Silver: No Longer "Poor Man's Gold"

The accelerating price rise of the last nine quarters has taken silver out of the "poor man's gold" class. The abundant supplies and low prices of even 15 years ago are gone for good.

Silver and gold are metals with unique metallurgical qualities in an equally unusual combination. No substitute as yet exists which can approach their advantages when used for ornamental art, money or certain small-unit, high-volume industrial applications.

Silver and gold were used for money and artwork at least as early as 3500 B.C. in Egypt, Chaldea and probably China, more than 2000 years before the Bronze Age, the glory years of the Cretan civilization. As money, silver was more frequently used than gold because there was more of it, and lying close to Earth's surface it was more easily found. For example, the coinage of ancient Athens was silver. About 400 B.C. Aristophanes described the bitter comment of an Athenian as he contemplated the future of his "good silver drachma" recently alloyed with copper, an early, but far from the earliest, victim of currency debasement by an over-extended government. Today, even our copper pennies, hoarded by the public at a faster rate than the mints can produce them, are about to be made of aluminum.

Not often in an individual's lifetime do outstanding opportunities for long term investment occur, unrecognized by the great majority of investors. By 1970, however, the cumulative effects of rising U.S. inflation rates and their spillover into the economies of the other major industrial nations became increasingly apparent. To the few who did their homework carefully, it was clear that accelerating inflation at home and dollar devaluation (in terms of gold) abroad were sure to come in the near future. A strong, long term rise was bound to be ahead for gold and gold-related assets, while the future of the stock market over the next five years was loaded with risk and uncertainty.

Because of its normal price ratio (16:1) to gold, as well as its historic monetary role as a store of value, silver is a gold-related asset. By 1971, its technical characteristics, price insensitivity to both supply and demand forces, the production-consumption deficit and the end of U.S. government sales started silver on a strong, long term rise. Exhaustion of U.S. government inventory in 1970, the impending end of noncommunist private stocks by 1975-76, and an above-normal price ratio to gold brought the leverage on silver to a point theoretically greater than on gold. Bullion, silver coins and the shares of good silver mines were as good as and possibly better than gold for long term appreciation.

SILVER HITS BOTTOM

The two year decline in the spot silver price from the mid-1968 high of $2.56/oz. to the 1970 low of $1.57 had discouraged many investors. They were familiar with the production-consumption deficit, and knew little and cared less about the monetary roles of silver and gold. Most of these investors abandoned their positions with substantial losses, especially those in the futures market on thin margins. In the last half of 1971, a series of random events, short term in nature, occurred almost simultaneously. The remaining weak holders of silver assets sold out or were forced out. Meanwhile, the first drawdown since 1965 on private bullion stocks on the New York Commodity Exchange was made. The weekly Treasury sales to industrial users, which had kept private stocks largely intact after 1965, had ended in November 1970 on exhaustion of Treasury inventory.

The stage was set for solid, strong, long term investors in silver assets. The fourth quarter 1971 low of $1.28/oz. provided one of those rare opportunities to increase existing investments or initiate new ones. At the same time, a torrent of antigold propaganda from Washington depressed the free market gold price slightly and gold shares more severely. Investors in gold-related assets had the same unusual opportunity as silver investors to add to previous commitments and make new ones. Since then gold and silver bullion, coins, and shares have increased by about two and a half to five times.

Now (early 1974) investors with no gold or silver holdings wonder if they've missed the bus by failing to protect their assets from inflation and dollar devaluation. The huge increase in world oil and gas prices adds another kicker to already dangerous inflation rates in the major industrial nations whose economies have been based on abundant, low-cost energy.

