The 2020s Will Be the Decade of Deficit Doomsday

America will have to pay for its spending spree and its wars.

The decade that just ended saw a period of uninterrupted economic growth. In the decade to come, we'll pay for squandering it.

Since the so-called Great Recession officially ended in the third quarter of 2009, the United States has enjoyed 42 consecutive quarters of solid if unspectacular economic growth. That's the longest run of uninterrupted growth since government economists began tracking the business cycle in the 1850s, far outpacing the average economic expansion of 18 months. Employment has increased by 12 percent, the jobless rate reached record lows, and America's gross domestic product (GDP) has increased by more than 25 percent.

It has been, by almost any measure, one of the best times in American history. Almost.

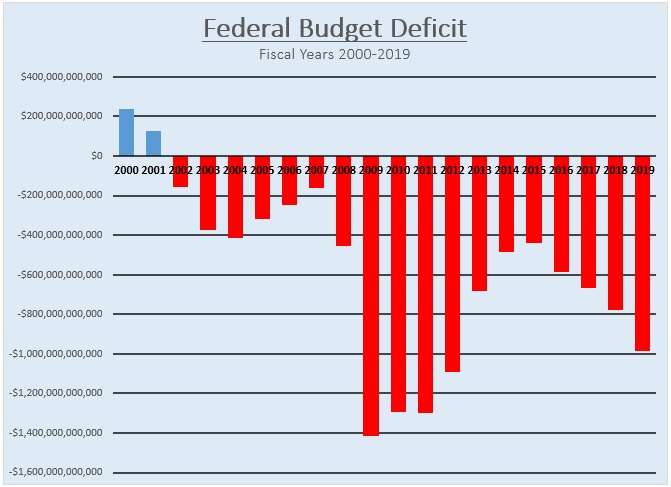

Hanging over this decade of good news is the gloom of a missed opportunity. After piling up trillions of dollars in deficit spending during the last recession, the federal government took some modest steps towards reducing that red ink during the middle years of the 2010s. But after Republicans took full control in 2017, spending skyrocketed and the deficit inflated again.

Since Trump was inaugurated, Washington has added $4.7 trillion to the national debt—almost entirely the result of a gigantic spending binge, but with a small assist from the 2017 tax cuts, which reduced revenues without offsetting spending cuts.

Now, more than a decade after the last recession ended, the United States is carrying a record amount of debt: more than $23 trillion. The country is on track to add more than $1 trillion to that total in every year of the coming decade, with old age entitlements ramping up as Baby Boomers retire and the country as a whole ages.

"Debt matters because it's the one issue that impacts all others," says Michael A. Peterson, CEO of the Peter G. Peterson Foundation, a nonpartisan policy center dedicated to fiscal issues. "Debt threatens our economic health and hinders our ability to make important investments in our future. If we want to tackle big issues like climate change, student debt or national security, then we shouldn't saddle ourselves with growing interest costs."

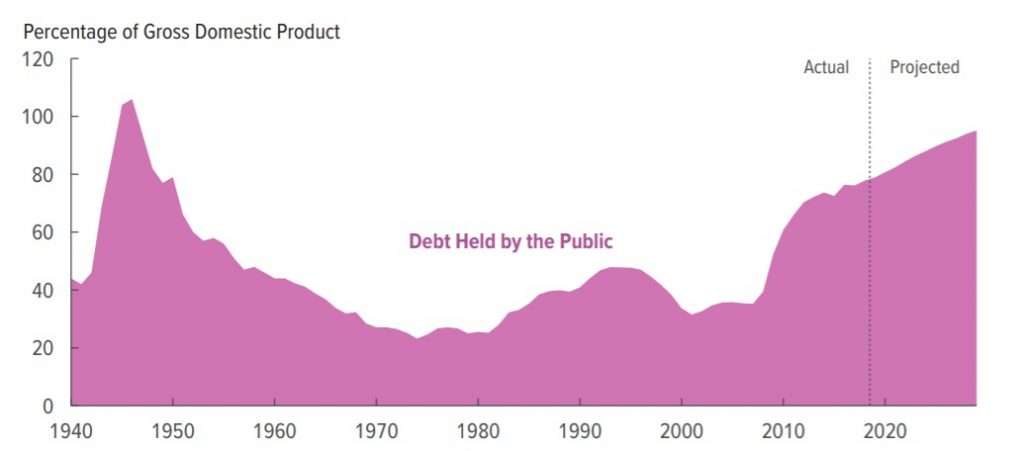

According to the Congressional Budget Office, the national debt will approach the size of the entire U.S. economy by the end of the current decade—and will keep on growing until it hits 144 percent of U.S. GDP in 2049. The current situation, warns the Government Accountability Office (GAO), is "unsustainable."

