The Real Tax Gap

Wealthier Americans pay a record share of federal taxes, but voters (and President Joe Biden) believe they're freeloading.

After listening to President Joe Biden or looking at polls of the general public, you might come away thinking that this weekend's federal income tax filing deadline is a holiday for America's wealthiest residents.

And, more to the point, you might be left with the impression that solving the country's fiscal problems is as easy as raising their taxes.

Neither is true. In fact, the wealthiest Americans are now paying a higher share of federal taxes than at any time in the past 40 years.

Still, the persistent gap between what Americans (including the current occupant of the White House) believe about the federal tax code and the reality of who shoulders most of the burden is a problem. It muddies the debate over how to address chronic budget deficits and how to best manage the insolvency of Social Security and Medicare. More generally, it contributes to a phony sense of class warfare that boosts populist politicians of all stripes.

Biden, who was historically more of a centrist, has leaned harder into that message since becoming president. A common refrain in his speeches is a claim that American billionaires pay an average tax rate of just 8 percent—a claim The Washington Post's Glenn Kessler thoroughly debunked earlier this year. There's also the more generic claims, like Biden's promise in last month's State of the Union address to "protect and strengthen Social Security and make the wealthy pay their fair share."

Polls bear out a similar point of view. A recent Morning Consult/Bloomberg poll of voters in seven swing states found that 69 percent support raising taxes on Americans earning more than $400,000 annually—a rather arbitrary threshold, but one that Biden has used as a measuring stick to determine wealth. Meanwhile, a Pew Research Center poll conducted last year found that 82 percent of Americans are bothered "some" or "a lot" by the feeling that the wealthy are not paying their fair share in federal taxes.

Other surveys show that many Americans have a low level of tax literacy. A recent survey conducted by the Tax Foundation found that "most Americans are not just unhappy with the current tax code but also do not understand it." One commonly misunderstood aspect is how much the wealthiest Americans pay in taxes every year. In the Tax Foundation survey, 78 percent of respondents did not know the share of taxes paid by the wealthiest 1 percent of Americans—but, tellingly, 65 percent of respondents said their own taxes were too high.

The most straightforward conclusion here is hardly a surprising one. Americans want someone else—preferably someone richer—to pay for the cost of government.

Here's the good news: That's already happening!

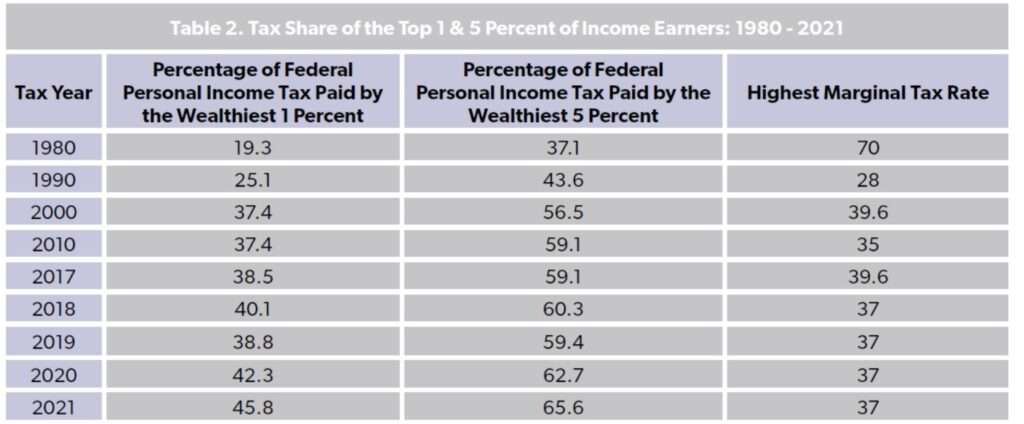

"The top 1 percent of earners, defined as those with incomes over $682,577, paid nearly 46 percent of all income taxes" in 2021, according to federal tax data crunched by the National Taxpayers Union Foundation (NTUF), which advocates for lower taxes. That's the highest percentage of taxes paid by the top 1 percent of earners in any year since 1980.

Other wealthier Americans are also contributing heavily. "The top 10 percent of earners bore responsibility for 76 percent of all income taxes paid, and the top 25 percent paid 89 percent of all income taxes," the NTUF report found. Meanwhile, the bottom 50 percent of all earners paid just 2.3 percent of federal income taxes in 2021.

The sense that the wealthy aren't paying as much these days might stem from the fact that the top marginal tax rates have steadily fallen in recent decades. The top federal income tax bracket charged 70 percent in 1980, but today demands 37 percent from those lucky enough to qualify for it. Despite that, the tax code has grown significantly more progressive during the same period. The top 1 percent of earners paid less than 20 percent of all income taxes in 1980, and well more than double that amount now.

"Over the past several decades, lower income earners' share of income taxes has steadily grown smaller as the burden was shifted more and more to the wealthier," writes Demian Brady, NTUF's vice president of research. "On the other end of the spectrum, our highly progressive tax code ensures that low-income earners are afforded protection from income taxes through exemptions, deductions, and credits."

The gap between perception and reality in the federal tax code has important implications for some big decisions that federal policymakers will have to make in the near future. The first of those big decisions will hit next year, when many of the provisions of the 2017 Tax Cuts and Jobs Act expire. Among other things, Congress and the winner of this year's presidential election will have to decide whether to allow personal income tax rates to climb back to pre-2017 levels.

Then, there is the question of Social Security's looming insolvency. The old-age entitlement program is set to run a $2.8 trillion deficit over the next decade. Since both Biden and former President Donald Trump are steadfast in their refusal to touch Social Security benefits, hiking taxes is likely to be part of the preferred political solution. When that idea starts gaining steam, keep in mind that working Americans are already "on the hook to finance $164 trillion in Social Security and Medicare benefits for seniors" over the next three decades, as the Manhattan Institute's Brian Riedl pointed out in an analysis published this week. Hiking taxes to protect entitlements means asking younger Americans to foot an even larger bill.