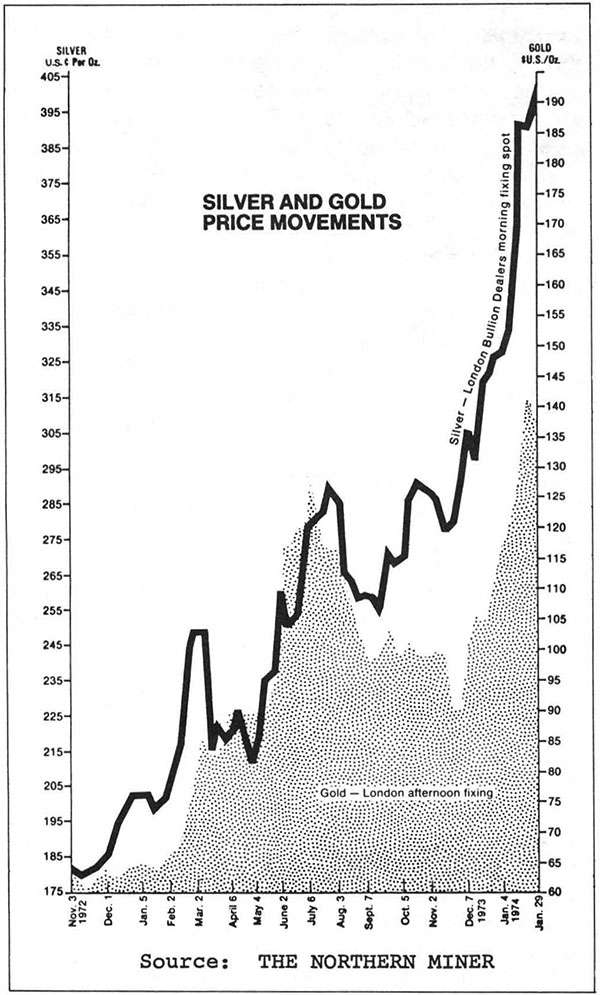

This situation, on top of seriously strained financial structures in the Common Market, Japan, and especially the U.S. will cause balance of payments deficits, increased destructive inflation rates and slowing economic growth in all of these nations. No one of these three factors has occurred at the same time in all major, industrial countries prior to 1970 when world inflation began to get out of hand. Now, for the first time in history, all three problems will plague these governments simultaneously. The impact, particularly on the U.S., compounded with already critical financial fundamentals, will be immense. Under these conditions we expect gold and silver prices to rise. Gold will move to $200 per ounce, perhaps higher, this year. Silver's advance in February to a spot price of $6.70 may be its high for 1974. Its price has doubled since year-end. In addition to uncertainty about Congress's action on the bill to sell 117 million ounces of the remaining 139 million in the strategic reserve, India's recent repeal of its law forbidding the export of silver raises the possibility of increased supply. We will review this in more detail later on.

By the end of this year, or early next year, unexpected deflation should be apparent in the U.S., and probably other large industrial countries. This development should cause a sharp drop in silver and probably gold prices. The Common Market and Japan will fight for their overseas trade. Competitive devaluations, already begun, will increase.

Against this emerging change in the world's principal economies, we believe that gold shares are still in an early phase of a long term rise as bullion prices continue to increase. Gold mining companies will need at least a year after the gold price peaks to adjust operations to maximize earnings. Carried along with gold and impending scarcity, silver and silver stocks should also have a bright future over the next few years.

However, toward the end of the year as deflationary evidence mounts, silver's price will probably fall, especially if the Congress votes to sell the proposed 117 million ounces from the strategic stock pile. The price drop should be sharp, probably aggravated by bullion dealers' transactions. The reasons will be largely emotional. In prior recessionary periods, a demand slump caused severe price declines. The conditions which produced this result won't be around now, and silver's fundamentals will continue to be strong. Nevertheless a Pavlov reaction is likely to occur. Investors should be prepared to reduce silver investments in this event. If a substantial price drop actually occurs, a great buying opportunity will be at hand.

SILVER IN THE RECESSION

Any uncertainty about the short and intermediate term price levels of silver centers on five questions. First, in a recession will a contraction in demand cause a serious price depreciation as has been true in the past? In the case of silver we believe it will not, this time. The demand factors are as follows. Noncommunist world consumption in 1973 increased again to 483 million ounces, up 13 percent compared to 1972. Of this, industrial demand was 463 million ounces, up 18 percent, and coinage 20 million ounces, down 45 percent. Use of silver coinage had risen steadily from 1970 through 1972. The drop last year we believe temporary, and coinage should rise substantially again this year. U.S. industrial demand rose to 190 million ounces, up 26 percent and accounted for 41 percent of total industrial usage.

