The Volokh Conspiracy

Mostly law professors | Sometimes contrarian | Often libertarian | Always independent

Does Anyone Have Standing to Bring a Lawsuit Against Biden's Student Loan Debt Cancellation Policy?

The likely answer is "yes." There are three types of potential litigants who probably qualify.

In previous posts, I criticized both the Biden administration's legal rationale for the president's massive student loan debt cancellation policy and a possible alternative justification for it. But many experts think these issues will never get their day in court, because no one will have standing to file a lawsuit challenging debt cancellation. Perhaps the administration sees this procedural issue as their ace in the hole: it doesn't matter if the legal justification for your program is weak if no one can get into court to challenge it!

The problem of standing is a genuine challenge for opponents of the debt cancellation policy. But it need not be an insuperable one. There are at least three types of litigants who can plausibly get standing: one or both houses of Congress, student loan servicers, and colleges that do not accept federally backed student loans, but compete with those that do.

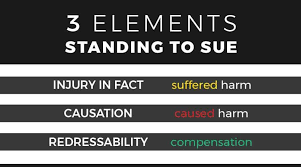

Under current Supreme Court precedent, plaintiffs have to meet three requirements to get standing to file a lawsuit in federal court: They must 1) have suffered an "injury in fact," 2) the injury in question must be caused by the allegedly illegal conduct they are challenging, and 3) a court decision should be able to redress the injury.

In my view, the entire doctrine of standing is not a genuine constitutional requirement, and the Supreme Court should abolish it. But that's highly unlikely to happen. So, for present purposes, I will assume the validity of current precedent. Whether it's right or not, litigants will have to work within it.

The main potential stumbling block in this case is the requirement of "injury in fact." It may be difficult to prove that student loan cancellation injures anybody, in the sense required by Supreme Court precedent. Cancelling some of A's student loan debt doesn't necessarily injure B and C. The others may believe it is unfair they had to pay off all their loans themselves, while A doesn't. But, with rare exceptions, current precedent requires some sort of tangible injury. Unfairness, by itself, isn't enough.

It may be that taxpayers suffer a tangible injury, because loan forgiveness denies funds to the federal treasury, thereby forcing them to bear more of the burden of public expenditures. Any illegal expenditure of public funds necessarily diverts taxpayer resources away from duly authorized purposes. But the Supreme Court has long denied such taxpayer standing, in all but a few unusual circumstances, which aren't relevant here.

I think taxpayers should have broad standing to challenge any unconstitutional expenditure of public funds. But this is another issue on which the Supreme Court is unlikely to go my way, anytime soon.

But while taxpayers generally do not have standing to challenge illegal uses of public funds by the executive, the Senate and the House of Representatives do! The US Court of Appeals for the DC Circuit so held in a 2020 case where the Democratic-controlled House of Representatives filed a lawsuit challenging Donald Trump's attempt to divert military funds to build his border wall (a case which has many parallels to the present situation). The decision was written by prominent conservative Judge David Sentelle, who reasoned as follows:

[T]he House is suing to remedy an institutional injury to its own institutional power to prevent the expenditure of funds not authorized. Taking the allegations of the complaint as true and assuming at this stage that the House is correct on the merits of its legal position, the House is individually and distinctly injured because the Executive Branch has allegedly cut the House out of its constitutionally indispensable legislative role. More specifically, by spending funds that the House refused to allow, the Executive Branch has defied an express constitutional prohibition that protects each congressional chamber's unilateral authority to prevent expenditures….

To put it simply, the Appropriations Clause [of Article I of the Constitution] requires two keys to unlock the Treasury, and the House holds one of those keys. The Executive Branch has, in a word, snatched the House's key out of its hands. That is the injury over which the House is suing…

To hold that the House is not injured or that courts cannot recognize that injury would rewrite the Appropriations Clause. That Clause has long been understood to check the power of the Executive Branch by allowing it to expend funds only as specifically authorized…

Sentelle's reasoning is compelling, and pretty obviously applies to Biden's loan forgiveness plan, no less than Trump's border wall diversion. Under this approach, either the House or the Senate would have standing to sue, even if the other house chose not to. The DC Circuit decision was later vacated by the Supreme Court when the case became moot, after Biden terminated Trump's efforts to divert the border wall funds. But the DC Circuit and other lower courts are likely to adopt its approach in any future case on the same issue.

Of course neither house is likely to sue so long as Democrats control both of them. But that could change after the November election, when Republicans could potentially retake one or both of them (the House far more likely than the Senate). If so, they could rely on the border wall precedent to get the standing they need for a lawsuit.