None of these decisions will be free from painful tradeoffs—but without a better understanding of the burdens of the current tax code, many Americans will be unable to appreciate those trade-offs. Demagoguery about taxing the rich might produce a political pay-off in the short term, but it has created a political culture that's less well-equipped to tackle the serious questions about who should be paying what to cover the annual cost of our $7 trillion (and growing) federal government.

The wealthy are already paying record levels of federal taxes. How much more will be enough?

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The wealthy are already paying record levels of federal taxes. How much more will be enough?

That's easy to answer. The rich don't pay enough taxes. How do we know this? They're still rich! They will have paid their fair share when they're not rich anymore.

Ideas!

We also know that as long as the politicians can sell favors to the rich and disguise it as "exemptions" and "campaign contributions" while simultaneously trading political favors for key demographics like "corporations" and "organized labor" that nothing even remotely like "transparency" or "honesty" will ever exist.

As long as there is wealth inequality, politicians will say those at the top have not paid their fair share. Doesn't mean they'll actually do anything about it, but saying the words will get them into office and keep them there.

That’s ok. You’ll still provide endless cover for your democrat friends.

Just a few days ago either you or Jeff were implying the Trump tax cuts only helped the rich. Did something change?

I doubt Sarc even remembers. He will say the same thing again when the subject comes up in relation to Trump.

Jeffy is just a lying moronic leftist.

Thatcher said something somewhat similar....The problem with socialism is that you run out of other people's money to spend.

taxation is theft.

War is peace. Freedom is slavery. Ignorance is strength.

Bad comparisons.

But taxation is theft. Someone holding a gun to your head and demanding money. Maybe it's theft that is necessary and justifiable. But it's still theft. If you want to defend taxation, you have to defend the violence that backs it up.

+1000000 This.

Ed is a fucking lefty ignoramus.

This is known

He left off EdG is smart

Things I’m sure are part of your core beliefs.

Taxation is government extortion.

This is a disappointingly disengenous piece of work. Almost everyone who works pays payroll (FICA) taxes, which are taxes. The rich are paying more because they're getting richer. Do you have a problem with getting richer? I don't see why magazines run articles designed to fool their readers. Reason needs to do better.

You are being egregiously disingenuous yourself here in mischaracterizing this “piece of work.” Almost no one has a problem with higher incomes paying higher taxes or with their paying a higher marginal tax rate or even with their paying a higher proportion of income taxes. No libertarian would have a problem with the rich getting richer as long as the income was honestly earned in a free market. Apparently, you are one of the Americans who displays the woefully low tax literacy complained about in this article. A very large percent of wage earners pay zero income taxes because they fall below the minimum wage to pay those taxes. If they pay Medicare and Social Security taxes, it’s because they can expect to someday receive medical and retirement benefits from those taxes – at least until the Federal government and the Medicare and Social Security pyramid schemes go bankrupt.

You are being egregiously disingenuous yourself. Rich people receive benefits from their tax payments: the world's strongest military to protect their possessions; police forces to ensure their safety; an educated populace to work the menial jobs at their businesses; Social Security and Medicare programs that help keep the peasants in line; etc.

an educated populace to work the menial jobs

I thought that’s what immigrants were for.

No, not immigrants, illegals. Illegals can be used as menial labor by the democrats, and replacement soft the parts of their voting base who are now defecting because of the failure of democrat governance.

Did someone claim rich people don't receive government services?

Two things to point out here: 1. rich people also pay for those services for everyone else and 2. They are forced to pay and didn't necessarily ask for those services to be provided. They could probably obtain those services that they actually want for less money privately.

It’s the populace who gets the benefit of working and earning a salary at a profitable business. A capitalist had to take (sometimes huge) risks for that to happen.

Ed really is an abysmally stupid pile of lefty shit.

Why should people with higher income pay more taxes?

Lazy Leftard Envy? ????

Excellent Question.

You know you can go to federal websites and find the effective tax rates by quintile right? It would help you understand your comments are false talking points.

Quintiles would mask a lot of very high income "earners".

Sure. But even then they have higher effective rates than the bottom 50%. Guessing you mean asset sale taxation which is lower but higher than bottom 50%

So did you have a point?

Yes Reason does need to do better. In order for Socialism to work it has to find an enemy to unite people against. Today it is the rich. In the 1930's the Nazis used the Jews for the same purpose, for much of the same reasons. When he was Vice President, Biden stated that he wanted to take everybody's 401K's and give them an IOU from the Federal Government.

Remember the "Occupy" groups, who were they against? They thought it was the Republican millionaires who supposedly rigged the financial situation in the US. Guess what? Those doing the rigging support the Democrats.

The democrats are also using Trump and ‘MAGA republicans’, who Biden and his minions constantly demonize.

Even including payroll taxes, the top 20% of earners pay more than 70% of ALL federal taxes. And even with payroll taxes, the bottom 40% "pay" net negative taxes. That's a good way to kill "democracy".

"It muddies the debate over how to address chronic budget deficits and how to best manage the insolvency of Social Security and Medicare."

There IS NO debate. This assertion is misleading, and the writer should be ashamed! There is a cacophony of self-serving politicians and officials and their narrative. And a small group of people trying unsuccessfully to get them to listen to reason.

"Americans want someone else—preferably someone richer—to pay for the cost of government."

If the cost of government were only the overhead on the officials and offices necessary to carry out the basic functions of government as specified in - and limited by - the Constitution, there would be no problem paying for it with a MUCH lower level of taxation on EVERYONE. The problem here is that ignorant citizens who long ago abandoned any hint of competence in the realm of the responsibilities of citizenship feel that all their desires should be covered as a cost of government.

Fuck you. Cut spending.

^ This

Agreed!

It is weird you say this despite the majority of congressional members you attack are the only ones pushing to cut spending.

I usually can't stand Congressional acronyms for bills, but I wouldn't mind seeing a pol introduce the "F.Y.C.S. it Act."

Agree...cut spending.

^Exactly.

Yet you attack those who try to cut spending and give cover to those trying to spend more.

but voters (and President Joe Biden) believe they're freeloading.