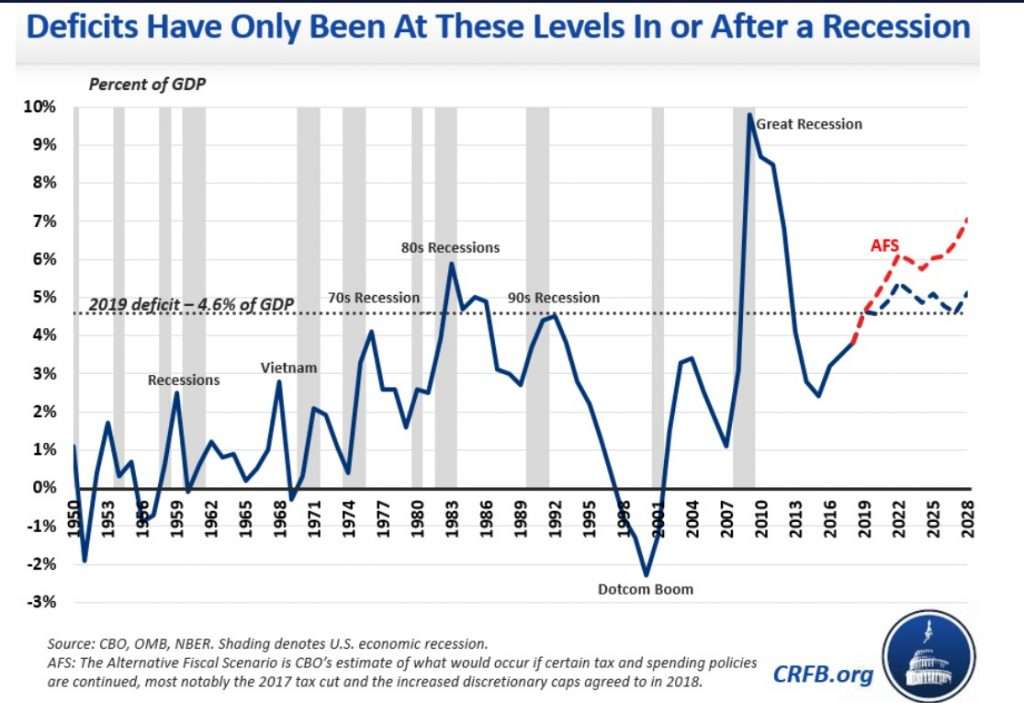

Compare all this with early 2001, at the end of the second-longest economic expansion in history. The federal government was running a surplus. The national debt was falling and amounted to only 31 percent of GDP. That's what you'd expect to see now, since deficits typically fall when the economy is growing and grow when the economy is rotten.

Indeed, since the end of World War II, the U.S. has seen deficits greater than 4 percent of GDP only in years when the country was either deep in the throes of a serious recession or emerging from one.

In the short term, deficit spending—or tax cuts that aren't offset with spending cuts—can juice the economy and boost growth. But in the long term, high levels of debt drag down economic growth. The CBO projects that the average American household will lose between $2,000 and $6,000 in annual wealth by 2040 if the current trajectory continues. It also says America's GDP will shrink by 2 percent over the next two decades if current policies continue and the debt keeps growing.

And the CBO projections are probably too rosy. They predate the approval of a new bipartisan budget deal in late 2019 that is expected to add another $1.7 trillion to the national debt over 10 years. Furthermore, the CBO is required to build projections based on current policies. Those assume, among other things, that some of the 2017 tax cuts will expire in the middle of this decade. Politically, that's unlikely to happen.

Worse yet, the CBO's projections don't account for the inevitable eventual end to this run of economic growth. If we're running a trillion-dollar deficit in the good years, what happens when the next downturn occurs?

"A recession could quickly push the deficit up towards $2 trillion," says Brian Riedl, a former Republican congressional staffer now based at the Manhattan Institute. A recession would likely trigger politically motivated calls for even more deficit spending, causing the debt to skyrocket even more than it already has.

It might also cause interest rates to spike, compounding America's debt problem. Every percentage point that interest rates rise will add $1.8 trillion in added costs over the decade.

"A nervous bond market could demand higher interest rates, further weakening both the economy and the deficit," says Riedl. "So while the economy looks strong and the deficit seems irrelevant, the fiscal situation is quite fragile."

It may require a crisis before anyone in Washington takes the situation seriously. The American political system seems incapable of planning for the long term. Even passing a federal budget through the normal committee process appears to be impossible, a testament to the failure of both parties' current congressional leaders. Congress lurches from one crisis to another—some real, some manufactured to score political points—and Trump's tempestuous presidency has only made things worse.

Assigning blame isn't the most important thing, but there is plenty to go around. The Trump administration and current crop of Republicans in Congress have made the problem worse than it already was. Some of them—like former deficit hawk Mick Mulvaney and former House Speaker Paul Ryan, who made his name in Congress as the GOP's budget-maker—deserve special ignominy for abandoning their fiscal conservatism when it was most needed. Trump came into office promising to eliminate the national debt in eight years, and that's even more of a joke now than it was then.

Meanwhile, Democrats' aversion to spending reductions and their refusal even to consider changes to entitlement programs—the biggest driver of the national debt—are equally large obstacles to any meaningful attempt at fixing this mess. The party's progressive wing is pushing for Medicare for All and expanding Social Security benefits, while elevating economic theories that say we should ignore the deficit.

And neither party seems to have a serious plan to rein in military spending, despite two decades and more than a trillion dollars spent in the Middle East quagmire.

In contrast to their elected officials, most Americans believe the debt and deficit are important. A Pew Research Center poll conducted earlier this month found that 53 percent of Americans view the federal budget deficit as a "very big" problem facing the country. That's a larger share of the public than the portion that views terrorism (39 percent), racism (43 percent), or climate change (48 percent) as a major problem.

But you'll hear much more talk about climate change, terrorism, and racism during the 2020 election. You'll here much more talk about many other things too. Neither party is taking the debt seriously right now, and no prominent national politicians appear positioned to lead a deficit reduction effort—at least not until the next Democrat is inaugurated and Republicans pretend to care about spending again.

"Lawmakers should work to manage our fiscal outlook now, when the economy is performing well and while we have time to manage the debt gradually and responsibly," says Peterson.

We had time. We may yet have more. But Washington is more likely to squander the 2020s, just like it did the latter half of the 2010s.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

//But you'll hear much more talk about climate change, terrorism, and racism during the 2020 election.//

Because those are things politicians can endlessly bitch about to pander to their base, without actually doing anything.

Cutting spending requires make difficult decisions; calling some toothless farmer a racist asshole and pontificating about out-of-control tornadoes is much, much easier.

