Extending the Trump Tax Cuts Is a Good Idea. But It Won't Deliver 'Big, Beautiful' Economic Growth.

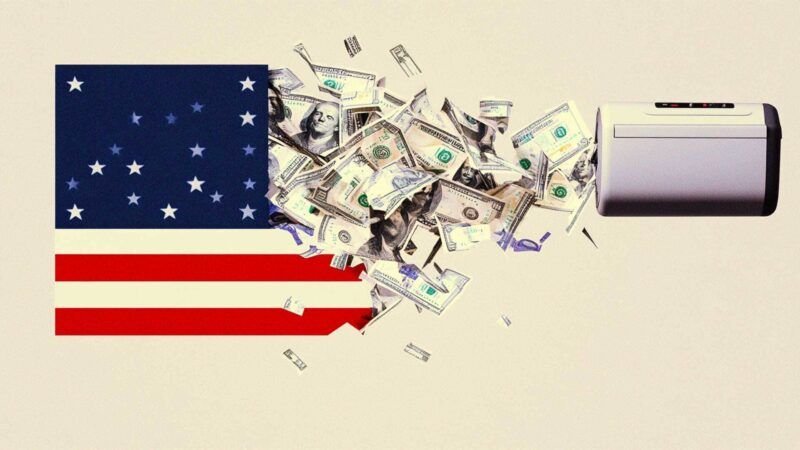

The budget legislation is full of other expensive provisions that will add trillions to our sky-high national debt.

President Donald Trump and many of his allies in Congress are making grand claims about the economic growth they say will result from the recently proposed "One Big Beautiful Bill." Trump has accused critics of not understanding the budget proposal, "especially the tremendous GROWTH that is coming." A closer examination of the economic realities involved reveals that these claims are dramatically overstated.

I have no objections on principles to extending the expiring provisions of the 2017 Tax Cuts and Jobs Act. Allowing these cuts to expire would deliver some measure of pain to the economy and add to our troubles. Tax hikes at a time when individuals and businesses are expecting tax stability would undoubtedly depress investment, employment, and overall economic confidence. Americans are already getting a huge tax hike because of Trump's tariffs.

However, making a sound case for maintaining the current tax structure is fundamentally different from making the case that it will bring about substantial new growth. It's largely a defensive move. Realistically, the economic boost will be modest at best.

In fact, the administration and congressional supporters of this bill admit that much without realizing it. On the Senate side, lawmakers argue that the fiscal cost of extending the 2017 tax cuts should be measured against today's tax code rather than against the code to which we would revert if the cuts automatically expire. They argue that assuming the cuts will be extended reflects the common expectation among taxpayers and markets.

But if markets already expect extensions, then making the tax cuts permanent cannot generate significant additional economic growth. The growth that can be achieved by these tax cuts has largely been realized. Merely continuing with lower rates doesn't unleash many new incentives or productivity.

In addition, the budget legislation does lots more than extend the 2017 tax cuts. In fact, about 25 percent of the bill consists of different tax breaks on tips or overtime, and spending hikes for the military and various special interests. These are not pro-growth policies—in addition to being expensive.

The Tax Foundation estimates that the bill would raise economic output by approximately 0.8 percent in the long run. The Economic Policy Innovation Center analysis pegs the economic gain at around 0.5 percent of gross domestic product (GDP). Both are far from the revolutionary 3 percent figures that Trump's most ardent fanboys are claiming.

Moreover, most economic models don't adequately consider the negative consequences of ballooning federal debt on long-term growth. And according to the Congressional Budget Office, this bill will add a further $2.4 trillion to the debt. High levels of debt put upward pressure on interest rates, crowding out private investment and dampening long-term growth prospects. Historically, too much debt correlates with diminished economic performance.

Whatever blip in the growth rate we will see thanks to the tax bill, it won't compensate for the damage done by the Trump administration's ongoing trade wars. Tariffs disrupt supplies, increase costs for American businesses and consumers, and create considerable economic uncertainty. Even if we generously assume that tax cuts will deliver an additional 0.5 percent to 0.8 percent in annual GDP growth, the drag from tariffs easily surpasses this modest benefit.

The contradiction couldn't be clearer. Proponents of the bill and the president himself trumpet its growth-enhancing powers while simultaneously piling up debt and enacting trade policies that are both guaranteed to undermine economic dynamism.

