Trump's 1 Percent Tax on Money Immigrants Send Home Is a Tax on the Global Poor

Analysts expect the One Big Beautiful Bill Act to reduce the number of remittance payments sent abroad.

President Donald Trump signed the One Big Beautiful Bill Act (OBBBA) into law on July 4. One measure buried deep in the 870-page law imposes a 1 percent tax on remittances—the money that people send to friends and relatives in their home countries. The 1 percent tax applies to all remittance senders in the United States, though not to transfers sent from bank accounts and U.S.-issued debit or credit cards.

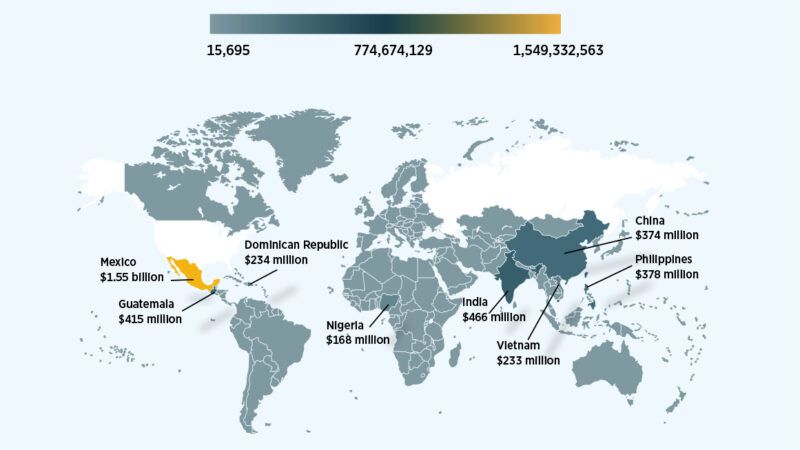

The Center for Global Development (CGD), an economic research think tank, suggests that remittances could drop by 1.6 percent "if the new tax raises costs by 1 percent." Analyzing the potential impact on remittances sent by migrants in the U.S., the CGD finds that Central American countries will "suffer the greatest loss relative to their gross national income (GNI)." El Salvador is projected to lose 0.6 percent of its GNI, Honduras 0.55 percent, and Jamaica 0.42 percent.

The Tax Foundation found that an earlier version of the measure—which would have imposed a 3.5 percent tax—was "likely to create collateral damage by imposing compliance burdens on people who are not the intended target of the tax while struggling to collect revenue from the intended targets." In other words, the tax's "primary impact will be far more paperwork, not more revenue."

Remittances account for a large share of many countries' economies. (Tajikistan tops the list at 51 percent.) The OBBBA's remittance tax likely won't produce much revenue for the United States. It's far more likely to reduce the amount of money people send home, drive senders to use riskier money-transferring channels, and harm impoverished communities that rely on remittances.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

After the millions (and millions!) of illegal alien rapefugees are deported, this likely will have a lesser impact. Don’t love people coming to the US just to send money abroad but not sure I like the tax.

Remitly sometimes has offers for a zero transfer fee as does its initial transfer, iirc.

Seems unnecessary. Will likely cost more to implement than revenue it generates. Also not much of a deterrent.

Also snot very likely to to do ANYTHING to increase goodwill (here or abroad) for greedy, selfish American Government Almighty, which preys upon the poor, who are tying to earn and share money by... OH MY GOD, CAN YOU IMAGINE?... WORKING to provide goods and services for willing buyers?!?!? The incumprehensibe EVIL of such low-lifes and rapefugees!!! Why can they SNOT, instead, be hatred-spreading Servants, Serpents, and Slurp-Pants of Dear Orange Satan, like the rest of us GOOD people?!?!?

I'm fine with this tariff on exported labor and actually think it should be closer to 50%.

Should there be a 50% tax on folks traveling abroad?

Only if they return.

Americans?

You mean the people that illegally move in and work off the books, legal tourists or people here legally to work and paying taxes? I get my comment catches all 3 when it should properly be only #1 with means to exclude and refund those in #2&3 if caught up in it, but who do remittances mostly apply to?