It doesn't even require difficult decisions. End baseline budgeting for 5 years.

The entitlement question is a bit worse, but stopping the assumed 5% growth rates for budget baselines will stop the insanity.

Also stop spend it or lose it policies in budgets.

Question 8: Do you think the federal government spends more money on social programs, such as Medicare, education, and food stamps—or does the federal government spend more money on national defense, such as the Army, Navy, and missile defense?

Correct Answer: Social programs. In 2018, 62% of federal spending was for social programs, and 18% was for national defense. In 1960, the opposite was true, and 53% of federal spending was for national defense, while 21% was for social programs. Reporters sometimes mislead the public about the composition of federal spending by using a subset of spending that omits the vast majority of social programs.

Correct answer given by 36% of all voters, 14% of Democrat voters, 59% of Trump voters, 40% of males, 33% of females, 23% of 18 to 34 year olds, 36% of 35 to 64 year olds, and 41% of 65+ year olds

"...Correct answer given by 36% of all voters, 14% of Democrat voters, 59% of Trump voters, 40% of males, 33% of females, 23% of 18 to 34 year olds, 36% of 35 to 64 year olds, and 41% of 65+ year olds."

We get a continuing run of lefties showing up here on issues like O-care and the like, claiming that if we cut the defense budget, all will be well.

It is a clear demonstration of their lack on knowledge and of intelligence; you'd assume anyone intelligent would spend a minute or two on their fave search engine to confirm the claim.

From overt's link in the "facts matter" article:

Question 5: The average U.S. household spends about $30,000 per year on food, housing, and clothing combined. If we broke down all combined federal, state, and local taxes to a per household cost, do you think this would amount to more or less than an average of $30,000 per household per year?

Correct Answer: More than $30,000. In 2018, federal, state and local governments collected a combined total of $5.1 trillion in taxes or an average of $40,000 for every household in the U.S.

Correct answer given by 43% of all voters, 36% of Democrat voters, 47% of Trump voters, 42% of males, 44% of females, 51% of 18 to 34 year olds, 46% of 35 to 64 year olds, and 38% of 65+ year olds

Question 7: Now, changing the subject from taxes to spending, suppose we broke down all government spending to a per household cost—do you think the combined spending of federal, state and local governments amounts to more or less than $40,000 per household per year?

Correct Answer: More than $40,000. In 2018, federal, state and local governments spent a combined total of $6.9 trillion, or an average of about $54,000 for every household in the United States. For reference, the average U.S. household spends about $45,000 per year on food, housing, clothing, transportation, and healthcare combined.

Correct answer given by 48% of all voters, 44% of Democrat voters, 53% of Trump voters, 53% of males, 43% of females, 53% of 18 to 34 year olds, 52% of 35 to 64 year olds, and 43% of 65+ year olds.

Question 9: What about federal government debt? The average U.S. household owes about $122,000 in consumer debt, such as mortgages and credit cards. Thinking about all federal government debt broken down to a per household basis, do you think the average federal debt per U.S. household amounts to more or less than the average consumer debt per U.S. household?

Correct Answer: More than $122,000. Federal debt is now $23.1 trillion or about $180,000 for every household in the United States. Such levels of debt can have far-reaching negative effects on wages, living standards, and government and personal financial security.

Correct answer given by 77% of all voters, 76% of Democrat voters, 81% of Trump voters, 75% of males, 80% of females, 84% of 18 to 34 year olds, 79% of 35 to 64 year olds, and 75% of 65+ year olds

Question 21: In 1960, governments paid for 24% of all healthcare costs in the U.S. Do you think governments now pay a greater portion or a lesser portion of all healthcare costs in the U.S.?

Correct Answer: A greater portion. In 2017, governments paid for 49% of all healthcare expenses in the United States.

Correct answer given by 57% of all voters, 42% of Democrat voters, 70% of Trump voters, 62% of males, 52% of females, 46% of 18 to 34 year olds, 57% of 35 to 64 year olds, and 59% of 65+ year olds

Question 8: Do you think the federal government spends more money on social programs, such as Medicare, education, and food stamps—or does the federal government spend more money on national defense, such as the Army, Navy, and missile defense?

Correct Answer: Social programs. In 2018, 62% of federal spending was for social programs, and 18% was for national defense. In 1960, the opposite was true, and 53% of federal spending was for national defense, while 21% was for social programs. Reporters sometimes mislead the public about the composition of federal spending by using a subset of spending that omits the vast majority of social programs.

Correct answer given by 36% of all voters, 14% of Democrat voters, 59% of Trump voters, 40% of males, 33% of females, 23% of 18 to 34 year olds, 36% of 35 to 64 year olds, and 41% of 65+ year olds

Also stop spend it or lose it policies in budgets.

^ This. I work in the construction department of a public entity, and we get flooded with project requests at the end of the fiscal year from people with buckets of money they need to make go away.

The amount of money that gets blown just to fight off budget cuts is obscene.

It's true in large corporations too.

Saw it happening first hand at Home Depot HQ

Office supplies, chairs, computers, etc

Whatever they can spend on just to keep budget for next year

I'm a contractor. First thing I ask when a municipality calls is, "What are your budget requirements?" They usually tell me outright what they NEED to spend. I tell them, "I think I can fill your budget needs AND leave $599.00 in the petty cash fund, in case you want to throw yourselves a party for doing such a good job this year." That's how you get 3-4 times going rate and lock down the job for yourself. I almost feel bad about it sometimes...almost.

I still don't understand why people don't just allow their budgets to be cut... If you have money left over every year that you need to waste... Doesn't that just mean you don't need all that money to get your job done??? So who cares if the budget goes down.

