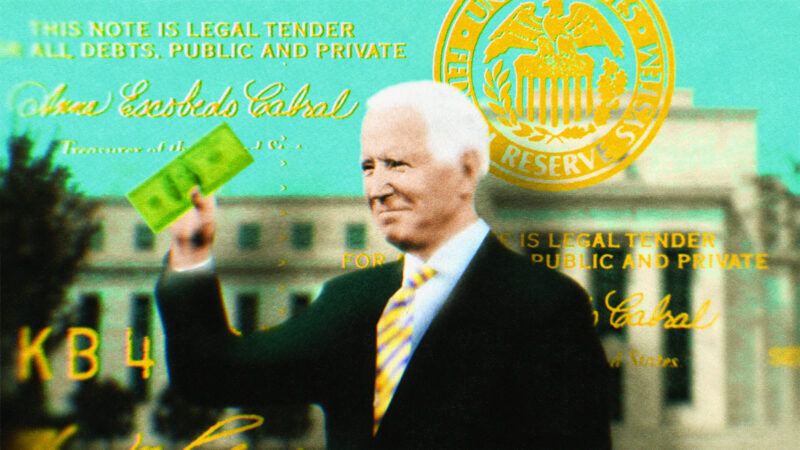

Biden Promises To Let Social Security's Ship Keep Sinking

Biden vowed to block any attempts to cut Social Security benefits, and Republicans made it clear that they have little appetite to try it.

President Joe Biden vowed Tuesday to keep Social Security and Medicare on their current course toward insolvency, promising to block any congressional attempts to reduce benefits in the two major entitlement programs.

And Republicans loudly agreed.

"If anyone tries to cut Social Security," Biden said during the State of the Union address, "if anyone tries to cut Medicare, I will stop them. I will veto it."

Except, well, it's not clear that anyone is trying to cut them. Republican leaders have also said they won't consider cuts to Social Security or Medicare as part of the upcoming debt ceiling negotiations—something Biden acknowledged after Republican members of Congress loudly protested his characterization of their plans during the speech. "Apparently, it's not going to be a problem," he declared.

But there is a problem. Social Security will be insolvent by 2034. One of the trust funds for Medicare will be insolvent even sooner. When insolvency hits, both programs will be subject to mandatory benefit cuts. The exact size of the cuts will depend on payroll tax collections in that year, but the current estimate is that Social Security will be able to pay only 80 percent of promised benefits in 2034.

As I wrote last month, when Republicans such as former President Donald Trump were making similar vows not to cut Social Security benefits: Promising to do nothing amounts to promising a roughly 20 percent benefit cut in a little more than a decade. There is no getting around that fact.

What you saw during Tuesday night's speech was a bipartisan suicide pact.

Biden's solution seems to be "make the wealthy and big corporations pay their fair share," but it's unclear what that means, since entitlement programs are funded with payroll taxes—paid by workers and employers—and not by the federal income tax. Biden is set to outline a fiscal plan next month. We may get more details then on how exactly the White House plans to deal with the entitlement crisis.

Even so, the State of the Union address would be a good time for that sort of thing. Oh well.

"Social Security and Medicare are a lifeline for millions of seniors," Biden said. "Americans have been paying into them with every single paycheck since they started working. So tonight, let's all agree to stand up for seniors."

Standing up for seniors (and everyone else who has been paying into Social Security and Medicare for their entire working lives) requires acknowledging that there is no reality in which the politicians do nothing and the entitlement programs continue functioning normally. The choice is between making changes now or accepting mandatory cuts in about a decade.

The clock is ticking, but Biden didn't give any indication Tuesday night that he's paying attention to it. And the Republicans' vociferous reaction to his remarks suggest that they're not serious about it either.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

🙂 AND GOOD LUCK. 🙂

Here is I started.……......>> http://WWW.SALARYBEZ.COM

Then you don't need Social Security so you can leave us alone and go spam another article.

The function of government is to defend liberty anything more is tyranny.

I get paid over 190$ per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless. Heres what I’ve been doing..

HERE====)> http://WWW.NETPAYFAST.COM

And the tyranny won't be going away any time soon, so they need to figure out how to fund it.

What you saw during Tuesday night’s speech was a bipartisan suicide pact.

