Concealed Costs/Bloated Benefits

Your federal tax dollars at work

In fiscal 1981, the Federal Railroad Administration will waste $90 million in taxpayers' funds on Local Rail Service Assistance projects. This waste will occur despite the requirement that the costs and benefits of a subsidy plan be toted up—with a plus on the bottom line—before funding can be awarded.

How could this be? With cost/benefit analyses, we are supposed to get the best of all possible worlds: waste will be unmasked; only efficient and productive government programs will be supported, marking a leap forward from the old, political ways of deciding how to disburse the public kitty. But this picture is more wishful thinking than anything else. While the cost/benefit approach has some attractive attributes in theory, the existing evidence shows that in practice this analytical tool is abused for the purpose of providing so-called economic justification for the same old government boondoggles.

And think of it—the FRA is only one, relatively obscure, government agency. A hard look at its assistance projects shows how it's done, but it's happening all across the vast spectrum of government largess.

To understand how cost/benefit studies go wrong, you have to understand why they're necessary in the first place. The marketplace, of course, employs something like them, even if the process is not formalized. If the benefits of whatever a firm is producing, as approximated by sales revenues, do not exceed the costs of producing it, the firm will earn nothing for its investors, and those investors will take their funds elsewhere—to some firm that is producing something consumers value highly enough to cover the costs of production, including a return on the investment.

The users of government-provided goods and services, however, are not generally required to pay their full cost, and those who must ultimately make up the deficits—the taxpayers—are not given the choice of declining to pay. So the typical government product lacks the fairly clear signals provided by ordinary market transactions concerning the benefits of that product. "Not to worry," say the advocates of government cost/benefit analysis. "Our studies will allow us to estimate the answers that would be given by the market if a market for the product were permitted to exist."

The first problem with this is the task of estimating the benefits enjoyed is, at best, prone to measurement errors. After all, individuals vary enormously in the value they attach to things. The marketplace itself only gives an approximation of the minimum value of a product or service at a given point in time. Many purchasers might have been willing to pay more than the going price if they had to. Take away the marketplace, as the government typically does in embarking upon its operations, and we have even less basis for estimating values.

BEEFING UP THE BENEFITS Beyond the difficulty of the task, however, is the fact that, as presently constituted, all government cost/benefit analyses systematically overstate the benefits and understate the costs of government spending. This systematic bias is accomplished by loading up the benefit side of the equation with all manner of gains over and above those directly concerned with the proposed spending. At the same time, these types of side effects are studiously ignored when it comes time to consider the costs of the government activity.

One way to load the benefit side of the equation is to transform some of the costs of the proposed program into an increment to the benefits. In the railroad subsidy program, for example, a typical cost/benefit technique is to count the wages paid and the inputs purchased as additions to the value of the service performed. In any reasonable approach to evaluating the viability of investments, such expenses are part of the stream of cash outflow necessary to produce a product or service. Surely it is a good thing that people will be employed and suppliers kept in business. But that costs, and by putting these into the benefits column, any project can be made to look good. Furthermore, this approach is an open invitation to a skillful petitioner for government funds to pump up the amount of benefits by incurring outrageous expenses for labor and supplies.

This inflation-of-benefits technique can be taken even further, as it is in the FRA guidelines, by factoring in secondary wage and employment losses that can be forestalled by rail subsidy. As such, the FRA methodology can show the "need" to subsidize a losing rail line in order to continue service to an unprofitable shipper, because the shipper's shut-down would eliminate jobs.

To place the methodology in perspective, suppose that Chrysler were located on the rail line under review. The monumental losses achieved by Chrysler would constitute a source of benefit streams that could be used to justify federal subsidy. The expenses Chrysler would incur in keeping its plant open would be summed into the benefit portion of the ratio. The less efficient the rail user's operation or the less its product is desired by consumers, the more it has to spend in order to keep the plant open, and hence the larger the benefit/cost ratio will be.

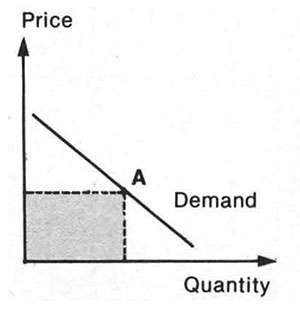

Another virtually unbounded element of value that can be used to pad the benefit portion of the analysis is the so-called consumer surplus that exists in the consumption of any product or service. To understand the concept of consumer surplus, imagine yourself an economist. If you were such a creature, you would illustrate the point by drawing a graph plotting the two relevant variables—price and quantity. With price on the vertical axis and quantity on the horizontal, you would draw in a hypothetical demand "curve," sloping downward from left to right to show that, the lower the price of a product, the greater the quantity bought.

THE CONSUMER SURPLUS PLOY

Now, suppose that in the picture you have drawn, A is the price/quantity arrived at in the market, given the cost of producing various quantities (we won't mess up our picture with a supply curve). Price X quantity, of course, equals the total amount paid out by consumers for this product, represented graphically by the shaded area. This is the "calculation" of the minimum value of this product to consumers—minimum, because some people value it highly enough to pay more if they had to. How much more, in toto, is represented by the triangle lying above the area of actual sales. And that is the famous "consumer surplus."