That's one of the things I've never understood about government employees. They pay fucking taxes too, don't they realize they're fucking themselves, along with everybody else? It just blows my mind.

The pay scale and promotions are based on how much money or people you manage. If you lose budget or people the position is downgraded (after you depart). GS-11s looking to make GS-12 do what they gotta do.

How about you just do your job well and get promoted with GS-12 or WTF ever by being competent at your job and coming in under budget???

You know in local government, especially in conservative places, at least a good chunk of elected officials and government workers would theoretically appreciate that.

I wonder if one could do a study on government employee productivity in red areas vs blue. Somehow red states tend to have better roads, better schools, etc while having lower taxes still... I wonder if that's related to an effect like the above, simply the expectation that one needs to not waste. Would be interesting to know.

Rescind the Trump and Bush tax cuts and cut defense spending in real dollars to what it was when Clinton was in office and you will get rid of most of the deficit. Unless we do both of these things we will never come close to getting our fiscal house in order.

Haha, yeah. Cut defense spending.

The only reason 'cut defense spending' is the rallying cry of the far left is because it's the only spending they can think of that won't alienate some portion of their redistributionist voter plantation.

I note the left never concludes that reducing spending is a solution in any other policy area, nor is it even a consistent conclusion to cut defense spending.

Remember, if you try and cut entitlements you're murdering grandma. Democrats have been making that argument the entire time I've been alive. With that outlook on spending, cuts are simply not possible. Spending can only go in one direction, and increasing revenue will never equal the amount our government spends.

So, TL;DR, if you can't cut entitlement spending you can't get rid of the deficit.

It's not just Grandma who we are murdering. The entire populations of El Salvador, Guatemala, Honduras, and about 30 other countries need to come here or they will all be murdered. Those who came here illegally must be given free health care, free college, and every other government entitlement program we have.

There is no one line item that must be cut to get the debt under control. There are easy cuts (or should be) and then there are the tougher ones (the majority). The way our political system works now any amount of spending for "me" to get reelected is an "investment". Like most things in the US, there must be a catastrophe for anyone to focus on it, and even then we can't act.

Whose fault is this? Us and most of the media. Masses of the population pay no attention to what is happening and are easy to manipulate. Most of the media has long forgotten what journalism is supposed to be and have become public relations entities.

Not a lot to look forward too.

Yup.

The fact is people are stupid, which is why the founding fathers never intended universal suffrage. Basically their cutoff of being a white male landowner was a proxy for "middle class or richer, and probably above average intelligence."

Idiots voting got us here, and the politicians don't have the spine to make the "tough" decisions that need to be made to fix everything. Sometimes when you look at how easy the solution actually is to our financial woes it makes you sick.

Raise the retirement age a couple years, and make single digit cuts to SS and it's fine damn near forever. God forbid you actually invest even a small portion in assets that make real returns like stocks, then you wouldn't even have to make cuts. Simply maintain a balanced budget, never pay down a dime, and modest inflation alone will make the debt shrink to nothing as a percentage of GDP in just a couple decades.

It's all so easy it drives me mad!

"Rescind the Trump and Bush tax cuts and cut defense spending in real dollars to what it was when Clinton was in office and you will get rid of most of the deficit."

Nope. Cut spending, period. Screw raising taxes; it only encourages more spending.

Abolishing tax cuts and cutting defense spending isn't going to do the trick. In fact, both corporate and income tax cuts are necessary to keep companies and skilled workers in the US.

What's driving government debt is entitlements, pensions, and bloated government programs; cut/eliminate those. There is no reason government workers should receive pensions (rather than 401k's like the rest of us). And entitlements should turn into a strictly means tested program of last resort.

That is, you get government healthcare and government retirement only if you are broke and unable to work.

HEARTLESS BASTARD!!!!!!!

What's "heartless" about saying "let's prioritize limited funding for those in dire need"?

What's "heartless" about saying "let people make their own decisions with their own money, but provide them with a safety net that keeps them from dying in the street"?

That's what I'm saying.

Other people are saying "take lots of money from the middle class, remove 80% overhead for government, and then give the remaining 20% back to the middle class". That seems a lot more "heartless" to me.

I make similar arguments when I'm discussing with commies. The fact is if we even just treated health care, SS etc as the welfare programs they are, it would save us sooooooooooooooooooo much money it'd be insane. If we deregulated the free market healthcare system, and then just paid for poor peoples shit, we would be the envy of the world. But control freaks just can't let that sort of thing happen.

Defense spending is only 14% or Federal Spending.

http://mil14.com

There is no 'there there' to put a dent in the deficit.

I am making 10,000 Dollar at home own laptop .Just do work online 4 to 6 hour proparly . so i make my family happy and u can do

........ Read More

Let me guess. You send random strangers emails from a Nigerian prince who has $20 million locked in a secret bank account in Switzerland, and they send you $2,000 to help with your expenses getting it out in exchange for half the money.

Hey look, a can. Just keep kicking it and we're all good.

We can't even freeze currently levels of spending.

No one really wants to pay more for less.

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure “unbacked” fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $479 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

If you only steal a little bit from absolutely everybody, it doesn't count as stealing!

Win-win.

"The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars."

Uh, that does not sound correct. At all.

If the government borrows 100 Million dollars and spends it, there is a net increase of 100 million- some public entity gave 100 million to the government, removing that money from the economy.

If you just print the money, then you have increased the total amount of money in the system by 100 million. That is more inflationary.

*Er, sorry there is a net increase of 0 dollars. The government sells t-bills pulling that money off the economy, ant then turns around and spends it.

Wrong. Banks lend money by CREATING it. They do not lend money by taking it from someone else

You keep pitching that pile of bullshit, but no one here is stupid enough to go for it.

