Numb to the Numbers

The national debt has become an alarm bell ringing in the distance that people are pretending not to hear, especially in the city that caused the problem.

There's a weird little bus stop at the corner of 18th and K streets in Washington, D.C. On the inside, a ticker tallies the national debt in real time, the glowing numbers whizzing by too quickly for the naked eye. On the outside, there's a printed poster with a round number for the total debt: $34 trillion at press time.

I've lived in D.C. long enough to remember when changing that poster was a special occasion. But lately I've been checking regularly on my commute, since the trillions are racking up more quickly than they used to. The ink is barely dry on the current poster, yet the folks at the Peter G. Peterson Foundation, the fiscal responsibility nonprofit that maintains the display at the bus stop, will be due to roll out $35 trillion quite soon.

The bus stop is a semidesperate attempt to convince Washingtonians to care about—or at least give a passing thought to—the national debt as we go about our business. The debt has become an alarm bell ringing in the distance that people are pretending not to hear, especially in the city that caused the problem.

As Brian Riedl explains in this month's cover story, the only way out will be if politicians—and voters—stop lying to themselves about the possibility of a quick fix. We can no longer "tweak our way out of this," he writes, as we might have in the 1980s or '90s. No one party's pet proposals can solve the crisis. Yet the bipartisan trend is headed in exactly the wrong direction. Politicians of both parties have tacitly agreed to rule out all of the viable solutions.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, commented on a recent Congressional Budget Office report: "There is no way to look at these eye-popping numbers without realizing we need to make a change. And yet we have lawmakers promising what they won't do: I won't raise taxes, I won't fix Social Security, I won't pay for all the things I do want to do. And so we continue on this dangerous path."

***

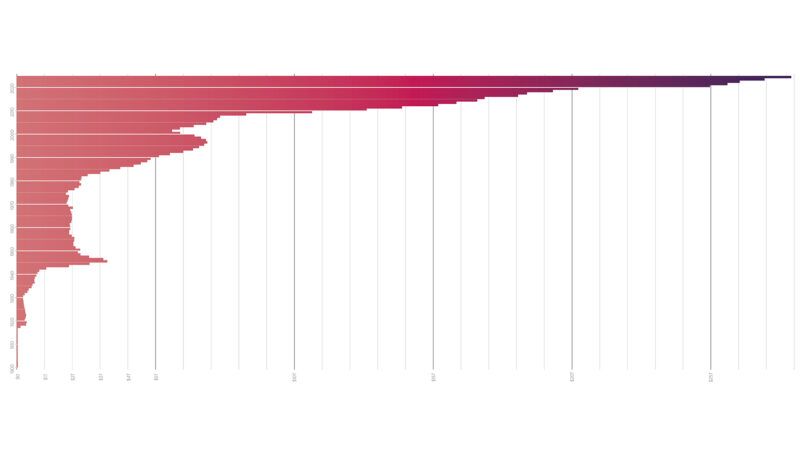

There are different ways to tally the debt: The Peter G. Peterson clock uses debt held by the public plus debt held by federal trust funds and other government accounts, but Reason's charts don't include the trust funds since that money isn't really borrowed from anyone. The raw dollar figures for the gross federal debt is the most shocking—and I certainly don't begrudge the bus stop some shock value—but economists tend to agree that the debt as a percentage of gross domestic product is the more meaningful representation. So we've offered readers both in this special edition of Reason. Feel free to unfurl this issue of the magazine whichever way you prefer at your own bus stop, subway station, or coffee shop to do a little awareness raising of your own.

President Joe Biden's administration recently unveiled a budget plan that proposes borrowing an additional $16 trillion over the next decade. Its backers claim this approach is fiscally responsible, but the plan involves spending $86.6 trillion while collecting only $70 trillion in revenues, leading to annual deficits averaging nearly $2 trillion. The administration touts a $3 trillion reduction in projected deficits, but the plan slows the debt increase rather than reducing it. Those figures also assume there are no additional major crises, natural or man-made.