While I would enjoy the House and Senate reenacting the Jonestown massacre, they keep letting me down.

+++ LOVE IT!!

Covid 24 will take care of the Social Security problem.

Shirley, you mean Covid 34.

That's not very fucking funny.

Lighten up, Francis.

Love it! I'd give you a thumbs up if there was one.

Collectivism fails. Grandma, hope you treated your kids well because you may need to move in with them after this implodes.

The Canadians have the final solution.

Canadian bacon is people!

For some reason folks assume that "paying their fair share" always means that the wealthy and corporations should pay more in income taxes. This may or may not be true, but this assumption overlooks the fact Social Security and Medicare are funded with payroll taxes, not income taxes. Currently, employees pay combined Social Security and Medicare payroll taxes at a rate of 7.65 percent. Their employers contribute a matching amount. But their are regressive income limits built in to this arrangement. Currently (2022), anyone earning more than about $147,000 per year do not make any contributions to Social Security at all. For Medicare anyone earning more than $200,000 per year pays at a rate of only 0.9 percent instead of the 1.45 percent paid by everyone else. So, one way of improving (to some extent) the overall outlook for Social Security and Medicare would be to have everybody paying the same rates in payroll taxes regardless of income. This would have an additional benefit of making payroll taxes at least somewhat less regressive. That's assuming of course that enough people care whether taxes in principle ought to be fair. Many people (the 90 percenters perhaps) believe that taxes should be progressive, while others (the 10 percenters perhaps) should be flat, regressive, or nonexistent.

FWIW SS is also regressive owing to the difference in life expectancy on retirement.

It's a wealth transfer from young black men to old white women.

"It’s a wealth transfer from young black men to old white women."

Oh lord, not funny. But more than a little truth to it. As late as 1970, the life expectancy for Black men was 64.1 years. It's also true that when SS was implemented, the retirement age was 65, and life expectancy for women was 64, and for men, 60.

Funny how that works.

●US Dollar Rain Earns upto $550 to $750 per day by google fantastic job oppertunity provide for our community pepoles who,s already using facebook to earn money 85000$ every month and more through facebook and google new project to create money at home withen few hours.Everybody can get this job now and start earning online by just open this link and then go through instructions to get started..........

See this article for more information————————>>>http://WWW.DAILYPRO7.COM

If you look at the difference in ROI between minimum wage workers and minimum social security payments and max-out workers and maximum SS payments, the ROI social security payments is already damn progressive. The only thing that would make it more progressively is making "recipients" with a net worth above some arbitrary threshold completely ineligible for Social Security payments. And I suspect someone has that notion in the back of their minds already.

Taxation is robbery.

I'd argue that it is slavery - Not being compensated for the fruits of your labor. Luckily, we're "only" around 50% slaves (sigh).

Bolded is false; they just don't pay on the amount above $147,000.

Whether the second is false, I do not know, but it looks like you've made the same mistake.

The pay out is capped as well. So it doesn't fucking matter pay in is capped. The equation used to determine payout is also biased against top wage earners, earning less per dollar of pay in. SS is progressive wealth transfer.

Some folks will have madoff better than others.

Yes, both figures are one rate to a cap then a different marginal rate beyond that cap.

Yes, the second is false as well. It's actually that those with income over $200K ($250K joint, and not adjusted for inflation) pay an *additional* 0.9% on top of the 1.45% of their own (plus 1.45% from their employer, or 2.9% overall for the self-employed). Documentation: https://www.irs.gov/businesses/small-businesses-self-employed/questions-and-answers-for-the-additional-medicare-tax

Also, benefits are based on the contributions, so if the cap on annual taxable amounts is raised (which jumped to $160,200 for 2023, thanks to inflation) then their benefits payout would increase accordingly as well. I'm sure that would cause even more screaming when those who are taxed on more of their income start getting substantially larger benefits checks commensurate with the amount stolen from them to fund the program.

That’s b.s. People making more than $147k make the maximum contributions to Social Security.

Contributions are capped because benefits are capped.

"Currently (2022), anyone earning more than about $147,000 per year do not make any contributions to Social Security at all. For Medicare anyone earning more than $200,000 per year pays at a rate of only 0.9 percent instead of the 1.45 percent paid by everyone else."