Except you.

no one here is stupid enough to go for it

Golly. Who should I believe about how money is created?

A proven idiot on the internet or

The Bank of England

"A proven idiot on the internet..."

Nope, not your bullshit.

I guess you figure the Venezuelan banks are loaning money left and right?

"Price inflation is out of control in Venezuela. The inflation rate hit 130,060% in 2018, according to the new data."

https://www.cnn.com/2019/05/29/economy/venezuela-inflation-intl/index.html

As mentioned, few here are as stooopid as you, so your pile of bullshit isn't selling.

To JFree. Wrong. Banks still have to have money, capital or deposits, before they can lend it. That 'create' business comes from the artifice that once it has been lent banks are allowed to count the money twice, once for the depositors and once for the borrowers.

And that is why defaults are so bad. The lost money has to be erased twice, the second time from the bank's capital.

Actually, JFree is correct in a real sense. You are correct in that banks are capital constrained when it comes to lending, but JFree is correct in saying that banks create money when they lend. The banking system creates most of the money in our system. Loans create deposits. Banks are not counting the money twice. Deposits are liabilities for banks, loans are assets.

Boehm hints at the real risk in our monetary system: harmful inflation. Having said that, I'm not confident he really understands the operational components of how our system works. Bringing up examples like Venezuela or Weimar Germany is fine, but odds are the people mentioning those cases of hyperinflation don't understand that in each case, it was NEVER government debt by itself that caused the hyperinflations. There has always been one or two other severe exogenous events in cases of hyperinflation in the last 120 years. The severe events tended to be losing a war, a collapse in production, regime change, or ceding monetary sovereignty via foreign denominated debt, rampant government corruption, or a breakdown in the tax system.

The world may lose confidence in our system (and government) sooner than I think - and we'll feel the pain of high inflation. Will it be an outright rejection of our currency (which is what happens in hyperinflation)? I doubt it.

I also think it's interesting to note what's happening in Japan. Their monetary system is similar to ours - it's a fiat currency system. Their government debt vs. GDP numbers are way, way higher than ours - and they have not experienced hyperinflation.

Lastly, we should remember that the CBO's record on projections is okay in the short term, but not good longer term.

Will it be an outright rejection of our currency (which is what happens in hyperinflation)?

This is 100% what 'hyperinflation' is. The term itself is very misleading. It has nothing to do with 'inflation'. It has everything to do with utter rejection of the currency. If you bought an egg this morning and try to buy an egg with the same amount of money this pm and the grocer says 'Eff off I don't want that money', that is the root of hyperinflation. The currency stops being a unit of account and goods start getting priced in something else. And since at any moment, there is not a lot of surplus production, the economy quickly runs out of whatever the new unit of account is. At that point, everyone just hoards whatever they can get their hands on and the price of everything becomes infinity and the trading economy shuts down.

Their government debt vs. GDP numbers are way, way higher than ours – and they have not experienced hyperinflation.

That's because they haven't repudiated their debt. Banks create money when they make loans - but the repayment schedule eats it back up (plus a bit - interest). If the debt isn't productive, then you have deflation as people chase money to pay down their debt repayment. And until creditors get strung up from a tree, they are not inclined to write debt off. Back in the ancient days, the solution was 'jubilee' - but the only economist now who understands that history is Michael Hudson.

The trick with fractional reserve lending is that it's not the first transaction that makes it crazy... It's the 10th.

If you have to have 90% reserves by law (don't recall actual reserve requirements now, too lazy to look up), the first bank can only lend out $90 on $100 in deposits, which is fine. The problem is that $90 gets deposited in another bank that can now lend out $81 on top of that original $90. So on down the line until you have $1,000 bucks or whatever of created money sloshing around the economy from an initial $100.

This is how banks create money out of thin air in our system.

There's plenty of credible research that points out that the money multiplier (fractional reserve lending) is a myth, or at least inaccurate:

https://positivemoney.org/how-money-works/advanced/the-money-multiplier-and-other-myths-about-banking/

That whole article simply stated that fractional reserve lending is true... But it's more complicated than 10% reserves, which is typically used as an example of the theory. They, rightly, stated that some countries have NO legal reserve, in other words can lend infinitely. That's still fractional reserve lending since they are lending more than they have by some random amount.

In short, all that said was "It's more complicated!" which nobody denies. The standard example of 10% leading to 10x money creation is just a way of dumbing it down so people who don't know anything about banking/money can understand the concept. However that general idea is very much how the world works... A bunch of imaginary money created by private banks, and a central bank (or government) that has a few mechanisms for attempting to tweak things to get outcomes they desire.

All that is true.

That's happening already, at least with the first $4 trillion (and growing). The Fed prints money to buy the debt, then hands the interest on that debt right back to the Treasury.

WC Varones wrote "The Fed prints money to buy the debt, then hands the interest on that debt right back to the Treasury."

And nobody thinks that the government will ever pay back the Fed money that it borrowed, and nobody, so far, cares about the Fed's balance sheet and whether it is bankrupt. - Someone remarked decades ago that if the government (or the Fed) goes bankrupt, then the whole country goes bankrupt too.

Almost - but actually, the Fed is buying Treasuries on the open market. Treasury auctions have continued without problems (so far). It's true that the Fed has (especially in the rounds of QE) purchased a lot of Treasuries - and quickly, after the auctions have been successful - but I don't think we can say the auctions have only continued to be successful because buyers "knew" the Fed would quickly buy the bonds on the open market.

This is a distinction without a difference. Whether the Fed purchases Treasuries directly or lets banks buy it and flip it to them, the Fed still ends up buying Treasury debt with printed money.

