Review: Henry George's Many Children

The 19th century reformer's influence on 20th century progressives, conservatives, and libertarians

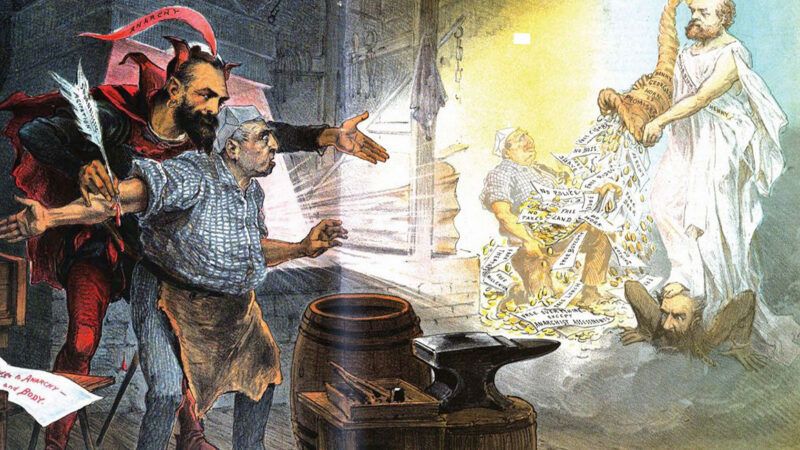

Henry George, a 19th century reformer who famously favored an end to all taxes except a levy on land, believed his system would allow us to "approach" the "abolition of government" as a coercive force. He also wrote that his single tax could fund various public services, transforming the state into "a great co-operative society." Depending on which way you tilt your head, he can sound like he's either almost an anarchist or almost a social democrat.

In Land and Liberty, the Georgetown University historian Christopher William England shows that both sides of George's thinking bore fruit after his death.

In the early 20th century, George's followers found homes in a host of progressive reform movements and progressive-run governments. But other followers—sometimes the same followers—helped create contemporary libertarianism. (Some even had a hand in contemporary conservatism: He kept it low-key, but National Review founder Bill Buckley was a George fan.) By the time the New Deal arrived, Georgists sometimes found themselves lining up on opposite sides of the era's debates.

Perhaps because he is so hard to classify, George is often misremembered as a momentarily popular radical of the Gilded Age, his influence on later movements forgotten. England restores him to his place in political history, both in the U.S. and abroad. (George's international fans stretched from Cuba's José Martí to China's Sun Yat-sen—figures later honored in name but not in spirit by Fidel Castro and Mao Zedong.) And while England mostly traces George's influence on modern liberalism, he does not ignore Georgism's libertarian current. As he notes, even progressive-minded Georgists often clashed with actual Progressives: While the "dominant strands of Progressivism are now seen as opposed to individualism," most Georgists "were classically liberal, individualistic, and even libertarian on questions like vice enforcement and regulation."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

By George, I do believe that a simple one-tax-only system might work! However, not on land... On EVIL! Evil, and evil alone, should be taxed extremely heavily!

The problem with the Single Tax is... it's a taxation. And taxation is government extracting wealth from the people.

So it doesn't matter if it's an income tax, or a sales tax, or a land tax, it's still a tax and to use a libertard phrase, still "theft". Expropriation of wealth.

Of course, some forms of taxation maybe less onerous than others, due to the inherent incentives involves. But a Single Tax is still taxation and thus theft.

The core problem with the Georgist Land Value Tax is the hordes of assessors trying to value parcels without their improvements but taking into consideration all the nearby improvements which increase other parcel values. And then adjudicating all the inevitable disputes about what "nearby" means. It's a burrocrat's wet dream.

There is indeed that problem too. And the administrative expense of the assessors and the assessment appeals process would add to what the "Single Tax" would have to support.

