Biden Wants Lower Oil Prices and Lower Oil Supply

That's not how it works.

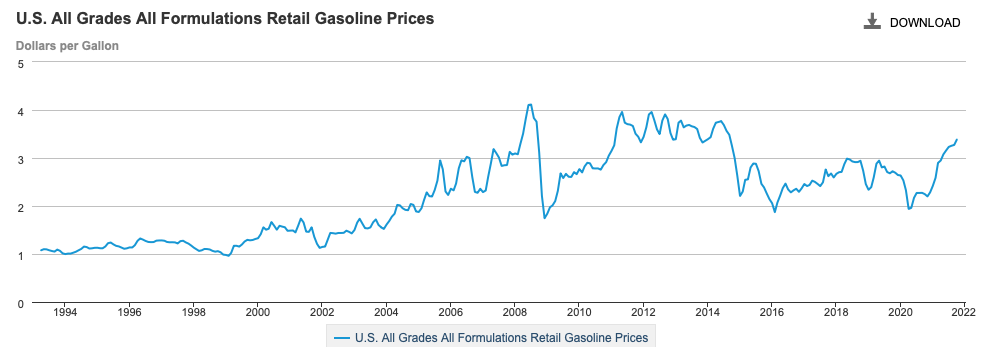

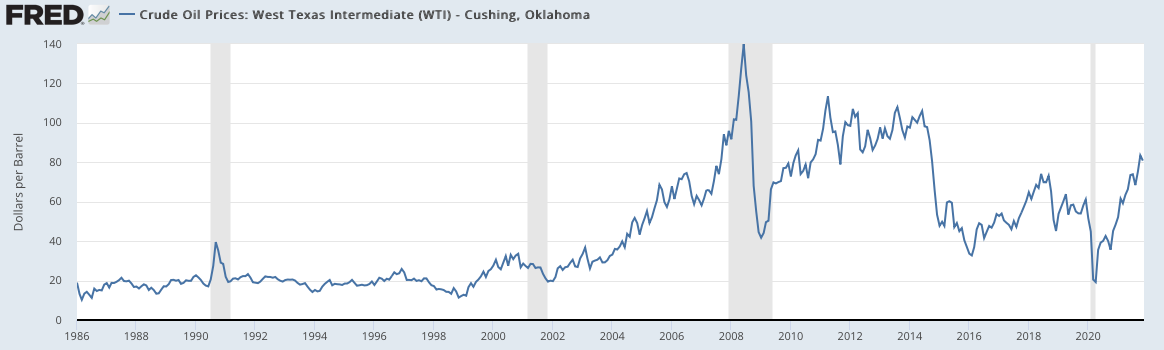

President Joe Biden is engaging in political theater in the pretense of doing something about escalating gasoline prices. For his latest act, the president announced earlier today that he is ordering the release of 50 million barrels of oil from the nation's strategic petroleum reserve in an effort to tamp down rising gasoline prices. Oil prices tanked at the beginning of the global COVID-19 pandemic, falling to around $20 per barrel; as the world's economies recovered, prices have risen to nearly $80 per barrel. Consequently, the average price of a gallon of regular gasoline has risen from $2.11 a year ago to more than $3.40 this week.

Biden and his allies, such as Sen. Elizabeth Warren (D–Mass.), have blamed Big Oil for the rising prices. In a letter sent last week to Federal Trade Commission (FTC) Chair Lina Khan, Biden asked the agency to investigate the oil companies for "anti-competitive potentially illegal conduct." The Obama administration performed a similar bit of political theater in 2011 by demanding an FTC investigation when gasoline prices rose steeply to nearly $4.00 per gallon. Spoiler alert: The FTC's September 2011 report concluded that "crude oil prices continue to be the main driver of gasoline prices. Crude oil prices since 2005 have changed due to shifts in both world-wide demand and supply." Comparing U.S. gasoline prices and global oil prices amply confirms that conclusion. In other words, Big Oil is not to blame for rising gasoline prices.

In fact, petroleum prices ranged between $115 and $80 per barrel through much of 2011.

More usefully, Biden in August 2021 begged Saudi Arabia and other Organization of Petroleum Exporting Countries and Russia (OPEC+) to pump more crude oil.

It would have been even more useful if the president had encouraged American oil companies to produce more at home. "The Administration is blaming others when it ought to take a sober look at its own energy policy," observed Derrick Morgan, vice president of American Fuel & Petrochemical Manufacturers, a trade organization. "Prices are determined by competitive firms operating in an environment of supply and demand," Morgan pointed out. "Unfortunately federal policy is discouraging supply by shutting down pipelines, putting future production off limits, talking down the future of the petroleum business, and imposing expensive requirements on refineries, chief among them a burdensome Renewable Fuel Standard."

The Biden administration cancelled approval of the Keystone oil pipeline earlier this year and may or may not be considering shutting down the important Line 5 pipeline in Michigan. In January, the Biden administration froze the issuing of new leases for oil and gas drilling on federal lands and waters, but has since backed off and begun permitting new oil and gas exploration. Worried about man-made climate change, Biden has certainly been "talking down" fossil fuels such as oil and gas. The renewable fuel standard adopted in 2005 requires refiners to blend in ethanol to their gasoline and that boosts the average price of a gallon of gasoline by as much as 30 cents. Both the Trump and Biden administrations—in thrall to midwestern biofuel states—strongly supported the renewable fuel standard.

Just before the pandemic hit in March 2020, the U.S. had become, due to the fracking revolution, the world's largest producer of petroleum, going from an importer of nearly 13 million barrels per day in 2005 to exporting around 1 million barrels daily in 2020. Thus did U.S. oil companies during the past few years basically become the price setters for the global oil market. However, the initial economic fallout of the pandemic caused oil prices to collapse and the number of U.S. oil rigs operating consequently fell to just 250, the lowest level ever.

To make matters worse, the slow recovery of oil production in the U.S. has allowed two loathsome regimes, one that chops up journalists and another that poisons dissidents, to effectively set the current world price of petroleum. However, the pricing power wielded by OPEC+ may not last too much longer since the good news is that the number of oil rigs drilling in the U.S. is rising and reached 563 this past week.

Show Comments (101)