Unfortunately, the House or Senate would likely have to file as an institution in order to get standing. The Supreme Court has ruled that individual members of Congress lack standing to sue the executive over fiscal issues.

A second type of entity that could get standing to sue is student loan servicers. These firms collect student loan payments on behalf of the government, and the size of the fees they get depends in part on how much money is owed, whether the loan is delinquent, and how long the borrower takes to repay it. If loan forgiveness reduces delinquency rates, enables some borrowers to repay faster, or otherwise affects the amount servicing firms get paid, they pretty obviously suffer an injury in fact, and would have standing to sue. Fordham law Prof. Jed Shugerman has reached much the same conclusion.

It's possible loan servicers will be afraid to sue, because they don't want to antagonize the federal Department of Education. A good relationship with the feds may be necessary to ensure their continued profitability. But if any are willing to sue, standing shouldn't be much of a problem. And one plaintiff is enough to get the issue to court. Even if most loan servicers prefer to stay out of it, one may be willing to take the risk. Alternatively, they could band together and sue jointly, thereby making it harder for the Department of Education to retaliate against them (since the Department may be reluctant to cut them all off).

A final category of plaintiffs who could get standing is colleges that refuse federal funding (including federal student loans), but compete with those who accept it. These mostly conservative-leaning institutions reject federal funds because they do not want to be subject to the regulations that come with them. Examples include Grove City College, and Hillsdale College. For obvious reasons, loan cancellation makes colleges that accept federal student loans more competitive relative to those that do not. The latter become relatively cheaper alternatives for students.

Courts have long recognized "competitor standing" to sue to challenge policies that strengthen the competitive market position of the plaintiff's rivals. Perhaps the competitive injury here is small. Maybe only a few students are likely to forego attending Grove City College or Hillsdale as a result of Biden's actions. But even a small financial loss, such as nominal damages, is enough to qualify as an "injury in fact" under standing doctrine.

These three possibilities aren't necessarily exhaustive. They are just the ones that most readily occur to me, and I admit I am far from being an expert on student loans. There may be other types of litigants who can also get standing to challenge Biden's student debt cancellation plan. But these examples do suggest that standing need not be a show-stopper here. More likely than not, courts will eventually have to rule on the legal merits of the policy.

UPDATE: I have revised this point to note that the DC Circuit case was later vacated as moot.

Editor's Note: We invite comments and request that they be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of Reason.com or Reason Foundation. We reserve the right to delete any comment for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The denial of standing to the taxpayer is more denial of reality by the toxic lawyer profession.

This is a good analysis of standing by Ilya.

The Constitution is a contract between the states to create and limit the federal government. Theoretically, the states should have standing to sue anytime the federal government breaches the contract. I have no idea if the Supremes have already ruled that states have no standing in Constitutional disputes, but it seems logical that they should have automatic standing.

Perhaps Congress can address standing in challenging unconstiutional actions by the federal government in legislation. It might be very embarrassing for Democrats to vote against state standing to challenge federal government actions that are unconstitutional.

A student borrower who is subject to the forgiveness would have standing to sue. I would imagine that there are more than a few who are ethically troubled by Biden's proposed actions. The injury would be the acceleration of the state income tax obligation.

Receiving forgiveness will require an application.

I do not think you have standing if you caused the injury to yourself by applying for forgiveness.

Student borrowers need not apply for the forgiveness. It seems odd (well, more than odd, rediculous) to claim someone has injured you by offering you a benefit you voluntarily accept, and then turn around and sue the person because you feel “ethcially troubled” by accepting it.

You state that "student borrowers need not apply for the forgiveness", which is contra what the above commenter stated. If the forgiveness is automatic, as you state, then the injury is likewise automatic and the standing argument applies. Agree with the above commenter that if the forgiveness is "opt-in" the injury argument is much more problematic.

Many folks even in this day and age have an ethical discomfort with borrowing money and then not paying it back. Your milage may vary.

No, it's just phrased very badly; it confused me for a moment also. What he meant was "Students can choose not to apply for the forgiveness if they don't want it."

But, also: claiming that having to pay taxes is an "injury" doesn't make a lot of sense either in this context. Is one "injured" by winning the lottery because the government will take some of it? One still comes out ahead.

Perhaps that was what he meant. I assume that from the actual wording of Biden's act, when they are known, there is an answer one way or the other.

The injury from the tax impact of debt forgiveness is pretty clear however. If you have a thirty year mortgage in the amount of $300,000, you pay the principal off with after-tax dollars over that period. If the entire mortgage were forgiven in year one, you have imputed income of the entire $300,000 in that year and that amount would be taxable.