Utter lies.

Anyone making more than $147,000 per year pays full SS rates on the $147,000. Then, having paid the maximum required by law ($9114.00), they pay no ADDITIONAL taxes. This is at least partly because the benefits are similarly capped. SS pays out based on a formula consider your previous employment income, with a maximum payout that is based on the $147,000 income cap. So someone earning $147k and someone earning $2M both pay the same amount of SS taxes and are eligible for the same amount of SS benefits.

The Medicare taxes are paid in full up to the limit, then at a reduced rate after that, and even then there's the Medicare surcharge on capital gains.

The Medicare surcharge is on more than just cap gains.

Agree. There are no limits on the amount of earned income subject to the Medicare tax.

Daddyhill needs to rent a good brain before he posts. Contrary to his rant, the actual facts are 1) people making more than $147K ($160K for 2023) pay full SS taxes on income up to this limit but none on income above this limit. 2) People making more than $200K pay an additional 0.9% Medicare tax on income above this limit, in addition to the 1.45% everyone else pays.

Little understood fact: FICA does not fund Social Security.

The federal government is Monetarily Sovereign. It has the unlimited ability to create dollars.

ALL federal spending is funded by bew dollar creation, not by taxes. Even if all federal taxes ended, the government could continue to spend, forever. Your federal taxes (M2) are destroyed upon receipt.

The true purpose of federal taxes is to control the economy by taxing what the government wishes to discourage and by giving tax breaks to the rich.

Increase legal immigration for people under say 40, but change SS payouts for immigrants and refresh SS from the payroll taxes they pay.

One of the issues of SS is the demographics. You can to an extent fix the demographics by letting younger people immigrate.

Give everyone their contribution back adjusted for inflation and close the program down.

I downloaded Dow Jones and S&P 500 yearly gains from slickcharts.com, ran them and my SSA deductions since the beginning through a calculator, assuming no taxes and blindly following the indices. If I withdrew 5% a year from those funds right now, the DJIA withdrawal would be 3 times SSA and the S&P 500 would be 7 times as high. It was an interesting exercise.

It's no wonder there was such a shitfit about how dangerous it would be when Bush proposed allowing people to invest some instead of leaving it in the trust fund. We can't have people actually making money instead of letting the government take it then spend it responsibly!

Seriously, I don't remember the whole plan or know what was good or bad, but the most specious of all arguments was how dangerous it would be to put retirement in the market. A simple total market index fund, over the working life of an average adult, would be pulling 8% or more. Way more if it was the S&P fund. As long as it's long term, you win. Maybe you ate shit in 2008, but then it goes gangbusters in 2013... If you're retiring in 2035 who cares about the hills and valleys along the way?

Bush's privatization was anything but. He basically let people gamble their retirement money in a speculative industry propped up largely by the government. Historically the stock market (I am using the term loosely) has done well over multiple decades, but if things keep going in the same direction, the US may end up in a Venezuela (worst case) or Argentina type of scenario.

I am making $92 an hour working from home. I never imagined that it was honest to goodness yet my closest companion is earning $16,000 a month by working on a laptop, that was truly astounding for me, she prescribed for me to attempt it simply. Everybody must try this job now by just using

this website....... http://www.jobsrevenue.com

i did the same math. if i had saved & invested my contributions instead of having then stolen by gov, my money would be worth north of a million dollars. and i would own an asset that i can leave to my heirs.

There are no "contributions". There are no accounts. There is no "my money" anywhere. SS is and always has been a payroll-tax that funds current benefits.

And occasionally a free money jar whenever politicians decide a particular piece of spending is rather important.

Social security is a Ponzi scheme that is dependent on an ever increasing population. Since Americans (especially working Americans) aren’t reproducing enough to grow the population, mass legal immigration is the only thing that can postpone the collapse. racism If my kids won’t pay for me when I’m old, maybe Juanita and Arturo will. /racism

this is 100% true.

Ponzi schemes just need more idiots to join to survive. Great analysis shrike.

There are at least half a dozen measures, taken in various combinations and proportions, that would keep SS and Medicare solvent. The trouble is AARP and various other groups would make sure any politician voting for them would never serve again. You can say, "Well, you might not get re-elected but you should have the courage to do what is right." Which overlooks the fact that the new Congress coming in would throw out all the changes the courageous folks made.