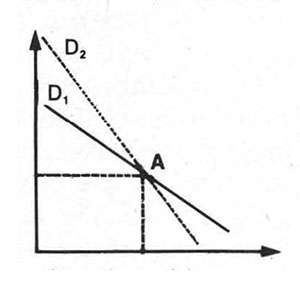

Government cost/benefit analysts, naturally enough, like to count that surplus among the benefits of their projects. The trouble is, however, that they don't know what the demand curve looks like in the real world. And by playing around with the curve, you can see what a difference it makes. If you assume that demand looks like D2, rather than D1, you will come up with a much larger consumer surplus.

The FRA's suggestions for estimating this curve are ludicrous. One idea is to assume that all rail shipments would be replaced by truck hauling if the rail line were to close. This was the premise of a cost/benefit study done for a project in Texas, for example. But since, in the nature of things, it costs more to transport some commodities by truck than by rail, this amounts to an assumption that the quantity of transportation service demanded is totally unaffected by its price. Even though such an assumption is quite clearly absurd, it was labeled "conservative," on the grounds that the FRA guidelines would've permitted even more ridiculous assumptions.

A second FRA suggestion for estimating the consumer surplus is to ask shippers what price they would be willing to pay for rail service and to use this to calculate the amount of consumer surplus. There's nothing like the real marketplace for getting people to put their money where their mouths are. The problems with this approach to estimation can be seen in this example: Patrons of an emergency flood train service in Arizona avowed a great willingness to pay several times the $1.00 fare for continued rail passenger service. A consumer surplus figure based on this data would have amounted to $5 to $10 million per year. The fly in the ointment was that when the flood-damaged freeway bridge was repaired, train ridership at the $1.00 fare dropped by 80 percent.

The whole consumer surplus ploy is but a means of inflating the apparent benefits of rail subsidies. The surplus cannot be measured by any known methods. The FRA's proposals merely place the stamp of official approval on estimation techniques that are certain to result in gross distortions and unconscionable overestimates of the benefits of the subsidy program.

OVERESTIMATED SAVINGS A third tool for inflating the apparent benefits of government spending is to incorporate what are obviously mere transfer payments as if they were net gains to society. The local recipients of federal grants are permitted and encouraged to hypothesize dislocation costs that would be experienced by local businesses if the proposed government subsidization of rail service were not forthcoming.

This procedure inverts the typical cause-and-effect relationship. Local rail lines that once were bustling with activity, but now are failing, are failing because the underlying economic rationale for business activity at the locations being served is changing. This is especially the case where rail lines were originally built to service mining industries. As the economy's needs change over time, the type of transportation required changes. Put another way, declining industries lead to declining rail lines, not the reverse. Yet the assumption of this cost/benefit technique is that the declining economic viability of rail-using industries can be reversed by subsidizing rail service.

Beyond this mix-up between cause and effect, though, are the erroneous notions of the savings to be garnered for the nation by preserving rail service. If a firm cannot pay the full cost of transporting its product to market, it should close down. The economy is best served by such a closure. One would not know this from examining FRA guidelines on calculating the social benefits and costs of business shut-downs and relocations. Losses in local land values due to plant shutdowns in dying towns can amount to enormous sums—all of which can be computed as benefits if the losses are prevented by subsidizing rail service. The potential consequence is that, again, virtually any rail subsidy can be made to look beneficial.

The problem, from a public-interest perspective, with all of these devices used to inflate the prospective benefits of government spending is that their one-sidedness distorts the analyses, leads to the misallocation of resources, and actually reduces the general welfare. The dislocation factor, for example, focuses solely on the perceived benefits of a specific project. Unmentioned are the dislocations that will result in areas that must forgo the use of those resources. Within the context of the government's own programs, the funding of some projects means that some other potential projects cannot receive funding. The unfunded projects will suffer the dislocating consequences of not being chosen for subsidy. At most, the benefit of forestalling dislocation is the increment of the chosen over the rejected alternatives in terms of dislocation costs that can be prevented.

FRA funding of a project for Apache Railway in Arizona shows one of the results of such techniques—providing a new avenue for private businesses elbowing their way to the public trough. Apache was fully capable of financing its own capital investment project. Its parent corporation—Southwest Forest Industries, a major paper producer with annual revenues in excess of $750 million—was investing $50 million in the purchase of a manufacturing facility in another state at the same time as it was asking for $600,000 in taxpayers' money for a railroad construction grant.

For the railroad, it was a question of the money being there for the taking. For the state of Arizona, it was a case of grabbing the money or losing it to another state. For the FRA, it was a matter of using up its budgeted funds, even though the project did not fit its notion of the proper use of federal funds, in that the rail line in question was in no danger of failure. This latter fact is the sole positive element in the whole sordid affair. At least the investment made sense from a return-on-capital perspective (the return was projected at 24 percent per annum).

