Taxpayers Are Morons, Says Journalist

You want to pay less in taxes? No soup for you

Esquire's Charles Pierce strikes again, calling taxpayers a "dumb rampaging beast." Does he call them that because they willingly pay into a system that spends more and more on policies they often disagree with? Nope. It's because they have the audacity, in what's often called a democracy, to demand a lower tax burden. The statement from the "veteran journalist" came in a blog post supporting the Chicago Teachers Union strike. Pierce reminds those who criticize the teachers' strike for being inconvenient that, duh, that's the reason people strike. That show of solidarity, though, does not extend to taxpayers, largely also workers! As is fashionable these days, he skewers Grover Norquist's "lunatic" no tax hikes pledge as well as California's ballot initiative-driven restrictions on taxation and spending, blaming them for California being "largely ungovernable." Expecting what might be called, in the collective, a "dumb rampaging beast," in, say, Sacramento or Washington, to abide by the wishes of voters (politicians sign Norquist's pledge, obviously, because its good electoral politics for them) and restrict their urge to more taxation, apparently, is a ridiculous notion for taxpayers to have. Don't these taxpayers realize supporting less taxes is inconvenient?

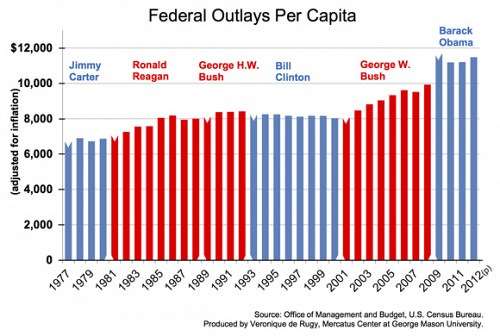

This chart by economist Veronique de Rugy, which Nick Gillespie called "terrifying," shows the growth of federal spending since the Carter administration, and is adjusted for both inflation and population growth:

The last time Washington took a sober look at taxation, spending and debt was the Grace Commission, nearly two generations ago, which reported that "all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their Government," in 1984, when the federal debt stood at $1.6 trillion, and more than doubled under Ronald Reagan's terms in office, while since then its grown to top $16 trillion.

Washington's tax apologists spend their time pushing things like the "Buffett rule," which would collect enough revenue to fund 11 hours of the federal government's operations in a year.

Neither party in Washington is serious about spending cuts when both parties mean "spending cuts" to mean reductions in the rate of increase in spending, and one party does all it can to make even that definition of a spending cut seem draconian and nightmarish, while taxpayers trying to reduce their burden, and doing it, aghast, "collectively," is, according to Pierce, "dumb". Collective action is not for taxpayers, and how dare they question throwing more money into the money hole anyway?

Show Comments (34)