Do they believe it? Or do they just say it?

A few years ago feminists began claiming most rapes on campus were committed by a handful of committed serial rapists citing the Lisak (sp?) studies because this helped create pressure to minimize civil rights protections on campus. But longstanding data consistent with research on related topics like child abuse argued otherwise, that the typical rape accusation, founded or not, was against someone known to the accuser. So how did interested people determine whether this was a true belief or invented as a useful political tool?

If such a difference in motivation and methods were true awareness programs, policing methods, and safety measures would have to completely change in order to effectively combat the true threat. Yet literally not one university changed their training, awareness, or safety programs to make them more effective against this type of threat. Not a single campus.

The simple fact is that left wingers do not consider reality a relevant factor. Their only motivation when speaking is to create pressure for people to adopt their political preferences. As a result if they thought it would help pass their believe-all-women style laws they would claim the Queen of England personally committed every single rape on American campuses and they'd have three "studies" supporting that conclusion by next Thursday.

but voters (and President Joe Biden) believe they’re freeloading.

Do they believe it? Or do they just say it?

Not sure if anyone has pointed this out before but it just bugs me to see "X believes Y" headlines when referring to politicians or any politicized mouthpiece. They generally dont believe anything they spout but are merely advancing whatever terrible jihad they are on at the moment.

Biden and the democrats ARE the freeloaders.

This is an excellent post. Digging into the beliefs of the left.

"Their only motivation when speaking is to create pressure for people to adopt their political preferences."

... which 99% of the time is all about STEALING ('armed-theft') and pretending their theft is just 'equality' while throwing the justice (deserved/earned) part out the window.

The left literally preaches injustice in everything.

many Americans have a low level of tax and fiscal literacy.

Heck, most Americans (probably most people) can't even handle simple arithmetic involving numbers greater than 20 (or 21 for the males in the crowd).

https://www.forbes.com/sites/howardgleckman/2019/10/11/are-us-billionaires-really-paying-a-lower-tax-rate-than-working-people-probably-not/?sh=3e70920c29ac

Some do some don't depending on how many foreign tax shelters they have.

However, if multi-millionaires did pay a somewhat higher tax rate, they wouldn't suffer for it. After a certain threshold (say 50 million or so to be generous) the richer you are, the less an increase in tax rates impacts your lifestyle. There are only so many yachts you can buy.

"Stealing's morally ok as long as you only steal from big box stores."

It's not stealing when the taxes collected from the rich help pay for the US Navy that protects their yachts.

“Navy protects their yachts”

What color is the sky on your planet?

Yes, it is stealing.

"Taxes are theft" is the war cry of the pseudo-libertarian keyboard warrior. I can't remember ever hearing an economist, even Austrian or Chicago School ones, make that kind of statement.

Do you give money to the government voluntarily, or do you do so under the threat of punishment?

I do so consensually.

When the mugger points the gun at my head, I voluntarily hand him my wallet.

Hardly. You, like everyone else, ask the government each April "What's the smallest amount of money you will take to go away for another year?" If the answer were "zero," you'd give the government zero.

This is not the act of someone willingly giving money away.

You wouldn't remember water is wet if it served your Nazi-Empire.

The VERY FOUNDING (Independence) of the USA was based on that.

Enter the Boston Tea Party.

Ed is a fucking lefty ignoramus.

Yeah, he says a lot of stupid things. We would be better off if everyone like him committed suicide. Should Trump become president again, we can only hope that some of them will.

My comment wasn't a direct statement on whether taxation is or isn't theft (that just devolves into a an argument of semantics).

I was pointing out the logic of justifying heavier taxation of the wealthy because they can more easily absorb the cost is very similar to how many people justify literal theft from large corporations, chain stores, etc.

Either case leans heavily on moral relativism and completely ignores the practical/operational implications.

I got that. I was replying to Don't look at me! because he was saying it was theft to tax people to pay for national defense that protects the taxed people.

Progressive taxation vs. a flat tax as a practical economic policy debate would be great. It comes down to a moral or fairness question by people so often because few want to take the time to study that topic. Not many people have the time, truthfully. It would be a full time job in itself to be truly well enough informed on every public policy issue to make objective, purely rational decisions based on verified facts.

No, I was talking about stealing from a large store vs a mom and pop.

Glenn Kessler's supposed debunking of the 8% meme cited by Biden is based on faulty analysis. Biden said 1,000 billionaires pay 8%. Kessler moved the goalpost to "top 1% of taxpayers", which is over 13 million people, and then used their average tax rate of 26% to debunk the 8%. Last time I checked, 13,100,000 is more people than 1,000 is. Those are entirely different groups of people.

Nobody should pay more than 8%.

Good luck convincing any portion of the electorate to accept 8% of GDP as the limit of federal government spending.

Any portion? You mean nobody would like that?

Do you understand that income taxes are not the sole source of federal revenue?

How much income do those billionaires have? We're talking about income tax here. Why bring up net worth?

Because voters are morons.

Maybe a wealth tax would be more appropriate if it were feasible. Even a flawed one would probably be more equitable than mere income taxation.

Hasn’t seemed to work anywhere it’s been tried. Most European countries that had wealth taxes have scrapped them over the past couple of decades

E.g.,

https://www.investorschronicle.co.uk/education/2021/02/11/lessons-from-history-france-s-wealth-tax-did-more-harm-than-good/

A mugging is just an undocumented wealth tax being collected.

So if my stock goes up 50% for the year - I pay tax.

What if that same stock downs 90% the next year - do I get a refund?

What about your house? That would be consider wealth. Guess you should hope your house doesn't go up.

You also realize for savers - if you have a 100k saved, you would get taxed on it every year. Not on the dividends, just on the balance because it's wealth.

Wealth fluctuates and punishes you for saving

Also forgot, what if you are a small business owner. That is consider part of your wealth (After debts, etc)

No, a wealth tax is a very bad idea full stop. The problem is spending, not insufficient tax revenues. You could confiscate all the wealth of all the billionaires and it might pay for a few years of the insane spending we have going on, while destroying enormous amounts of wealth in the process.