The amount of your debt forgiveness, whether $10K or $20K or whatever, is entirely recognized in one year and has its entire tax impact in that year. You have to come up with money for the tax liability in that year that would otherwise be spread over the term of the student loan. Might even put you in a different tax bracket; certainly the time value of the money alone is a cognizable injury. Though the amount may be relatively small, it is still a monetary injury and should suffice to give standing. Unless as has been claimed the forgiveness is an "opt-in".

Section 108(f)(5) has a temporary provision (effective for years 2021-2025) which provides that student loan forgiveness is not included in gross income.

This seems like a textbook situation of not having standing under current doctrine.

What injury would this student borrower suffer?

They worked during college and their buddy didn’t. They suffered loss of time and worse grades which impact post graduation career opportunities because they didn’t know the President would unilaterally shred contracts.

The goal isn't to buy votes by having someone else pay off your debt. It's to pretend to buy votes before the election, and long after it, when it gets stopped by the courts, who the hell cares? Mission accomplished.

In other words, politics as usual. See another example: laws against flag burning passed for brownie points, knowing it will get overturned.

It's an illegal, corrupt, and cynical vote buying scheme. If the courts can't stop it, it puts their legitimacy at risk.

Usually, debt forgiveness is considered as income, subject to tax. State and federal income tax. Did Biden also try to wipe that burden away too?

If so, any number of states might be in a position to initiate litigation.

Supposedly, Biden passed that law last year: https://www.forbes.com/advisor/taxes/student-loan-forgiveness-taxes/

Thanks. He can’t do that as to state income tax. I don’t think.

More Biden clown bullshit. He’s hiring 80,000 agents to audit grandma’s quilt store, but for political gain they’ll waive hundreds of billions of income. No scruples whatsoever.

He’s hiring 80,000 agents to audit grandma’s quilt store

You don't get to be angry that tax laws are getting enforced because you don't like the tax laws.

Well, you can, but then your protestations of lawlessness fall pretty hollow.

“Lawlessness”. You realize that a lot of audits are random, and that a whole bunch of the audited filed their taxes correctly. And all those new auditors are gonna need some pelts to justify their jobs. But fuck ‘em, right? At least Biden gets to claim that stuff will be paid for.

And good for you for not parroting the lie that it’s only going to hit rich folk.

So you're pissed off the IRS has a bit more resources to do it's job.

Nah, screw that. If you don't like our tax policy, change it. Don't make sure we can't implement what we have - that kind of backwards policymaking is how you get perverse incentives.

You know who is easy to go after? Middle class people. You know who is harder? the rich, with their accountants. So starving the IRS of resources is how you get disproportionate audits of grandma’s quilt store.

I love how I'm the villain for wanting the law to be enforced. Actually, those who don't like paying taxes and so screw up our revenue stream rather than address the issue head on are the problem.

Tax evasion doesn't become legitimate because you can bloc vote special privileges for your group. In your world, it's morally illegitimate to not report income, but it's morally legitimate for a group of blacks to gang together under Stacy Fat Fuck Abrams and vote for free shit for blacks paid for by whites.

It's not.

" In your world, it's morally illegitimate to not report income, but it's morally legitimate for a group of blacks to gang together under Stacy Fat Fuck Abrams and vote for free shit for blacks paid for by whites. "

How does a group of right-wing law professors attract such a bigoted, ugly audience?

By design, of course.

Well tell your boy Honest Joe to come clean then, because he’s insisting that he’s only coming after rich folk.

With so many more agents I wonder how many more honest people will have their private information released to Politico? Presidents as disparate as Nixon and Obama used the IRS to attack their political opponents. Highly doubtful that desperate Biden will avoid the temptation with so many potential attackers.

But it’s ok to you because they’re the government, so whatever they do to us is a-ok.

Nice pivot to attacking Biden.

The point is, the IRS needs people to do their jobs. If you are worried about leaks, there are ways to deal with that without hamstringing an organization that needs to exist.

Though right now I wonder what reforms you have in mind, because most of what you're throwing out there is speculation and generalization.

No, the point is that the IRS (along with the FBI, but that’s a different discussion) is the government agency most commonly responsible for abusing the civil and privacy rights of Americans. Note that you totally ignored the recent illegal releases of private tax information of politically unpopular citizens. Not to mention golden child Obama setting the IRS on conservative organizations. You didn’t mention that either.

My reform is to simplify the tax code and shrink the IRS to a shadow of its current self. You’re fine with the abuse, until trump wins in ‘24. Then you won’t like it any more.

the government agency most commonly responsible for abusing the civil and privacy rights of Americans.