COST COVER-UPS Beyond the confines of the government's own programs is the inherently disruptive impact of income transfers. The cost/benefit methodology does not acknowledge the effects that taxation of productive enterprise for the purpose of subsidizing deficit enterprises has on the national income. There is no getting around it: taxing activities with positive returns in order to fund activities with negative returns on investment reduces the national wealth. This consequence has widespread implications for both present and future employment and standards of living. Yet it is completely ignored in the government's cost/benefit analyses.

Absurd as it may appear, it is standard operating procedure for government cost/benefit studies to be conducted as if government spending alone produces benefits beyond those measured by the transactions themselves. The fact of the matter is that all economic activity has indirect effects on the community. All economic activity produces consumer surplus. These indirect benefits and consumer surpluses are not generally accommodated in private investment analysis because, in addition to their being unmeasurable, they are unbankable. They are also largely offsetting. To consider these factors as part of the benefits without also taking cognizance of them in the estimation of costs produces the systematically biased results that serve as some sort of pseudo-rational justification for ever-increasing spending.

The classic capstone to the whole rigged process of government cost/benefit analyses is the estimate of the cost of capital. In the business world, a firm must base its investment decisions on its cost of capital. Projects which cannot generate a sufficient cash flow to cover this cost are financially infeasible. And so cost/benefit analysts in government dutifully put this cost on their balance sheets. But how they estimate it!

While there is some room for reasonable disagreement over what a representative cost of capital might be in any given instance, there is no question that the methodology endorsed by the FRA, for example, is seriously deficient. Employing this methodology, the state of Texas was able to make the asinine announcement that four percent is a representative cost of capital. The use of such an absurdly low cost of capital will, of course, inflate the net benefits of the subsidy program by substantial amounts.

The rationale for the selection of such a low cost of capital is that, since the project is government-financed, it is risk free! It is true that, since the government possesses a virtually unlimited power to levy taxes in order to pay its debts, it can borrow at the lowest rates and its debt instruments are considered safe from default (and therefore "risk-free"). To use these low interest rates, however, as the cost of capital for government investment is to introduce a major distortion into the analysis.

Since the whole concept of the cost/benefit analyses is that the benefits and costs can be calculated in order to determine whether the project is justifiable, the relevant measure of risk is not the ability of the government through its taxing power to make up any deficits. The relevant measure of risk is the probability that the anticipated benefits will in fact equal or exceed the benefits that could have been obtained from an alternate use of the resources. In short, the cost of capital is the opportunity cost of converting liquid assets into specific fixed investments.

The fact that the government may be able to borrow money at low, "risk-free" rates is fundamentally irrelevant as a consideration in a cost/ benefit analysis. Since government spending diverts resources from private investment, the relevant opportunity cost for the FRA, for example, is at least the return that could have been obtained from an average investment at average risk, plus an allowance for the additional risk inherent in attempting to revive an unprofitable branch line and an increment to allow for the sacrificed indirect benefits and consumer surplus forgone as a result of this diversion. That is, in contrast to the usual procedure of using a lower cost of capital for government projects, a true social welfare-maximizing methodology would require a higher cost of capital for such projects.

ARTFUL MANIPULATION The general welfare, however, turns out not to be the constraint one might have thought, given all the virtues laid at the feet of cost/benefit analysis. Take the FRA's handbook, Benefit-Cost Guidelines: Rail Branch Line Continuation Assistance Program, put out in January 1980. With a universe of possible examples with which to illustrate its methodology, the FRA came up with negative returns. It is no accident, of course, that the numbers came out this way. When one is constrained to consider the total impacts of any subsidy program, the general welfare will always show negative returns.

A neat way around this problem is simply not to require a project to show positive (national) returns in order to be eligible for subsidy. An applicant for FRA funding, for example, is free to establish whatever "frame of reference" seems convenient. In the Benefit-Cost Guidelines manual, the option that showed the largest net social loss on the basis of the national "frame of reference" could be manipulated—and was manipulated—to show a net gain of nearly $6 million from a local perspective. In this way, an applicant for federal funding can make a project that in reality loses nearly 80 percent of the original investment appear to generate a sixfold return on investment.

As should be evident by now, the standard government approach to cost/benefit analyses is fatally flawed. It stacks the deck against rational allocation of resources. The implied rigor of economic evaluation through government-generated cost/ benefit analyses is an illusion. Whether the entire process is an elaborate hoax or an exercise in self-delusion is not easily discernible from the utterances of the proponents of this miracle tool.

The resort to such devices as the cost/benefit analysis is stimulated by the determination to reject the marketplace as an arbiter of the material desires of mankind. At best, if honestly performed, the technique is inferior to the marketplace as a means of allocating resources among competing needs. At its worst, it is a sophisticated tool for propagandizing on behalf of nonexistent net benefits of public spending. In the hands of an artful manipulator of numbers, the most preposterous schemes to waste the taxpayers' money can be made to appear veritable gold mines of opportunity to enhance the public interest. The timely demolition of this bureaucratically concocted ruse could do much to promote both the rights of taxpayers and the general welfare.

John Semmens is working as an economist for the Arizona Department of Transportation, while completing his master's in business administration at Arizona State University.

This article originally appeared in print under the headline "Concealed Costs/Bloated Benefits."

Show Comments (0)