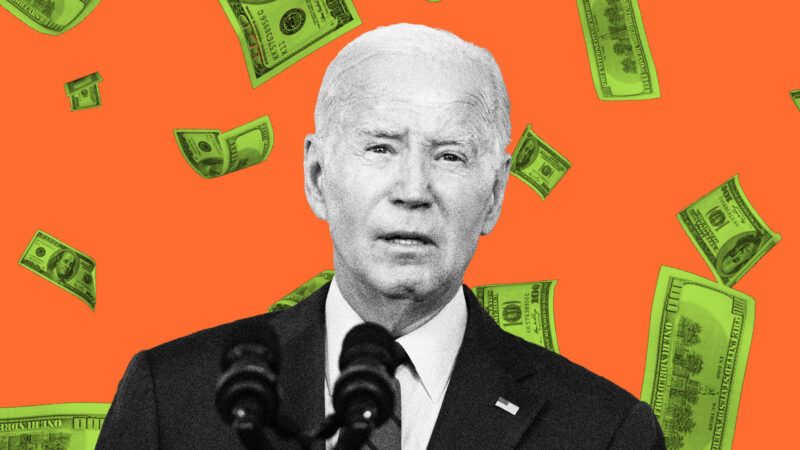

The Clock Is Running Out for Student Loan Forgiveness

With only months left in his term, Biden wants to forgive the loans of nearly eight million borrowers experiencing "hardship."

Since Kamala Harris' defeat in the 2024 Presidential election, the Biden Administration's student loan forgiveness agenda seems in greater peril than ever. Placing student loan forgiveness at the center of a Democratic Party increasingly dominated by the college-educated didn't result in the electoral gains politicians like Harris and Biden hoped it would, adding insult to the injury of consistent legal setbacks.

But these defeats haven't prevented the Biden Administration from continuing to attempt to enact far-reaching student loan forgiveness policy.

Late last month, perhaps as a last-ditch effort to tempt indebted voters, the Biden Administration unveiled a set of proposed rules that would give the Education Department broad leeway to cancel student debt in cases where the borrower is facing financial "hardship." Nearly eight million borrowers are estimated to be eligible.

"If these rules are finalized as proposed," reads an October 25 press release, "the Secretary of Education could waive up to the entire outstanding balance of a student loan when the Department determines a hardship is likely to impair the borrower's ability to fully repay the loan or render the costs of continued collection of the loan unjustified."

The rules provide two main pathways to receiving student loan forgiveness. The first would not require borrowers to apply for forgiveness, and would instead be based on predictive data analysis. If this analysis predicts that a borrower has an 80 percent chance of defaulting on their loans within two years, the Department of Education could then provide one-time forgiveness of up to their entire loan balance.

According to the proposed rules, this analysis would be structured to prevent borrowers from deliberately going into default to receive forgiveness. The Department of Education "would address the risk of strategic behavior with a two-fold requirement that the borrower must be highly likely to be in default, or experience similarly severe negative and persistent circumstances," read the draft rules, "and that other options for payment relief would not sufficiently address the borrower's persistent hardship, including [income-driven repayment] plans, for those eligible."

The second pathway would allow borrowers to apply for a "holistic assessment of the borrower's hardship." According to the Department of Education, factors like "unexpected medical bills, high child care costs, significant expenses related to caring for loved ones with chronic illnesses, or devastating economic circumstances from the impacts of a natural disaster," would be considered when determining whether a borrower is facing financial hardship that places them at high risk of default or other negative consequences of nonpayment.

While Biden has managed to forgive massive amounts of student loans through smaller-scale programs, he's faced continual legal defeats of his major loan forgiveness efforts. With this and the recent election in mind, how is this latest effort expected to fare? Not well, according to economist Adam Looney, the Executive Director of the Marriner S. Eccles Institute at the University of Utah and a visiting fellow at Brookings.

The main roadblock is the comment period required for proposed federal rule making. In this case, the Education Department is undertaking a 30-day comment period, after which the department hopes to finalize the rules in 2025. With Trump's inauguration set for January 20th, 2025, even starting to provide forgiveness could be mathematically impossible.

"It seems like it's hard to imagine that there is enough time," says Looney. "And even if it did go into effect…I assume the Trump administration could stop it very quickly."

While these latest proposed rules could theoretically enact wide-ranging student loan forgiveness, the clock has simply run out on any hope of enforcing it. Combined with the legal setbacks faced by some of Biden's other regulations, it looks like student loan forgiveness is going to be put on the backburner for the next four years.

