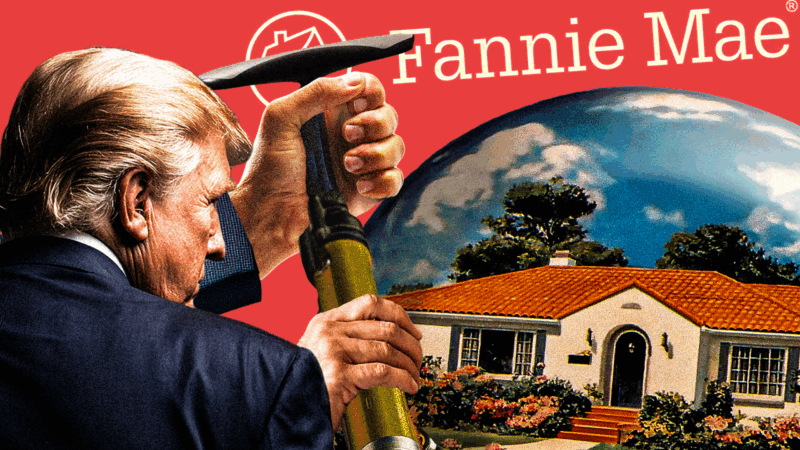

The Trump Administration's Latest Housing 'Fix' Could Inflate Another Bubble

Socializing risk to subsidize demand isn't a solution to the housing crisis, but it is a good start to another financial crisis.

President Donald Trump made headlines with his controversial proposal to make housing affordable by introducing 50-year mortgages. While that plan was merely floated—and may not even be legal—the administration has laid the groundwork for another housing bubble by eliminating the minimum FICO score requirement for federally-backed home loans.

Last Wednesday, Fannie Mae announced that "the minimum representative credit score requirement of 620…will be removed for new loan casefiles created on or after Nov. 16." Fannie Mae, a government-sponsored enterprise (GSE), doesn't lend to borrowers directly, but purchases mortgage loans from private lenders like commercial banks. Together with Freddie Mac, another GSE that buys mortgages, the two "support around 70 percent of the U.S. mortgage market," according to The New York Times.

Instead of relying on this minimum FICO score, Desktop Underwriter, Fannie Mae's automated mortgage loan underwriting system that helps lenders determine whether a loan is eligible for purchase by Fannie Mae, will "rely on its own comprehensive analysis of risk factors to determine eligibility." Despite the change, Bill Pulte, director of the Federal Housing Finance Agency (FHFA) that oversees Fannie Mae, insisted that Fannie Mae's "underwriting standards are the same."

Pulte simultaneously pitched the plan as a "big deal for consumers." On this point, he's not wrong—the policy is eerily reminiscent of those that precipitated the 2008 financial crisis; it socializes the risk and incentivizes lenders to issue loans to those who are more likely to default. Anthony Randazzo, former senior fellow at the Reason Foundation (the think tank that publishes this magazine), explains that, leading up to the Great Recession, Fannie Mae and Freddie Mac "decided to begin taking on riskier mortgages in order to grab a slice of the subprime mortgage market [because] they knew they had a government safety net to back them up." Adding insult to injury, the Securities and Exchange Commission charged top executives of Fannie Mae and Freddie Mac with securities fraud for misleading investors about their subprime exposure.

Peter Wallison, senior fellow emeritus at the American Enterprise Institute, explained to Reason that, of the "28 million subprime or very weak mortgages [in 2008]….20.4 million were on the books of government agencies like Fannie Mae and Freddie Mac…that were holding them as a requirement of the Community Reinvestment Act." When subprime borrowers defaulted, Fannie Mae and Freddie Mac had their losses socialized: Both were put under FHFA conservatorship and bailed out by taxpayers to the tune of $189 billion.

Despite instigating the Great Recession, Fannie Mae and Freddie Mac still have a huge hand in American homeownership via the secondary mortgage market. Fannie Mae guaranteed 25 percent of single-family residential mortgage debt in June and provided $287 billion in liquidity to the mortgage market in the first nine months of 2025, per its September fact sheet.

Jessica Riedl, senior fellow at the Manhattan Institute, fears that eliminating the minimum credit requirement "may end up as a political move to expand homeownership without regard to whether the families can afford the loans." David Bahnsen, managing partner at the Bahnsen Group, a wealth management firm, is not so concerned. He tells Reason that, while it is "marginally possible" that the elimination of the minimum credit score may subsidize demand for unqualified homebuyers, "income verification is now so rigorous [that he doesn't] see much room for expanding credit worthiness to really expand affordability." He says that "income verification and appropriate debt-to-income ratios are the most important metric" in determining creditworthiness.

It's still early to tell what the exact impact of this policy change will be, but as history shows, providing federally-backed mortgages to those with dubious credit histories isn't a fix to the housing crisis. Rather than boosting the supply of housing, this plan could socialize risk and potentially inflate prices.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Politicians have never met a boondoggle they didn't like. They enjoy taking credit for helping people and then shifting blame to someone else for the disaster that ensues. And The Peepulz let them get away with it every time.

It might cause folks to borrow more to get into a “better” house, which could increase housing prices.

