicians from conducting medical examinations on one-half of the human body.

In 1970, Interior began a moratorium on coal-prospecting permits. Since then, deprived of their "hunting license," many coal prospectors and exploration firms have gone out of business.

In 1973, Interior instituted a freeze on coal preference-right leases. Since then, hundreds of small mining companies that had spent their meager funds to locate a deposit have gone bankrupt.

Finally, in 1976, Congress killed the preference-right lease method for coal by amending the 1920 Mineral Leasing Act. From now on, unless you own land, the only way you can get into coal mining is through competitive bid leasing.

"In view of the energy crisis and of the federal government's control over coal land," says Courtland Lee, "the need for a rational leasing policy is more important than ever. But no such policy exists. Or if it exists, it certainly hasn't reflected any effective management, as shown by the record of federal leasing during the past nine years."

For instance:

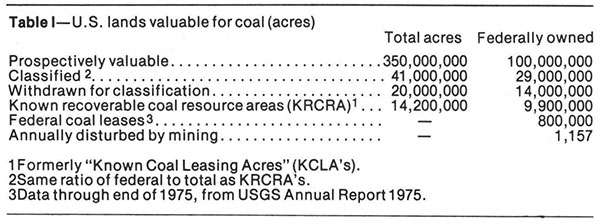

• Coal land made available under federal lease is only 800,000 acres. This is equivalent to 0.8 percent of the 100 million acres of federally owned land prospectively valuable for coal (see Table I).

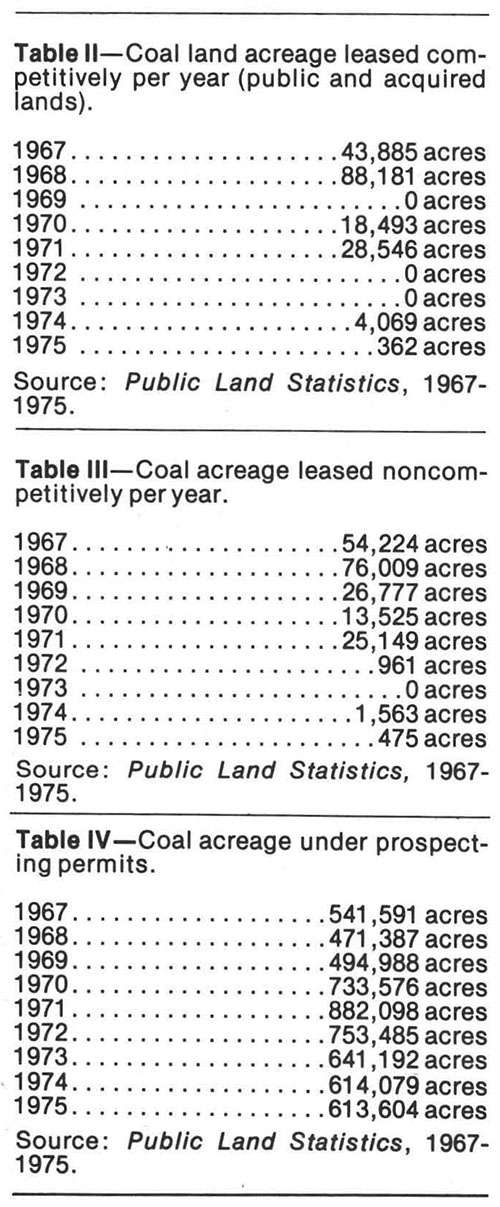

• The acreage made available annually under competitive bidding since 1967 has fluctuated sharply downward—from a peak of 88,181 acres in 1968 to zero in 1972 and 1973, and the acreage presently leased is minimal (Table II). This condition was largely caused by interpretations of the 1969 National Environmental Policy Act.

• The acreage made available annually under preference-right leases, also known as "non-competitive leases," has plunged from the 1968 peak of 76,009 acres to 475 acres in 1975 (Table III).

• The acreage under prospecting permits has not changed appreciably since 1967 and is now 613,604 acres (Table IV). That is a sizeable number; but it is also a meaningless number in view of the fact that only 475 acres became available in 1975 through a few prospecting permits that had matured to preference-right leases.

FACTS AND FICTION ABOUT COAL LEASING

For several years the Department of Interior has defended its zero-leasing policy by stating that 800,000 acres of land already under lease contain a total of 25 billion tons of coal reserves. "This was, and still is, the argument most frequently ventilated in political and environmental circles," say Lee and Russell, "and if taken at face value, particularly by people who don't know much else, this reserve-under-lease argument carries the built-in conclusion: Let's put a halt on coal leasing."