The 8% figure is not an effective income tax rate actually paid on income. It came about from treating unrealized capital gains as income and then dividing the taxes they paid by that instead of their actual income. Granted, I think the effective income tax rate paid by the top couple of dozen billionaires in the U.S. was something like 16%. That is definitely a lower % than people that are only fairly rich or very rich would pay. The super-rich obviously have ways to avoid taxes that even other rich people can't make work. Start comparing it to people in the upper middle class earning a salary that pay SS and Medicare taxes, and no doubt that is the part of the income distribution that is likely to have the highest effective tax rate.

A self-employed person pays 15% payroll tax right off the top.

Unrealized Caitlin gains are not legally taxable. The SCOTUS struck that down a hundred years ago.

13 million people (the 1%) pay 26%. The 1,000 billionaires that apparently pay "only" 8% is among that group.

Biden tried to cherry pick stats to create a narrative, and Kessler provided a correct perspective. keep in mind that someone who earns 400,001 dollars is operating in a whole different kind universe than a billionaire, who has to mind a gigantic industry and is accountable to debt, investors, shareholders, etc.

Is the one standing and holding the bone or whatever supposed to look like Ginsburg?

I thought it looked like Steve Buscemi was going to blow a dildo, but that isn't fair to Buscemi. Or to observers who probably don't want to see that.

I was just thinking about... imagine getting all glammed up to join your friends around the table, having all that time off from work and your family, a table complete with tablecloth, place settings and centerpiece, people in costumes and capes, dresses, even plastic decorations for people to carry around. Imagine doing it all not because you've got a few minutes to sit and eat with the ones you love or haven't seen in a while... but as a protest... pretending that you aren't the rich ones.

It is quite obnoxious that Eric Boehm makes the thesis of his article that Biden (and progressives more broadly) are dishonest about how much in taxes are paid by "the rich" when he only relies on one measure of that which is itself, misleading.

The article he references as debunking Biden's 8% figure is behind a paywall for me, but other fact checks explained what was wrong with it. Biden's figure came from a report from his Council of Economic Advisors that looked at what would happen if unrealized capital gains were taxed as if they were income. But then, he was comparing how much they pay in taxes under current law with an income that includes unrealized capital gains, which is not taxable income under current law.

Now, the reason progressives want to tax unrealized capital gains so badly (aside from the increased revenue) is that they claim that the super-rich are avoiding ever paying taxes on a lot of their wealth while enjoying spending fueled by paper increases in their wealth. The idea is that assets that they own increase in value, they take out loans on those assets, and just keep servicing that debt until they die, and then the net worth of their estate is lower than what their lifestyle and the assets themselves would have been. That value is eaten up as the estate pays off loans, is donated to foundations, etc., and then less is paid in estate taxes.

I don't know how often that happens, or if it even works that way, but the paper value of assets isn't entirely ephemeral. The paper value of assets matters when applying for loans to finance $20 mil mansions, purchases of other businesses or investments, to cover temporary shortfalls in cash flow, and so on. Then, of course, even if they do pay capital gains taxes when those assets are sold, the capital gains tax rate is considerably less than the highest marginal income tax rate.

Yes, Biden's figure isn't true, even if you give them the benefit of the doubt that they might have something of point on how increases in wealth on paper might affect a billionaire's ability to fuel consumption.

Where Boehm is misleading himself, though, is in only looking at the share of all income taxes paid by the top portions of the income distribution. Why is that misleading? Because it hides the increase in the share of all income that those same percentiles are making. Wouldn't you think that the top X% of the income distribution should be paying a higher share of all income taxes if they have a higher share of all income?

A more honest calculation to make would be to look at the effective tax rate for those that earn different amounts of income and see how that has changed over time. It is fairly obvious to me that this is a more important measure to look at. But then, I have no ideological bias to prefer lower taxes and lower spending. So, I also have nothing to gain by making it look like the rich are already being soaked if they actually are enjoying boom times while the working class is stagnant.

Wouldn’t you think that the top X% of the income distribution should be paying a higher share of all income taxes if they have a higher share of all income?

No. A flat rate is the fair rate.

No one ever seems to bother to define what they mean by "fair". It's not even clear to me why taxing everyone the same percentage of income is more fair than, say, capping the amount of income that can be taxed and taxing that at a flat rate. And then of course many seem to think that "fairness" requires a redistributionist tax structure.

Any such debate is pretty pointless if the people involved don't even agree on the premises of the argument and the definitions of words.

Sales taxes are applied the same for everyone. Why not income taxes? Keep it simple.

The progs would love to force the wealthy to pay graduated sale tax rates. Modern technology might make this feasible.

My go-to response when someone brings up what's "fair"... Fair's a place to get ribbons and eat funnel cakes.

Defining the terms of the debate is elitist. Or racist or colonialist or something. Whatever it is, it isn't democratic.

No. A flat rate is the fair rate.

You must not have thought about what you just quoted before responding. A flat tax would result in the top X% paying a higher share of all taxes if they had a higher share of all income. That's how ratios and percentages work.

So? People who spend more money at the department store pay more in sales taxes too.

"People who spend more money at the government store should pay more in income tax."

Why?

Unrealized capital gains are not income any more than you have income when the market value of your house changes. The whole idea of treating it as income is absurd. People being able to accumulate capital is a good thing. It's pretty much the basis of all the prosperity of the modern world.

I thought the basis of all prosperity was the division of labor. But hey, if some people sitting on huge piles of money while others scrape by or even do without is more important than that for overall prosperity, then will you volunteer to be one of those scraping by?

Nobody is sitting on a piles of money. Scrooge McDuck is a cartoon.

What an odd response. How the fuck would that help? People aren't poor because other people are rich. The economy is not a zero-sum game.

And as sarcasmic points out, capital and money are not the same thing.

Turns out Jason is kinda dumb

People are poor because of a combination of bad luck and bad choices. In America, it is not because of the system, whatever corrupt system that may be.