"Borrowers will have to start repaying their loans under the standard plan or another plan that the Trump administration proposes," says Looney. "The Department of Education has a long regulatory agenda. And I assume that a lot of those regulations will now no longer be implemented or will be reversed."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Emma:

Biden's full of shit.

Except for open borders, right Emma?

I'm thinking someone named Emma has a little student debt.

Can't be. She's been unable to get an FAFSA help.

Her hardship is the commentariat.

And math. And driving. And peeing standing up.

What hardship? The economy is booming!

Hey, if having to get out of bed after Trump won the election is no hardship, then I don't know what is.

Besides, paying for stuff, and having to work to earn money to pay for stuff, is unfair.

^THIS +10000000

Social justice is literally -- "paying for stuff ... is unfair"

The left ... Still the party of slavery.

Blue hair dye and that blue heart tattoo costs money; they can’t make the student loan payment and fund their virtue signaling. Taxpayer should chip in.

Inflation is profit.

Only for those holding the "last twinkie".

Gen Z/Alpha thinks that's why they're called "Boomers", while complaining that they're too broke to ever afford a house and need loan forgiveness.

The main block to student loan forgiveness is that it's been repeatedly ruled illegal when done in the very way proposed by this article. The fact that Biden has continued to refuse to include Congress to actually pass a law is responsible for this failure.

This was assisted because the majority of Americans dislike this sort of mass loan assumption by the federal government. So Congress did not want to be involved in this wealth transfer to the richer half of society

Biden originally said he couldn't do it. It would be up to Congress. The Speaker of the House at the time (Pelosi) said Biden couldn't do it and it would be up to Congress. SCOTUS has shot down Biden's attempts saying he can't do it, it's up to Congress.

All three branches of government have concurred that this is something the president can't do.

Yet [Na]tional So[zi]alist Biden does it anyways just like Hitler did.

Government playing Santa Claus to baristas creates additional hardships to net positive taxpayers.

They took out the loan and should be expected to pay them back per the terms of their agreements. If Biden wants to pay any off out of his own pocket, he should be free to do so.

+10000. But the leftard [WE] gang think 'Guns' against those 'icky' slaves makes stuff.

Is that the $250,000 a year hardship? Where can I sign up for such a hardship?

Trump will make the education department use loan proceeds alone to fund operations.

That should end this nonsense.

That would actually be a genius proposal.

Maybe the Gov-Guns just never had any legal authority in Ed.

Everyone that facilitates or engages in such an illegal scheme should be prosecuted and the Sr management and Executive branch participants given the Enron exec treatment. There should be no place in government for this level of corruption.

Requiring a young adult to go into debt slavery in order to obtain education should be treated as a shameful practice. The people who perpetrate it should be shunned from society and not invited to cocktail parties.

Does "debt slavery" mean "I have to get a job and can't keep living off handouts"? If so (and I can think of no other translation), then I'm afraid I have no sympathy for you.

I also have little sympathy if you chose to spend your years pursuing a degree in underwater basketweaving or anything-studies instead of something with a positive ROI. Your poor life choices are not a valid reason to extort my tax dollars.

Does "requiring" mean "I have the choice to decide whether to pursue higher education, and if I do, I have the choice of where to enroll, how much I can afford, or whether it will be a worthwhile investment"?

We give every child in this country 13 years (K-12) of free public school education.

We have a vast community college network across the country offering access to affordable education for two year degrees.

We have state/public colleges that offer affordable rates to secure a four-year degree, along with vast amounts of Pell grants and public (and private) scholarships to make college more affordable.

If you want the taxpayer to foot the bill for college education, like many other nations do, a few hard realities are going to come into play - and you may not like them:

1) College and Universities will become meritocracies, where remedial classes will not be offered and a students gender, orientation, race or religion won't give them an advantage.

2) Students will be limited in the selection of majors - no longer will college students pick a school, take two years of general studies classes while they try to figure out "what they want to be when they grow up".

3) Colleges will be forced to trim costs, limit extracurricular activities and stop building $100M student centers to attract students - colleges will be funded just like Medicare doctors, rather than by convincing students to borrow $100K in student loans to fund their sports medicine degree program...

Nothing is ever enough for the left if it justifies spending more money. This doesn't even address that we need college specifically because their control of the k-12 has ruined education at that level so we need college to do what high school should be doing. If they do achieve "free" college they will ruin that as well.

