The Great Illinois Exodus

Will fiscal responsibility follow? Or is it too late?

The migration of citizens out of the financially volatile state of Illinois has finally caused it to drop in population rankings. Once the fifth-most-populous state, the U.S. Census reports this week that Illinois has been surpassed by Pennsylvania.

And who can blame Illinois residents for fleeing? Reason has extensively blogged about the state's many fiscal problems, and more disturbingly, the extreme resistance of the state's public employees to any solution that didn't involve taking more money from the citizenry. Heck, they're even taking money from nearby states and still can't fix the mess.

Over the course of a year between July 2016 and 2017, Illinois suffered a net loss of 33,703 people, more than any of the seven other states that lost population during that time. As a result, the Keystone State now has a 3,500 population lead on the Prairie State:

The greater metropolitan area of Chicago has been bleeding population for two years now. The state itself has been losing population for the past four years. One expert told the Chicago Sun Times that it's typically the more rural parts of Southern Illinois that declines in population, but that's not what is happening here. He also notes that the population decline could cost Illinois in federal funding and even potentially cause the state to lose a seat in the House.

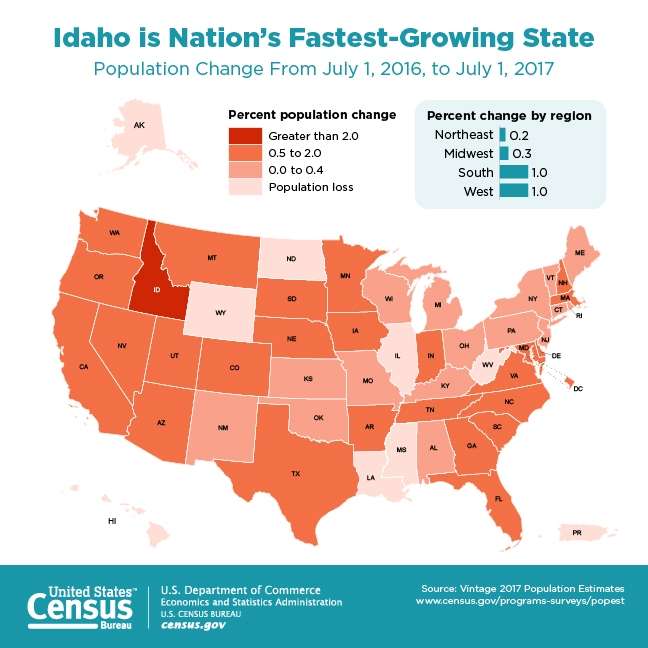

The Illinois Policy Institute notes that since 2010, the state has lost nearly 650,000 people to other states. According to the census, every single state surrounding Illinois saw a population increase over the past year.

Illinois just jacked up its income tax rate to nearly 5 percent over the summer, and Democrats there are pushing for a switch to progressive tax rates to try to get even more. But with the passage of the GOP tax reform bill, they've now got a new problem—a $10,000 cap on state and local (SALT) tax deductions.

Illinois may have low state income taxes compared to places like California and New York, but its citizens pay a humongous host of other state and local taxes. People who live up in the greater Chicago area deduct on the average between $4,000 and $8,000 (depending on which county they live in) from their federal taxes annually, according to the Tax Foundation. And state, county, and local government are always looking for new things to tax (or tax more) from soda to sewage, so that new SALT cap is going to present a huge additional challenge trying to convince Illinois citizens to approve more.

The cap on the SALT deduction will likely hit the wealthier citizens (particularly with the federal standard deduction doubling as an offset), but while some short-sighted folks may celebrate the idea that the rich will be paying more in taxes, this will exacerbate problems in the Chicago area even further. A study noted last year that Chicago was bleeding out millionaires, and they're the only city in the United States where this is happening. It's not just working class folks migrating to nearby states in pursuit of work opportunities and a more reasonable cost of living; even rich folks are taking a hike.

Maybe the loss of census ranking and the passage of a SALT deduction cap will shock the state into actually dealing with its fiscal irresponsibility. Don't hold your breath though: The state is only just now accurately portraying its levels of skyrocketing debt.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

He also notes that the population decline could cost Illinois in federal funding and even potentially cause the state to lose a seat in the House.

Wouldn't that just be heartbreaking.

Wouldn't that just be heartbreaking.

Why do you hate black brown people?

That's just racist.

I hate everybody.

A Specious Speciesist.

Do you hate everybody for a general reason, or do you just hate each individual human for specific, possibly unique, reasons?

Both?

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

Including yourself?

Except that the dems who control Illinois will make sure that its not one of their seats that is lost.

Only Republicans gerrymander.

