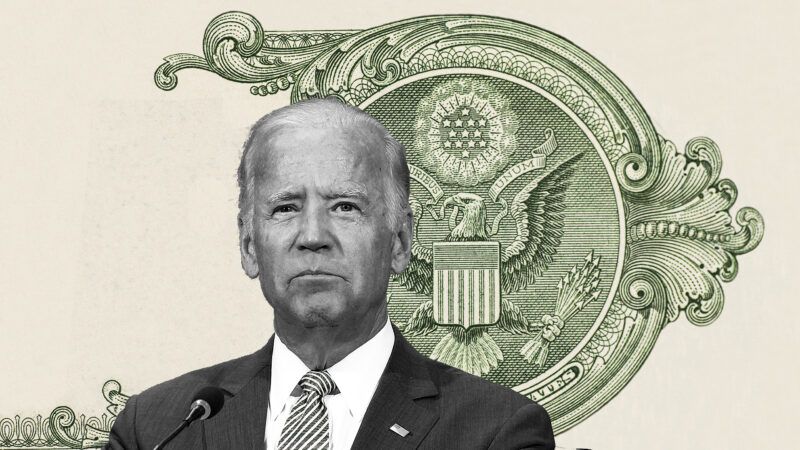

Does Joe Biden Know Why Delaware Is Home to So Many Corporations?

Delaware figures prominently in Biden's stump speeches for the Build Back Better plan, but he seems to deliberately ignore some key details.

President Joe Biden knows that his home state of Delaware is also home to more corporations than just about any other place on the planet—but he doesn't seem to know why.

Take, for example, what Biden said in a speech in Baltimore, Maryland, last month. Speaking just a few days after he'd signed the $1.2 trillion bipartisan infrastructure deal into law, Biden's November 10 appearance was mostly a victory lap, but the president used the occasion to rally support for the other half of his domestic policy agenda: Build Back Better. A crucial part of that massive spending package—which includes spending for child care, subsidies for electric vehicles, and a huge tax break for wealthy residents of high tax states—is a set of tax increases aimed at high-earning individuals and, importantly, corporations.

As Biden put it that day in Baltimore, Build Back Better was intended to "build an economy from the bottom up and the middle out…where everybody is better off."

"You know, I'm tired of this trickle-down economy stuff," the president continued. "I come from Delaware—just across the line up here—and, you know, we have more corporations in Delaware than every other state in the nation combined. And so, I understand big business."

There's just one tiny bit of context missing from Biden's argument: Delaware, which is home to more than half the businesses in the Fortune 500, didn't become America's top destination for corporate headquarters by raising taxes on the businesses that operate there. The state is famous for its favorable tax laws, including no sales tax, no corporate income tax on revenue earned outside of Delaware, and no corporate income tax on investment earnings. (It's not all about taxes; the state also has a unique legal system that confers some advantages on businesses headquartered there.)

Biden is trying to take the country in the opposite direction. Earlier versions of Build Back Better called for hiking the corporate tax rate to 28 percent (currently at 21 percent). That would have made American-based businesses subject to some of the highest taxes in the world. The most recent version of the proposal, however, ditched that tax hike in favor of a new 15 percent minimum tax on corporations that earn over $1 billion in annual profits—a tax that would have to be paid even if the corporation owed no federal income tax—and a new surtax on corporate stock buybacks. Those are two of the largest revenue-generating provisions in the proposal, estimated to suck about $500 billion out of the economy annually.

The president's attempt to appropriate Delaware low-tax success to push his own higher-tax agenda was not merely a rhetorical slip during that Baltimore speech. It has become a recurring bit in what's effectively Biden's stump speech for the Build Back Better plan.

Here's Biden during an October interview with CNN's Anderson Cooper: "You're in a circumstance where corporate America is not paying their fair share. And I come from the corporate state of the world: Delaware. More corporations in Delaware than every other state in the union combined."

And here he is during a speech at a tech school in Minnesota in late November: "More corporations are incorporated in Delaware than every other nation and every other—excuse me—state in the nation. And guess what? Fifty-five percent of the Fortune 500 companies—the largest ones—paid zero in income taxes last year after making $40 billion in profits."

And during a visit to a General Motors factory in Michigan earlier this month: "Well, I'll tell you what, real simple: I come from the corporate capital of the world. More corporations [are] incorporated in my state of Delaware than all states combined. And guess what? They ain't paying enough."

It's easy to eye-roll away Biden's deliberate misunderstanding of Delaware's corporate tax situation as just so much meaningless political bullshit—the equivalent of me claiming that, since I'm from Pennsylvania, I innately understand the economics of running a cheesesteak joint, while also proposing a new tax on Whiz and onions.