According to Lee and Russell, the error in the reserve-under-lease argument—as any experienced geologist, mining engineer, or mineral economist can easily point out—is that such an argument would only be valid if the geology, economics and legality were completely known and understood. In the real world, unfortunately, the reserve-under-lease approach is limited by insufficient geological knowledge, as well as by traditionally misleading interpretations of just what reserves are and what they mean as far as providing a land position sufficient for coal production.

Moreover, recently enacted regulations will have an adverse effect on the 800,000 acres of coal land presently under federal lease. Most of this land, which exists in scattered leases acquired before 1973 by coal producers and would-be coal producers, was issued non-competitively—i.e., it was issued outside of those "high-grade" areas that are exclusively designated for competitive leasing. Obviously, some of these non-competitive leases will never become productive coal mines for economic reasons, and some will never become productive because of various environmental and regulatory reasons of fairly recent vintage.

Lee and Russell have further pointed out that reserve-under-lease figures are a potpourri of measured, indicated, inferred, economic and subeconomic reserves, and resource estimates—not all of which were economically and legally extractable even in 1973 when these figures were determined. The analysis also failed to include the fact that 30 or more tons of measured recoverable coal are needed to produce just one ton annually, all of which must be in a "logical mining unit." During the years of the coal leasing moratorium (1971-1975), many leases that had been applied for to complete logical mining units had not yet been issued.

Any operator must receive timely governmental permission to economically mine and market coal from measured, economic reserves in a logical mining unit, with a large enough reserve position to justify the initial capital expense of property, plant, and development. These factors were not considered, either, in totaling the 25 billion tons of coal supposedly in reserve under lease.

"Even if those bloated tonnage figures were realistic in describing how much coal is under lease," notes Courtland Lee, "industry would not and could not be interested in thin beds or poor quality; or in areas with high production costs; or in areas that lack a market; or in areas where federal, state, and local governments have placed so many restrictions—e.g., land withdrawals, restrictive land-use stipulations, complex and time-consuming permit requirements, prohibitive access, arbitrary anti-pollution regulations—that often raise costs on leased land too high to justify the investment. A prime example of this can be found in the abandonment of the Kaiparowits leases."

The Kaiparowits Power Project, incidentally, was originally conceived 14 years ago to deliver 5000 megawatts to users in Utah, Arizona, Colorado and New Mexico. Investment for this coal-burning power project was initially estimated at $600 million. But because of inflation and bureaucratic delays, this project was scaled down to 3000 megawatts in 1975 while its capital requirements soared to $2.5 billion. Last year, when Southern California Edison and the other participating utilities were informed that they had to file yet another environmental impact statement, the entire project was scrapped. At that time, the delays were costing more than $6 million per month in plant construction alone.

A GOVERNMENT MONOPOLY

Every year since 1970, the Department of Interior has announced a "new leasing policy," which invariably increases the federal monopoly over mineral resources.

This year was no exception. In fact, at the 1977 meeting of the American Mining Congress Coal Convention in Pittsburgh, Interior Secretary Cecil Andrus promised to evaluate the entire federal coal leasing policy "as quickly and expeditiously as possible." That may take some time because a new bureaucracy—the recently formed Department of Energy (DOE)—will have its finger into federal leasing practices. "The Department of Energy," said Andrus, "will take over some of the leasing functions we now have and will also carry out research and development of mining techniques. In general, the Department of Energy will tell us (at Interior) how much coal they think should come from the public lands and what the economic terms of the leases should be. The Interior Department will determine which federal lands should be leased and will call for the bids, oversee the leases, and monitor the lease operations."

(Obviously, government planning is the answer because, after all, "We've tried free enterprise, and it has failed.")

Secretary Andrus, who identifies himself as a conservationist, then went on to spell out the new division of labor between industry and government: "You are the people who will do the mining, and we—meaning the federal government—are the people who will provide the regulations which will guide the mining practices, the environmental protection, the land reclamation standards and much of the coal." (Translation: "You are the people who will do the mining, and we—meaning the technical illiterates who can't even spell anthracite—will tell you how to mine the stuff, where, when, how much, to whom to sell, at what price, and how to reclaim the land.")

Oh well, if you like the postal system, you'll love nationalized coal.

As Lee and Russell point out, incidentally, the degree of control exercised by the federal government already greatly exceeds the official 100-million-acre figure.

The reason?

Because checkerboarding (i.e., a railroad's ownership of one-square-mile parcels of land on alternate sides of a railway) and complex ownership patterns of private land, state parks, national parks, Indian reservations, etc., are often the rule rather than the exception, many mining operations must include at least some federal property (especially in the West). In addition, the federal government owns over 700 million acres of surface and minerals, mostly in the western states and Alaska.