The total shortfall between total non-communist production and total consumption was 234 million ounces in 1973, 184 million in 1972, 133 million in 1971, and 110 million in 1970. The gap was made up from 1971 on by drawdowns from private stocks, U.S. Treasury coinage, stocks of foreign governments, demonitized coin, smuggled silver from India and salvage.

Withdrawals from private reported and unreported bullion stocks, not counting supplies from India, were 90 million ounces in 1973, 95 million in 1972, and 55 million in 1971. The latter year was the first for such drawdown since 1965. In that interval, U.S. government sales made up the difference plus adding to private inventories. About two-thirds of the difference between total production and total consumption, on the average, is made up from secondary sources and the rest from private stocks.

Among the components of demand, the photographic, electrical and electronic, and commemorative and collector arts categories each hold about 25 percent of the market for a total of 75 percent. Usage in commemorative and collector arts doubled in 1973. We expect this market to remain strong as purchasers increase hedging against inflation. Photographic, electrical and electronic demand, we believe, will fall this year as deflationary forces develop.

Total noncommunist world demand should drop about 15 percent. Allowing for a modest increase in primary mine production and a drop in by-product silver from copper, lead and zinc, we estimate a two percent rise in total new production. The end result should be a reduction in the withdrawal rate from private stocks. However, in view of the rising gold price, continued monetary uncertainties, widespread distrust of currencies, and scarcity not far off, sales of inventories will be at historically high prices. And while usage reductions in two of these major use categories will occur, the use of silver in new applications—bearings, brazing, batteries, electrical contacts and circuitry, water purification, x-ray film, detergents, catalysis and petroleum additives—will help to offset the decline.

SILVER SUPPLIES

On the supply side world production rose four percent in 1973. There are five major sources—

(1) Mining—primary silver mines produce only around 13 percent of total supply. At current prices, an annual increase of two percent may be expected. In three to five years as new mines—they will be few and small—begin to produce, annual growth should rise to three percent, but by then private stocks will be almost gone except for carefully tended hoards.

About 39 percent of total supply is byproduct silver from copper, lead and zinc. These metals are the first to suffer in a recession. Their production will drop faster than silver demand. Salvage by recycling of all three base metals without any silver byproduct will increase. On balance, silver demand will drop less than silver production. In past recessionary periods, a huge silver inventory over-hanging the market pushed prices down. Now most of these stocks are gone. And 40 years ago, there was small industrial demand.

(2) Secondary sources—these include salvage and sales from India. Since 1969 salvage has risen steadily from about 15 million to about 56 million ounces. As silver prices rise, opportunity for increasing salvage improves. Still we think this rising trend will continue to flatten out as it has since 1972. Most of the technical progress in recycling silver has been made, and further advances will be gradual. In a recession, silver salvage will decline with demand.

Indian silver has long been one of the two major threats often reported by silver bears. It's true that India holds large amounts of silver. Nobody, including the Indian government, knows how much. The February ending of its law prohibiting the export of silver probably was motivated by Arab requests for payments for oil in gold and silver. Perhaps another reason may be pressure from western governments.

If the Arabs take silver bullion directly in payment for oil, they will probably store the silver and it will not be available elsewhere. If India sells silver for foreign currencies, the silver supply will be increased. However, their supply of bullion is small compared to the total amount. Most of the silver is contained in jewelry and religious objects tightly held by individuals who regard silver as their ultimate security. The chances of any release, even at present prices, is less than even except in some personal emergency like the famine of 1968. The government will have to find, persuade or order, and then refine the metal.

By 1972 smuggled silver dropped to 6 million ounces. Higher prices in 1973 brought this amount to about 26 million ounces, within our estimated range of 25-30 million. It's been estimated by some that the end of export restrictions will produce 200-300 million ounces from India. We think the wish is father to this thought. Nobody will have a standard of measure until at least the end of this year. We think these exports may reach 40 million ounces annually. If they are sold for foreign currencies instead of directly for oil, this should have a mild, retarding effect on silver's price rise.