Still, Biden's repeated use of the Delaware example is telling in at least one way. It is a microcosm of the entire monthslong effort by the White House and its allies to push Build Back Better through Congress—and, more broadly, perhaps even a useful metaphor for Biden's first year in office as a whole.

This is the same administration that was warned by economists about how passing a massive stimulus bill would trigger inflation. They pushed for the bill anyway, and now inflation is here.

It's the same administration that, when faced with opposition from some Senate Democrats to borrowing and spending even more money, crafted a revised version of the Build Back Better plan that relied heavily on budget gimmicks to hide the true cost.

And it's the same administration that is continuing to ignore what economists say will be the long-term consequences of passing such a huge expansion of the federal welfare state: slower long-term growth, a reduction in average wealth, and ruinous amounts of debt.

In the Biden administration, it seems, economic reality is easily discarded when it gets in the way of a political agenda. But inaccurate, misleading arguments for major policy changes can only get you so far. Perhaps it's no wonder that Build Back Better seems stalled, at least for now.

But if Biden wanted to sincerely interrogate the question of why Delaware is home to so many corporations, he might find a few other useful lessons too. Being business-friendly has worked out pretty well for Biden's home state—one of the wealthiest in the country in terms of GDP per capita. And the gap between Delaware's richest and poorest residents is considerably smaller than the national average.

Biden might say he's tired of "this trickle-down economy stuff" but his home state actually provides pretty good evidence that lower taxes are a key to prosperity.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Hey all of ye Reasonoid readers! Do NOT bother to read this article about Joe Biden (or his policies)! Do NOT bother to read (or read about) ANY links, facts, or logic contained in this article and-or video! Do NOT bother to trouble your pretty little heads about silly factual details gathered by useless Reason-writer eggheads!

Because I, the SMARTEST ONE, can “summarize” it ALL for you! Here it is, above article summarized: “Senile Mackerel Snapper Bad”!

(/Sarc, revenge for moronic “summaries” about “Orange Man Bad”)

Home to the largest amount of shell companies in the country. Ripe for fraud and corruption. There was even a movie done about it.

"...Ripe for fraud and corruption. There was even a movie done about it..."

You're citing a MOVIE to make your point? Did they make you repeat 6th grade?

Worth saying twice?

Fuck off and die, TDS-addled spastic asshole

Joe Biden doesn't even know when he craps his pants. The regime, on the other hand, very much understands the concept of "taxes for thee but not for me".

1 Biden doesn't know what day it is

2 Biden doesn't know that it's wrong to molest children

3. You the fucking scumbag that voted for this retarded corrupt pile of crap.

He didnt even know who brandon was.

Ron Klain and Susan Rice are running the show. A lucid competent POTUS would be firing them and replacing them due to polling numbers, including polling numbers on cash for kids and no voter id laws. A lucid POTUS would replace them with moderates and try to salvage the political party.

That was fucking hilarious!

He may not know who Brandon is but he agrees he must go.

"You know, I'm tired of this trickle-down economy stuff," the president continued.

LOLOLOLOLOLOLOLOLOLOLOL

In less than a year the Biden economy has already concentrated a third of a trillion dollars in the hands of the 10 richest Americans.

#OBLsFirstLaw

#BillionairesForBiden

NEW WORLD ORDER DEPOPULATION OLIGARCHY JEWS!

You are really losing it as you have completely given up pretending you aren't an OSF gaslighting leftist. Please explain how gdp growth less than inflation is good again lol.

turd lies; it’s all he ever does. turd is a TRS-addled asshole and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

The only "Trickle-Down" he knows about is Pudding Pop and Boost from the corner of his mouth and pee from his Depends.

I'm confused now about all this talk about Biden and Delaware corporations - Joe is a coal miner from Scranton, Pennsylvania, isn't he?

Yes, old Joe is a hardhat from Scranton just like Dubya is a cattle rancher from Crawford TX and the Con Man is a bidnessman.

Americans love a myth.

turd lies; it’s all he ever does. Turd is a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

That's why they voted for Obama, born in a manger in Honolulu.(PBUH)

Truck driver.

...like Kerry was a Swift Boat Captain...

He would have likely been a Lieutenant (either full or J.G.).

And if the accounts in the book "Brown Water, Black Berets" are accurate, he saw some pretty nasty fighting.

Joe is a coal miner from Scranton, Pennsylvania

He didn't live in a Manchin.

No, but a Manchin lives in his (handlers) head.

Maybe he can go the the Sinema and catch the new Spiderman movie.

Give it a little time and Joe can be convinced he's a coal miner's daughter.