It does matter what kind of tax it is. My opinion is that anyone who thinks we can have government without taxation is fooling themselves. Anyone who thinks we can do totally without any government at all is fooling themselves. The only fair tax system is a flat tax – AKA “poll tax” – which is extremely unlikely to be approved in this day and age. The next least unfair system is a straight percent of income tax – i.e. no deductions or loopholes and no tax "brackets" – with the more complex and expensive bureaucracy that entails. Government does not “extract” wealth (and not all taxation is theft) if the taxpayers generally pay the tax willingly because they see the common good done for them and everyone else equally, they believe their contribution is fair and only going to pay for what they overwhelmingly believe is necessary without excessive waste. In that situation very few people get away with not contributing or benefiting without paying their share.

Government could conceivably be funded by voluntary premiums, but to do that sustainably, Government would have to be pared down to it's sole legitimate functions of Police, Courts, and National Defense/Border Patrol.

Another long distance dream goal for Libertarians, I grant you, but at least it's not fraught with all the problems of a "Single Tsx."

taxation is government extracting wealth from the people.

Land value is not created by you. You have title to that land. The cost of that grant of and continuing enforcement of title is - a land value tax. And that, according to George, should be the ENTIRE extent of taxation. No taxes on the improvement. No tax on whatever you create or profit from with the use of that title. It is not theft of wealth. It is payment for services rendered to the land owner with title.

There is nothing original about that. Smith and Ricardo and the Physiocrats said similar stuff. Everyone from Locke to anarchists understood land. It is we who no longer understand what land really is.

Indeed.

What would make it worse is if governments instituted this “Single Tax” while also keeping the Welfare State “safety net.” As the “safety net” incompasses more and more “basic needs” and becomes a “hammock” and increases in price and as the safety net incompasses more administrative expenses, eventually, the “Single Tax” would eventually not be enough and would be followed by an increase in either land evaluations or rates or both.

Also, so far, everything that humans use to survive and prosper ultimately comes from the Earth. Thus, a so-called “Single Tax” on land is ultimately a tax on everything on Earth. And were we to master interplanetary travel, settle other worlds, and again implement this “Single Tax,” the end results would be the same.

A Single Tax is one tax too many. 🙂

Once again labels serve to obfuscate rather than enlighten. Calling a policy "progressive" doesn't mean that it leads to progress. The only thing anyone can plausibly claim as an advantage for single-taxes is that single-tax systems simplify and make more predictable for the taxpayers and the central-planners what the costs and the funds available for government spending will be; and, probably, reduce the overhead costs for determining what is due and verifying compliance. It says nothing about the context (what percent of GDP taxation burden represents, for example) or what the tax revenues are spent on (pork or the general welfare or defense, for example.) It also might make it easier for the taxpayers to KNOW what the burden upon themselves is and object accordingly when politicians start to get too greedy, compared to more "progressive" tax systems that hide the burden behind mumbo-jumbo.

Thomas Paine makes the argument for a land tax well before George.

He analyzes the implications of the violation of the Lockean Proviso in Agrarian Justice:

It is a position not to be controverted that the earth, in its natural, cultivated state was, and ever would have continued to be, the common property of the human race. In that state every man would have been born to property. He would have been a joint life proprietor with rest in the property of the soil, and in all its natural productions, vegetable and animal.

But the earth in its natural state, as before said, is capable of supporting but a small number of inhabitants compared with what it is capable of doing in a cultivated state. And as it is impossible to separate the improvement made by cultivation from the earth itself, upon which that improvement is made, the idea of landed property arose from that parable connection; but it is nevertheless true, that it is the value of the improvement, only, and not the earth itself, that is individual property.

Every proprietor, therefore, of cultivated lands, owes to the community a ground-rent (for I know of no better term to express the idea) for the land which he holds; and it is from this ground-rent that the fund proposed in this plan is to issue.

From Wikipedia on the small city of Fairhope, Alabama: “Fairhope was founded in November 1894 on the site of the former Alabama City as a Georgist ‘Single-Tax’ colony by the Fairhope Industrial Association….”

Henry George lives! I visited the offices of the Fairhope Single Tax Corporation a few years ago and found copies of Progress and Poverty and handouts explaining Georgism and its relationship to Fairhope.