Leftists absolutely believe that other people’s wealth makes the masses poorer. Democrats elites feed them this line of bullshit endlessly to get support for their Marxist agenda. And they have to.

Elite democrats tend to be useless assholes who were either pulled out of the right crotch, or were conniving sociopaths like the Clintons, Bernie, or Biden. Have you ever noticed that none of these people have ever produced anything of value in their entire lives?

Democrats exalt the useless, and the covetous. And most of them are too stupid to grasp that.

So if I work 40 hrs a week, and you work 1 - we should be paid the same right? Or I make 10 widgets, you make 1 of the same, we should be paid the same right?

See comrade - socialisms doesn't work for anything greater than about a group of 10 people. You are always going to have people who work hard, and people who just get by doing nothing.

Capitalism rewards hard work. Is it always far no, of course not.

Life is about choices. You want everyone to pay for your choices. You never explain what happens when you run out of other's people money.

"The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent." TaxFoundation.org

taxfoundation.org/data/all/federal/summary-latest-federal-income-tax-data-2023-update/

"From 1945 through 1965, rates for taxpayers with the highest 1 percent and 0.01 percent of AGI fell. Due in part to the Tax Reform Act of 1969, rates on both the top 1 percent and top 0.01 percent rose by 1975, but then fell back to about 25 percent by 1985. Although the rates rose and fell after that, they remained at about 25 percent from 1985 to 2015." TaxPolicyCenter.org

http://www.taxpolicycenter.org/taxvox/effective-income-tax-rates-have-fallen-top-one-percent-world-war-ii-0

Average tax rate for top 1% in 2020 was 26.0%. TaxFoundation.org (same link as above).

"Wouldn’t you think that the top X% of the income distribution should be paying a higher share of all income taxes if they have a higher share of all income?"

Not disproportionally so, no.

If they had 22% of the income and paid, say 25% of the taxes, there'd be not much to quibble over. Or if they had 41% of the income and paid 42.3% of the taxes, I don't think anyone would argue much.

But people earning 22% of the income and being charged with paying 42.3% of the income taxes doesn't seem quite fair to me.

Show me someone who says the rich don't pay enough taxes, and I'll show you someone who doesn't know the difference between money and wealth.

Yup. Just look at all the shit people go on about regarding billionaires and unrealized capital gains and wealth taxes.

All the wealthy people I know acquired their wealth with what was left of their income after paying taxes on it.

None of them inherited any wealth? That isn't income.

Talking about the people I know. They’re all new money. Don’t know any old money. However if the children of the wealthy people know inherit their parents’ wealth (home, investments, etc), then taxes were already paid on the income used to buy the stuff.

*people I know*

Yes, all wealthy people inherited their wealth. Every marxist knows that.

And some people are better looking than other people. Life is so terrible and unfair.

Class warfare rhetoric is identocal to incel rhetoric.

But ugly incels actually have a point.

After we get done with the ‘fair share’ of wealth, they will swing the ugly sticks to even that out too

You made me stop and think. Of all the wealthy people I've known personally, about half were born rich and half earned it. Don't know what the stats are on that.

Inherited wealth is then taxed again Jason T.

Doesn't it depend on the state? At the federal level, the estate pays a tax (if the estate is worth more than ~5 million for an individual, ~10 million for an estate owned by a couple), but then the heirs would only pay a tax on that if their state has an inheritance tax. If there is no inheritance tax, then, it would be untaxed income, right?

Unless you mean to say that they pay taxes when they spend inherited money, pay property taxes on inherited property, etc. But then, that wouldn't be different than any other kind of wealth that they obtained. The question was on how they first gained the wealth. Was it income that was taxed, or something of value they obtained without it being taxed upon their acquisition of it?

Forbes ([2021] 40th annual Forbes 400 list of the wealthiest Americans):

A total of 282 members of this year’s ranking have fortunes that are self-made—defined by Forbes to mean they are entrepreneurs who either started a company (like Jeff Bezos founding Amazon) or were hired by someone to help build one (such as Meg Whitman, who was CEO of Ebay for a decade, starting in 1998, and obtained shares of the company as a result of that job) —as opposed to being an heir. Sixty-one on the list inherited their fortune and another 57 inherited fortunes and then have played an active role in increasing them.

A total of 282 members of this year’s ranking have fortunes that are self-made—defined by Forbes to mean they are entrepreneurs who either started a company (like Jeff Bezos founding Amazon) or were hired by someone to help build one (such as Meg Whitman, who was CEO of Ebay for a decade, starting in 1998, and obtained shares of the company as a result of that job) —as opposed to being an heir.

That definition of being self-made is as reasonable as you can get, I think. But it doesn't factor in any other types of advantages one might have gotten due to their socioeconomic background. Bezos does seem reasonably self-made by any definition. He was able to attend Princeton, but on his own merit, not as a legacy or other privileged individual, for instance. He and his (then) wife started Amazon in their garage.

But sometimes, those that start companies that make them rich had substantial help from family and/or family contacts, received Ivy League educations that enabled access due to family status and/or connections, and so on. (One particularly obvious example of that should immediately come to mind.) The true "rags-to-riches" American myth is mostly just that. A myth. People starting near the middle of the income scale, with at least one parent with a college degree, for instance, are far more likely to advance the next income quintile as adults than those born into the bottom two quintiles.

So what? If preceding generations of a family have made efforts to ensure that their descendants succeed, that is something that should be applauded and encouraged. There may not be a lot of people who go from rags to fabulous riches in their lifetime. But there are plenty who have done it over 2 or 3 generations.

Then why do you support democrats, and attack anyone here who criticizes them?

There's a couple of things missing here. One is the exclusion of payroll taxes, which are regressive. The other is columns in the table that would show the percent of national income earned by the top 1% and 5%.

If you include payroll taxes as regressive, balance would say you have to include EITC and other offsets designed to alleviate that.