The second scare story frequently used by the bears is a new photographic process eliminating silver. Officers of Eastman Kodak periodically deny this story, but it's still around. We think there will be developments that gradually reduce the use of silver in a few areas, but this will be limited in application and the impact small. The difference will be more than made up elsewhere.

(3) Coinage—it's been estimated that the potential supply may be two billion ounces. No one can be sure. Quantities of demonitized coin fell from 50 million ounces in 1969 to 15 million in 1972 and 1973. Recently the volume increased when U.S. coins sold at a discount from spot silver prices. The U.S. coin melt rose three million ounces in 1973 from 213,000 ounces in 1972. World coinage melt will probably increase this year by 5-10 million ounces.

(4) Government Stocks—these stocks now total about 250 million ounces, mostly in the U.S., Mexico and India.

In 1946 the U.S. government held nearly 2 billion ounces. Although a large net importer, the government rapidly sold off its supply first at $0.91 per ounce, then at $1.29 and finally at the market price down to zero inventory in 1970. From 1964 through 1970 alone, the Treasury sold 904 million ounces. Thus like gold, our huge stock of these increasingly scarce, store of value assets have been sold off at bargain basement prices.

Today most of the remaining total government stocks will be held for military reserves and coinage. Except for the possible sale of 117 million ounces from the U.S. strategic reserve, we expect sales to decline from last year to about 25 million ounces and to continue that trend.

(5) Private bullion stocks—these include industry stocks plus the reported stocks of the London, New York and Chicago commodity exchanges. Also included are unreported stocks held in the U.S. and abroad, excluding communist countries. Their values are estimated. The total is put at about 200 million ounces. We estimate minimum working inventory, including the hard core hoarders, at about 80 million ounces, leaving a balance of 120 million ounces in strong hands after the 1971 shakeout.

The best thermometer for the silver temperature is total inventory at New York, Chicago and London. At the end of June, 1973 these stocks were about 90 million ounces compared to December 31, 1971 at 130 million ounces. By November of last year there was a further drop. But at year end, the total rose to 108 million as shorts rushed silver to New York to meet December contracts for unexpected delivery of 20 million ounces to Texas investors. By February total stocks resumed their decline to 105 million ounces.

Balancing our estimated fall in world consumption in 1974 against our estimated supply, there will still have to be some liquidation of private stocks, assuming the U.S. government does not sell the proposed 117 million ounces from the stock pile. With private stocks strongly held, reinforced by world monetary pressures, rising gold prices, and a "scarcity premium," any price decline will be largely emotional rather than fundamental. Such an event would offer a buying opportunity. Assuming a future average 50 million ounce per year depletion rate in world stocks, these inventories would be down to minimum working levels in two and one-half years.

MELTING DOWN COINS

The second major question is whether old silver coinage will come to the melting pot in amounts large enough to have an important effect on the price. While potentially this is possible, as a practical matter we don't think so. We believe that no more than about 300 million ounces will ever be melted. In 1973 total demonetized coin was about the same as in '72. Recently U.S. coins have been selling at a discount from the spot silver price making it practical to absorb the melting cost. Coin melt has increased. Still, until the forward premium disappears, we think release from this source will be gradual. Probably silver from demonetized coin will increase this year another 10 million ounces to total 25 million. We don't expect the coin melt to be large enough to effect the fundamentals for at least three years.

Third, will Congress approve the Administration's proposal to sell off its strategic silver reserve for income—a move, in our view, comparable to a once wealthy individual disposing of the family jewels to maintain his unrealistic standard of living? Such action would include 117 million ounces of silver of the total remaining reserve of 139 million ounces. We believe that the entire reserve is already so inadequate that only a part, if any, of this amount will be sold.

During the first World War the U.S. government had to use 350 million ounces for international payments, because suppliers questioned the currencies of belligerent governments. In the second World War 900 million ounces were used for the same reason. In 1965 the Defense Department, we understand, asked for a minimum silver reserve of 500 million ounces. Now a small Treasury reserve for coinage, about 6 million ounces in the Defense Department, and the 139 million ounce strategic stockpile is all the government has left of a rapidly disappearing, almost irreplaceable asset.