And yes, in addition to the expected opposition from Democrats, Sen. Rand Paul (R-Ky.) and a few other voices from the right side of the aisle have been highlighting the bill's inadequacies, to the great displeasure of the president.

Among other things, they point to its subsidies and other distorting economic interventions and accurately observe that the economic benefits being touted are inflated and misleading. Paul understands that a true pro-growth agenda would extend the tax provisions while limiting the debt impact by cutting wasteful spending, closing tax loopholes, and not loading the bill with lots of special-interest giveaways.

The legislation is now in the hands of the Senate. If senators are interested in genuine and productive tax reform, they will scrap the new provisions and do 10-year extensions of pro-growth policies that are currently temporary in the legislation as passed by the House (such as 100 percent bonus depreciation and research-and-development expensing)—and they'd still be left with room to lower the cost. If they keep the spending offset included in the House bill and Medicaid reform, this would become both pro-growth and fiscally responsible legislation.

Instead of indulging in the dangerous fantasy that any tax cuts will produce enormous growth, Congress needs to do the work and revise the bill so that it does produce growth and offsets the debt accumulation.

COPYRIGHT 2025 CREATORS.COM

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I love predictions.

Especially the ones about economic future.

Then you must love Trump fanboy rosy predictions too.

3% is ridiculous. Ain't gonna happen without cutting out half the regulations, now. Ain't gonna happen as long as Trump's tariff flip flops disrupt business planning.

What happened to the inflation from tariffs that was predicted ?

https://www.bloomberg.com/news/articles/2025-06-12/us-producer-prices-increased-less-than-forecast-in-may?srnd=homepage-americas&embedded-checkout=true

Ripples man. Ripples.

No economist thinks tariffs cause inflation, because inflation is strictly a matter of money supply. Prices will rise, but that is not inflation.

It's kind of hard to argue for (or against) the tax cut extension without making predictions about the effects on the economic future. Though with tax cuts, you can at least be highly confident that most people will be paying more taxes if they expire.

If you wanted accurate predictions wouldn't you need to include the totality of actions (recissions, tariffs, budget bill plans, etc) and not the single bill?

Yes. Though I think removing a lot more regulatory burden is the real key to improving growth.

The 2017 TCJA was a mistake when it was originally passed. It did not live up to the predictions made when it was passed and should not be extended. Allowing the 2017 TCJA to expire now would means some pain, but better to accept it now rather than putting off and increasing that pain in the future.

Which predictions? Your side predicted tax revenue would plummet. It increases every year. CBO predicted this as well, they were wrong. Even leftist economics groups admitted the cuts were primarily lower and middle class.

Oh. Youre a parody.

Tax revenues went up, they usually do but the these increases, for any tax cut, never cover the cost of the cut. The TCJA was sold as increasing jobs but it never did, most of the saving were spent in stock buy backs that simple built wealth for the already wealthy and this was reported by FOX news. Finally you are correct that the largest chuck of the tax cut went those with least wealth, but the large amount of recipients meant that most people tax cut wasn't large enough to even notice. The noticeable cuts were for the smaller group of the most wealthy.

You need to read more.

Tax revenue, in the face of these massive terrible horrible tax-cuts, increased by 50 fucking percent just since 2020. IT'S NEVER ENOUGH FOR YOU SHIT-EATING LEFTISTS.

So what you are saying is that tax revenues went up during the Biden administration, is that correct? No tax cuts here, just solid building of the economy.

Absent major economic downturns, tax revenues go up regardless of the level of tax cuts, even in minor recessions as we experienced under Biden. This has been shown many times.

In fact, Mrs. De Rugy has repeatedly shown that tax revenues, even when the marginal rates were 90%, only vary between 18-21 percent of GDP.

So maybe the problem is spending and not how much you’re able to pull out of my pocket.

The problem is spending but cutting spending is difficult. The American people are undertaxed for the service they receive. People are getting a bargain and so they see no reason to cut spending. If taxes were more in-line with cost of services people could better decide if that service was really necessary or if it should be cut.

The American people are over-serviced. Nearly 50% pay no income tax. 1% pays more than 50% of income taxes. Muh billionaires need to pay moar! Moron. People who get free shit don't care where it comes from or who pays for it, as long as it isn't them.

Vinne, take a moment and look at what you just said which is simply a rewording of what I just said before that.

I read that, in the context of who you are, as you want to increase taxes, especially on the wealthy, to pay for the services for the less wealthy.