Yes - the Fed "prints" money when it buys Treasuries, although it's all electronic entries. Given the relative strength of our economy, I still think Treasury auctions would go just fine if the Fed cut way back on it's bond buying.

How bout the Congress creates a $23 trillion coin that says "cannot make exact change" on it. They can hand that to the FED and say "Our imaginary currency is as good as yours, but also backed by our nuclear arsenal and CIA assassins. We off you our 'protection.'"

That is in fact a more or less viable option.

The one decent thing Lincoln possibly ever did was issue Greenbacks, which were unbacked dollars. Back in those days no fiat shit should have been tolerated to begin with, but he at least understood there was no reason to pay interest in debt when one has the ability to print money.

Nowadays if we just issued even a partial amount of the deficit in debt free money we could definitely use it to get us out from under this mess.

Better option is to just stop spending like drunken sailors though...

But the government is borrowing money to fund their spending. If government stopped SPENDING, they could stop BORROWING.

Unless the deficit and debt actually drove the growth...

Welp, who's ready for the Great Depression 2, electric boogaloo?

+10000

We're already in it. Japan is what a fiat-money depression looks like.

Those who have assets will do very well

Those who don't will find the table tilted more and more against them

Is doomsday imminent, Boehm?

We're doomed.

https://cis.org/Report/High-Cost-Resettling-Middle-Eastern-Refugees

Maybe if we stopped shipping in poor people from around the world and giving them welfare we could dig out of this hole. Like anyone at Reason would ever make that argument.

Broke my 2020 resolution of not posting at this trolling dumpster fire of a website... 10 days.

Keep clowning you clowns. honk honk.

Welcome back!

One anecdotal report. Now, go show us how economists actually feel about the impact of immigrants on our market, how the fact that there's an immigrant washing every dish and picking every potato is the fact that you get to take for granted your lifestyle.

The terms "legal immigrant", "illegal immigrant", and "refugee" are not interchangeable. People should be allowed to come here if they're willing to contribute to the economy, but not when they come to rely on government handouts.

Ever heard of automation?

Ever heard of labor force participation rate?

Ever heard of getting rid of bullshit welfare and telling the 10s of millions of people who don't work to get a fucking job?

We don't need illiterate peasants to wash our dishes. If you look at national stats the majority of people in ALL those jobs are already native born, including in farm work fucktard!

There's a big difference between letting an Indian engineer move here, who will be a net tax payer and likely never commit a crime... And letting in illiterate peasants who will be a net tax drain on native born people, commit more crimes on average (as do all poor people), and cause a host of other issues.

Not all "immigrants" are the same retard.

Not surprising at all. Can we at least drop the farce that says the Republican party is the party of "fiscal conservatism" now? Like having a drunk guard the liquor cabinet.

Not that I think Republicans are any better. But the house controls the purse. Who is in control of the house?

"But after Republicans took full control in 2017, spending skyrocketed and the deficit inflated again."

While it is true that Democrats now control the house, we're only now starting to see the impact of some of their policies. Of course, 2019 was mostly a lost year in policies, since the Republican Senate refused to take up hundreds of pieces of legislation that the House passed. So while I will not say the Democrats are without blame, I think it is clear that their only successful legislation has been legislation that the Republican Senate was going to have majority support in. This means that even the Democratic House's legislation has a huge stamp of Republican impact.

While both parties enjoy spending money, one party believes that cuts to government spending are literally murder which might cause a person to logically conclude they are not a party with any interest in cutting spending.

That seems worse than a party that spends a lot of money but doesn't actually believe cutting spending is genocide. At least there, you have the possibly of cuts vs. the certainty of no cuts at all.

Also, there's the RINO factor. The fact is there are a LOT of Rs in the house, and some in the senate, who would LOVE to gut most of the BS federal spending. The problem is the shitbags that talk the talk, but won't walk the walk when it comes down to actually getting it done.

McCain single handedly tanked healthcare reform. Now their plan may have been shit too, but it would have been less shit that Obamacare.

By electing more legit conservatives the Rs could theoretically become decent. I've always said that the Rs in the house tend to be a lot more ideologically true to what they say, mainly because there are too many races for the RNC to handpick every shill as a winner... But the senate is mostly all poser fucks. This is also why you see tons of good GOP people locally and in states. There are just too many races to control from the top down, and real deal conservatives actually win some of those local races.

wearingit wrote "Can we at least drop the farce that says the Republican party is the party of “fiscal conservatism” "

Yes, lets. That leaves us, when viewing the naked bright-light truth, with only one conclusion, "WE ARE DOOMED!"

- So it is time to study how people in other doomed countries, like Italy, Greece and Argentina, somehow continue to live in the midst of economic wreckage.

The current situation, warns the Government Accountability Office (GAO), is "unsustainable."

"As it has been for decades."

Boehm is just such a hack.

The US economy didnt recover from the Great Recession in 2009.

The Obama Administration's big lie was to skew economic facts to hide the last effects of the great Recession. Millions of people leaving the unemployment numbers was one such example.

"The Obama Administration" did no such thing. You are the hack. The measures of unemployment were not suddenly changed in a back room by Obama. And they're the exact same measures currently used by Trump, as he trumpets the low unemployment.

The fact is a lot of people permanently left the work force during the Great Recession. The fact is that the Baby Boomers are fully in retirement mode, with the oldest of them being 65-years-old ten years ago, and 75 today. That means we had 10 years of Boomers reaching retirement age after the Great Recession. OF COURSE they were leaving the labor market permanently (at least those who could afford to).

It's really time for Reason to rebrand. The commentary better fits the Drudge Report.

You don't know how labor force participation rate is calculated, do you, DrInsomnia

Yup.

