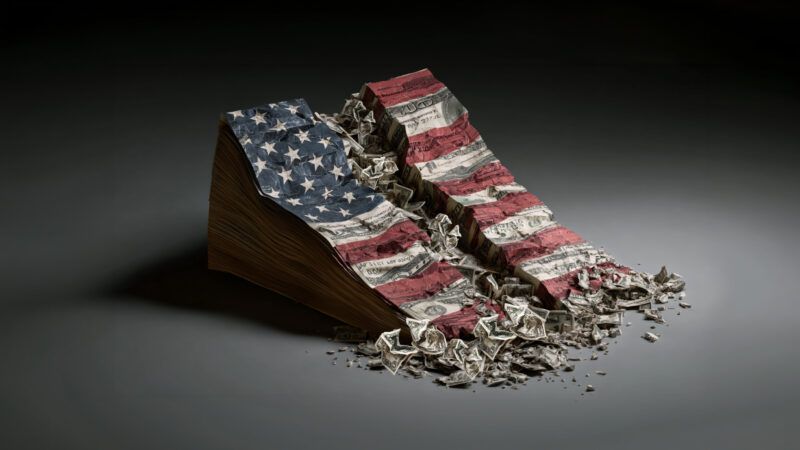

Interest on the National Debt Will Cost $16 Trillion Over the Next 10 Years

A new Congressional Budget Office outlook expects entitlement spending and the national debt to explode in the next decade.

Increased spending on old-age entitlements and the cost of financing the national debt will push annual budget deficits from $1.9 trillion this year to over $3 trillion by 2036.

That's according to the Congressional Budget Office's (CBO) latest 10-year budget estimate, released Wednesday morning. Over the next decade, the CBO expects the national debt to hit a record high of more than 120 percent of America's gross domestic product, exceeding the previous high of 106 percent near the end of World War II.

Much of that new borrowing will occur despite an anticipated increase in federal revenue, which the CBO expects will increase from about $5.6 trillion this year to $8.3 trillion by 2036. That increase in revenue is completely swamped by a projected rise in government spending, which will surge from about $7 trillion this year to over $11.4 trillion by the end of the 10-year budget window.

Nearly all of the expected increase in spending is a result of entitlement spending and the rising cost of servicing that massive pile of debt. The federal government will spend over $1 trillion on interest payments this year, and the CBO expects those interest payments to more than double over the next 10 years.

Over the course of the 10-year budget window, the federal government will spend an estimated $16 trillion on interest payments—that's $16 trillion in taxes that won't buy taxpayers any new government services but will merely pay the tab run up in previous years.

The major tax bill that Republicans passed and President Donald Trump signed last year will contribute to the worsening fiscal picture. The CBO estimates that policy changes implemented by the One Big Beautiful Bill Act will add about $100 billion to the deficit this year and about $1.4 trillion to cumulative deficits over the next decade.

On the other hand, higher tariffs imposed by the Trump administration will increase revenue by an estimated $3 trillion over the next decade, if they remain in place.

"The CBO's projections remind us that our fiscal trajectory remains unsustainable," Dominik Lett, a fiscal policy analyst at the Cato Institute, said in a statement. "This reckless borrowing has real, tangible costs for Americans, creating inflationary pressure, slowing economic growth, and making borrowing more costly."

Indeed, studies have linked higher debt to rising interest rates and persistent inflation. Higher interest rates or higher inflation could, in turn, worsen the CBO's already bleak projections. The 10-year budget outlook released Wednesday assumes that inflation will stabilize at 2 percent (it is currently 2.7 percent) and that interest rates will fall in the coming years. Fiscal hawks have been warning for years that unforeseen spikes in inflation—like the one that hit after the pandemic—or other emergencies would expose the federal government's precarious fiscal position.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a nonprofit that advocates for reducing deficits, said in a statement that the new CBO report contains no "bright spots of encouraging news."

"A healthy balance sheet is critical for a growing economy, national security, and the ability to respond to unforeseen emergencies," she added. "At this moment in time with challenges ranging from the aging of society to growing geo-political rivalries, it is nothing short of self-sabotage to operate with such a self-imposed disadvantage."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Given the probable inflation from the money printer when we start to be unable to cover the spending any other way - the cost of the debt is the end of the dollar.

Just make execute all our Marxists and then make the rest of the world pay tribute. Debt problem solved.

Not the end of the dollar. The end of the US as an important power. We'll keep the dollar because there's no choice. We're not going to yuanize or swissfrancize. So we'll become like Turkey with the lira.

Not clarified in this article is that the interest payments on the federal debt are paid with fiat money to private lenders and that those lenders will then spend that money, putting it into circulation and causing continued inflation. The tax revenues that are collected, insufficient to cover the expenses, are diverted from other more productive enterprises, diminishing the production that might otherwise increase to meet the increasing demand caused by more people with more (inflationary) cash in circulation, exacerbating inflated prices.

^THIS exactly +100000.

It would be so nice if people cared about the # of ?what? instead of just the # itself.

The dollar doesn't have another ten years to live. It might not have one year.

That's the problem with fiat currency and chaotic systems. No one knows where the tipping point or cusp might be, or what minor incident will trigger the sudden loss of faith by the public in the soundness of the currency, causing a crash and triggering the next great depression. The most obvious trigger would be the point at which the Treasury fails for the first time to make a payment on the national debt, going into default.

The Treasury will not fail like that.

We should have gotten rid of the democrats and RINOs 20 years ago. More people need the will to do this.

Look where going along to get along has gotten us. The democrats aren’t worth this.

Man, imagine if Reason ever supported any actual attempts to reduce spending.

If you cant fix it in one go it ain't worth doing. - old man Reason.

Indeed.

"If you ain't saving $5T immediately, then do not even waste our time"

This is why libertarianism is as close to dead a political philosophy as exists. Fucking Communism has a better shot at winning elections now than libertarianism.

That’s why we need to get rid of the communists. You can’t have Marxism without Marxists.

And inter agency protocol must be observed.

As the good people of Martha's Vineyard will remind us, those 50 migrants won't pay for themselves.

"No generation has a right to contract debts greater than can be paid off during the course of its own existence." ~ Thomas Jefferson

This is why a debt jubilee is the only solution. It doesn't matter whether govt has that right. That's what we did and the corollary of that breach is - a debt that can't be paid won't be paid.