However, if the 117 million ounces are all sold, the amount would be used in 12-18 months. There would be a psychological impact on the price. We think the reaction low, considering world monetary conditions, could be $4.00.

SILVER AS MONEY

Fourth, is silver money? For centuries there have been repeated attempts to demonetize gold and silver as governments sought to pay for extravagant policies through inflation. Every attempt has failed, and we believe present attempts will also fail. Finally fed up with base metal coinage and fiat money, the public, or a new government in to clean up the mess, each time restored "hard coins" and gold or silverbacked paper. Recently, the head of the Bank for International Settlements, the Common Market clearing house bank, stated that gold will remain in the monetary system at higher prices. He referred to S.D.R.'s (paper gold) as without value, and declared gold as the only monetary asset guaranteeing monetary authorities independence from political interference. All this is contrary to what we hear from Washington.

Over 5000 years ago these two metals were selected as "money" because of their unique combination of qualities. As a medium of exchange and standard of value, both metals were used with balancing scales to measure weights of items offered for sale whose values were expressed in terms of silver or gold. The metallurgical characteristics that led to their selection then are the same today. Thus the reasons for the original choice of silver as money are not subject to change simply because silver is not now a currency reserve or generally used in U.S. coins.

Recently this point has been emphasized by a proposed revival of the ancient practice of selling materials against a measure of gold or silver. The Arabs have proposed partial payment for oil in these metals.

Silver coinage is again beginning to increase, largely because of public insistance. In 1969, 64 issues were minted by 28 nations. In 1972, 78 issues were minted by 41 nations. Total noncommunist government gross silver revenue (total face value of all world coins divided by total ounces of silver minted) was $3.53 per ounce in 1969, $4.88 in 1970 and $6.90 in 1972. In three years, the monetary value of world silver coinage increased 95 percent.

During 1973, however, world coinage dropped 45 percent to 20 million ounces. We believe this is an abnormal decline. 1974 will see a return to rising usage. The Canadian government has announced an 11 million ounce sterling issue with 50 million ounces to follow. The U.S. has authorized 60 million 40 percent silver coins for the U.S. Bicentennial, 45 million to be minted by July 4, 1975.

THAT OLD 16:1 RATIO

Fifth, is the historic 16:1 price ratio of gold to silver dead? The value link between silver and gold has existed for over 5000 years, as long as silver and gold have been considered money. No combination of national rulers, finance ministers or economists has been able to shake the tie. In the beginning the ratio was small, 2.5 to 1. But in the fourth century B.C., a 15 to 1 ratio was established that lasted till 1874 when the U.S. changed the ratio slightly to 16:1. The 1890 discovery of the Comstock Lode, a huge silver strike now mined out, during a period of small industrial use, increased the ratio to 40:1. However, the 16:1 ratio reappeared from April to September, 1968 when for the first time in over a century there was a free market price for both metals.

In our opinion, silver is still cheap relative to gold. At current prices the ratio is about 30, far above the normal 16 existing for 23 centuries until recently, but down from about 46 at the end of June 1973. During these centuries, however, there were swings around the norm. As long as the gold/silver price ratio was constant, silver was as good as gold as a currency reserve. But since the ratio wasn't constant, in 1867-74 silver as a monetary reserve ended in Germany, the U.S., Sweden, Norway, Holland and Japan. India joined the others in 1893, though in all these countries the use of silver coins continued.

Assuming that gold will reach $200 per ounce this year, and using last summer's high price ratio of 46, silver should be worth $4.35. By last February the ratio had substantially closed the gap and declined to 30. Applying this ratio, twice the long term average, silver should reach $6.67, the approximate year's high already achieved in February. The average ratio of 16 brings the price to $12.50. This year, uncertainty regarding action by Congress and the Indian government should tend to retard the rise in silver's price. Until these factors clear, we think $6.00 is a good target for silver in 1974.