Are you advocating for the middle and lower class to pay more taxes and receive less welfare? Or to pay more tax in order to receive welfare? Maybe we should go back to only property owners can vote? Or people who actually pay income taxes?

There is zero cost for tax cuts. Hope that helps.

Wrong again. Tax cuts are spending except when there is a government surplus.

Moe Ron.

I would say “unless there is a corresponding reduction in spending”.

Fuck off, slaver.

Reason realized advocating a large tax increase is bad. But KMW doesn't realize this moots her and Eric's deficit arguments. Heh.

Like all other wrong predictions, you forget how it went the first time, and also ignore all the other economic factors in the world outside the BBB.

(and, oh by the way, we don't yet know what will actually be IN the BBB)

Come on, Veronica, don't you know that rising deficits are good when Trump does it?

The bill cuts 8% from mandatory programs.

We must hate trump for not fixing 60+ years of deficit spending in 4 months!

when are those empty store shelves going to happen?

Tax cuts while running a deficit is wrong for those who are around now are getting the benefits but those who come later need to pay the bill.

Fuck you, cut spending.

I would love to means test Social Security and Medicare. Kick all the rich off it.

More free shit, says shit-eating Tony.

Not going to see spending cuts in the OBBB.

Summarized....

- Taxing DOMESTIC causes economic growth.

... apparently since Tax-Cuts don't cause economic growth? /s

- Taxing IMPORTS on the other hand causes economic CRASH! /s

... if that be the case who's economy is in control here?

Sarc ?economics? that he needs to teach everyone?

The Tax Foundation estimates that the bill would raise economic output by approximately 0.8 percent in the long run. The Economic Policy Innovation Center analysis pegs the economic gain at around 0.5 percent of gross domestic product (GDP).

Which parts of the bill are responsible for those effects, under their models? Surely not the elimination of the tax on tips, which De Rugy seems to acknowledge.

[Economic Policy and Innovation Center? Really? What Gen Z'er came up with that when it started two years ago?]

Besides, people that earn tips and overtime might want to know exactly how the "no tax" on tips or overtime is actually going to work before they get too excited about that.

To summarize Reason's big problem with BBB, if I'm not mistaken

(1) Extending tax cuts is not the same thing as new tax cuts

(2) Future borrowing and resulting interest payment necessitated by tax cuts (less revenue) will add to the deficit.

(3) "giveaways" to special interests

If Trump actually proposed more tax cuts, then the objection from (2) remains the same. So basically the argument is "you can't cut taxes without corresponding spending cuts, like ever".

Let's agree in principle that deficits are bad in the long run. The question is - is that Trump is proposing now any worse than what we saw in the Reagan or the Clinton admin, or even the early parts of the Bush 2 years? Back when there was economic growth?

We're only scratching the surface on the AI front. Trump made new deals allowing market to access essential minerals. He spared the nation millions and billions of dollars by deporting illegals. The room for growth is there.

Somewhere along the way, America will realize that entitlement spending is unsustainable will be forced to act - just like they did with illegal immigration. It became too explosive an issue to keep kicking it down the road. A new Trump may arise to take advantage of the issue.

We're not quite there yet. Ramming in a bunch of spending cuts that no democrat will support and may even give them momentum is not the right course of action. People who actually get things done do not make good the enemy of perfect.

Let's agree in principle that deficits are bad in the long run. The question is - is that Trump is proposing now any worse than what we saw in the Reagan or the Clinton admin, or even the early parts of the Bush 2 years? Back when there was economic growth?

Yes. It is worse. Much worse.

U.S. debt as a % of GDP:

- Q4 1988: 49.7%

- Q4 2000: 54.3%

- Q4 2007 (pre-financial crisis): 62.7%

- Q4 2008: 73.2%

And to be fair, I'll throw in the end of Obama's tenure and Trump 1 pre- and post- COVID.

- Q4 2016: 104.6%

- Q4 2019: 105.8%

- Q4 2020: 125.7%

Q1 from this year = 120.8%, which is a 1% drop from Q4 of last year.

It doesn't matter who you blame for the growth of our debt over the last 40+ years. The fact remains that a policy that adds a even a penny more to that debt now than some other policy would needs to be justified far more rigorously than previous administrations or congresses did for their policies that increased deficits. This isn't a value judgement about which party is more or less responsible for the fiscal bomb ticking away. It is about how it is going to be diffused, if it can be, or how to limit the damage, if it can't.