“From now on, I want you all to call me Loretta!” (Aides silently trading nervous glances)

That's a Helluva daily commute on a Washington Metro with a lunch-bucket.

“And so, I understand big business."

The more you have to say that, the less true it sounds.

"I've been giving people the business since I got into the Senate, and been teaching my boy how to do it."

His son Hunter is the business mogul.

Needs moar pudding

What's the magic word?

VACCINE!

Authoritah!

Joe Biden doesn't know what Joe Biden had for breakfast.

He should look on his pants and in his drool bucket.

Don'tcha know he said he ate Corn-Pop for breakfast?

SUPPLY CHAIN KILLED THE ECONOMY BOYS! SLEEPY JOE FAULT!

Holiday sales were up 10.7% compared with the pre-pandemic 2019 holiday period.

By category, clothing rose 47%, jewelry 32%, electronics 16%. Online sales were up 11% from a year ago and 61% from 2019. Department stores registered a 21% increase over 2020.

https://www.politico.com/news/2021/12/26/holiday-shopping-christmas-omicron-526155

It's nice to see Politico is one of the few websites that hasn't descended to wingnut.com status.

But I still cannot believe NYT did. Have you seen this Russian misinformation — As rising inflation threatens his presidency, President Biden is turning to the federal government’s antitrust authorities to try to tame red-hot price increases that his administration believes are partly driven by a lack of corporate competition.

"Red-hot price increases"? "Threatens his presidency"? I suspect Putin has a pee tape involving one or more NYT editors.

The. Only. Price. Increase. Has. Been. Spittin'. Tobaccy.

#DefendBidenAtAllCosts

As elitists - we don't care about a bump in prices.

So your spittin' tobacco is up a dime a pouch? I even heard one of the shit-kickers complain that his fryin' grease went up a nickel a can.

We. Just. Don't. Care.

Lol. You think you're elite. Hilarious.

Could be. There are likely less pedophiles than millionaires in this country. That is kind of elite status.

Bidens both!

turd lies; it’s all he ever does. Turd is a pathological liar, and a TDS-addled asshole, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

Fascinating. But I couldn’t find anywhere in the article whether those figures were adjusted for inflation.

Remember, progressive economics, and, increasingly, Democratic economics, don't use numbers, at least in any quantitative relationship sense. And most financial concepts are also just moral feelings, like taxes (good) and profits (bad). Thus giving Joe a hard time about logical consistency is just not fair.

A fair point. It's unrealistic to expect the party of "muh feels" to understand things like monetary policy and markets.

Since Prog-nomics are not real economics they can invent it any way they want, like the Stooge Pelosis " welfares good for the econony."

The Broken Window Fallacy is popular with short sighted fools.

That statement reminds me of Bobcat Golthwaites line about " war is good for the economy because a dead guy cant flip a burger."

Economics is a cyclical model of demand for goods and manufacture of them.

Cyclical model, not Bidens circle-jerk model.

Of course he knows business. He didn't win the moniker "The Senator from MBNA" (large bank in Wilmington) for nothing as he carried water for the banks, and for Dupont's interests, for years.

"intended to "build an economy from the bottom up "

.1. Admitting the economy is dead.

2. Admitting the Govt wants to subvert and take over whats left if the free market economy which thanks to Ibama-Obiden team since 2009, and their coordinated economic attacks, is mostly muni funds and selling China made pencils in the streets.

"Botyom up" means " small business. Not Big corps with big kickbacks.

The whole concept of "Build Back Better" implies that there's something that needs building back. Everything is better than what it was before, isn't it? What could possibly need built "back"?

Exactly. But with Progs its all Word Salad to hide their real intent...screwing us.

Make America Better Again... am i doing it right?

MAyBA. 🙂

...and this Biden sham on the heels of him grifting TRILLIONS OF DOLLARS to Pharma corporations for vaccines.

Free? Hardly.

Recall when "Big Pharna" was a Demonazi Bush- bashing meme?

Suddenly its different?

Fuck Joe Biden

.. and his little dog, too.

When it comes to screwing the pooch, you're in the right house.

LMMFAO. Good one!

Him and his Whore.

Leave Champ alone. Looks to be the most likable person in the White House

https://www.businessinsider.com/all-the-presidents-dogs-2018-8

Oops RIP Champ. It’s Commander now (nice smelling fur too)

OK, we had Moring Links, then we got Roundup, now it looks like we wing it:

"One year in, Biden has been slow to unwind Trump immigration policies"

[...]

