Rent Prices Are Falling Fast in America's Most Pro-Housing Cities

From January 2024 to January 2025, average rent in Sarasota fell from $3,290 to $1,886 per month.

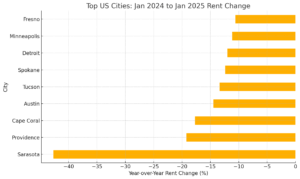

Rental prices in some of the country's largest cities are falling—some by almost 45 percent, according to new data from Five Star Cash Offer, a real estate investment firm that operates as a direct cash homebuyer. The dataset, which includes the top 65 metropolitan areas in the United States, reveals that cities that have recently enacted pro-housing policies have experienced the most significant year-over-year decline in rental prices nationwide.

The data from Five Star Cash Offer supports recent reports from online real estate brokerages Redfin and Realtor, which detail a decline in rent prices across some of the largest metropolitan areas in the United States. Sarasota, Florida, is the city with the highest annual decline, with a 42.67 percent drop (from $3,290 to $1,886) in average rent from January 2024 to January 2025. In recent years, the City Commission has adopted a series of pro-housing policies aimed at addressing the city's housing crisis, such as the easing of restrictions on mixed-use and higher-density developments in 2022. In 2024, the commission passed several additional measures to relax density restrictions and allocated $40 million for affordable housing projects.

Providence, Rhode Island, the city with the second-highest year-over-year decline, saw a 19.22 percent drop in monthly rent, from $2,513 to $2,030. Some of this decline may be attributed to policies aimed at deregulating the housing industry. In 2023, the state passed a package of housing legislation to "address the long-lagging housing production rates" in the state by streamlining permitting for land use and land development and easing restrictions around repurposing existing structures for housing. In 2024, the city of Providence streamlined its construction application process.

The completion of multifamily housing units is also driving rent decreases in Austin, Texas, and Cape Coral, Florida. Across the U.S., multifamily housing construction has slowed from its pre-COVID levels, partly due to regulatory hurdles, high costs, and concerns about affordability. Yet cities with the steepest rent declines, such as Austin and Cape Coral, are notably issuing building permits at or above their pre-pandemic rates. Austin, fourth in rental price drops, issued the most multifamily permits nationally (64.5 per 10,000 people). Cape Coral, third on the list, almost doubled its pre-pandemic rate with 59.6 permits per 10,000 people.

Minneapolis, which experienced an 11.14 percent annual decrease in rent, saw a 12 percent increase in housing supply between 2017 and 2022, partly fueled by its 2019 zoning reforms. In the first five years after these reforms passed, Minneapolis rents decreased by 4 percent, and Hennepin County, home to Minneapolis, has become the second-easiest county to purchase a house in compared to the seven counties adjacent to it, despite being the most populous county in the state. Minneapolis was also the first major U.S. city to end single-family-only zoning, allowing developers to mix up the types of projects they build across different neighborhoods.

While these rent decreases may be a result of a more deregulated housing industry, other factors could be at play. Florida has been struck in recent years by Hurricanes Ian and Milton, and higher flood insurance premiums could be forcing some homeowners—especially those with second homes—to sell, creating a surplus of available housing. (In March, Sarasota reached an eight-year high for its housing inventory.) Still, Cape Coral and Sarasota are both expecting to see their populations increase in the coming years.

The data are clear: Pro-housing policies lead to more affordable housing. Cities seeking to reduce the cost of living would be best served by adopting policies that facilitate the construction of new homes and residential buildings.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

If rent prices went in the other direction, we would be able to blame tariffs. Perhaps deporting TdA landlords has resulted in more wallet-friendly Mr. Roper types.

Estimated 1M immigrants gone through self deportation or deportation. Wonder if there is a decreased demand...

A record number of apartments were delivered in 2023/24…the blame goes to illegal immigrants! 😉

Rent prices are falling everywhere, even LA, ever since trump started booting the invaders

Nope, the illegals built the apartments and they don’t want to live in Texas with 3 months of over 100 degrees heat. America, where a house in DFW costs $700k and $3k a month in taxes and insurance and utilities…and we don’t even have free health insurance!!

Florida is a pretty poor example for the argument. Cape Coral for example is one of the worst real estate markets in the country. Entrepreneurs are selling foreclosure boat tours with houses getting cheaper by the minute. The weather, insurance rates and state mandated condo fees have a lot more to do with affordability than deregulation. This cycle has been repeated in Florida for decades. A few calm years and prices explode, a couple of hurricanes and everybody runs for cover. Same as it ever was.

Exactly, most illegals are going to come from places 5000 feet above sea level where air conditioning isn’t necessary…they will return once the jobs disappear as Trump tanks the economy.

Funny how removing millions of trespassers would free up housing prices. Maybe some of the Californians will now flee back to California.

some by almost 45 percent

Since when does this describe a situation where one data point is nearly 45%, and the closest after it is not even 20%?

What is wrong with the fucking writers here? Does all of Reason share 1 brain cell?

To be fair, it's an intern. This means its one brain cell is concentrated entirely on pushing the propaganda the editors at Reason want.

Enjoy your traffic and crime, or your move out to the suburbs to see a tree.

I live in New York City and there are dozens of trees within yards of my house.

And we have one of the lowest homicide rates in the US.

Are the trees on the roof or in the pavement?

Maybe we can get some state rules to override the local city rules that keep getting in the way of progress...

Its way too early to see rent prices as an indicator for whether housing supply remains broken or is fixed. Density in R1 zones does not solve a housing problem. It mostly just increases auto traffic/dependence. Multi-family/apartment construction is mostly a function of land prices. Its just not profitable on lower land price parcels unless the US heads down the Triangle Shirtwaist model of tall building 'regulation' (which is certainly where Reason will advocate).

What will make a difference is increasing the % of land in a city that is mixed-use zoning. Portland may be one of the few American cities where they openly allowed creating new mixed-use zones (in the 1990's). Rather than just grandfathering zones that existed in the streetcar days. But looking at a zoning map of Portland it is clear nothing has really changed. 77% of the land is still single-family only - with the vast majority of the rest being commercial-only, industrial-only, and the usual Euclidian stuff of devoting land to parking lots, highways, etc. Of course Portland has become dysfunctional but I doubt it is because of what is happening on 1% of the land there.

You seriously think that building safety and fire codes are a bad idea?

I am pretty sure this means JD Vance was wrong and it's all Trump's fault?

The data are clear: Pro-housing policies lead to more affordable housing.

Now add "American" between "pro" and "housing".

Meaning tax foreign homeowners (and real property owners) 10000%.

If you're not an American citizen, you pay a 10000% tax on any property you own in America. American citizens, on the other hand, get tax rebates for any/all improvements they make on the property to increase its value.

That is absolutely fair and there is no good reason not to do it.

It is absolutely unfair and will result in the expropriation of the much larger amount of American investment elsewhere.

Big Shocker./s Demand-Side only Urbanites find out their Central-Planning Gov-Guns aren't making it "better & affordable" but instead made it completely UN-Affordable and Far-Worse.

As it has done over and over and over and over again.

'Guns' don't make sh*t. If nobody is EARNING and everyone is TAKING you're playing a zero-sum resources game. Precisely why the stronger the socialism/communism the more poverty stricken the people get. STOP buying the criminal-minds pipe-dream.

It will be interesting to see how NYC's recent up zoning works out. It was entirely progressive Democrats who pushed it through the City Council. Every Republican voted with the NIMBYs.