That is not at all evident - where did you get this 'fact?' Check out the police, sometime!

I didn't ignore anything - I said if you have things you want to reform, then advocate for reform. Don't advocate to keep them around but purposefully prevent them from doing their jobs.

golden child Obama Oh, fuck off with this partisan nonsense. I mean, your empty anecdote-driven hostility to the IRS was already not doing much for your credibility here, but this manages to bring you lower. I won't engage on how you misunderstand who did what back then, but when you find yourself typing stuff like that in a policy discussion you should think about how you come off.

My reform is to simplify the tax code and shrink the IRS to a shadow of its current self.

Fine. But until that happens, preventing the organization from doing the job it's meant to do is an awful way to go about things.

Deal with the institution you have as an institution. Spite-based messing with it's workings but not it's mission is a recipe for unintended consequences. Like the rich getting away with whatever they want, while the middle class gets targeted. Which I thought you were against, but I guess it takes a second seat to simplistic spite.

I'm pretty sure that's Congress, not Biden.

Well, Biden asked for the authority and they’ll be hired by the executive branch, so I think it’s probably Biden. No?

Most states tax statutes definition of taxable income starts with the definition of taxable income under the internal revenue code then make modifications from the federal income to arrive at the state's taxable income.

therefore, If the state wanted to include the student debt forgiveness as taxable income in that state, then the state would have to pass an amendment to their tax statutes in order to include the income.

Note - Section 108(f)(5) has a temporary provision (effective for years 2021-2025) which provides that student loan forgiveness is not included in gross income.

Two separate issues with the 80k additional IRS agents

1) the IRS is currently understaffed and due to what the IRS blames on covid, their performance has suffered greatly just in terms of processing with a huge increase in error rates. Its often 6 -8 months out just to get errors corrected.

2) the second issue is the pool of qualified applicants is tight/quite limited. There has been a major shortage of accountants since the early 2000's. So the ability of the IRS hire those 80k agents will be limited and slow (unless they lower the qualification standards rather significantly - accounting grads with 2.5 gpa's or less)

A lot of these are a stretch. I'd love more Congressional standing, but I that would be a change of doctrine.

And competitor standing is also pretty dodgy, especially in this case where those schools that don't receive federal funding target a pretty different cohort.

But I don't see an issue with the collection agencies, other than internally prudential ones.

Collection agency standing runs into Lexmark and the zone of interests test for claims that the statute does not authorize loan cancellation. Of course a district court judge in the right division of the right district in Texas (Hello Judge O'Connor) will find standing no matter who sues, and will almost certainly issue a nationwide preliminary injunction.

Thanks for this - the legal realism is both true and sad, but your analysis was informative - I'm sure I learned about the zone of interest test, but it's been quite some time at this point and it was good to look up and refresh myself!

I would think non-participating schools would also have a problem in that, as I understand it, this is forgiving debt already undertaken, not debt not-yet-issued.

Yes, that's correct.

Which would make any standing argument massively speculative.

Student loan seevicers seem the most likely. I disaagree with Congressional standing.

The competitive injury atgument seems particularly silly. The forgiveness program applies to people who are paying off their loans. They are out of college already. Alternative colleges can oy compete for their business BEFORE they go to college.

Whatever competitive injury may constitute an injury in fact, it can’t be an injury that requires possession of a time machine to inflict.

Does retroactive student loan forgiveness make federally-funded colleges more competitive? Where we are dealing with debt that has already been incurred, I don’t see an argument that any students would attend a federally funded school over one of the conservative schools you discuss due to the current student loan forgiveness policy. They might in the hopes that there will be another loan forgiveness policy put in place, but that seems too speculative to grant standing. But I don’t think forgiveness of already existing debt under the current policy has anything to do with competitiveness between the colleges moving forward.

I would be fascinated to see Prof. Somin's of standing articulated explicitly.

*theory of standing, obviously (I hope).

Is, or ought?

Ought, he doesn't seem to like it in general.

Is...well, that's gotten a bit muddled.

No, I would like to see Prof. Somin explain the situations in which he thinks people should or should not be able to file lawsuits.

Well, he gave you a link. It's 12 years old so his opinion may have changed since then, but it's here:

https://volokh.com/2010/08/19/the-case-against-restrictive-constitutional-standing-requirements/

What of the power of the purse.

This thing needs funding, as it is a new debt moved onto the federal government's ledgers. Or has congress long ago abdicated oversight of debt.

The money appropriated for the loan program is already spent--the schools have it. There is no "debt" that has been moved onto the government ledgers. That is, if all these folk simply defaulted, it just would mean that the government gets less money--the same situation as where, for whatever reason, projected tax revenues fall short. Whatever "debt" occurs arises from lower collection, not the spending of money.

