No Fat to Cut at the IRS? So Take a Chainsaw to the Rest of the Beast.

The IRS is never more dangerous than when it's answering the phone.

Just before Christmas, IRS Commissioner John Koskinen called a press conference to complain that Congress just isn't giving tax collectors enough money to extract revenues from the American people. "We're well beyond cutting out any fat. And we're now into cutting, as people say, muscle headed toward bone."

Of course, Koskinen framed it in terms of customer service, and friendly media outlets immediately parroted the message that a $346 million cut, bringing the IRS budget down to $10.9 billion, inevitably means longer wait times on the phone for distraught taxpayers seeking answers for their pressing tax questions.

This is an all-hands-on-deck spin on IRS cuts, with National Taxpayer Advocate Nina Olson (who is theoretically on the victims' side, despite her government paycheck) recruited to caution that the IRS is "chronically underfunded" with unfortunate implications for taxpayer service and assistance.

Then again, that might not be so horrible an outcome, given that IRS assistance involved giving taxpayers bad advice 22 percent of the time back in 1987, 41 percent of the time in 1989, 22 percent of the time in 2002, and 43 percent of the time in 2003. And no matter the advice dispensed by the tax collectors themselves, taxpayers are on the hook for getting it right.

These days, the IRS focuses more on how few calls it has the resources to answer rather than the dangerous possibility that one of its employees might actually pick up the phone and speak into it. Still, maybe a few cuts to taxpayer service and assistance aren't such a tragedy if that thins the ranks able to mangle the response to an occasional query.

But it's not just the call center taking a hit. Koskinen warns that a leaner IRS will collect less revenue.

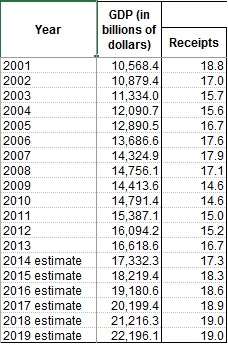

Well, cry me a river. While I have a dream that someday wind will blow through the broken windows of the Capitol Building and chase trash around the abandoned hallways, this minor budget trim is unlikely to do the job. Federal government receipts are currently at 17.3 percent of GDP (XLS), expected to rise to 18.3 percent next year, and 19 percent in 2018. The beast, it ain't starving—to the contrary, it's fattening up on us. A bit of a diet won't hurt.

Given the alternatives, a few cuts to an IRS that may be at its least dangerous when it's illegitimately targeting political groups isn't all that frightening a prospect.

Show Comments (146)