Things have improved under Trump, but we're still well below where we were pre recession. The labor force participation rate has been slowly improving though, which means more people are being tempted back into work by rising wages etc.

About $1T of new spending got baked into the baseline budget during the Obama years. The emergency stimulus spending never went away, and the deferred Obamacare costs starting piling up.

Economy imploding!

This is the article you should have run instead of cheering Trump's tax cuts.

Don't worry, when a Democrat wins the Presidency, Republicans will suddenly care about the deficit again. Hopefully it doesn't come at a time when the economy needs saving.

when a Democrat wins the Presidency, Republicans will suddenly care about the deficit again

Yeah, but the Democrats won't.

Rinse, repeat.

It doesn't matter about the Democrats caring. History tells us that the best chance for reduction in deficits is when the President is a Democrat and at least on House of Congress is controlled by the Republicans. It is not much but if you care about deficits and debt it is the best you can do.

Well, the Democrats have been making some noise about *what* Trump wants to spend money on, like a wall, and then making mewling noises about how that spending will increase the deficit. But that language is reserved for very select Trump expenditures and not applicable at all to things Democrats want to spend money on.

nothing some double digit inflation can't fix

And that's probably what this is all going to come down to sooner or later...

A couple of things. One, I think that a site like Reason, the writer should know the difference between hear and here. I understand that he might have thought that the spellcheck would take care of him, but it did not. Secondly. Trump was accused of saying the he would get rid of the national debt in 8 years. True, he did say that, but he also recanted his statement and said it would be unlikely and took that promise off of the table. A little more fact finding would be nice.

"The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure. It is a sign that the U.S. Government can’t pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government’s reckless fiscal policies. Over the past 5 years, our federal debt has increased by $3.5 trillion to $8.6 trillion. That is ‘‘trillion’’ with a ‘‘T.’’ That is money that we have borrowed from the Social Security trust fund, borrowed from China and Japan, borrowed from American taxpayers. And over the next 5 years, between now and 2011, the President’s budget will increase the debt by almost another $3.5 trillion.

Increasing America’s debt weakens us domestically and internationally. Leadership means that ‘‘the buck stops here.’’ Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.

I therefore intend to oppose the effort to increase America’s debt limit.

Senator Obama. Who famously changed his tune and claimed that speech was a political one, and not one he was bound by as President, when his viewpoint changed 180% in a major flip-flop.

The public may say they think of the debt and the accumulated deficits as a big problem, but not really. They favor spending reduction as an abstract idea, but when asked which programs should be cut, they say "no" to most. Tax increases aren't that popular either.

Ultimately, the two giants (SS and Medicare) are unlikely to be messed with in any way, for the simple reason that old people vote more than anyone else, making their reform a political loser.

So we're stuck waiting for a big ol' fiscal crisis, big enough to pressure even the beneficiaries of those programs to accept some cuts or reforms. And even then, the geezers would sooner soak the rich (i.e. their fellow geezers for the most part) to remedy the problem then accept cuts. Same for Gen Xers most probably. Though it might soften Republicans a little more to the idea of military cuts.

Until then, DC will keep spending like nobody's business.

You have definitely hit on one of the biggest problems, that everyone is for cutting spending on programs that don't benefit them and for taxing someone else. Until we are willing to see cuts in programs we like and pay more in taxes we are stuck.

The trick is to get enough Rs with spines in office to ACTUALLY cut all the shit they don't like.

As useless as half our military spending is, it's more useful than all the domestic welfare crap. Rs don't like almost any of that, possibly outside of SS and Medicare. So start with all that fluff, and we can move on after that!

Yes, Yes --- Vote to CUT DOWN the federal government... Good Idea; too bad too many voters are too stupid to stop voting for "Free" stuff when anyone with anything bigger than a bird-brain knows there is nothing "Free" about it.

How can you write that many words about the deficit and not even mention Federal Reserve monetization?

You seem confident that without the Fed buying Treasuries on the open market, that the auctions would not ALL have gone off without trouble. Demand has remained strong.

The US prosperity stems from a national credit card it thinks is unlimited. When the Democrats raised taxes they were doing the financially solid thing in attempting to pay as they went. However, the Republicans have cut taxes and push the costs of today's living on to future generations. Even Ronald Reagan pointed out how wrong that is. But the Republicans are high on spending for business which means keeping the US military well prepared to protect capitalism around the globe. But they are hypocritical on maintaining the well being of the people that the military is really supposed to protect and that is the American people. There has to be a balance between protecting the people from the inequities of capitalism and the defense of capitalism. The US is not the only nation benefitting from capitalism. But many European nations do not pay as much for NATO as the US but they also realize the welfare of their people is their responsibility much better than the US.

"...There has to be a balance between protecting the people from the inequities of capitalism and the defense of capitalism..."

You mean like having to pay for what they want? That sort of 'inequity'?

Stuff it. Capitalism and a relatively free market has contributed to human welfare far beyond *your* ability to comprehend.

You have hit correctly on the problem. While Democrats maybe tax and spend, but the Republicans are borrow and spend. Each is bad but its easier to accumulate debt when you accept the later philosophical approach.

"When the Democrats raised taxes they were doing the financially solid thing in attempting to pay as they went."

ROFL!!!!! Wow that spin.

2011 and 2014 both had negative Q1. It helps not to be wrong in the 3rd sentence.

"Entitlement programs", that is, any spending program that does not help the rich, are not "the biggest driver of the national debt." Not one word is said about giving $28 billion, mostly to rich farming corporations, to undo the harm done by the Trump tariffs, which themselves are taxes on the American people. Social Security is fully self-funded, and Congress stole much of their funds (our retirement savings) to pay for tax cuts for the wealthy under GW Bush. Instead of paying that back, Obama did close to nothing. Instead of paying that back, Trump gave even more tax cuts to the rich. In other words, Trump gave the money to pay your social security to wealthy people and corporations, and the author of this article now wants to claim that somehow the people who have paid into social security for decades, and were the victims of the theft, are the reason that most of the money is gone.

