The Great Illinois Exodus

Will fiscal responsibility follow? Or is it too late?

The migration of citizens out of the financially volatile state of Illinois has finally caused it to drop in population rankings. Once the fifth-most-populous state, the U.S. Census reports this week that Illinois has been surpassed by Pennsylvania.

And who can blame Illinois residents for fleeing? Reason has extensively blogged about the state's many fiscal problems, and more disturbingly, the extreme resistance of the state's public employees to any solution that didn't involve taking more money from the citizenry. Heck, they're even taking money from nearby states and still can't fix the mess.

Over the course of a year between July 2016 and 2017, Illinois suffered a net loss of 33,703 people, more than any of the seven other states that lost population during that time. As a result, the Keystone State now has a 3,500 population lead on the Prairie State:

The greater metropolitan area of Chicago has been bleeding population for two years now. The state itself has been losing population for the past four years. One expert told the Chicago Sun Times that it's typically the more rural parts of Southern Illinois that declines in population, but that's not what is happening here. He also notes that the population decline could cost Illinois in federal funding and even potentially cause the state to lose a seat in the House.

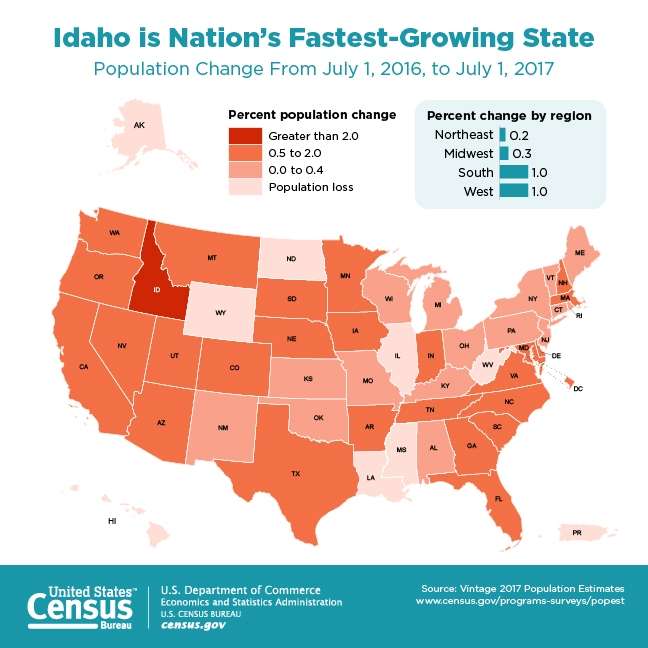

The Illinois Policy Institute notes that since 2010, the state has lost nearly 650,000 people to other states. According to the census, every single state surrounding Illinois saw a population increase over the past year.

Illinois just jacked up its income tax rate to nearly 5 percent over the summer, and Democrats there are pushing for a switch to progressive tax rates to try to get even more. But with the passage of the GOP tax reform bill, they've now got a new problem—a $10,000 cap on state and local (SALT) tax deductions.

Illinois may have low state income taxes compared to places like California and New York, but its citizens pay a humongous host of other state and local taxes. People who live up in the greater Chicago area deduct on the average between $4,000 and $8,000 (depending on which county they live in) from their federal taxes annually, according to the Tax Foundation. And state, county, and local government are always looking for new things to tax (or tax more) from soda to sewage, so that new SALT cap is going to present a huge additional challenge trying to convince Illinois citizens to approve more.

The cap on the SALT deduction will likely hit the wealthier citizens (particularly with the federal standard deduction doubling as an offset), but while some short-sighted folks may celebrate the idea that the rich will be paying more in taxes, this will exacerbate problems in the Chicago area even further. A study noted last year that Chicago was bleeding out millionaires, and they're the only city in the United States where this is happening. It's not just working class folks migrating to nearby states in pursuit of work opportunities and a more reasonable cost of living; even rich folks are taking a hike.

Maybe the loss of census ranking and the passage of a SALT deduction cap will shock the state into actually dealing with its fiscal irresponsibility. Don't hold your breath though: The state is only just now accurately portraying its levels of skyrocketing debt.

Show Comments (77)