Only the party in control gerrymanders. And right now, Democrats control the IL legislature.

2020 will be the time to break out the popcorn to watch the IL politicians fighting against each other to see how the districts are drawn so two of them don't have to run against each other. Though right now, there are 11 D congressmen and 7 R congressmen from IL.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,..... http://www.startonlinejob.com

Everyone moving to Idaho? Damn, that was going to be my retirement plan.

That's a percentage increase. Tom and Mary moved back to Boise.

Florida is now the third largest state. Which sucks. We want people to visit, not move here.

I thought Trump killed all of Florida with a hurricane?

Hopefully the left doesn't move to Idaho and ruin it like everywhere else they move to.

Progs like to be near the ocean I've noticed. They also don't like to be near Mormons, or lots of guns-so I don't think they'll take over Idaho anytime soon.

Tell that to the folks in Colorado.

No doubt

If they like being near oceans, WTF are they doing in Ill-Annoys?

The ultimate stupidity would be to vote for the same policies causing you to leave your current location. But they would do it.

The natural idiot tendency would be to vote for the same policies causing you to leave your current location.

FIFY

Doesn't it make sense, if you vote for government to give you stuff, and one area has run out of other people's money, to move to another area where people haven't had as much taken from them? That's what wolves do when they voted with the sheep on what's for dinner, and then they've run out of sheep to eat.

Ex girlfriend's hyper leftist sister moved to Idaho.

Strange how Lefties who preach the wonders of diversity move to blindingly white Idaho to retire.

You call someplace paradise, kiss it goodbye.

...they've now got a new problem?a $10,000 cap on state and local (SALT) tax deductions.

Make no mistake, that's Illinois' problem, not that nation's. The feds should never have been covering these places for their tax schemes.

they've now got a new problem?a $10,000 cap on state and local (SALT) tax deductions.

I love how disingenuous liberals have been on this one. Using it to hammer republicans over the new tax bill even though it almost exclusively hits people the liberals would classify as "rich people who need higher taxes".

My roommate is a progressive but at least he is honest ... when I explained about the deduction he was in favor of eliminating it or reducing it since it's a subsidy to the rich etc

It's pretty funny how leftists are now against higher taxes for rich Californians and New Yorkers

It's pretty funny how leftists are now against higher taxes for rich Californians and New Yorkers

You're talking about their biggest donors-people like Mark Steyer and Michael Bloomberg. So of course, they don't want them taxed-it might mean that they will have less money to control the little people with.

It's not just the Democrat's biggest donors. There's a lot of people deducting more than $10,000/yr total from state income taxes, city taxes, property taxes, sales taxes, and charitable donations. The property tax on say a $750,000 home in Illinois alone is $12,975. With a limit of $10,000 in deductions, losing that deduction alone, probably (depends on their marginal federal income tax rate) costs the owner about $1000/year. Then there's all their additional SALT deductions they can no longer deduct and have to pay federal taxes on. There's about 1400 homes for sale in Chicago over $750,000 right now, so with about 4.5% of all homes for sale, that suggests there are about 31,000 homeowners in Chicago with homes this value or higher. Assuming 2.5 people/house, and dividing by Chicago's population, that's about 3% of the households there, that's 81,000 people in Chicago living in homes of that value or higher.

The great thing about limiting SALT deductions, is it stops the incentive for states to increase taxes, and beggar thy neighbor states on their federal tax obligations.

Actually, it hits rich people in high-tax states, which tend to be populated by liberals. In low-tax states, nobody goes over that limit anyway.

Ding ding ding! LarryA you are today's winner in "Who wants to reverse engineering spiteful tax policy?'

Srsly tho, this whole "progs did it" as a catch-all justification for local/state fiscal nuclear meltdown is ... Incorrect. It's the government worker pensions, stupid. Specifically it's police, teachers & firefighters. This will blow your mind: Team Red votes to kick the pension disaster down the road just like Team Blue. Whatever the initial justification was for creating pie in the sky retirement plans for the most useless among us, since it's been done it's been done everywhere. Every state - blue, red or purple - is a disaster when pension liabilities are factored into their balance sheet. Partisanship will not fix the problem, because the reasons for local & states to acquiesce to public union demands are the same across both parties. The only solution involves passing transparent accounting rules, dismantling of public unions (ESPECIALLY police) & ending their retirement benefit. Voting a party ticket or claiming the fault is with the Other Tribe sends a loud message to legislators that current policies serve their own self interest, & odds are they will be out of office when the debt goes bad.

How long before the Democrats begin to demand a federal bailout? Although Illinois might have to wait in line.

Maybe they'll just build a Berlin Wall, try to stop people from escaping.