AARP can kiss my ass. Look at their board of directors; not a single one of them represents my grandmother. They're all rich, barely qualify to be in AARP, and mostly white. And they're all lefties.

Nah, people get the government they deserve. If a politician knows the electorate is so dumb that it will vote out any politician taking steps to make SS self-sustaining, then no thinking, honorable politician is going to take such steps. After all, an honorable politician, once bought, stays bought (and obedient). And if you know people for whom you are attempting to save their dumb asses are guaranteed to set their dogs upon you as a reward for your efforts, why bother? Just stay close to the trough and keep your snout in it - deep. The dumb-asses out there in flyover land will get what they justly deserve.

ChatGPT, write me a column in the Reason Magazine style, include "BOTH SIDES!" and then shift the blame to the Republicans:

"President Joe Biden vowed... to block any congressional attempts to reduce benefits in the two major entitlement programs.

And Republicans loudly agreed...

Republicans such as former President Donald Trump were making similar vows... There is no getting around that fact."

Perfect.

Can we take a step back and recognize how absolutely Orwellian the term "Social Security" is? If one were honest, what would we name this program?

Ponzi Pensions.

Slavery

Mandatory Campaign Fund

The Franklin D. Roosevelt Law For People Who Can't Save Good And Want To Retire Good Anyway

As I've said here before, this is what is going to happen: SS will be scrapped and replaced with a means-tested welfare program for the elderly. No one in Congress will talk about this publicly until it happens. Affluent people who have paid in will get screwed.

Affluent people don’t get screwed.

Being forced to pay into something that knowingly has a bad return is getting screwed.

Many will get no return.

As others have said,putting the money into an s and P index fund over your working lifetime would earn way more than you would get in social security payments.

As it is now, there will be a 20% cut in 2025.

The best strategy is to do nothing

My analysis is that defined benefits (in SS and Medicare) don't match up with defined contributions. If the ~15% contribution was doubled (I am too lazy to do the math) there would be no problem with the defined benefits.

The stock market over the historical long run has paid around 8% but that is not a defined benefit and could be more or less than 8%.

Point is there is no way to assure a defined benefit without a realistic defined contribution but there is no way Congress will raise the contribution.

Stop using pension terms to describe SS.

SS is a transfer payment funded through payroll taxes.

There are no accounts. There is no investment. There is no interest or rate-of-return. "Your money" doesn't exist once it is taxed away to be spent on current payees.

When insolvency hits, both programs will be subject to mandatory benefit cuts.

Why cut now if the system will cut itself later and with no personal responsibility?

First, "entitlement programs" are, by definition, "a government program that guarantees certain benefits to a particular group or segment of the population." Thus, SS is an entitlement program...except that the word guarantee must be understood in context. As a law, like any other law, SS can be modified or eliminated by Congress. Should that unlikely event come to pass, the Supreme Court has already held that you have no "right" to your SS benefits (see Flemming v Nestor: "Ephram Nestor [was deported from the US and denied SS benefits and he] argued that a contract existed between himself and the United States government, since he had paid into the system for 19 years. The Court ruled that no such contract exists, and that there is no contractual right to receive Social Security payments. Payments due under Social Security are not “property” rights...").

Second, due to the way SS is constructed, current SS taxes are used to pay for current beneficiaries as they are collected. "Your money" was already spent. When you become eligible for SS, you are not getting back "your money", but rather you are getting paid from the taxes collected from the younger people who are still working and paying the tax. Meanwhile, everyone is just hoping that they live long enough to collect and that the program doesn't collapse under the weight of its Ponzi Scheme mechanisms (see Social Security: The Most Successful Ponzi Scheme in History) "Social Security is exactly what it claims to be: A mandatory transfer payment system under which current workers are taxed on their incomes to pay benefits, with no promises of huge returns. By design, that means a certain amount of wealth transfer, with richer workers subsidizing poorer ones. That might rankle, but it's not fraud." The fact-checkers dodge the Ponzi Scheme label by semantics, but they cannot dispute the fact that in 1945, there were almost 42 workers paying in to SS, while today there are 2.9 and dropping (projections by 2030, there will be only 2.0). The average SS check is $1,373.81 (2016), which at today's combined 12.4% SS tax rate requires the 2.9 workers to make a combined $132,949.35 annually.

