Beware These Gold & Silver Myths

Watch out for some common fallacies about the precious metals

Many investors have become extremely bullish on gold and silver since last summer. It isn't uncommon to see, in print, price objectives of $1,500 to $4,000 cited for gold and $100 to $200 for silver.

Although I don't believe we'll see $100 silver (unless a runaway inflation causes bread to cost $10 a loaf), it's possible that gold or silver (or both) may be in a new bull market now. However, some of the reasons offered in support of the rosy futures for gold and silver are fallacious.

And if your reasons for making an investment are wrong, you can get hurt—even if the investment is generally right. With wrong reasons, you might stay in too long (as many people did in 1980 by waiting for $100 silver); you might invest more than you should (thinking the investment can't possibly lose); or you might refuse to cut your losses by getting out if the trend goes against you.

So this article examines six bullish arguments for hard money investments that I've seen or heard in the past few months. The sources aren't given because it's the content that's in question, not the speaker. In some cases, I've paraphrased the argument to condense it.

1. The Federal Reserve has given up its tight-money policy and begun reflating; so price inflation and the gold price will go to new highs.

It seems to be gospel that the Federal Reserve, afraid of a worsening recession, threw in the towel during the summer of 1982, cranked up the printing presses, flooded the country with new liquidity, and drove interest rates downward. I haven't seen one piece of evidence to support this idea. It simply is assumed that if interest rates fell, the Federal Reserve must have caused the event—as if it were impossible for interest rates to fall for any other reason.

In truth, during the months of the supposed easing, the growth rates for the M2 money supply, for bank reserves, and for the monetary base all slowed from what they had been during the first six months of 1982. It was only at the end of 1982 that monetary growth began to speed up. And that most likely was an aberration that will have been reversed by the time you read this.

The "easing" hypothesis was supported by supposed statements by Fed Chairman Paul Volcker that the Fed was abandoning its money-supply targets in favor of lower interest rates. In fact, he didn't say that.

Because of changes in the laws, banks began offering new types of accounts and services last year. This caused some bank deposits to be switched from one type of account to another. In addition, the downward trend in interest rates caused transfers out of savings accounts and money market certificates and into checking accounts.

Because of these shifts, the Fed expected the M1 money supply to be fairly volatile, while M2 (which includes almost all bank deposits) would be much more steady. So Volcker said the Fed would pretty much ignore M1 for the rest of 1982, paying more attention to M2. But he said nothing about trying to influence interest rates.

The Fed lowered the discount rate several times during 1982. But this was in response to falling interest rates, not the cause of them. It has been more than a decade since the discount rate was used as a tool to influence the economy. Had the change in the discount rate been a cause, rather than an effect, the result would have shown up in the monetary aggregates—but there was no big spurt in the monetary aggregates.

Since October 1979, the Federal Reserve has maintained a more consistent monetary policy than it had pursued at any time during the previous 20 years. The Fed might throw all that away tomorrow morning, but there's no evidence so far that it has done so already.

2. The Fed's reflation has eliminated the possibility of a deflation. There's only one direction from here on—upward—in the money supply, in price inflation, and in the prices of precious metals.

The possibility of a deflation hasn't been eliminated—not yet, at least. In the first place, as I've already said, there's no evidence that the Fed made a significant change in course last year. Second, even if it had, the Fed isn't the sole cause of inflation or deflation. Inflation results from a rise in the supply of money that exceeds any rise in the demand for money. And deflation results from a rise in the demand for money that exceeds the rise in the supply of money.

If the public becomes concerned about the safety of certificates of deposit, commercial paper, and other money substitutes, there could be a run out of these instruments and into cash itself. The demand for money would rise. And since this demand can't be measured on a short-term basis, the Fed might not increase the money supply fast enough to keep up with the rise in demand. The result would be deflation—even as the Fed was inflating the money supply. (Such a possibility is described in more detail in chapter 4 of Inflation-Proofing Your Investments by Terry Coxon and myself.)

At some point, the threat of widespread bank and business failures may lessen sufficiently, so that the possibility of a rapid rise in the demand for money will be averted for a few years. But it's also possible that this threat will stay with us for several years. We're no longer in the up-and-down monetary cycles that characterized the 1960s and 1970s; and it's always a mistake to base your investment decisions on patterns that no longer are valid.

3. The federal budget is out of control. And, historically, the bigger the government spending, the bigger the federal deficit, the bigger the resulting inflation, and, consequently, the higher the gold price.

Although it's convenient to say that big federal deficits cause inflation, that just isn't the case. Large federal deficits put a strain on the credit markets and could encourage the Fed to speed up monetary growth to keep interest rates from rising. But there's no automatic correlation between budget deficits and inflation.

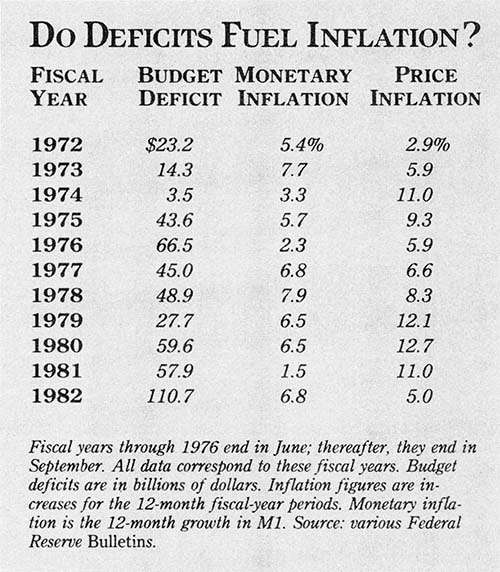

History provides no statistical evidence that the inflation rate is tied to the size of the budget deficit. Consider the figures in the table to the left. Data for the last 10 years show no correspondence between the deficit size and either inflation rate—not on a leading, coincident, or lagging basis.