The solution to the national debt lies in reevaluating and cutting back on unnecessary and wasteful programs, reforming entitlement programs such as Social Security and Medicare, and implementing a more efficient tax system that encourages economic growth.

But none of this can even begin to happen until politicians perceive a demand for it from the American people. Rising debt reduces investment and can slow economic growth, while increasing worries about inflation and the strength of the U.S. dollar. It reduces confidence in the social safety net and increases the risk of a fiscal crisis. Perhaps when these problems manifest, the voters will demand that politicians take the issue seriously. But by then, it may well be too late for the economic stability and growth we have taken for granted.

In the bus stop on K Street these days, there's usually a bundle of dirty bags and rucksacks below the debt clock. In bad weather, someone is often stretched out trying to sleep under the shelter. Perhaps Washingtonians walking by can heed that more human warning about the self-inflicted costs of economic crisis, even if we have become numb to the numbers.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

No one party's pet proposals can solve the crisis.

Whaaaaaaaaaaaaaaaaat?!?!? You mean we can't just say "Borders is fake. All is welcome!", cram all the immigrants into local community centers whether the communities want or need them or not, and then pretend like they're all contributing 150% to the tax base across their 5 independent businesses like some sort of revers magic dirt tariff?

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure “unbacked” fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $1,000,000,000,000 in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

But how will the bankers get so rich if they're not lending any money to the government? Anyway, at least having to borrow it keeps the spending somewhat in check. Some small what. Imagine what will happen when there is no check on generating dollars out of thin air and there is no limit at all on spending. None at all. Best to go the other way and return to commodity backed dollars.

Until we do return to commodity-backed dollars, debt-free fiat money is a better alternative than debt-based fiat money. See http://www.fixourmoney.com .

As recent experience shows, a huge and growing national debt is not a meaningful deterrent to an ever-increasing deficit. For the past several decades, Congress has authorized excessive spending despite the explosive growth of the national debt.

Most Republican members of Congress, along with their constituents, are at least somewhat on board with reining in excessive federal spending. But if the Democrats retain the presidency and regain both houses of Congress, a ballooning national debt will not serve as a meaningful barrier to a wild government spending spree. The Obama/Biden experience is proof of that.

"The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. Government BORROWING drives up the debt, not government SPENDING"

Ooo playing word games. True the deficit is a yearly basis and the debt is sum of deficits through the years.

What causes a deficit? You say borrowing not spending? Why do they borrow? Just to borrow in your view? It's because government spending is more than what they take in.

"Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero."

That's only if you don't borrow/have a deficit anymore. "unbacked dollars" you are right. It will stop borrowing because no one will trust you paying them back. It will also cause debt to be called in.

Would you except a job where payment isn't backed by anything?

It's not that hard. Cut spending. Increase revenue if you must. Don't spend more than you take in.

No, I won't go to your nonsense site since you can't even be honest here.

Speaking of “word games”, you didn’t refute a single thing I said. From a conservative or libertarian perspective, pure or “unbacked” fiat money is much less destructive to the economy and to personal liberty than the “debt-backed” fiat money we use today.

• Debt-free money will allow us to slowly pay down the national debt without a lengthy, unpopular and economically damaging austerity program.

• Debt-free money does not saddle future generations with unchosen obligations.

• Debt-free money poses a lower risk of hyperinflation and economic collapse than debt-based money.

• Debt-free money helps shift monetary control from the Federal Reserve back to Congress.

• Debt-free money is less destructive to individual liberty than debt-based money.

Being on the hook for a $31 trillion (and growing) national debt is not a realistic basis for inspiring confidence in the “integrity” and “soundness” of our monetary system. Taking meaningful steps to pay down this debt is much more likely to accomplish that goal. Such steps can only be undertaken using money that is independent of the national debt that it is paying off.

If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

Although inferior to a gold-based currency, fiat money does in fact have real value. The U.S. dollar’s value derives from the fact that it is the official medium of exchange and unit of account within a large, productive and reasonably stable economy. It does not derive from the fact that $31 trillion in U.S. government IOU’s are “backing” the nation’s currency.

