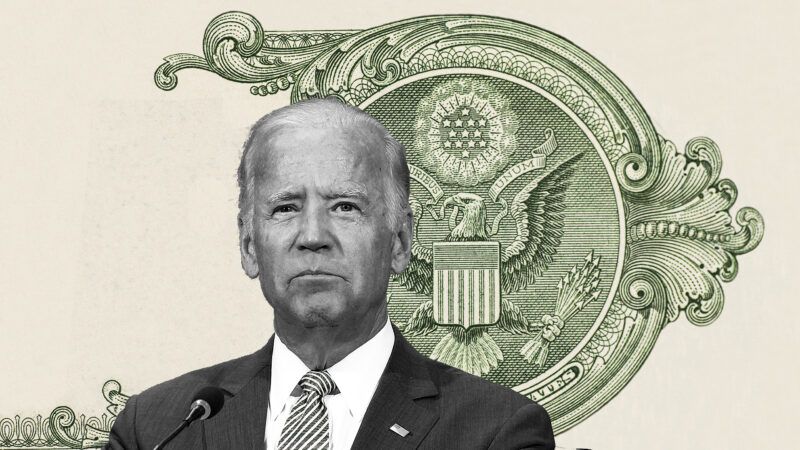

Does Joe Biden Know Why Delaware Is Home to So Many Corporations?

Delaware figures prominently in Biden's stump speeches for the Build Back Better plan, but he seems to deliberately ignore some key details.

President Joe Biden knows that his home state of Delaware is also home to more corporations than just about any other place on the planet—but he doesn't seem to know why.

Take, for example, what Biden said in a speech in Baltimore, Maryland, last month. Speaking just a few days after he'd signed the $1.2 trillion bipartisan infrastructure deal into law, Biden's November 10 appearance was mostly a victory lap, but the president used the occasion to rally support for the other half of his domestic policy agenda: Build Back Better. A crucial part of that massive spending package—which includes spending for child care, subsidies for electric vehicles, and a huge tax break for wealthy residents of high tax states—is a set of tax increases aimed at high-earning individuals and, importantly, corporations.

As Biden put it that day in Baltimore, Build Back Better was intended to "build an economy from the bottom up and the middle out…where everybody is better off."

"You know, I'm tired of this trickle-down economy stuff," the president continued. "I come from Delaware—just across the line up here—and, you know, we have more corporations in Delaware than every other state in the nation combined. And so, I understand big business."

There's just one tiny bit of context missing from Biden's argument: Delaware, which is home to more than half the businesses in the Fortune 500, didn't become America's top destination for corporate headquarters by raising taxes on the businesses that operate there. The state is famous for its favorable tax laws, including no sales tax, no corporate income tax on revenue earned outside of Delaware, and no corporate income tax on investment earnings. (It's not all about taxes; the state also has a unique legal system that confers some advantages on businesses headquartered there.)

Biden is trying to take the country in the opposite direction. Earlier versions of Build Back Better called for hiking the corporate tax rate to 28 percent (currently at 21 percent). That would have made American-based businesses subject to some of the highest taxes in the world. The most recent version of the proposal, however, ditched that tax hike in favor of a new 15 percent minimum tax on corporations that earn over $1 billion in annual profits—a tax that would have to be paid even if the corporation owed no federal income tax—and a new surtax on corporate stock buybacks. Those are two of the largest revenue-generating provisions in the proposal, estimated to suck about $500 billion out of the economy annually.

The president's attempt to appropriate Delaware low-tax success to push his own higher-tax agenda was not merely a rhetorical slip during that Baltimore speech. It has become a recurring bit in what's effectively Biden's stump speech for the Build Back Better plan.

Here's Biden during an October interview with CNN's Anderson Cooper: "You're in a circumstance where corporate America is not paying their fair share. And I come from the corporate state of the world: Delaware. More corporations in Delaware than every other state in the union combined."

And here he is during a speech at a tech school in Minnesota in late November: "More corporations are incorporated in Delaware than every other nation and every other—excuse me—state in the nation. And guess what? Fifty-five percent of the Fortune 500 companies—the largest ones—paid zero in income taxes last year after making $40 billion in profits."

And during a visit to a General Motors factory in Michigan earlier this month: "Well, I'll tell you what, real simple: I come from the corporate capital of the world. More corporations [are] incorporated in my state of Delaware than all states combined. And guess what? They ain't paying enough."

It's easy to eye-roll away Biden's deliberate misunderstanding of Delaware's corporate tax situation as just so much meaningless political bullshit—the equivalent of me claiming that, since I'm from Pennsylvania, I innately understand the economics of running a cheesesteak joint, while also proposing a new tax on Whiz and onions.

Still, Biden's repeated use of the Delaware example is telling in at least one way. It is a microcosm of the entire monthslong effort by the White House and its allies to push Build Back Better through Congress—and, more broadly, perhaps even a useful metaphor for Biden's first year in office as a whole.

This is the same administration that was warned by economists about how passing a massive stimulus bill would trigger inflation. They pushed for the bill anyway, and now inflation is here.

It's the same administration that, when faced with opposition from some Senate Democrats to borrowing and spending even more money, crafted a revised version of the Build Back Better plan that relied heavily on budget gimmicks to hide the true cost.

And it's the same administration that is continuing to ignore what economists say will be the long-term consequences of passing such a huge expansion of the federal welfare state: slower long-term growth, a reduction in average wealth, and ruinous amounts of debt.

In the Biden administration, it seems, economic reality is easily discarded when it gets in the way of a political agenda. But inaccurate, misleading arguments for major policy changes can only get you so far. Perhaps it's no wonder that Build Back Better seems stalled, at least for now.

But if Biden wanted to sincerely interrogate the question of why Delaware is home to so many corporations, he might find a few other useful lessons too. Being business-friendly has worked out pretty well for Biden's home state—one of the wealthiest in the country in terms of GDP per capita. And the gap between Delaware's richest and poorest residents is considerably smaller than the national average.

Biden might say he's tired of "this trickle-down economy stuff" but his home state actually provides pretty good evidence that lower taxes are a key to prosperity.

Show Comments (87)