New York's Single-Payer Health Care Plan Would Be More Expensive Than New York's Entire State Government

New York collects about $80 billion in revenue annually, but the health care plan passed Tuesday would cost at least $91 billion every year (and probably more).

The single-payer health care plan that cleared the lower chamber of New York's state legislature on Tuesday would require massive tax increases to double—or possibly even quadruple—the state's current annual revenue levels.

The state Assembly voted 87-38 on Tuesday night to pass the New York Health Plan, which would abolish private insurance plans in the state and provide all New Yorkers (except those enrolled in Medicaid and Medicare) with health insurance through the state government. The same proposal cleared the state Assembly in 2015 and 2016, but never received a vote from the state Senate.

The bill might get a vote in the state Senate this year—for reasons that I'll get into a little later—but the real hurdle for New York's single-payer health care plan, like similar efforts in other states, is a fiscal one.

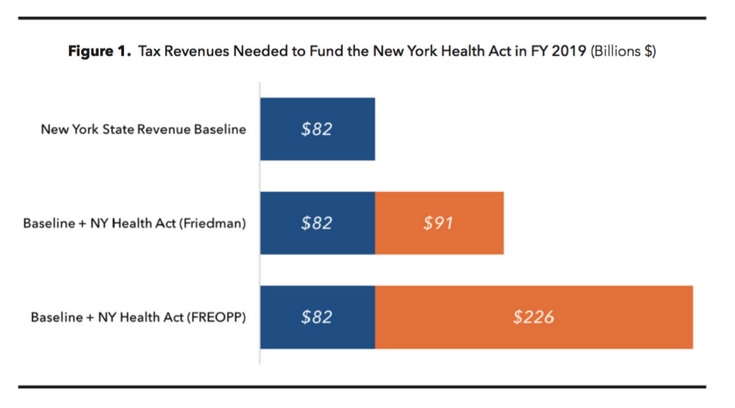

New York collected about $71 billion in tax revenue last year. In 2019, when the single-payer plan would be enacted, the state expects to vacuum up about $82 billion. To pay for health care for all New Yorkers, though, the state would need to find another $91 billion annually.

And that's the optimistic view. In reality, the program is likely to cost more—a lot more.

Gerald Friedman, an economist at UMass Amherst and longtime advocate for single-payer health care, estimated in 2015 (when the New York Health Act was first passed by the state Assembly) that implementing single-payer in New York would cost more than every other function of the state government. Even if New Yorkers benefit from an expected reduction of $44 billion in health spending, which Friedman says would be the result of less fraud and less administrative overhead, the tax increases would cancel out those gains.

To pay for the single-payer system, Friedman suggested that New York create a new tax on dividends, interest, and capital gains that would range from 9 percent to 16 percent, depending on how much investment income an individual reports, and a new payroll tax that would similarly range from 9 percent to 16 percent depending on an individual's income.

It was a similar prescription for massive tax hikes that sank Vermont's experiment with single-payer health care in 2014. Funding it would have required an extra $2.5 billion annually, almost double the state's current budget, and would have required an 11.5 percent payroll tax increase and a 9 percent income tax increase. Voters in Colorado rejected a proposed single-payer health care system when they found out how much it would raise their taxes, and efforts to pass a single-payer plan in California (being championed by U.S. Sen. Bernie Sanders, the Vermont progressive) are facing similar financial troubles.

Back in New York, a second analysis of the single-payer health care plan, suggests that Friedman's projections significantly underestimate the cost of single-payer in New York (while overstating the savings).

According to the Foundation for Research on Equal Opportunity, a Texas-based free market think tank, the annual price tag for the New York Health Act could be as high as $226 billion. In other words, it would require quadrupling the current tax burden in New York.

"While the New York Health Act would expand coverage to the uninsured in the Empire State, it would do so at a staggering cost that would drive hundreds of thousands of jobs out of the state," wrote Avik Roy, who authored the FREOPP study. "The resulting economic crash would cause far more harm for lower-income New York residents than they would gain from acquiring state government-run health insurance."

The gains would be quite limited, as Roy points out. In 2014, only 8.7 percent of New York's population lacked health insurance. Transitioning to a single-payer system would disrupt coverage for millions of people—potentially forcing them to find new doctors and accept coverage that differs from what they would otherwise choose—in the name of extending coverage to that group of uninsured. Providing health insurance to those who cannot afford it is a noble goal, but there are less disruptive, less expensive ways to pursue that goal, Roy argues.

Despite Friedman's promises of savings from less fraud and fewer administrative costs, the FREOPP study suggests that both costs would increase, as has historically been the case in government-run health care programs. (Read the rest of Roy's detailed analysis here.)

Regardless of who is correct, one thing is clear: The New York Health Plan will be devestatingly expensive for the state, and for anyone who lives or works there.

Setting aside the important policy questions for a moment, the politics of passing single-payer in New York's state Senate could get really whacky.

There are 63 seats in the upper chamber, so 32 votes are necessary to get anything passed. Right now, no one has 32 votes. Republicans hold 31 seats and Democrats hold 31, with one vacant seat in a heavily Democratic district set to be filled with a special election on May 23. It might seem like that would give Democrats the majority they need. But Senate Democrats are split into three factions, one of which—the Independent Democratic Conference, which has eight members—is part of the majority coalition supporting Republican leadership in the chamber.

Assuming there will be no Republican votes for it, passing the single-payer bill in the state Senate would require getting all Democrats to vote "yes," despite the ongoing schism between the mainstream Democrats and the more moderate IDC members. There's at least a pretty good chance that moderate Democrats will take a look at the cost of the health care plan and decide they can't stomach it. The question is whether they will have a more powerful incentive to distance themselves from Republicans—either because of Trump's down-ballot toxicity or because of the GOP's floundering health care effort at the federal level, or for any other reason—and throw away an oddly compelling experiment in legislative politics in the process.

State Sen. Jeffrey Klein (D-34), the head of the Independent Democratic Conference, told The Huffington Post that he would support the single-payer plan because it would provide "peace of mind" for New York residents.

Doubling, or quadrupling, his constituents' taxes might not have the effect that Klein thinks it will, but that's between him and the people who elect him. There's no timetable for the state Senate to take up the bill.

Show Comments (123)