Debt-free fiat money is far from perfect, but it is vastly superior to the debt-based monetary system we have now.

I've never understood this logic.

It's sure as shit owed to somebody! If it's so meaningless, imagine just writing it off. It's in those trust funds to pay SSA and other welfare moral obligations; they aren't legal obligations: Congress could shut off the taps any time they wanted, other than the public screaming and voting them all out of office.

"Oh yeah, we printed a bunch of money and we're keeping it, and it's all OK, it's free money."

No is fucking isn't.

^THIS. Criminals never want to see their ?free? money ( but a median of someone's labors ) for what it really is; they just might have to acknowledge they're the criminals.

The debt isn't the only number people are numb too. Check out the number of illegal border crossings. So many food trucks in our future.

“Each one of those illiterate, indigent illegals is an economic boon for this country”

- Reason staff

Well they do care when their groceries go up by 4-Times. They're just too stupid and criminally minded ignorant to understand why.

'Guns' don't make sh*t.

Dirksen reportedly observed, “A billion here, a billion there, and pretty soon you're talking real money."

Yeah, that turned out not to be true. The 'real money' part, of course, since there isn't even that much cash in existence.

It's been decided by everyone in power, just about anyway, to just let this train wreck happen because the political will doesn't exist to avoid it and it would cost them their phony baloney jobs in the short term.

It was always known how the American experiment would end, and this is the very thing cautioned about by just about every serious thinker since Democracy was first conceived. Keep in mind it was conceived of around 508 BC.

"When the people find that they can vote themselves money, that will herald the end of the republic."-- Ben Franklin

My only question at this point is whether it will take a Weimar level of failure or something worse; that is before a crisis is announced and a new breed of politicians on horseback ride in the fix everything.

A we know what kind rode in on the heels of the Weimar Republic. Ain't gonna be pretty.

20% inflation a year for 5 years would cut the inflation-adjusted debt in half.

As long as they stop adding to it. Which seems unlikely.

That's why interest exists (correct for inflation).

You can't spend your way out of debt.

That's not what Paulie Krugman and the Obama brain trust group say. Every government dollar spent, comes back as $1000000

Actually it would cut it by close to 60%

35 trillion dollars in debt.

350 million Americans.

100,000 dollars each. That seems like a lot of money (for now).

Only 163M working. The ?free? ponies gang doesn't pay debt.

Only if you pay your fair share - Elizabeth Warren

The latest numbers, from the US National Debt Clock website:

Debt: 34.9 trillion

Debt per citizen: 103.5K

Debt per taxpayer: 267K

GDP: 28.5 trillion

Debt to GDP: 122%

Total state/federal/local govt spending: 10.8 trillion

Actual productive economy: 17.7 trillion

GDP to actual productive economic output: 197%

It's not going to stop. I don't know why anyone's pretending otherwise.

We're past the point where we can't even pay off the juice, let alone touch the principle. And take a good hard look at the Unfunded Liabilities.

That's it. Game over man. Game over.

Only two options, neither of them particularly realistic. 1) Cut off ALL entitlement spending and ANY government spending that isn't the DOD/OCO's, or the GSA; 2) Invade and pillage another nation's resources/treasury. Probably a couple of them, actually.

Like I said, unrealistic. So. Get ready for the crash boys and girls. Time to be investing in the three G's.

You gotta love how the MAGAs think that most of the debt is caused by immigration. Cute.

Gotta love how dumb you are since no-one said debt is caused by immigration. Wait, you don't know the difference between debt and deficit right?

Illegal immigration does figure into each years deficit but not the driving factor. You know part of the entitlement package. Or do you think all those hotel rooms, spending money, insurance, and welfare appear out of the air. Wait, never mind you do. You think taking in 2 million a people a year, where most don't work is a boom to the economy. Based on the last few years, shouldn't we be rolling in dough?

I know it's the evil defense industry that has been slowly decreasing. What else is it right?