I want to spend my money on hookers and blow, to stimulate both myself and the economy. I have a mortgage, paying that prevents me from stimulating myself and the economy. Where is my mortgage debt relief? I want the taxpayers to pay for my loan that I entered into freely because reasons. Pay my mortgage to buy my vote!!!

Housing is a human right!

^This - indeed.

Fyathyrio thought that was hyperbole but its not by current left-standards.

The student loan should forgiveness policy must be implemented before Uncle Joe leaves office.

After all, student loan forgiveness is a good idea.

Just ask anyone who scrapped, scrimped, saved and took years to pay off their student loans would agree.

NO. Major reforms to the program is required. Why should the taxpayers pay off the student loans of a kindergarten teacher just because she wanted to go to Harvard?

But where do I benefit from your loans being forgiven? Where does the factory worker who didn't attend college benefit from your education loans being forgiven? Where does the plumber who maybe did on-the-job training or attended a trade school benefit?

Get off the government subsidy wagon.

Pay your bills. I did and didn't look back. It might be hard. Pull up your pants and get it done. No whining.

Heck, maybe think before you sign for a huge loan that you have to pay off even in retirement. Once people refuse to attend pricey universities and attend realistic places, prices will fall. High overhead costs will be reduced. There is no incentive for high-priced, high-overhead institutions to change and be competitive.

You should check your sarcasm detector.

Even worse, I managed college without any loans. What a dummy I was, being all responsible and shit.

Reform the student loan program. Congress should:

1) Require the schools and training organizations to be 1st guarantor of the loan up until the student graduates from the program and obtains a job.

2) If a student fails to complete the program, then the school pays off the debt to the lender.

3) Restructure the loans so that they are not structured as revolving credit. They must have a fixed term and payment and interest rate.

4)Limit the degree or training programs eligible for guaranteed student loans to those that will provide skilled workers for jobs that are short workers based on Dept of Labor projections.

5)Limit the costs that are covered by the loans to tuition and lab fees, $50.00 max per book or instruction manual. No transportation, NO housing , No food, No Student Union Fees.

6) Existing holders of student debt who completed their programs - their loans shall be restructured into normal loans with a stated payment amount, interest rate and 10 term. If the payments paid to date are greater than the total payments on a fixed rate loan with a 10 year term, then and only then are the loans forgiven.

7) Existing holders of student debt who failed to complete their programs - their training organization shall be liable for the balance of principle outstanding to the lender.

8)A disclosure must be signed by the school, lender and student agreeing to the terms and disclosing the 1st year, 5th year and 10 year average salary for the jobs that the student will be eligible to apply for after completing the program.

9) In no case may a lender and school offer a loan to a student if the loan payment, plus current average rent will be greater than 40% of the average 5 year income for the qualified jobs.

Here's a better way to fix it: Get rid of it entirely.

Thank you. Reading the first post and then seeing your response reminded me from the scene in one of the Indiana Jones movies. Some Arab swordsman is showing off his skill, wildly gesticulating with his sword as a preface to attacking Indiana Jones. Jones just pulls out his revolver and shoots the swordsman.

I do like ensuring that we are uplifting American citizens before importing foreigners for critical jobs. There ARE a lot of intelligent hardworking Americans out there that just do not have the resources to fulfill their potential. A limited loan program would help.

But I do understand your sentiment.

This 100%. The only way to reduce – massively, overnight – college costs is to eliminate student loans (from federal govt at least). Those loans are the sole reason costs have risen above inflation for decades. The only reason the ‘for-profit’ sector started their fraudulent sucking on the tit. The only reason employers have generally stopped thinking about paying for a lot of coursework that results in degrees rather than certifications. The reason that schools have doubled down on the focus on the 18-24 crowd (making college a social/networking event) rather than rethinking all the different ways education could be structured.

There will still be loans/financing. But getting the feds out of it will force school to use their endowments, employers to change their recruiting/benefits, students to think more about longer-term part-time study, etc.

^This exactly +100000000.

"Those loans are the sole reason costs have risen above inflation for decades."

'Guns' don't make sh*t.

The only reason the ‘for-profit’ sector started their fraudulent sucking on the tit.

This is why leftists are useless even in the rare cases they are able to recognize the problem. The ‘for profit’ sector is tiny, yet somehow that’s his takeaway as if waste is acceptable as long as it is within government. Ridiculous.

