When Is a Tax Increase a Tax Increase?

In California, many Republicans vote for a tax hike they say wasn't a tax hike.

Before the 1984 Republican National Convention in Dallas as Ronald Reagan prepared to run against Walter Mondale, a feisty debate took place among those that drafted the party's political platform. In their biography of Jack Kemp, authors Morton Kondracke and Fred Barnes write about the so-called "Battle of the Comma."

Tax-cutting "supply-siders" such as Kemp wanted the platform to oppose "any attempt to increase taxes, which would harm the recovery…" Some GOP insiders, they wrote, wanted the comma removed. The first group was against any tax increases, which they argued would always harm the recovery. The other side was only against those specific tax increases they believed would harm the recovery. The comma prevailed.

I was reminded of that battle last week as California Republican leaders considered a tax measure that recently came to the Capitol. The one thing that has united Republicans has been their opposition to increasing taxes. Those GOP legislators who have crossed the aisle to support tax hikes have often become ex-legislators. The latest battle wasn't focused on a punctuation mark, but on a simple question:

When is a tax increase not a tax increase?

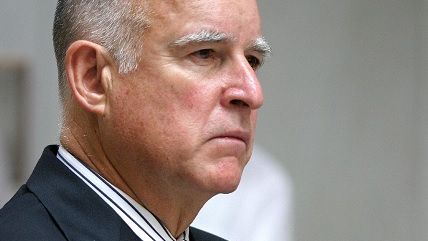

The issue centered on a measure proposed by Gov. Jerry Brown (D) and the state's Democratic leadership dealing with managed-care organizations (MCOs). Currently, the state imposes a tax on managed-care organizations that participate in California's Medi-Cal program that provides health care to poor people.

But the Obama administration rejects that approach and insists the California government tax all MCOs, or lose more than $1 billion in federal reimbursements. The MCO plan would increase the tax across the board in order not to leave federal money on the table. It would reduce other taxes on health organizations, thus leaving the tax-hike question unanswered.

In 2010, California voters approved Proposition 25, which allows the Legislature to pass a budget with a simple majority vote. But the majority still needs a two-thirds vote for tax increases. The same year, voters also approved Proposition 26, which helped answer a similar question to the one being debated right now: What is a tax hike? Previously, a simple majority was needed if a tax package was revenue neutral. Prop. 26 required a two-thirds vote on any bill that raised anyone's taxes even if other taxes were reduced at the same time.

Republican votes were therefore needed on this MCO tax plan. Republican Assembly Leader Chad Mayes of Yucca Valley backed it, although Senate Republican Leader Jean Fuller of Bakersfield had not. The extra federal dollars would help fund a Republican legislative priority–assistance for the developmentally disabled.

Tax opponents complained the governor is holding hostage such funding for the disabled. There's no reason, they say, to tie spending for these programs to the health-care tax hike. They don't like the idea of sending California tax dollars to Washington, D.C., then having to comply with federal rules to get the money returned to the state. They note that federal reimbursements are indeed tax dollars – and make a broader argument against excessive government spending and the fruits of insider deal making in the context of the national political scene.

"It is exactly the kind of crappy deal that is driving Republican voters nuts," wrote Jon Fleischman, publisher of the Republican-oriented Flashreport.org, in an open letter to GOP legislators before the vote. "We campaigned on holding the line against tax increases. … And that path is clear – just say no. The MCO multi-billion dollar tax increase simply ends, and killing that tax becomes symbolic and a momentum-builder heading into the November election."

State Sen. John Moorlach, R-Costa Mesa, complained about Democrats referring to the tax as a no-brainer when they continue to fund costly and controversial projects such as the high-speed rail system. That shows how this issue has become a touchstone for broader debates about state spending – and is a line in the sand early in the new session.

However, one of the key allies in most California anti-tax battles, the Howard Jarvis Taxpayers Association, sent a letter to Republican leaders earlier this month explaining its neutral stance even though the Legislative Counsel views the MCO plan as a tax increase: "Just because a bill is keyed as a tax increase by Legislative Counsel does not necessarily compel the conclusion that it reflects bad policy. Otherwise, California's tax code would be cast in stone." It reiterates its opposition to "tax increases impacting citizen taxpayers."

So the main questions: Will California Republicans oppose any tax increases, which impact citizen taxpayers? Or will they oppose any tax increases which impact citizen taxpayers? As it turns out, the comma lost. On Monday, 11 Republicans voted for the hike in the Assembly and two Republicans voted for it in the Senate.

Show Comments (21)