"We estimate that the federal government owns 70 percent of the coal as well as equivalent or greater amounts of other leasable minerals in the western half of the United States," report Lee and Russell.

This federal monopoly so pronounced in the West has the full support of eastern politicians, organized labor, and western socialists (some of the latter posing as "environmentalists"). The United Mine Workers Union, which draws most of its membership from the eastern underground mining operations, is understandably opposed to surface mining in the West—particularly since, as the argument goes, "If we can prevent surface mining, more coal has to be mined underground, and that means more money and power for us." Many elected officials from eastern states also oppose the development of western coal because this "foreign" coal imported from Wyoming or Montana might cause unemployment at "home."

Thus, even though surface mining is the best, most efficient, safest, and most profitable technique to be developed in the past 50 years (see box), I am certain that the development of western coal will not be allowed to reach its potential for at least the next 10 years.

One weapon against western coal is the zero-leasing policy. Another weapon is the blanket requirement for sulfur dioxide scrubbers on all coal-burning power plants, regardless of whether such power plants burn high-sulfur (i.e., eastern) coal or low-sulfur (i.e., western) coal; this weapon will remove whatever economic incentives the utilities might have in purchasing western coal. Another weapon is the "non-degradation" requirement that is being incorporated into the amendments to the 1970 Clean Air Act allegedly for the purpose of preventing "significant deterioration" in areas of pristine air quality—but in reality to prevent or delay the construction of western mine-mouth coal-burning power plants. Another weapon is the "horizontal divestiture" proposal (union-endorsed, of course) which would cut off the only source of risk capital for western coal development by forcing oil companies to sell their coal holdings. Another weapon is the new Surface Mining Act (see box).

I could go on, but you get the drift.

A TENTATIVE SOLUTION

The zero-leasing policy so relentlessly pursued by the Department of Interior is perhaps the biggest obstacle to fossil fuels and minerals development. It is also the logical result of almost a century of good intentions enforced by government edict and based upon three erroneous premises. Two of these premises are historical; one is philosophical.

Once the historical context is established, the solution (or at least, a tentative solution) will virtually suggest itself. "Throughout the 19th century—especially after the Civil War—the federal government encouraged settlers, war veterans and private developers to move westward and take up homesteads," say Lee and Russell, "and this is how our forefathers were given 'free' homestead for only a nominal filing fee.…Several million acres of coal land, however, were excluded from the disposition of homestead laws.…Eventually, the federal policy that evolved during that period was geared at keeping the nation's resources within federal control for at least two reasons: to create a source of revenues, and to prevent private monopolies." (emphasis mine)

Well, the first reason might have made sense until 1916 because, before then, there was no such thing as an income tax. But it certainly doesn't make any sense in 1977 when government (local, state, and federal) takes in taxes more than 50 cents out of every dollar we earn as individuals and as corporate entities.

The second reason, i.e., that a leasing policy has to be established to "prevent private monopolies," is totally false. It was government itself that created most of those coercive private monopolies—for instance, by granting huge tracts of land to railroads (the famous "checkerboarding"). In fact, the biggest scandal in mining—a scandal rivaled only by Watergate—occurred when government abuses were discovered: "In 1921, the then Secretary of the Interior, Albert Fall, using questionable authority, secretly leased without competitive bidding some military oil reserves in California and Wyoming (Teapot Dome) to E.L. Doheny and Henry Sinclair," report Lee and Russell. "Secretary Fall, who went as far as to call the Marines to evict Sinclair's rival claimants from the Teapot Dome reserves, was also found guilty of a corrupt conspiracy to secure for Doheny unleased land in the California reserves and accepting $100,000 in bribes."

Finally, the third reason for a leasing policy rests on the public-property premise, i.e., that unoccupied land is "public property" and that government must administer this land. This premise was implied in much of the legislation passed at the turn of the century, but it has now become explicit particularly in every piece of land legislation enacted in the past few years. The argument usually begins with the plea that "federal" land should not be made available to the multiple use of individuals and industries, but must be preserved as ecological and wilderness areas, except that the real purpose is neither of these. The real purpose is to cash in on the concept of "public property"—which is a contradiction in terms.

The public is everybody in general and nobody in particular. "Property," on the other hand, is a concept that, on legal-moral grounds, identifies the relationship that exists between an individual and an object of value—and the law clearly spells out the method in which a person acquires title and possession of a particular value. (The concept of a collective or public property has no validity in science either: there is no such thing as a collective property of the elements, or a collective viscosity, or a collective density, or a collective molecular weight of substances.)

So, what should be done with the hundreds of millions of acres of public property?

As I see it, the solution would be to convert this land into private property—either through a new version of the old homesteading laws, or by a land-selling program quite similar to the periodic gold auction sales organized by the U.S. Treasury Department. The proceeds from such land auctions would then go to the ultimate owners—the U.S. public—via tax rebates.