The reasons, we think, for these abnormally high ratios are a growing consensus that silver no longer has a monetary value, and loss of confidence resulting from the severe, unexpected price drop in 1971. The inventory overhang that caused the 1971 price collapse is practically gone. We believe that the majority opinion which refuses to accept silver as money and considers the silver-gold value link dead will change. The result will be a gradual decline in the ratio, as it has in previous, similar periods.

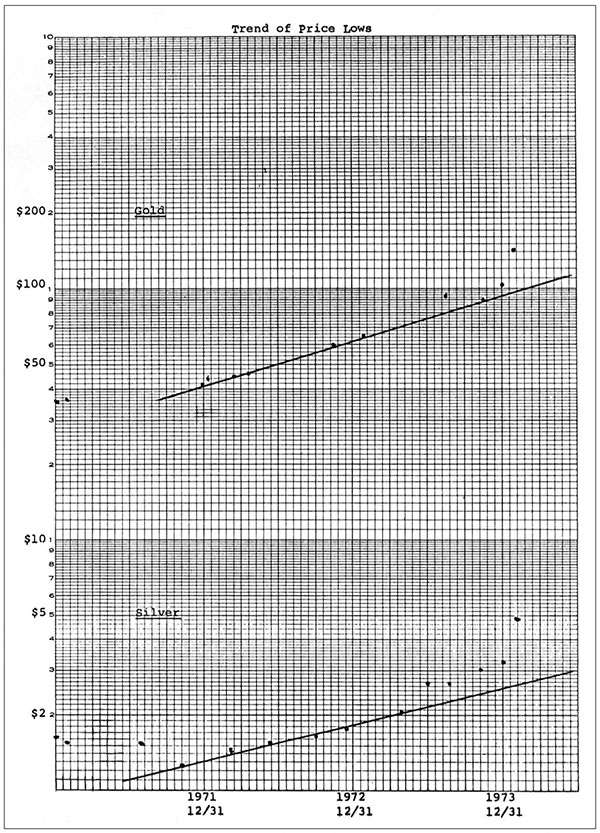

The ratio chart, showing the rate of price change, compares the rising trend of price lows since 1971. The trend lines are nearly parallel, showing that bottom trends are rising at about the same rate. But since the second quarter of 1973, the lows of both silver and gold are rising above the trends at roughly similar, increasing rates, exponentially. This indicates a high probability for still higher prices ahead.

We think that during the next three to five years the gold-silver price ratio will not only return to its historic value, 16:1, but possibly go below it. Assuming the government's silver reserve stockpile is not dumped on the market, this year should see a hard squeeze on the shorts. Continuing monetary uncertainty, rising gold prices, and approaching scarcity will probably slowly turn private owners from sellers to holders and buyers. On the numbers, it's probable that silver's price will increase more than gold's.

Recent price increases reflect not only continued demand by industrial users, but also increased, unofficial monetization of silver by private owners. We think their objective is less for short term trading than for long term protection against rapid money depreciation.

Most buyers of silver bullion are British and American because they cannot legally own gold. It is assumed that if Americans were to be permitted to own gold, silver holders would switch from one to the other. This may happen in a minority of cases, but because silver is still historically cheap compared to gold and the scarcity premium is not far off, the majority of silver holders, we think, will stand firm, anticipating the rewards of superior leverage.

Although silver stocks have risen substantially, the shares still lag the bullion price. They are, generally, in the early stage of a long term rise. By taking advantage of temporary reactions, and especially the setback that should occur if the Congress approves the proposed sale of silver from the strategic reserve, the securities of good silver mining companies and silver bullion should be outstanding long term investments.

Henry F. Banzhaf was graduated from the U.S. Naval Academy, and served with the Navy during the second World War. He has held functional and general management positions in the manufacturing industries. In the past 12 years he has engaged in general management consulting, the last 9 years with his own firm. Since 1966, his work has been concentrated on investment management for a limited number of clients. He conducted the Silver Workshops at the International Monetary Seminars held in Bermuda (1971) and Montreal (1973). He is a licensed Professional Engineer and Investment Adviser.

Show Comments (0)