Americans traveling abroad.

Immigration is primarily a "push" issue. If those who stay at home can live a better life they're less likely to try and come here themselves, which you claim to want. I won't say you're the dumbest motherfucker I've ever seen, but only because I've seen some really stupid motherfuckers.

Reason.com likes to tout the fact that migrants spend money in the local economy, but as this article shows, the reality is they tend to buy necessities only and send the bulk of their salaries overseas. That's not a good thing for us.

It's definitely NOT a good thing that some countries are totally dependant on remittances. That's a state that is dependant on largesse - literally a welfare state. What is the future prospects of such a country?? It also adds to local inflation, pushing even more people to work overseas, or in illegal enterprises.

You can also think of this tax as a retalitory tariff, because the reciever countries take their cut, and they take a lot more than 1% (I know this from personal experience)

Spot on.

Meanwhile they use lots of services from hospitals, to schools, to food pantries. Drive uninsured leaving people they hit owing tens if thousands. Even killing people.

But we are supposed to care about a 1% tax.

Every last illegal is precious to Fiona. Especially raping, murdering, gangbangers.

She must be tired of all that "special attention" by now.

I’m almost certain the banks take more than 1percent on the wire. Alas, the reason for wealthy bankers promoting open borders.

Grok:

Bank remittance fees to foreign countries vary by provider, amount, destination, and currency, but typically range from 5-10% of the transferred amount for small sums (e.g., $200), including flat fees ($15-65), percentage fees (0.125-2%), exchange rate margins (2-5%), and intermediary charges. Some banks offer $0 fees for select corridors. Global average: 6.49%.

6.49 is greater than 1. The administration should adjust to the banks.

They drive uninsured because the nativist bigots won't let them get US drivers licenses. But it is legal for them to drive on international drivers licenses.

I agree except for the comment it creates local inflation. With less money chasing the same goods, prices typically go down as demand is lower.

Now look at the economy the money is sent to and the conditions and cycle there.

I meant it causes inflation in the country the migrants are sending money to.

It's their money, though. At least if they are here legally, they should be able to do whatever they want with it.

A tax on the global poor? Only the ones that are coming here, taking advantage of our system, and sending their money home. They are free to stay in their own countries and avoid the tax.

Should be a 100% tax on remittances.

"I don't like what someone chooses to do with their income, so I'm going to confiscate it," says the statist.

Fuck off. Often these people impose massive costs to yiur fellow citizens from identity theft to medical costs.

I bet you dontate exactly zero to charity for these groups, but seemingly demand taxpayers and fellow citizens foot the bill from their actions.

Your fake morality is noted.

What does my morality (or any morality for that matter) have to do with appropriate actions from the state?

Often my fellow citizens impose massive costs to my other fellow citizens. I find it interesting that you'd support higher taxes to presumably continue that behavior. An appropriate libertarian response to that would be, "fuck you, cut spending."

I find it interesting that you have no problem being a hypocrite.

Want to lower illegal immigration? This will do it. And it's time we stop letting people breaking our laws fund their home countries.

The same BS argument is made for all kinds of things. Want to lower _____, tax it. It's a big government, anti-liberty approach in every single case. Libertarians recognize self-ownership and property rights. Your income is your property to do with as you please, regardless of whether or not the majority agrees with your decisions, so long as they don't infringe the rights of others.

I would much rather lower illegal immigration by making legal immigration much easier. That's the pro-liberty approach. Not adding yet another taxation scheme.

Libertarians for taxes. Because cutting spending enough to balance the budget is too hard.

Yeah, but tax the rich, amirite?

Yeah, he was here demanding the 2017 tax cuts end during the BBB. Taxing Americans is fine in his book.

No, I demand a balanced budget - and actually, even a surplus to pay down our huge debt. We should get there as much as possible by cutting spending.

If we fail to meaningfully cut spending to that degree, sadly that means we can't afford to cut taxes. Note, this is an *unfortunate* but necessary side effect of failing to cut spending. If failure to cut spending is a given, I will argue for taxes necessary to balance the budget because the alternative of running up the debt is *even worse* and brings us closer to being a failed state.