Still, as Somin said, a house of congress could have standing under the appropriation power. The argument is that the money was appropriated to be a loan, and it has now been "diverted" into essentially being a grant, arguably the same situation as where Trump took money appropriated for other purposes, and tried to divert into building the border wall.

I suppose the counter-argument is that once the funds have been spent as Congress directed, it has no further constitutional interest, because the Treasury is not being raided in violation of the appropriation power. A reduction in future expected receipts is not the same as diversion. That is, one can't "divert" money that has already reached its intended destination.

I guess the reply to that is that the timing of the "diversion" should not be controlling, because functionally it is as if the diversion took place at the time of the loan.

I can't tell which side would win, but it seems to me this probably the strongest case standing that Somin puts forward.

Professor Somin is making a statutory argument, not a constitutional one. He is saying that the President’s action was not authorized by statute.

I suppose there’s an implied constitutional argument that the action has to be authorized by statute. But everyone involved agrees this is the case. President Biden’s legal team would not have bothered to come up with multiple statutory arguments where they claim various statutes authorize his actions, if they thought they could be done without authorization in the first place.

Wrong. He is talking about standing, and the fact that courts have recognized that a house of Congress has standing to protect its constitutional perogatives.

Your argument seems to imply that unless a power is specifically reserved to Congress, the President has it. But our constitution doesn’t work that way. As the Court explained in the Steel Seizure cases, except in cases where the President has an enumerated iindependent power (e.g. foreign relations, commander-in-chief), the President’s powers derive from Congress, and he cannot act unless Congress authorizes it (and has the constitutional power to do so).

Again. Missing the point. It is about standing. The question, in my view, is whether the standing doctrine for a house of Congress, based on the appropriation power, applies to this case. My answer is quite plausibly, but allowing for some counter-argument.

I am not so sure about the assumption that loan servicers have standing to sue.

That is kind of saying that federal employee unions would have standing to sue if loan forgiveness reduced workloads, and thus employment. People who work for the federal government (including loan servicers) do not have a VESTED interest in a federal problem continuing so that they may help work on that problem. Another example would be private prisons. Would a private prison have standing to sue if some executive policy was unusually effective at reducing incarceration?

" Would a private prison have standing to sue if some executive policy was unusually effective at reducing incarceration?"

If that policy was actually illegal or the plaintiffs had some reasonable chance of proving it was, then probably yes.

If it was just an "ordinary" executive branch policy, then no.

But government employees would have standing to sue. If the discontinuation of the program was illegal, they would keep their jobs. If if was legal, they would lose them. A judge has power to decide if discontinuation is illegal and could order continuation as a remedy. So all the elements of standing are there, injury in fact (loss of job), causation (by the allegedly illegal discontinuation of the program), and redressability by the courts. Standing would be pretty open and shut here.

Sure, it’s possible the employees could have been fired anyway. But that doesn’t defeat standing. In numerous cases, at-will employees have standing to challenge being fired for an illegal reason even though they could have been fired for a legal one. Discrimination suits are a prominent example.

I do not believe that anyone has a vested property right in the continuance of a problem. Sure, they may hope the problem continues or gets worse so that their services are in-demand in the future, but that hope isn’t a property right.

Given the somewhat convoluted arguments for standing used in the Trump "travel ban" cases, a creative lawyer ought to be able to come up with good arguments for standing. It will depend on finding a judge willing to accept those arguments (as was true for the "travel ban" suits).

Question: Let's assume that the loan servicers or the colleges that don't take federal funds sue. What are the damages, assuming they win? That has to be part of the filing i.e. you need to specify a remedy when filing a suit.

For the servicers, "We estimate that we lost X many dollars in collection fees." so, would the court award them $X in damages without invalidating the whole loan forgiveness program? Similarly, for the colleges that don't take federal funds.

IANAL, but it seems to me that of the three categories of possible litigants, only one of the houses of congress could get the program reversed. Comments from actual lawyers cheerfully accepted.

They could get injunctive relief to continue the loans so they could keep getting servicing fees they would not have gotten otherwise. They would still have something of value they would not have had without the suit. I think standing is plausible. In many cases, e.g. Ex Parte Young suits against state official, there is standing based on injunctive relief only.

The 'actual lawyer' doesn't feel the pain, the plaintiff does.

This only confused me. If you are trying to get a loan or become a party to a contract and it is known that you student loan forgiveness will subject you to a tax bill --- anybody knows that everybody is 2nd in line on any contract to the Feds.

Of course you have standing.