I think the long game for Illinois Democrats IS to wait until their party gets control of Congress again and then lobby for a federal bail-out. The Dems will resolutely oppose any effort to change the US Bankruptcy code to allow a state bankruptcy protection and re-orgaization, since retired Illinois state employees would probably get a haircut, pension-wise, in any state bankruptcy re-organization scenario.

Puerto Rico politicians are already trying to protect their government pensions. PR borrowed on their "full faith and credit" from a lot of money market and other funds giving them superior rights in bankruptcy, while their government pensions have inferior status.

But even Obama rejected bailing out a city/state for several reasons, perhaps the big reason being the moral hazard and incentive it creates for states to go bankrupt. State/local governments that go bankrupt should suffer, especially the government employees should be the ones taking a haircut. It creates incentives for government employees to make sure that money is taxed and put aside as the liabilities are accrued, rather than support politicians who promise to make future taxpayers pay for it. Secondly, it forces the federal government to cut spending that affects people who donate to politicians.

Illinoian here. The saddest part of all of this is that all my friends are leaving. Usually the ties that bind are geographical but when the cascade starts there's nothing to keep you here. Catching breakfast with the guys I was in high school with, beers with the guys from college... can't happen anymore because we're too spread out.

I lay this at the feet of the democrats who couldn't contain their joy at giving more money to the public service unions in exchange for votes for democrats until the money ran out. In fact, they will continue to do so until there's nothing left but dried tears.

For those of you outside bad acting states, let Illinois, California, New York and Connecticut be cautionary tales of how to NOT run a state. Don't ever vote for a politician who will bail us out. You know that day is coming, when the Federal government has to decide to bail out Illinois. Make sure you say no.

You know that day is coming, when the Federal government has to decide to bail out Illinois. Make sure you say no.

I don't anticipate anyone at the federal level consulting me, but thanks for the heads up.

So why don't you move? That's my plan, as soon as possible.

It's only logical.

Job, family, too poor to move, no marketable skills to bring to another state?

Usually... Family.

Just my guess.

Just think how wonderful Illinois will be once they've finally chased all the evil rich out of their state.

If all you illinoisans picked your asses and let illinois become a toilet, then you are not wanted here. Stay the fuck away.

Illinoisans are very nice people. Its Cook County that's the problem.

The same can be said of Michigan / Wayne County.

Exactly. As a downstater, for decades I have been advocating sawing Cook County off Bugs Bunny style and shoving it into the middle of Lake Michigan.

Being in Lake County, I feel the same way.

But polluting the lake wouldn't be a great idea. I'm sure we could find a nuclear waste site where it couldn't do any harm.

^^Charmer, right there.

The greater metropolitan area of Chicago has been bleeding population for two years now. The state itself has been losing population for the past four years. One expert told the Chicago Sun Times that it's typically the more rural parts of Southern Illinois that declines in population, but that's not what is happening here. He also notes that the population decline could cost Illinois in federal funding and even potentially cause the state to lose a seat in the House.

Trump, I'm begging you, please build a wall around Illinois too. Protect my people from their horrible voting patterns.

I don't like taxes getting raised, but I do not think this is the reason that population is decreasing in Illinois. And ironically, we just got a tax increase for middle class home owners, which is going to make this problem worse not better. The problem is all about the affordability of housing; by that I mean the cost of real estate related to the wages of the middle class.

I make over double over what I made in my first professional job in 1991, but housing prices have more than tripled since 1991. Luckily, I've owned my house for almost 10 years, so I can get by. When I talk to people who bought homes in the 1960s through the 1970s, their homes cost 2 to 3 times their gross incomes. Now that figure is closer to 5x, and the new tax bill just got rid of the mortgage interest deduction, which will make it less affordable for families to buy a house. Our tax code should be structured so as to encourage personal home ownership. Yes we need job growth too, and if lowering corporate rates spurs the economy and raises wages, that is a good thing, but paying for the tax cuts by getting rid of the mortgage interest deduction is bad bad bad for the middle class. Oh, and don't forget that real estate developers and others who do not live in buildings they own can now take profits at pass through rates, which is ironic, so property prices will keep going up, and the ability of the middle class to afford private property is going to keep decreasing.

"Our tax code should be structured so as to encourage personal home ownership. "

No, no it should'nt.

I own a home...and I call bullshit on that. Why should home owners get a special advantage over renters? Maybe more people need to rent? This might open up the rental market. But picking winners and losers between renters and home owners is bullshit.

Why should home owners get a special advantage over renters?

Illinois has a very good reason to do everything it can to encourage home ownership. Homeowners have a tougher time moving out of state than renters do. Like all things fiscal, however, the Illinois Legislature seems unable to climb the learning curve.