That doesn't mean I like taxes. That means until Uncle Sam goes to rehab to quit his spending habit, his money needs to come from somewhere.

Then vote for fiscally conservative representatives and not tax and spend freaks that want to fundamentally transform America after collapsing it financially.

"Then vote for fiscally conservative representatives"

There are almost zero options available with any chance to win. Massie and Paul might be the only 2 left after Team MAGA ran off Justin Amash.

Amash ran himself off because he was more concerned about grandstanding and ingratiating himself with democrat state media than getting anything useful done.

Well that eliminates Republicans and Democrats.

Hey shrike.. reconciliation isnt a budget bill dumbass. And then you again admit what I said you saod is true.

Thanks for playing shrike.

Yet you vote for democrats who won’t even cut proven waste and fraud.

Shrike, I notice I never see you demand end welfare and taxpayer funded services to these groups. Why is that?

Y'know, whenever I do one of those budget simulators I manage to cut trillions. And about half of that comes from entitlements. In fact I don't see why the feds would pay *any* entitlements. Some should be axed 100% right away and the others phased out over time (not going to suddenly cut off granny's chemo).

Oh. You played a simulator. Did it include 47 DNC members of congress and about 10 GOPe members to approve your cuts?

What a fucking retarded response.

And he votes for people who fight like cornered animals to avoid even cutting outright waste and fraud.

You caught the hypocrisy.

Let me see if I get this

If you oppose tariffs, you are in favor of slave labor which we totally oppose morally.

If we let those poor immigrants come here to work, they're still slaves which we totally oppose morally.

Immigrants are also sending too much of their slave wages back to their families in their home countries so their families don't need to be slaves, but that's bad for our economy so we can't have that, but we still totally care that they're not slaves in that home country or here.

Why don’t we just cut out the middleman and send money to other country directly?

As individuals, we should be able to do with our money whatever we please. The state has no business sending our tax money anywhere, however.

We were. USAID.

Let me see if I get this

You don't seem to since you seem to imply points one and two simply aren't true under any circumstances.

Staying home and making their own countries better places to live is clearly not an option, eh quicky? They are simply not capable.

White knight for the win! Lol.

Globalist Marxism isn't happening.

OK, Globalist Marxism is happening, but it's not as bad as you think.

OK, Globalist Marxism is happening and it's as bad as you think, but it's a good thing. <- You are here.

So... Ye are Pervfectly saying that taxing dirt-poor working people MORE will help PREVENT Global Marxism?

I get that Your PervFected and Mind-Infected writings CLEARLY say "I am the Smartest MotherFucker around, and everyone of the useless-others are SLIME", but beyond that, Your PervFected and Mind-Infected writings aren't very clear at ALL!!!

The best way to eliminate Marxism is to eliminate it’s practitioners.

"It's OK to steal from people as long as it's not too much and you abscond far enough away with the pilfered goods."

OK, Reason "Borders are just an abstract social construct" Magazine, are you now going to draw lines at exactly how far a community, tribe, or nation can pursue misappropriation of public/tax dollars?

Once again and as always; Reason is neither a libertarian magazine nor your friend as a free citizen. Their open borders policy is an optimistically-named facade little different from a Five Year Plan or a Great Leap Forward. They don't actually want open borders because that means various gun-toting anti-libertarians and fundamental religious and racial conservatives far worse than Reason normally experiences get in and powerful people walk out with wealth. Things Reason finds undesirable won't be controlled according to Reason's standards. They want 'open borders' the way Hitler or Stalin wanted open borders. They want to be able to say which people should get which money and which acts of violence against which people constitute free speech. They don't advocate for the diffusion of libertarianism beyond our borders (but

GorsuchMilei!)... to say nothing of actively spreading it... they barely maintain the facade of supporting it here.a large portion of remittance goes to the cartels holding their families in their home country hostage. tax at 100% to end this. of course they may just send their gangs here to collect directly.

As Friedman and Bastiat and others pointed out; the bigger cost isn't the cartels, it's the all the other ancillary corruption and misappropriation that goes into it.