People in these conversations often ignore the fact that EITC does not apply to all low-income earners. It has eligibility requirements, such as having eligible dependents. There are plenty of very low income workers who do not qualify. Maybe even the majority—I don't have the numbers at my fingertips.

"The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent." TaxFoundation.org

Top 5% had 38.1% of the income, paid 62.7% of federal income taxes. Bottom 50% had 10.2% and paid 3.1% of the taxes.

The whole table https://taxfoundation.org/data/all/federal/summary-latest-federal-income-tax-data-2023-update/

Good info. Should have been included, along with payroll taxation and sales taxes.

How much federal sales tax do you pay?

States provide a lot of the government services to people, so any consideration of taxes should include state taxes, really. The federal government is only responsible for federal tax rates, but state taxes can't be ignored when you look at how tax rates affect the macroeconomics of the country and individual economic incentives. And states vary a lot in what they tax, how much they tax it, and how those taxes fall on different income groups.

No. Federal taxes are uniform across the country. As you stated, state taxes vary but you can decide which state to live in.

If I make 200k in CA or NY, am I rich? What if I make 100k in AL?

How are you going to fix that all into account?

The Tax Foundation has some good info, but as a center-right tax think tank, it could be skewing its analysis by choosing what information it looks at. The Tax Policy Center is center-left, so it could be worth checking it out for additional information.

https://www.taxpolicycenter.org/statistics/historical-average-federal-tax-rates-all-households

The average federal tax rates (total federal taxes and broken down as income taxes, payroll taxes, and estimates of corporate taxes and excise taxes) are shown. The average total federal tax rates have trended downward for every income group since 1979, including the top 1%.

The Tax Foundation is at least in part run by the Brookings Institute. So it isn’t really credible.

The Tax Policy Center has some good info, but as a center-left tax think tank, it could be skewing its analysis by choosing what information it looks at. The Tax Foundation is center-right, so it could be worth checking it out for additional information.

See how that works?

I actually prefer to use data from TPC *because* it skews left, and as it is under the Brookings umbrella, leftists tend to be more apt to accept or at least acknowledge data sourced there. But I don't give their analysis much credence, that too much like trusting Paul Krugman to balance your checkbook.

See how that works?

Yes, that was my point. They both have their policy agendas, and they are thus both likely to skew their analysis to fit those agendas. That makes it worth considering the information both provide then judge which is making more accurate and useful judgement calls in how they look at the data.

But I don’t give their analysis much credence, that too much like trusting Paul Krugman to balance your checkbook.

Hmm, I don't get that analogy. Is Paul Krugman not competent to do the basic math of balancing a checkbook? Or do you expect that he'd have some personal reason not to do it accurately? I know who he is, but I don't look for his take on government economic policies, because I know that his knowledge of economics would be less important to that than his political views. But if he is biased, then I would expect economists with conservative or libertarian political views to be biased as well. That's always the difficulty in dealing the cross section between economics and politics. I don't expect many people that study economics to be apolitical, so we always need to be skeptical and consider how someone's biases are effecting what they have to say.

"How much more will be enough?"

There will never be enough. In a sort of corollary to Parkinson's law, government spending expands to consume all revenues, and then some.

Also, there has never been a value put forth as the "fair share" that does not boil down to "I should pay less, and people who are even slightly more well-off than I am should pay more."

And finally, never forget that the tax code is often more about punishing people we don't like than it is about revenue generation. If we could magically invent a tax code where 99.9% of the people felt they were paying about the right amount and still have it raise more revenue than ever, if it came out that one billionaire somewhere paid $0 as a result, the whole thing would be rejected.

Well punishing and rewarding groups for votes.

Ever notice that the people that say everyone should pay their fair share, is always talking about other people not themselves. No one every volunteers to pay more

Eric Boehm is guilty of a standard arithmetical fallacy often seen in such discussions, and the fallacy is illustrated in the following extreme instance.

There is an island with 50 people. 49 earn $10,000 and 1 earns $1mm. Tax rates are 20% for all income below $10,000 and 10% for all income above.

49 people each pay $2,000 so revenue received from them is $98,000.

1 person pays $101,000

Total tax revenue is hence $199,000.

So 2% of the population pays about 50% of all taxes. From which some people might claim that the top earners already pay too much - but that "too much" is a function of distribution of wealth, not of tax rates. In reality, 98% of the population have a tax rate of 20% and the wealthiest 2% have a tax rate of 10.1%

For Boehm (and others) to make their case, they need to state, not what percentage of tax revenue comes from some category of taxpayer, but what their effective tax rate is.

Now this isn't a matter of politics but maths - the argument is hence irrefutable. It may be that the top 1% experience an effective rate of 30% when everyone else experiences a rate on average of 15%, in which case I would say they're overtaxed. Or they experience a rate of 10% when everyone else experiences 15%, in which case they'd be undertaxed,

But until we see those data, we can't say one way or another. I suspect that the effective rate is low because the US tax code intentionally favours income received from capital over income from labour - a point Wozza Buffet has made over the years, But that may not be right. Regardless, until someone provides the effective rate, we can't judge. I would just like genuinely to know the truth of it. You shouldn't make policy based on arithmetical fallacies.

A lower rate on capital is set to incentivize the creation of capital. Otherwise, why take risks?

Is it the government's role to incentivise private investment?

Also, you're confusing the creation of capital with the investment of capital - or at least, eliding between them, and you take risks because you think the returns will be higher than the risk-free rate, not generally because of tax policy.

It certainly isn’t the role of government to punish the successful.

Would it be punishment of the successful to make capital gains taxes the same rate as other forms of income? Or would it just be removing a privilege? To sound like a broken record, is it really better for everyone to tax capital gains at a lower rate than other kinds of income, particularly the income from labor that the vast majority of people rely on? Or is it just a give away?

Short-term capital gains are taxed at the same rate as ordinary income.

People with incomes less than $78K pay 0% on long-term capital gains. People with incomes less than $488K pay 15%, and incomes above $488K pay 20% on long-term capital gains.

There is also a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI).