As long as the federal govt isn’t the lender or the insurer, if a lender offers a 50-year note and a borrower accepts it then let it be.

The federal government will bail out the mortgage lenders with your money. MAGA loves subsidies for the irresponsible rich.

What is so magical about 30 years? Because that’s the way we’ve always done it? Why not 29? 31?

You can get a 29. Buy a 30 but pay more each month. I bought a 30 but paid it off in 20. I just didn't waste my extra salary increases as my skills developed on fancy cars or a boat.

If Fannie and Freddie would buy boat loans every American would have a boat. As God intended.

This isn't a fed problem (less getting rid of Fannie and Freddy and HUD). Mostly due to local government permits, land use fee, zoning regs and building regulations. Get the government out of housing and harness the greed of developers to over build stock.

Oh wait then the price of preexisting houses will also decrease, and we can't have that. Damn homeowners who look at their home as an asset instead of place to lay their head. And don't get me wrong there is something to be said about seeing it as an asset, but the balance is out of whack.

In what other countries is this true, and when and where did it start?

America. Housing was affordable in most of the country until recently, still is in places that are smart. But just look at Texas vs California, median single family home in TX is like 360k, while CA its 860k. In CA you get high taxes and stupid regs like shadow studies and mandatory solar panels. PLike I said mostly its a local issue.

Newsom is pushing to reverse this and Republicans are using scorched earth tactics to stop him.

Most of Western Europe is worse than the US.

Republicans are all in to keep as many such restrictions as possible. The New York City Council, dominated by liberal and progressive Democrats just approved another massive upzoning. In other good news, the only New York City Council member to be defeated in last week's election was a NIMBY Republican.

Yeah, kinda strange that Republicans and conservatives abandon their free-market property rights principles when it comes to housing. Maybe not quite so strange. Conservatives seem to be esthetically in love with suburbia or suburbanism - exclusively single-family homes on quarter acre lots. Conservatives don't have problems with government abridging individual rights like libertarians have. They have no problem with dictating what a property owner mayor may not construct on her property if that's what's necessary to enforce conservative suburbanist esthetic or "character" of the neighborhood.

The Trump Administration's Latest Housing 'Fix' Could Inflate Another Bubble

Surely you mean make the current bubble bigger? Or do you actually mean there will be a new and different bubble... a second bubble if you will, that sits next to the current bubble?

Déjà vu

trump goes barney frank

Raspy and overweight?

Gay.

Yeah. Its the 50 year notes and not the banks starting sub prime loans or regulstions requiring "race neutral" ignoring of math and risk.

regulstions requiring "race neutral" ignoring of math and risk.

I know, right? Why, if only the government practiced redlining again, the world would be a better place!

LOLWUT? You can't be this stupid, can you?

Yet another example of why independent agencies were created, to avoid counterproductive political meddling.

HA HA HA

If Freddie and Fannie were at fault for the sub prime mortgage debacle and resulting theft due to the Community Revitalization Act why does it not simply keep happening?

Nothing has changed, the CRA still exists though Obama is not a lawyer chasing lenders to give risky loans out anymore and Freddie and Fannie still secure the majority of mortgages in the market.

The article suggests charging employees of Freddie and Fannie was some sort of big deal. They may have been charged but settled and walked away with barely a slap on the wrists. And again, what changed?

The fucking instigators were Goldman Sachs, Lehman Brothers, Washington Mutual, Indybank and all the folks who worked for commissions giving out loans by defrauding the books. They walked away with billions and tax payers paid it all out and then gave them more because of Bush Jr's chicken little the global economy is collapsing speech.

How many of those execs ended up working in the Obama admin months later?

If Freddie and Fannie were at fault for the sub prime mortgage debacle and resulting theft due to the Community Revitalization Act why does it not simply keep happening?

Because - news flash - the whole narrative of "CRA caused the Great Recession" is a right-wing myth.

Look, we already get you are a low IQ brainwashed far left Democrat cultist....no need to continually confirm it.

No it is the MAGA trolls who have low IQs fir this. The worst offenders were independent mortgage lenders not subject to CRA regulations. MAGA is racist. Banks aren't. The only color banks care about is green and such free market non discrimination drives the MAGA Cult insane. That and lifting zoning restrictions means that more people with darker skin will be moving into their neighborhoods. Multiple listing real estate databases also contribute to this; real estate agents mostly don't care how dark the skin if their clients is. Capitalism is the enemy of bigotry.

What I fear most is the disparate impact of these policies. I'm afraid transgender sex workers and POCs will be hardest hit. Also Pacific Islanders who are kinda white.

Yeah, not a fan of this.

A guy with the last name Pulte recommended it…he wants more people to buy houses and he doesn’t care what happens 5 years down the line.

ARM (Gov-Guns) the Consumers... Ya; That always works out. /s

The only reason to arm a consumer is so the consumer doesn't have to *earn*/pay for what they consume.

It's the endless "conquer and consume" mentality of criminals.

Jack, are you a libertarian, or just a Trump hater? Libertarians believe in getting the government out of our business. There is nothing wrong with banks offering 50 or 100 year loans. People have the right not to get those loans. No government is needed for loans and no hater needs to write about it.