Um, Larry... are you really saying that the State Should distort one part of the marketplace in order to benefit The State?!

i.e., make it harder for residents to leave so that the State can raise taxes on the folks who are less able to leave?!

Isn't that more like slavery or maybe indentured servitude?

Or did you mean to post that comment on the Huffpost or WaPo or LAT or NYT site???

I didn't read that as LarryA saying he thinks that's a good idea, rather that Illinois clearly has an incentive to encourage home ownership and the lawmakers there are too ideologically blind to actually do it.

I've been wrong once or twice before though, so maybe not?

Correct. Government should not be involved in the housing market...any more than it should be involved in ANY market. If you're on the Reason website, theoretically you should understand sound economic principles. The ONLY (barely) valid function of government is to serve as an instrument to prevent aggression. Instead, government is generally the single largest aggressor in any segment of society.

No, the tax code should be designed to raise revenue. All th other BS it does just allows for cronyism.

Exactly Ride em' - taxes should only be designed to collect revenue.

Doesn't California have the same problems?

They are doing fine.

Might be a correlation and causation fallacy here, unless someone polled everyone leaving Illinois on their way out.

From 2010 to 2017, about 557,000 people moved out of California to another state. That is the third highest number of outmigrants after New York (1,022,000) and Illinois (643,000). What has kept California's population stable is net international migration (1,072,000) and net births over deaths (1,780,000).

(numbers in first two sentences are net)

As a Sud Californican let me just say, hahahahahahahaha!

"They are doing fine" he says! Hahahahahahahahahahaha!

OH! I think I just peed myself a little.

No seriously, I'd be happy to take a 10-15% pay cut, depending on location, to get out of here but there's no way I'm going to another state where the public worker unions pull all government strings like they do here in Cali.

Please call it like it is: public parasite unions - the day will come when those feeding at the public trough will find themselves without power, or friends, or worse.

Society is becoming less civil day by day, and at some point enough people will have had enough of being fleeced.

This is one of the most heavily-armed country in the world, after all. What happens when society breaks down, and everyone knows that a big part of the blame lies with their next-door neighbor "civil servant"?

California has the same problems, but it doesn't have the same weather.

I think in the interests of sharing the wealth, all of Southern California should be turned into a giant national park with housing and internet facilities, and every durned merican should be able to live there for a year (and only a year).

How can this be. Rahm Emanuel is the mayor of Chicago and he has declared Chicago a Trump-free city (they are allowing illegal gun owners though).

Why would anyone want to leave such a paradise?

Nothing is more satisfying then watching proggies and commies destroy their own state or country. I have ZERO sympathy for the assholes who continue to vote these big government bureaucrats into office year after year. I hope the entire state turns into a gigantic Detroit to serve as an example to the rest of the country.

The problem is they keep fleeing the mess they made for Colorado. I know the map above doesn't show it but Colorado is bursting with progs and the culture is transforming dramatically. Voting are has turned it from red to purplish blue.

Yep. We may have to turn off the water going to the Front Range soon.

When you walk around Chicago in 5 years you will here people talking about the good old times and then mutter, "oh well. Who is John Galt?"

IL needs to legalize recreational cannabis to get the pot tourist money before more states compete for it. But that would be freedom and make financial sense so they won't. They'll keep requiring MMJ patients to get refingerprinted every 3 years to funnel money into some politicians' friend who runs the background check service.

Idaho had a huge influx after the Rodney King thing as well, according to a friend that lived in Coure d'Alene at the time.

They lasted till the first really harsh winter, and then they moved somewhere else. I don't think the central northern tier states have much to worry about unless Al Gore musters enough hot air to really change the climate.

Way too late!

Illinois will be one very large Detroit.

Corruption will only escalate as the collapse proceeds towards bankruptcy, as the looters will loot while the looting is good, and the impending bankruptcy will increasingly reduce the few incentives for fiscal responsibility.

Why would a state full of Marxists and corrupt politicians suddenly discover fiscal responsibility?

I've three friends who moved out of IL for tax reasons. They can do their professions elsewhere so they moved out of the high tax zone and left it to the Lefties.

High tax rates and massive accommodations for beaners'n'bombers. Illinois is implementing exactly the policies Reason advocates for.

Just so they don't cross their northern border. We don't need any more FIBs in Wisconsin.

Millennials are fleeing Mississippi due to lack of job opportunities despite low taxes. Taxes are not the biggest factor by far or Massachusetts would be losing population too. Utah is still gaining people due to the high birth rate. Maybe Illinois should try to attract more Mormons.

Troll score=F-