There are special rules for certain types of capital gains. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent. Up to $250,000 ($500,000 for married couples) of capital gains from the sale of principal residences is tax-free if taxpayers meet certain conditions, including having lived in the house for at least 2 of the previous 5 years.

Why a lower rate for capital gains?

TaxFoundation.org:

The justification for a lower tax rate on capital gains relative to ordinary income is threefold: it is not indexed for inflation, it is a double tax, and it encourages present consumption over future consumption.

First, the tax is not adjusted for inflation, so any appreciation of assets is taxed at the nominal instead of the real value. This means investors must pay tax not only on the real return but also on the inflation created by the Federal Reserve.

Second, the capital gains tax is merely part of a long line of federal taxation of the same dollar of income. Wages are first taxed by payroll and personal income taxes, then again by the corporate income tax if one chooses to invest in corporate equities, and then again when those investments pay off in the form of dividends and capital gains. This puts corporations at a disadvantage relative to pass through business entities, whose owners pay personal income tax on distributed profits, instead of taxes on corporate income, capital gains, and dividends. One way corporations mitigate this excessive taxation is through debt rather than equity financing, since interest is deductible. This creates perverse incentives to over leverage, contributing to the boom and bust cycle.

Finally, a capital gains tax, like nearly all of the federal tax code, is a tax on future consumption. Future personal consumption, in the form of savings, is taxed, while present consumption is not. By favoring present over future consumption, savings are discouraged, which decreases future available capital and lowers long term growth.

This all sounds plausible, but until there is data to show that it really works out that way in the real world, it is all hypotheses.

Wages are first taxed by payroll and personal income taxes, then again by the corporate income tax if one chooses to invest in corporate equities, and then again when those investments pay off in the form of dividends and capital gains.

Aren't wages also taxed again by sales tax when they are spent? Or property tax if you use it to pay a mortgage on a house you bought? Or gas tax when you fill up your car at the gas station?

Follow the path of money, and it gets taxed again and again at many, if not most, of the transactions that occur.

My question is centered around how I can know that an argument like this is true, and that it isn't something that people come up with when they have an ideological or personal interest in a particular tax policy outcome. I figure that it would be fairly likely that I could find similarly plausible sounding arguments from left-leaning think tanks in favor of what they think we should be doing. How do I know who is right, when I don't have the expertise in economics to know for myself or the time to study and evaluate the arguments of both sides? Especially when I have my own political biases to deal with, not just those of the people making those arguments.

Urban Institute:

Economic issues in capital gains taxation

Inflation

Taxing nominal gains raises the effective tax rate on real capital gains and can lead to imposition of a tax in cases of real economic losses. Several studies have shown that a large percentage of reported capital gains reflect the effects of inflation, with the capital gains of lower- and middle-income taxpayers commonly representing nominal gains but real economic losses. The indexing of the cost or basis of an asset has frequently been proposed to correct for inflation.

Deferral

From the standpoint of economic accretion, the deferral of capital gains taxes until realization reduces the present value of the tax, thereby reducing the effective tax rate below the statutory tax rate. (The combination of deferral and inflation can produce effective tax rates much higher or lower than the statutory tax rates.)

Lock-in effects

Because capital gains are taxed only when realized, high capital gains tax rates discourage the realization of capital gains and encourage the realization of capital losses. Investors induced to hold appreciated assets because of capital gains tax when they would otherwise sell are said to be "locked in." Lock-in effects impose efficiency losses when investors are induced to hold suboptimal portfolios with inappropriate risk or diversification, or forgo investment opportunities that may offer higher expected pretax returns. Investors with appreciated property may also incur unnecessary transaction costs to avoid capital gains taxes if they obtain cash from their investment by using it as security for a loan, or reduce their risk by selling short an equivalent asset (short against the box). The financial incentive to be locked in is greater for long-held, highly appreciated assets and is increased by the step-up in basis at death.

Behavioral responses and revenues

Behavioral responses associated with capital gains tax rates are complex. In the absence of tax law changes, transitory fluctuations in income and tax rates may induce taxpayers to accelerate or defer realizations of gains. Similarly, taxpayers time realizations to take advantage of differential tax rates on short- and long-term gains. Statutory changes in tax rates are likely to result in short-run and long-run responses. Taxpayers may initially react to a cut in the capital gains tax rate by unlocking significant amounts of accumulated capital gains (such as the 49% increase in long-term gains after the 1978 capital gains tax reduction). The long-run response, which is generally thought to be smaller, would include higher realizations from more rapid turnover, from sales of more long-held assets, and from sales of assets that would otherwise be held for life or given to charity. Responses to increased tax rates are not necessarily symmetric as there is little inducement for a large short-run response, and taxpayers may gradually reduce realizations as they adjust portfolios and learn avoidance methods in response to the higher tax rates (such as seemed to occur after rate increases in the 1970s and after the 1986 Tax Reform Act).

You answer some of my concerns just by referencing a left-leaning outfit I recognize. And it does make sense to this person that never studied economics past a semester course in high school. (I like physics much more. I can actually see the results of controlled experiments to test the relationships between variables.)

Even if tax rates can be well justified as being lower for (long term) capital gains, I would also wonder about the complexity of the tax code and how it can be manipulated to reduce tax liability in ways that aren't economically efficient.

Democrats believe it is. Many, many of them have told me that over the years.

Why try to earn more income from labor if it is taxed at a higher rate than capital gains? Why doesn't everyone just become an investor?

This is a silly argument. The idea that you need to tax capital gains (and dividends) at a lower rate in order to incentivize people to invest their capital is not the kind of argument you can just throw out there as if it is a self-evident principle. You need to show that the lower tax rate on capital actually produces the benefit you say it will. And that the benefit is worth the loss in revenue to pay for government services that voters want.

And just to be clear, I'm not talking about a lower tax rate in a general sense, but why capital gains taxes should be a lower rate than ordinary income taxes. In other words, why should investing capital get tax preferences over labor?

You just ignored all the information that shows that capital gains is taxed twice huh? Once when the dollar is earned, which you use to buy the investment. Once when you sell.