There may be higher inflation rates in the future. But if so, it won't be because such rates were preordained by currently anticipated budget deficits.

4. In constant dollars, $35 gold in 1968 compares very closely with a $450 price today.

I don't know how the calculation was made, but I've seen such statements several times—and the conclusion is quite erroneous. A gold price of $35 in 1968 dollars is equivalent to a price of $98 in 1982 dollars.

Fortunately for the gold advocate, however, the argument is meaningless anyway. Prices don't move uniformly. If there were fundamental reasons for the gold price to multiply by 12 while the general price level only quadrupled, so be it.

But gold isn't "cheap" in real historical terms. Even a gold price of $35 in 1934 dollars is equivalent only to a price of $256 in 1982 dollars.

5. Big gold price increases are coming—if only because there is so much paper money in the world and so little gold.

Of course there's a great deal of paper money floating around. But so what? Is there 12 times as much paper money as there was when the gold price was $35? The gold price has been rising faster than the growth in paper money over the past decade, so today's level of paper money is no signal that higher gold prices are coming.

6. The government has created a silver shortage, and since both the supply of silver and the demand for it are inelastic, the shortage can be relieved only at much higher silver prices.

Shades of 1970! You may think that I dug this argument out of a time machine, but an entire speech detailing this 1970 silver pitch was, according to reports, one of the most popular at the 1982 New Orleans gold conference.

This argument was true once but is no longer so. The market has demonstrated already that the fundamental value of silver is somewhere between $10 and $15. Throughout 1980 and 1981, there was a surplus of silver rather than a shortage. Neither supply nor demand is inelastic once you get up to $10 or so.

7. Silver will rise for all the same reasons as for gold; but because the gold-silver ratio is so high now, silver will have a bigger price increase than gold will.

It is assumed that gold and silver must move in the same direction. In fact, the historical record is otherwise.

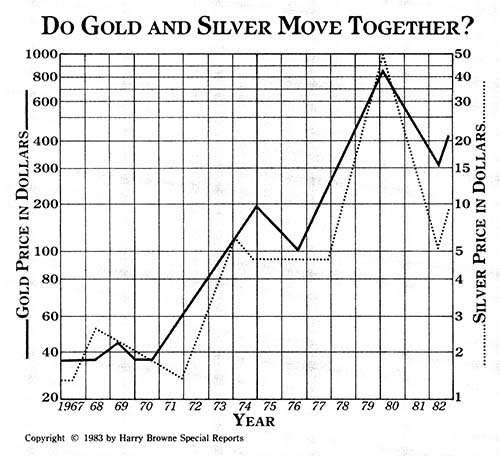

The graph below shows the trends for gold and silver over the past 16 years, but with the price movements smoothed out to show the basic trend direction at any given time. At first glance, it appears that gold and silver have moved together over these 16 years.

But look more Closely at the graph. For the entire four years of 1974–77, for example, gold and silver were in different trends. While silver was dropping, gold was rising; then silver was in a three-year sideways trend, while gold was in a bear market and then a bull market. Would you have done well during these four years by assuming that gold and silver always move together? In fact, during the 190 months covered by the graph, the two commodities were moving in the same direction during only 104 months, or 55 percent of the time—no more often than might be the case in any random pairing of investments.

Because gold and silver began their latest bear markets together in January 1980 and appear to have ended them together in June 1982, it's easy to think they always move together. Most commodities, however, moved into downtrends in January 1980; gold and silver just happened to be two of them.

As for the gold-silver ratio, there's no natural law dictating what that ratio should be. And investors who think they have a sure thing playing ratios get burned in the end.

One example occurred in 1977. The German mark historically had sold at a premium to the Swiss franc. When the franc "temporarily" rose above the mark, "savvy" investors knew to buy the mark and sell the franc short; they couldn't lose, because the mark would eventually rise above the franc again. Today, five years later, the franc has risen to an 18 percent premium above the mark—a bigger premium than in 1977.

Other investors are waiting for the platinum price to return to its "historical premium" over gold. That premium that hasn't existed for over two years.

Gold and silver are separate commodities with separate fundamentals. Gold is primarily a monetary metal, and silver is primarily an industrial metal. Each should be judged on its own merits.

I believe it's more likely that gold and silver will go their separate ways over the coming years. If there's turmoil, gold will rise and silver will drop. If there's prosperity, gold will drop and silver will rise.

Pat arguments and sure things are almost always wrong. In the early 1970s, "everyone knew" that the dollar would never be devalued because it was the reserve currency of the world. But investors who stood apart from the crowd made most of the profits of the 1970s—by betting against the dollar and for gold, silver, and strong foreign currencies.

Today, those outcast-investments of the 1970s are respectable. And the crowd is ready to reap its profits by betting that the 1970s will be repeated in the 1980s. The arguments I've discussed in this article are some of those upon which the crowd is depending.

I'm not saying that gold and silver are dead and buried. But I believe they should be treated with more caution than seemed appropriate 10 years ago.

Harry Browne is the author of numerous investment books, as well as How I Found Freedom in an Unfree World, and is the editor of an investment newsletter, Harry Browne's Special Reports, from which this article is adapted by permission of the publisher.

This article originally appeared in print under the headline "Beware These Gold & Silver Myths."

Show Comments (0)