Costs have skyrocketed because our institutions abandoned their core mission in favor of political advocacy. To achieve this leftists marched through our institutions specifically because they understood they could corrupt them into funding sources. This included creating politically based departments (the Grievance Studies departments) while taking over others (like English and the soft sciences) and also requiring all students to take classes from these departments to justify hiring additional politically active faculty. Then came even more massive increases in administrators. As that became difficult to justify they corrupted the DOE to claim Title IX required sex police on campus. See how they collude to create government and educational corruption in tandem. Now many individual campuses, such as Harvard, have over 100 Title IX officers when they should have literally zero. How many nationwide? Tens of thousands at least, each of them well paid, sucking money out of the productive economy, and an eternally reliable left wing vote.

When that reached funding limits the feds took over loan administration specifically understanding the next step was to make universities “free” so they could hide the costs and continue to hire otherwise unemployable left wingers.

The ‘for profit’ sector is tiny, yet somehow that’s his takeaway as if waste is acceptable as long as it is within government. Ridiculous.

It’s tiny NOW. But it was almost entirely fraud (and Wall St knew it) and at its height it accounted for 12% of students, 20% of student aid, and 50+% of loan defaults.

Well thought out and reasonable. I disagree, however, with your points 2 and 7. A student dropping out is not solely the institution's fault. The failing student needs some skin in the game, too.

8 is impractical because there are too many jobs that one could "be eligible to apply for" to create a meaningful average - especially since for many of the best paying jobs, you'd be eligible to apply even without the degree. Nor can you rely on disclosures of past graduates. There's a classic statistics lesson where a university did exactly that for their Communications degree and showed a remarkable return - easily double what any other university's Communications degree holders averaged. Only when you dig into the data do you discover that the average was skewed upwards by one multi-millionaire NBA star who just happened to have received that particular degree.

No, I think the simpler answer is to get the government out of the student loan business entirely. There are plenty of grants and private loans available to those who truly want to learn.

10) none of the above; end government issued and processed loans.

The clock ran out 235 years ago, when the Constitution gave the power of the purse to Congress, not the President.

I’ve been told the current president respects the constitution, so we have that at least for 2 months.

That is why I submit that Congress should pass legislation.

As reparations for mean tweets?

The Constitution also never granted the "Union of States" government any authority over Education.

Did no one tell Biden the election is over? He can stop with this nonsense now, he doesn’t need votes anymore.

Dead on arrival, just like the corpse that proposed it.

end the racket now before we end up with ObamaSchool

Being forced to change schools once every year?

And again, Biden is exceeding the authority of the Presidency in this latest attempt to find a way around the Court rulings telling him to desist.

I still think we should tax outstanding student loan debt. Getting to go to those posh schools was a luxury and luxuries should be taxed. Right?

One really wonders how this whole story could be put forth without any mention of the Congressional Review Act.

There is no way in hell that there are sixty legislative calendar days between when these rules could be finalized and when Trump is inaugurated. Which means the Republican Congress will have an opportunity (which procedurally cannot be filibustered) to pass an overturn resolution for Trump to sign, after which a substantially similar rule could never be issued again.

Somebody making $150k with 40k Student Loans just needs to suck it up. Somebody making $40k with a $150k SL is never going to pay it off. Bankruptcy courts exist to draw the line between "forgiveness" and "suck it up".

#1. Pass some rules making SL's dischargeable in bankruptcy court. Many of these are never going to be paid off, anyway.

#2. Stop guaranteeing $50k+ loans to eighteen-year-olds.

Of course #1 without #2 is the worse than what we have now, so that's exactly what is going to happen.

Oh yes indeed. So many dollar store clerks, secretaries, and carpenters are really worried that the Biden bureaucracy has just a few short weeks remaining to transfer the college debt of bankers, lawyers, congressional staff, gender study professors, etc onto the backs of them, their co-workers, and their children. Won't you just think of the children for God's sake!

He’s also running out of time to start WW5, but he’s doing his darndest

I was scrolling down to post the same thing. I just hope Putin holds out till January 20th as far as retaliation goes.

I wonder if Brandon knows that Democrats lost this election [as student loan "forgiveness" was nothing more than a vote buying scam]?

As always, The Bee is pushing past satire into prophecy:

https://babylonbee.com/news/in-last-ditch-attempt-to-prevent-trump-from-taking-office-democrats-start-world-war-3

To state what many who are against the 'forgiving' or 'elimination' of loans is actually saying:

We who pay our loans view those who choose not to pay as morally bankrupt individuals.