Third, in most cases, people get more from Social Security and Medicare combined than they put in, though the specific amount can vary depending on income and family circumstances. For example: "For an average-wage-earning, two-income couple turning 65 in 2010, the pay-in, pay-out ratio for Social Security by itself will actually be slightly negative —- the couple will have paid $600,000 in lifetime Social Security taxes and will receive only $579,000 in lifetime Social Security benefits. (Remember, the couple didn’t literally pay out $600,000; that’s the current value of what they paid out over the years, plus an additional 2 percent they may have gotten had it been invested.) And even so, the Social Security shortfall will be more than evened out by the extra dollars the couple gets back from Medicare. The couple will have paid $122,000 in Medicare taxes but will receive $387,000 in benefits — more than three times what they paid in." "Knowing that the average senior gets $3 in Medicare benefits for every dollar in payroll taxes does not point the way to any specific solution. " Even considering the (false) notion that you are at least initially getting back what you paid in, after that, you're getting direct payments of cash from federal taxpayers...we generally call that "welfare".

Another "welfare" turn, "[The Tax Policy Center] estimates that about one-third of workers who pay no federal income tax get net refundable credits that fully cover their payroll taxes, including their employer’s share." About 45% of workers pay no federal income taxes, so about 10-15% of workers will eventually be able to claim SS benefits without paying into SS.

in your third case you fail to account for opportunity cost that we lose when the gov steals my money for ss. so saying that most people take out more than they give in is misleading. if that same amount was invested in an index fund over the person's lifetime they would have much, much more. the government's poor management of my money does not change the fact.

I calculated that once about 10 years ago. I could have an annuity payment that is about 2X my SS payment, and I could leave a balance to my heirs too.

After moaning about "socialism" for decades, Republicans defend it en masse when called out by old guy.

People keep pretending that SS is some sort of retirement account.

Problem is, that's NOT how it was designed to work. It never was.

It was never "your money" being held in an account somewhere. You money was used to pay for people who were already retired. My money is playing for your retirement. There will be not enough money from future workers to pay for mine.

Think about it. At the time of SS creation, life-expectancy was 65. It's not a coincidence that SS age was set at 65--you were SUPPOSED to die without EVER getting any SS benefits. The money you paid in was AT BEST an insurance premium against the (unlikely) chance that you lived past 65. Plus, there were 300 active workers paying in for every 1 person drawing benefits (that quickly dropped down to about 45 per and steadily dropped). Now its down to close to 2 workers for each person receiving benefits.

What changed was better medicine and overall health allowing people to live well into their 80s. SS was not designed to support that sort of load.

It's almost as if it's called a "social insurance program" for a reason.

It's worse. Life expectancy at the time the program was implemented was 62.

There's a reason the proper acronym for the program is OASDI - Old Age Survivors and Disability Insurance. If it were the same model today with current life expectancy then it would be the same as longevity annuities that start paying out when the holder turns 80. Instead it's been determined by politicians to be a good source of votes, so they use it to buy votes with other people's money.

My prediction is that they'll wait for the trust funds to become insolvent, and then they'll make up that 20% by raiding the 401K's and IRA's of people who have tried to save for their retirement. The progressives have been lusting after people's retirement accounts for years, probably decades. They'll use the easily foreseeable "crisis" to finally get their wish while the Republicans fold like a cheap suit the first time they're accused of wanting to "kill grandma" at the first sign of even mild push back.

if the gov tried to take people's money from their 401k & IRAs that would absolutely be theft. those accounts are private property and the government has no hold on them. that would cause an armed populous to rise up and it would not end well.

Dream on.

it's also completely not practical. there would be some advanced notice that something like this was happening. everyone with a brain would simply move their money someplace safe. it simply wouldn't work.

it simply wouldn’t work.

When has that ever stopped them from trying shit before?

Why would they not take the money out of general revenue?

You mean just add it to the already massive pile of deficit spending and make the money printer go BRRRRR? I suppose that's a possibility too.

It’s what they’ll do. Creating big time inflation is the easiest course for politicians.