"Most immigration advocates abhor virtually every policy in the sphere that Trump pursued, but they do give him credit for two things: showing how much change an administration can make quickly, and driving home the power of fully committing to a salient political message. But they fear that instead of using those lessons to enact Biden’s stated objective — a fair, orderly and humane immigration system — the president has borrowed too many of his predecessor’s policies and not enough of the fervor..."

https://www.sfchronicle.com/politics/article/One-year-in-Biden-has-been-slow-to-unwind-Trump-16725642.php?cmpid=gsa-sfgate-result

Perhaps because for all the whining, Trump's efforts were about as good as you can get, and perhaps with the total incompetence Biden/handlers have some so far, expecting *anything* of value from them is a fool's errand.

It is important to remember that the publicly stated immigration goals of the current administration do not match their actual goals.

Illegal immigrants are a key demographic for the DNC. If Guatemalans voted GOP the border would be closed by lunchtime.

In an ideal world, people would be free to flow to wherever economic conditions were favorable. But once we established a cradle-to-grave welfare state secure borders became essential to sustainability.

they can vote Space Alien, its irrelevant. Dominion will be sure to " correct" it to "D"

why is that an ideal world? i don't think an open border is ever ideal. regardless of economics every nation needs a strong border for many reasons. we should have very strict entrance requirements and reduce the number of people allowed across the border.

Come on man! Same policies, but within normal parameters.

Most immigration advocates abhor virtually every policy in the sphere that Trump pursued,

These people are morons asTrump and Obama were essentially indistinguishable when it comes to illegal immigration

"Delaware figures prominently in Biden's stump speeches for the Build Back Better plan, but he seems to deliberately ignore some key details."

This is a fair take, but even if I believe Biden is mentally competent, I'm not sure Biden really understand economics all that well. Show me ANYTHING in his political career where he understand basic economic principals?

Except for grifting domestic/foreign companies for favors.

So are Deleware corps making 29% interest fostering eternal credit card debt going to " give back?"

Or Will they Bolster Bidens Bloviating?

biden wouldn't get elected dog catcher in any state. his Delaware enablers and the dems, set up an election crime family decades ago and he's been their puppet ever since.

"Perhaps it's no wonder that Build Back Better seems stalled, at least for now."

.The Left operates on Marxist Class Warfare.

.Manchin is from a very poor State, WV.

Very.

Its coming back to bite them now.

The Lower classes are always larger and when uit cones to a violent end, always win by numbers.

""You know, I'm tired of this trickle-down economy stuff," the president continued"

.

Yeah a RICH PRIVILEGED WHITE MAN is " so tired...." of being rich, priviliged and white.

Fuck you, Joe.

and more precisely, you cannot find a single economist that has ever promoted the economic concept of "trickle down". doesn't exist. it is not an accepted / taught economic concept / theory. once again sleepy joe is just making shit up to feed his warped narrative.

When I think of trickle-down economics, I think of government printing trillions of dollars and handing it out to the politically connected.

Joe Biden is certainly not tired of that, because his only plan is to print trillions of dollars and hand them out to the politically connected.

TD is giving money to corporations and govt entities.

So Bidens given TRILLIONS to vax companies.

NOW hes pretending thats bad

Damn hypocrite

yes in fact it goes UP the further down it goes. It expands, increases.

Marxism and Communism trickle down.

A Communist shill like Biden would see that as normal.

His trickle down problem can be fixed with a bib.

HAHAHAHAHAHA LMAO

Delaware has perhaps the lowest corporate board member personal liability risk. Basically, a company gets sued its board members and company are found guilty, but board members and C Suite staff have little out of pocket cost and risk.

So biden's state has state laws protecting the the highest paid corporate staff and at the same time is ranting about how corporations don't pay taxes. biden is one of the dullest politicians in our country's history; and now with his cognitive delays he has no memory to recall what he said let alone understand any financial, ethical or moral issues.

"Does Joe Biden know..." the answer is probably "no".

No doubt the state of Delaware is forever grateful that Biden ran for and won the US senate seat and not a seat in the state legislature or governor.

Taking credit for 'capitalist' success while proposing to kill it (?make it better?) with Nazism.

Because that's what criminalistic Nazi's do........ And not just Nazi-Criminals. It's the very FOUNDATION of every psychotic criminal.

https://fullypaidscholarships.com/

Home to the largest amount of shell companies in the country. Ripe for fraud and corruption. There was even a movie done about it.

BINGO.

Bidens a blowhard.

The only one ' bent' on doing anythung about this financial corruption was Bawney Fwank ( ergo, ' bent') and of course that went nowhere with all the collusion between Govt and corporations to keep mass fraud and theft in place.

It's also home to the largest amount of legitimate companies. Unless you are planning to only ever operate in a single state, there are good reasons to form your company in Delaware.

The question is not are there a lot of bad companies formed there, but are they disproportionately bad actors compared to other states.