Biden's New Student Loan Forgiveness Plan Helps Mostly People Who Don't Need It

Biden's plan to forgive nearly $300 billion in student loan debt will disproportionately help affluent Americans.

Today, Biden announced a plan to forgive nearly $300 billion in student loan debt. The benefit will be available to individuals earning up to $125,000 per year and couples earning up to $250,000, and will forgive up to $10,000 per borrower, rising to $20,000 for Pell grant recipients. In addition to direct loan forgiveness, Biden announced a suite of additional loan forgiveness measures, including allowing participants in Income-Driven Repayment plans to spend no more than five percent of their adjusted income on monthly payments and forgiving student loan balances of $12,000 or less after 10 years of payments.

The estimated cost of these programs has not been announced. As Reason's Eric Boehm has reported, however, the policy will likely wipe out nearly all the deficit reduction promised by the Inflation Reduction Act.

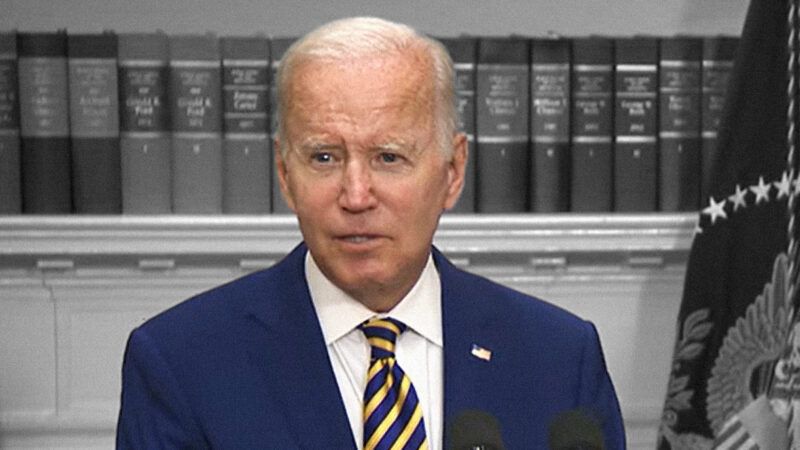

"Here's what my administration is going to do, provide more breathing room for people so they have less burden by student debt, and quite frankly to fix the system itself, which when [Secretary of Education Miguel Cardona and I] came in we both acknowledged is broken," said President Biden in a press conference on Wednesday.

"The idea that taxpayers—including college grads who paid back what they borrowed—should have to finance a $10,000 giveaway to Americans earning more than six figures is absurd on its face," wrote Reason's Eric Boehm. "Well-paid professionals do not need welfare, and it makes little sense to blow another $300 billion hole in the federal budget to provide it to them."

Biden's student debt cancellation policy is regressive, which means it disproportionately benefits people who least need welfare. According to a recent analysis from the Penn Wharton Budget model, under a previous version of* Biden's debt forgiveness plan "about 70 percent of debt relief accrues to borrowers in the top 60 percent of the income distribution."

Biden's plan attempts to address a real problem; the incredibly high cost of higher education in the United States and the unmanageable debt loads that some students take on. However, loan forgiveness does absolutely nothing to combat the high cost of a college education. Addressing college cost inflation would require government officials to seriously reconsider the federal student loan program. Instead of doing that hard work, the Biden administration is enacting a slapdash solution that ignores the underlying causes of our current student debt crisis.

Forgiving debt does nothing to encourage colleges to lower their prices. If anything, it encourages tuition increases, as emboldened universities can now justify tuition hikes by assuring would-be students that their debt is likely to be erased. Further, while this debt forgiveness will benefit those who currently hold debt, it offers nothing to current students facing a heavy debt burden to attend college, or those who sacrificed for years to pay off their student loans. In all, this slate of debt forgiveness only benefits a small fraction of those harmed by expensive college, while doing nothing to bring down prices.

Further, it is worth asking why student debt forgiveness has gained such a firm grip over American politics in the first place. The answer is that nearly all of the people who write, advocate for, and pass policy have college degrees. According to Brookings, the highest-earning 40 percent of households hold 60 percent of the outstanding student loan debt. In contrast, the bottom 40 percent owes just 20 percent of outstanding student loan debt.

Student debt forgiveness isn't the noble, equalizing project that its supporters claim it is. It's the personal project of some of our nation's most affluent and educated individuals. The college educations they benefited from will now be paid for by people who make less money than them and have less power.

If we want to tackle the student debt problem, we should stop wasting time—and truly obscene amounts of money—on temporary solutions like one-time debt forgiveness. Instead, the Biden Administration should focus its efforts on policies that will actually reduce the cost of college, such as rolling back the federal student loan program.

*CORRECTION: This article has been corrected to clarify that the Penn-Wharton analysis mentioned applied to an earlier version of Biden's proposal.

Show Comments (61)