People who had the intelligence to save enough to worry about have the intelligence to be aware that the government lusts after that money and have made arrangements to withdraw it - all of it - and pay the taxes on it to make it theirs at the first whiff of that kind of move.

It’s not clear to me why we care if the Democrats and the Republicans let the Social Security (and Medicare) ships sink. The damage has already been done – long ago, in fact – and whether they cut benefits now in order let it sink more slowly; or wait a couple more decades until it becomes insolvent seems like a “Tweedle-Dum and Tweedle-dummer” choice to me. The only real solution for the younger generations would be to eliminate Social Security (and Medicare) and let them put their money into whatever retirement savings they choose (or not) and stop trying to pretend that “some people can’t afford healthcare (or healthcare insurance?)” or that some people can’t afford to retire. It should not be the government’s job to make people comfie, especially since government has proven undeniably that it is not good at it.

I believe they’re writing about this because they know that unrealized gains taxes are coming to pay for all of it, especially after the midterms.

Boehm....I am very disappointed. You could have taken some 'digital ink' to explain how benefits are calculated, the importance of AIME, how bend points come into play. You could have made this informational, and educational.

Alas, you didn't. A lost opportunity to inform, explain.

Get ready for unrealized gains tax at the state and federal level (in addition to property tax). Are democrats divided on this- ?

https://www.msn.com/en-us/news/politics/san-jose-assemblyman-proposes-state-wealth-tax-ahead-of-sotu/ar-AA17ea9W

offshore accounts & hidden investments will become very popular

It sounds like an excellent idea, lacking one detail - how will "unrealized losses" be dealt with on a tax basis?

"...since entitlement programs are funded with payroll taxes—paid by workers and employers—and not by the federal income tax."

Stay tuned...

" ... insolvent ..."

This piece perpetuates the "trust fund" illusion. Why?

Why pretend the 'trust funds' are anything other than a balance sheet trick, a meaningless IOU. FedGov is strictly all cash in, all cash out of the same Treasury.

The worst is the affirmation that a certain type of tax funds a certain type of distribution. Well then, why does the "debt ceiling" crisis" threaten to stop SS payments? The FUND is not yet bankrupt, right? SS can just be paid from the enormous separate and sanctified checking account into which the payroll tax was collected. Right?

One word: fungible. Get it. Admit it.

FedGov spends

76% on Social Services,

10% on interest and general operations, and

14% on Defense of the Nation.

The only thing protecting your SS check is the "third rail" terrorism; Gov will never miss a SS check. Never.

The Republicans have openly stated they want to end it. By letting the liberals destroy it they win and Democrats lose. That's why they never said anything to stop all those disability lawyers from milking it for their fake disabled clients. Neither side is on our side.

Social Security is a Ponzi scheme. The only question is who will lose when it collapses.

Allowing doctors to form private equity businesses that are free to establish their own Medicare Advantage programs that essentially opt-out is a form of "cutting". Expanding the actual Medicare Advantage program to permit Medicare recipients to opt-out of original Medical is also a form of "cutting".

The Biden Administration has supported both.

I've been out of work for seven years since involuntary retirement. I've spent my IRA/401k down to a fraction it was to maximize my social security benefit. I recently started to get benefits at age 70. I made the bet that government would not ever fail to support it. If I lose that bet, I will accept it with mixed feelings. I never believed in the "wisdom" of FDR's program.

President Joe Biden vowed Tuesday to keep Social Security and Medicare on their current course toward insolvency, So Reason Blames Republicans!

The article is a wrong. Does anyone really believe the U.S. federal government can run short of its own sovereign currency, the U.S. dollar?

The government is Monetarily Sovereign. It has the infinite ability to create dollars. Even if the government didn't collect a penny in taxes, it could continue spending, forever.

The purpose of taxes is not to fund the government. The purpose is to control the economy by taxing what is to be discouraged and giving tax breaks to the rich.

The federal government's finances are unlike state/local government's finances. The federal government uniquely is Monetarily Sovereign, meaning it has the infinite ability to create dollars.

Your tax dollars are destroyed upon receipt. When you send your check to the Treasury, the dollars come from the M2 money supply.

When they reach the Treasury they no longer are part of any money supply measure. In short, your federal tax dollars are destroyed upon receipt.

Federal taxes do not fund federal spending.