Even if they send it home to their families, they pay more to have running water or air conditioning or cellular phones or whatever there because infrastructure requires more bribes and the bribes pay people to no do their jobs and look the other way. Jobs, personnel, attention, and money that are squandered to support the cartel and anti-social activity rather than making things better for everyone.

Are these legal or illegal immigrants? The article doesnt say. So long as they are legal and paying their fair share of taxes like citizens, I dont care what they do with the extra money. I would rather it stay here of course, but its not govts job to steer it.

Then again, someone has to pay for all the social spending. It might as well be people sending money to another country.

When the article doesn't say, you should assume illegal.

Correctly so in this case: The tax is only levied on essentially cash transactions; Remittances conducted from the sorts of funds a legal immigrant would have no trouble providing, such as a bank account, are not subject to it.

"(c) Tax Limited to Cash and Similar Instruments.--The tax imposed

under subsection (a) shall apply only to any remittance transfer for

which the sender provides cash, a money order, a cashier's check, or any other similar physical instrument (as determined by the Secretary) to the remittance transfer provider."

Now do Bidenflation.

Bidenflation did us.

How idiotically asinine.

Illegal immigrants, or any immigrant, that sends American dollars home is sending currency to their friends or family that is worth orders of magnitude more than whatever the local currency is in most cases. Sending a few hundred bucks home a month could very well allow those people to live like kings in whatever crap heap they happen to live in.

It's not always true, of course, but illegal immigrants in particular (who make up much of those cash transfers) don't usually come from, say, Scandinavia. They come from places like Venezuela.

Perhaps simply proving the money being sent had taxes paid on it before adding this penalty for sending money out of country?

Probably more paperwork than necessary making the program a net loser.

Some countries do not allow a nickel to leave the country.

People should be able to do what they want with their earnings and supporting their family is their decision not the governments.

But there could be safe guard in place to ensure the money was legally obtained.

"People should be able to do what they want with their earnings and supporting their family is their decision not the governments."

Should be "Law abiding people should be able to do what they want with their earnings and supporting their family is their decision not the governments."

True libertarians want Americans who buy imports to be taxed, and people who send money to their families to be taxed. Anyone who disagrees is a Marxist leftist with TDS.

The poor pay a tax on moving money out of the country. Rich people and corporations do it all the time tax free. Yup, sounds like a normal Republican policy. The rich win and the poor lose.

Yeah, because that’s exactly the same thing.

Stupid pinko faggot.

Except that she is right on this.

Everything Is So Terrible And Unfair, molly.

Haha.

The poor lose because they refuse to play the game by its rules. They only ever look for ways to cheat at it. And then get mad when called on it. And then get extra mad when steps are taken to prevent the cheating.

It's not like we're hiding the secret. Here's the rules:

Learn a useful skill.

Market that skill.

Get a job.

Work hard at that job.

Earn wealth.

Manage that wealth responsibly.

Raise a family.

Pass these values on to your children.

That's it. That's it in less than 10 steps. What you'd probably spent $40 for a in 200pg hardcover or $40K for in 4 years of gobbledygook "education," I just gave you in 8 bullet points.

I'll also give you a bonus line, cribbed from Mike Rowe: Don't follow your dreams. Follow your skills.

The rich "win" because they followed this very simple methodology. The poor "lose" because they always refuse to.

As this applies to remittances? Same thing, just on a bigger scale. The only nations with people that need remittance income are failed inferior nations that never bothered to do a single thing to fix their broken nations the way the American Colonists did. With copious amounts of blood and gunpowder.

Here's my compromise. 1% tax on remittance for any family that actively and openly joins a rebellion to overthrow their government. 100% tax on remittance for any family that refuses to.

Americans will be a whole lot more tolerant of money going to Make Venezuela Great Again, than they ever will Throw Money Away On Venezuelans.

So what?

It's far more likely to reduce the amount of money people send home, drive senders to use riskier money-transferring channels, and harm impoverished communities that rely on remittances.

Feature, Fiona, not a bug.