America's Unsustainable Long-Term Debt Trajectory

In the past year or so, the White House has become increasingly aggressive in touting President Obama's achievements in reducing the deficit. The deficit has been "cut by more than half since 2009," a 2013 blog post by the White House Office of Management and Budget declared, pointing to the shrinking of the deficit as a percentage of the economy. The budget office trotted out the same line last week. "Under the President's leadership, the deficit has been cut by more than half as a share of the economy, representing the most rapid sustained deficit reduction since World War II, and it continues to fall," an OMB official said. The president himself has downplayed the deficit problem, saying last year, "We don't have an urgent deficit crisis. The only crisis we have is one that's manufactured in Washington, and it's ideological."

It is unquestionably true that, judged relative to overall size of the economy, the deficit—the annual gap between federal spending and revenue—is down significantly since 2009.

But when thinking about the burden of debt and deficits on our economy, now and in the future, that's not the only factor to consider. Yes, annual deficits are down since 2009, but in no small part because the deficit that year—which was not exclusively Obama's doing—came in at a record-breaking $1.4 trillion. Deficits in subsequent years came in over $1 trillion as well. Deficits have dropped significantly under Obama only because they were unusually elevated during his first years in office.

Meanwhile, even out reduced annual deficits are still adding to the sky-high federal debt. They're just adding somewhat less each year to the total federal tab.

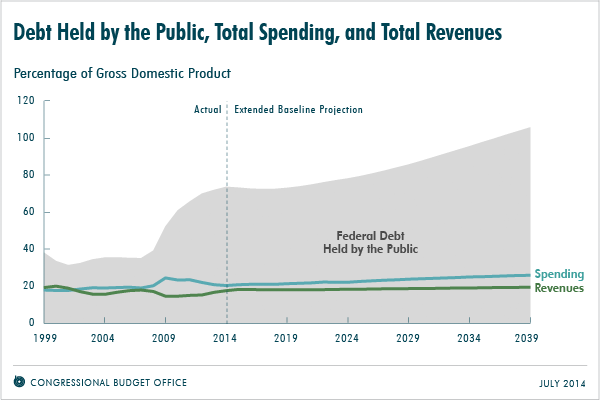

What that means is that, even if the budget picture isn't as gloomy at this very moment, the longer-term debt problem remains. As the Congressional Budget Office notes in a report today on the long-term budget outlook:

If current laws remained generally unchanged in the future, federal debt held by the public would decline slightly relative to GDP over the next few years, CBO projects. After that, however, growing budget deficits would push debt back to and above its current high level. Twenty-five years from now, in 2039, federal debt held by the public would exceed 100 percent of GDP, CBO projects. Moreover, debt would be on an upward path relative to the size of the economy, a trend that could not be sustained indefinitely.

Via the CBO, here's what that looks like:

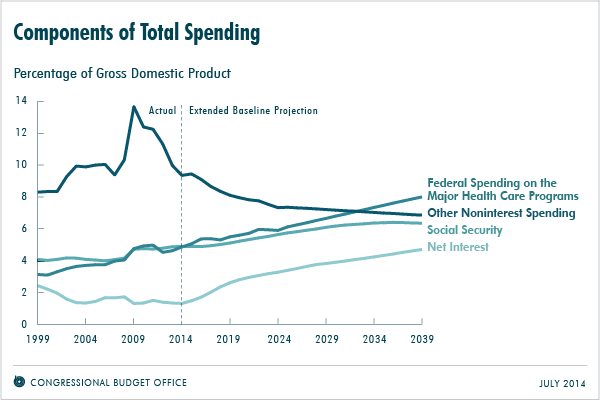

And here are the major spending components driving the long-term rise in debt:

The health care component is the most talked about. That's part of what President Obama was getting at when he argued that there's no "urgent deficit crisis." Instead, he said, the nation has "a long-term problem has to do with our health care programs." Even with some recent downward revisions, they are still the biggest part of the problem. But what gets less attention is that the growing role of interest. We're set to pay more and more on our debt—just to keep carrying ever-larger amounts of debt. Whether or not that's an urgent crisis, it's one that our current budget path doesn't address.

Show Comments (167)