I knew my daughter's fiancee was a keeper when he used the pandemic loan pause to more than double the rate of repayment because he could apply all dollars to the principal. He powered through the final 5 years of payments in 2 years, and emerged from both the pandemic, and wedding expenses, debt free.

Everyone else is a lazy good for nothing slacker.

Sounds like a keeper!

If this analysis predicts that a borrower has an 80 percent chance of defaulting on their loans within two years, the Department of Education could then provide one-time forgiveness of up to their entire loan balance.

Even Joe could write an algorithm that always results in "borrower has an 80 percent chance of defaulting on their loans within two years".

" . . . could then provide one-time forgiveness of up to their entire loan balance."

Only democrats could pretend there might be a need for a second forgiveness of an entire balance!

What constitutional, small government, or liberties-related issue is at play here? What does this have to do with libertarianism? This could be discussed as an administrative procedural issue (e.g., should presidents attempt this by executive action), a small government or fiscal responsibility issue (e.g., why is the government subsidising loans at all), a fairness issue (e.g., why is the executive attempting debt-forgiveness for some citizens with moneies that all citizens pay via their taxes), or as a Constitutional issue (e.g., this is a large fiscal decision that should, theoretically, fall under the purview of congress). In other words, why is Reason concerned with an administrative window closing, Emma? Is not a large administrative government with imbalanced government estates led by a pseudo-monarchal executive behaving with high-handedly and fiscally irresponsible manner anathema to everything Libertarianism and Reason stand for? Or, do you just want your loans forgiven?

Emma Camp is not a libertarian, and she probably hopes to get her student loans “forgiven.”

I don't think she's mentioned any of those libertarian aspects to this story in any of the slew of articles she's written on student-loan forgiveness.

Borrowers will have to start repaying their loans under the standard plan

https://c.tenor.com/vkodxf_ULOUAAAAC/tenor.gif

It's the same reason you don't give a Ferrari to a kid on his 18th birthday. They're not ready for that kind of responsibility and they'll invariably make the wrong decisions when handed the keys.

I don't think it's necessarily the age, but that children are basically brainwashed through their entire public school education that they have to go to college in order to be successful

Colleges also need to be held liable. They often offer unrealistic degrees, or admit students unlikely to be successful.

To them, it's just free money.

Those who took money out of the government coffers, in the form of student loans to enhance their career earnings, get their "debit" forgiven.

Those who put money into the government coffers, in the form of social security taxes to avoid poverty in retirement, get their "credit" forgiven (when the system crashes).

Sure, that seems fair.

I guess it's easier to rob me than to open your eyes :

Pentagon fails 7th audit in a row, unable to fully account for $824B budget

THe stupidest sub-sub-par career plodder of my lifetime, BIDEN

I am old enough to have had my college loans from a bank.

They were glad to loan me the money because I was premed.

Even if I had not gone to medical school, the degree in chemistry would have been the ticket to a job in either academia or industry that would allow me to pay the loan back.

I was amazed when the federal government took on the college loan program

I graduated in 81 with a degree in Math. My loan was through a bank. I also had a 40yr STEM career accumulating substantial wealth in the process. My risk profile was very low.

So, yes ROI has to be considered when handing these loans out.

If my mortgage or car payment is a “hardship,” should the government step in and “forgive” it for me, transferring those obligations to others while allowing me to keep my home or car? Of course not. Student debt is no different. You went to college, you benefited from the education, you pay the tab. Student debt forgiveness is even more unfair because it transfers the debt to tax payers who never benefited from the education in the least. I don’t care about gender women’s studies and don’t want to pay for yours.

Education is crashing and here comes Presdient Fool to help it fail, FAFSA style

More four-year institutions are offering courses for high school students, dipping their toes into what has long been community colleges’ domain

So now Pres_bottom_10_his_lawschool_class wants to subsidize the destruction. IF government would get out of the education business and schools had to deal with what people can afford this would stop.

THOMAS SOWELL

“The availability of federal grants and loans to help students meet rising tuition costs virtually ensures that those costs will rise. A college which kept tuition affordable could forfeit millions of dollars annually in federal money available to cover costs over and above what students can afford

FEDERAL RESERVE

A 2017 study from the Federal Reserve Bank of New York found that the average tuition increase associated with expansion of student loans is as much as 60 cents per dollar.

I wish I knew someone as generous as you and me.