The chances of any such solution being put into effect are nil, at present.

An alternative or tentative solution—which I propose with many reservations—would entail the restoration of so-called federal land to the various states, each of which would then compete (I hope) in selling this land to the public. This tentative solution has at least one virtue, and one vice. The virtue is that it would appeal to the greed of many local and state elected officials (whom we can always impeach later); the vice is that such a solution might wind up replacing one master (the federal government) with at least 50 masters (the state legislatures).

Many mining people would be satisfied with a leasing policy such as the one that existed until the mid 1960's. Lee and Russell have suggested establishing a leasing policy based on what is known about coal or any other mineral resource, compared to what acreage is available for lease and to what has already been leased. While I greatly respect both gentlemen, and concede that any leasing policy is better than a zero-leasing policy, I just don't want government as my landlord. Whatever government gives, assuming it "gives" anything in the first place, government eventually takes away—a fact corroborated by Lee and Russell's findings.

Ultimately, then, the only real solution is to return all coal land to private hands, where it can be developed (or not) in accordance with the laws of economics—not the edicts of politicians and bureaucrats.

Eugene Guccione, a chemical engineer, became editor of Coal Mining & Processing in June 1977. Before that he was editor of Mining Engineering, a publication of the Society of Mining Engineers of the American Institute of Mining, Metallurgical and Petroleum Engineers.

Some Facts about Western Coal

The new Surface Mining Act, which is merely a rehash of the old legislation vetoed twice by President Ford, was passed by Congress in July. Allegedly drafted "to protect the environment," this bill in reality is nothing but a crude attempt at halting coal development in the West.

Mining engineer John F. Havard, former president of the Society of Mining Engineers of AIME, points out that this bill is (a) unnecessary since "the 38 states producing most of the nation's minerals have already adopted stringent mining laws," and (b) dangerous because it overlooks the fact that "coal strip-mining conditions vary from state to state. Western strip mining differs from Appalachian strip mining. Even North Dakota strip mining is different from Colorado strip mining."

Why must western coal development not be stopped? Here is a list of reasons: (1) Surface mining is the only way to produce coal from many of the vast western deposits, which are near the surface and cannot be mined by underground methods. (2) Surface mining, compared to underground mining, is much safer: it is 20 times less likely to result in the death of a miner. And there's no such thing as black lung disease in surface mines. (3) Surface mining is more efficient; it recovers 80 percent of the coal; and in thick western seams, recovery rates can exceed 95 percent. Underground mining instead recovers about 50 percent of the coal (since the rest has to be left in underground pillars to hold the roof up.) (4) Surface mining is more productive. In the same amount of time it takes for an underground miner to produce one ton of coal, a surface miner can produce up to 20 tons of coal. In fact, surface mining averages about 35 tons per man per day; in the West, it can average up to 200 tons. Underground mining instead averages about 11 tons per man per day.* (5) Surface mining in the West yields clean coal, which contains from a half to one-tenth the amount of sulfur present in eastern coal. (6) Surface mining in the western states would disturb at least 90 percent less land than surface mining in the East. For instance: to produce 30 million tons per year of coal in the Powder River Basin of Wyoming, in any given year only 300 acres of land would be temporarily disturbed. To strip mine 30 tons per year of coal in a heavily populated state like Illinois would disturb 4500 to 7500 acres of land instead of a mere 300. (7) Surface mining represents only a temporary use of land. If half of the hoped-for 100 percent increase in coal production by 1985 comes from the West, it will require the surface mining of only 130,000 acres of land. The 130,000 acres that will be mined and reclaimed over the next 10 years is less than the amount of land covered by parking lots in one year. (8) The average selling price of surfacemined coal F.O.B. mine is $5 to $10 per ton; that of underground coal FOB mine is $10 to $20 per ton. (9) The mining industry, whatever its ancient faults, has been making a real effort in reclaiming for at least four decades. Of the 1.47 million acres used for surface coal mining from 1930 to 1971, one million acres had already been reclaimed by 1970. And in 1971, coal people actually reclaimed 30 percent more land than they mined. Finally, in spite of the grim picture of wholesale devastation allegedly caused by surface mining, only 0.16 percent of the total area of the United States has ever been disturbed by all kinds of surface mining. Of that, almost half has been reclaimed, and the rest is in the process of reclamation.

* It's interesting to note that in the United Kingdom, the average productivity in the nationalized coal industry is a mere 2.5 tons per man per day. There are no figures available for surface mining because virtually all British coal is mined underground.

This article originally appeared in print under the headline "Why Coal Won't Be America's Energy Salvation."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?