Again, investing is a risk. You can lower the risk by choosing good companies. Yes, the government will let you lower your taxable income by 3000 dollars for losses. What if I lose 50k? Do I get money back? I mean if I make a 50k gain I have to pay right? Or if I invest in a company that goes bankrupt, what then?

Do you go to work and work for a negative wage? You work 8 hrs and own the company 200 dollars?

You don’t look at risk at all in your narrow view of the world. You only see once side and can't see the bigger picture. No wonder you liked high school physics baby physics (Yes, I have a physics degree).

................Average Tax Rate

Top.1%..........26.0%

Top.5%..........22.4%

Top.10%.........20.3%

Top.25%.........17.1%

Top.50%.........14.8%

Bottom.50%...... 3.1%

All.Taxpayers...13.6%

Reply to Medulla Oblongata,

Average Total Federal Tax Rate (household, 2019) (income groups not broken down the same way as from your data; includes payroll taxes and excise taxes, for instance in addition to federal income taxes)

Top 1%……………………………………….……….30.2%

Next 4% (96th -99th percentiles)….……….24.4%

Next 5% (91-95th percentiles)………………22.1%

Top quintile (top 20%)…………………..………24.0%

Middle quintile……………………………..………13.3%

Lowest quintile……………………………………… 6.7%

All Taxpayers……………………………………..…19.4%

https://www.taxpolicycenter.org/statistics/historical-average-federal-tax-rates-all-households

"I suspect that the effective rate is low because the US tax code intentionally favours income received from capital over income from labour – a point Wozza Buffet has made over the years,"

Buffett a) pays himself a pittance salary, one that does even reach the maximum SS limits, and b) has donated a large chunk of his wealth to a charitable trust, which carries over to erase years of taxes on his income.

His salary is reported to be $100,000.

Forbes:

Buffett told [interviewer Charlie] Rose his 2010 adjusted gross income was $62 million. He implied that most income came from long-term capital gains and qualifying dividends currently taxed up to 15%. Only a small portion of his gross income – a few million dollars for Buffett – is ordinary income, like wages and interest income, taxed at higher ordinary income tax rates currently up to 35%.

Buffett [said] that he uses the maximum 30% charitable contribution deduction each year – for appreciated property – and he has a $10 billion carryover of charitable contributions for subsequent use too.

Buffett’s 30% charity tax deduction offsets his entire ordinary income, and next it offsets his lower long-term capital gains income. Hence, he pays approximately 15% long term capital gains tax rates only, and – as he likes to say – it’s a lower tax rate than others in his office pay.

At his income level the long term capital gains tax rate is most likely 20% not 15%.

Still it is less than the max 37% on earned income.

Forbes article was from 2012, when top capital gains rate was 15%.

Why is effective tax rate the correct thing to look at? If the millionaire in your scenario doesn't consume any more government services than anyone else (or at least doesn't at a rate proportional to his income), why wouldn't it be more fair for him to pay the lower rate? He's still subsidizing everyone else and paying far more in real terms.

Since both Biden and former President Donald Trump are steadfast in their refusal to touch Social Security benefits, hiking taxes is likely to be part of the preferred political solution.

Easy. Don't touch benefits. Just tax them at 115%.

The moral income tax rate is 0%.

The goverment does not own a portion of your labor.

The moral property tax rate is 0%.

99% of this tax discussion wouldn't exist if we lived in a *Real* USA defined by the US Constitution. There was a *real* USA once that was funded entirely with tariffs (ZERO domestic taxes).

But when the USA gets conquered by greedy criminals of a [Na]tional So[zi]alist ideology then the amount of 'armed-theft' grows and grows until the greedy Nazi's start killing their own in their zero-sum resources environment they created.

There was a *real* USA once that was funded entirely with tariffs (ZERO domestic taxes).

You really need to think about how tariffs actually work and who pays them if you think that they aren't "domestic taxes."

Good grief. They aren't "domestic taxes" you BS propagandist. Only those who CHOSE to buy/deal globally pay them. As-if everyone including you didn't know that.

The exact same people who deal in a market that literally utilizes by-far the most part of a national defense. Heaven-forbid those causing a required defense actually be asked to pay for it. /s

Only those who CHOSE to buy/deal globally pay them. As-if everyone including you didn’t know that.

That's right. If you buy anything that is imported and subject to a tariff, you are indirectly paying that tax. The tax is actually paid directly by the business, in the U.S., that imported the product. Since the tax is not paid by any entity outside of the U.S., how is that not a "domestic" tax? You'll need to define what you mean by a domestic tax, I think. The only thing that I could think of that would not be a domestic tax, under a definition that would make sense with the word choice, is taxes paid by U.S. citizens or corporations on income they earn outside of the U.S. and then bring back to the U.S.

In this day and age, you simply cannot avoid buying imported goods entirely. Even things "Made in the U.S.A." are likely made with at least some materials or parts that are imported.

Tariffs are not an ideal tax for raising revenue. They are mainly to try to allow domestic production to compete with things produced more cheaply in other countries. In other words, protectionism. Sometimes, that is good policy, as we may want to ensure that we have domestic production capability in some industry, even if those goods would be cheaper elsewhere, so that we aren't harmed due to international politics, natural disasters where those goods are made in other nations, or other disruptions to the supply chain. Other times, the tariffs are just there to protect a domestic industry with political clout.

"That’s right." - correct.

"Tariffs are not an ideal tax for raising revenue." - why?

"They are mainly to try to allow domestic production to compete" - due to their obvious disadvantage of being taxed at 50%+.

BTW, this pile of lefty shit is down with cops murdering unarmed protesters, since they might later do something the asshole doesn't like:

JasonT20

February.6.2022 at 6:02 pm

“How many officers were there to stop Ashlee Babbitt and the dozens of people behind her from getting into the legislative chamber to do who knows what?...”

Get fucked with a running, rusty chain saw, you pathetic piece of shit.

Hey, Eric! Who did you vote for? Are you beginning to realize the pernicious effects of assholes like you voting your TDS?

Fuck off and die.