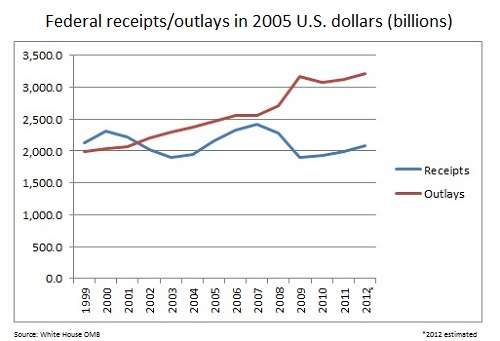

The Bush Tax Cut Issue in One Chart

Federal receipts and outlays, 1999 to 2012

Federal outlays and receipts in the last two years of the Clinton Administration, all eight years of George W. Bush and Barack Obama's first term:

In 2011, income tax revenue made up about 55 percent of federal receipts. Raw data here and here

A few notes: George W. Bush and supporters of the tax cut said federal revenue would go up after passing the cuts and it appears it did. In fact, federal receipts reached Clinton-era levels without Clinton-era tax rates in 2006, not long after all the cuts went into effect (passed in 2001 and 2003, they were tweaked with in 2005). Bush passed a tax cut as stimulus in 2008 and Barack Obama's trillion dollar stimulus package in 2009 included some type of tax cuts as well, but does that chart look like a revenue problem or a spending problem?

And for those who would say "well of course the government has to spend more when the economy is hurting" only one question applies: has it helped? If you think so, I've got a tiger-repellant rock to sell you.

Show Comments (182)