The biggest driver of national debt, by far, were the Trump tax cuts for the rich, on top of a tax system already heavily weighted in favor of the rich since Reagan, filled with giveaways for those wealthy enough to qualify. Any person who pays more tax than Amazon or Apple (that is, more than zero) should be outraged, but instead, Trump is counting on his supporters in Congress to explode the budget even more, by waging expensive war, and will save money by finding any way possible to keep benefits from veterans, not caring that many of them are living and dying on the streets, not caring about broken promises to the veterans and to our senior citizens.

The US is not surrounded by hostile nations. No nation was threatening to attack the US except North Korea, until Trump stepped in. The one nation that did attack us, Saudi Arabia on 9/11, is one of Trump's best friends, and we have no problem when they assassinate US journalists on foreign soil. No missile has taken out Prince Mohammed Bin Salman, architect of the Khasshogi assassination inside the Saudi embassy in Turkey. We do not need to make war in Afghanistan, Iraq, Iran, Yemen, etc. Let them sort out their own problems. It did not hurt the US one bit when we left Vietnam, and will not hurt us one bit when we leave Afghanistan. We need to drastically reduce our military spending, at least to the level of such nations as Russia and China, but as long as certain major corporations make billions from war, they can afford to make donations to persuade politicians that we need to keep attacking on the other side of the world, and keep shoveling money into the mouths of the owners and executives of those companies.

where do you come up with such stupidity?

The tax cuts had little to no effect on the deficit. the IRS still is bringing in record revenue each year.

The US has a spending problem. All we do is spend, spend, spend. Until the spending is curtailed, there is no tax rate which will end the deficits.

Well, perhaps. Every generation has its prophets of doom. The sad thing is, sooner or later they're gonna be right...

This article is a joke!!!!....One need only look at the second graph in thus article, (debt held by public) to see that our debt skyrocketed during, (tripling i believe) the entirety of the obama years.and Has leveled OFF DURING THE TRUMP YEARS, BECAUSE THE HEAVY SPENDING HAS BEEN MOSTLY OFFSET by INCREASED GOV. REVENUES DUE TO TAX REFORM BILL. STOP WITH THUS LEFTY PROPAGANDA.

https://www.thebalance.com/us-deficit-by-year-3306306

You should get your facts straight, friend.

This article is a ridiculous piece of propaganda. One need only look at the second chart "debt held by public" to see that under obama, our deficit tripled, far more than under any pres. Before or since. In fact , it has leveled off under Trump despite increased spending, due to increased revenues due to tax reform. Add to that the fact that is a time honored tradition of dem presidents since Carter, to decimate our military through drastic budget cuts, then spend that money on ridiculous domestic spending programs..Forcing the poor republican successor to spend a fortune getting our military back to a state of readiness. And thereby crating the false narrative that republican spending is the problem wen it is the opposite. The party of smoke and mirrors is very good at what it does.

Obama received an economy in deep recession, so deficit spending is a normal reaction to that.

By the time Obama left office, he was cutting the deficit down drastically. He handed Trump a booming economy which is the time to spend down the debt. What does Trump do? The opposite, he increases the debt, in good economic times.

Obama received an economy in deep recession, so deficit spending is a normal reaction to that.

Deficit spending in response to a recession is not the historical norm. Until the mid-20th century, the answer was slashing spending at the governmental level. There is a growing body of evidence that Obama should have done nothing (as in, no fiscal stimulus), and the economy would have recovered just the same. A more severe drop, followed by a faster recovery.

I get that politicians have to be seen as 'doing something'.

"There is a growing body of evidence that Obama should have done nothing (as in, no fiscal stimulus), and the economy would have recovered just the same. A more severe drop, followed by a faster recovery."

See "The Forgotten Depression", James Grant

The stimulus was $1 trillion, right?

Divided by 320 million people or so, that's around $3,000 per person.

If the gov had just given a $3,000 check to every person in the US, the economy would've recovered much faster

Of course, that's not how you pay off cronies

So just to be clear you're agreeing with us that Trump should have pushed harder to cut spending. Got it. I'll assume also that you're bothered by the many trillions in additional annual spending being proposed by the current crop of democratic presidential candidates. Good to see you coming around.

He should have. Should have let government shutdown(s) happen and then explained the cuts he wanted.

Problem with shutdowns is Democrats have managed, with media support, to blame shutdowns on Republicans. And Republicans run scared because of it.

Own it, shut it down, force some cuts.

Of all the things that annoy and disappoint me in POTUS Trump, federal spending is at the tippy-top of the list. Yes, POTUS Trump is spending like a squad of drunken marines on leave, let alone a drunken sailor. I am not happy about that.

Aside from vetoing spending bills, and forcing a shutdown (been there, done that), POTUS Trump's options are very limited. Chipper, do you see another workable option here? I mean, what else legally can POTUS Trump do to restrain spending? Impoundment? Recission?

Meaningful and sustained deficit reduction and retirement of the national debt absolutely requires Congress to act. I don't see any appetite in the House to pass legislation to attempt to reduce the deficit.

A Republican Congress and sequestration rules played some part in that deficit reduction. Look at the revenue vs spending year-over-year for the last 40 years or so, and you can see that revenue tends to lag spending by about 5 years. That is, the government will spend this year about what it brought in as revenues about 5 years ago. Rolling CRs, sequestration and a deadlocked Congress vs. President checked spending growth a bit and revenues kept growing.

If we could just FREEZE spending for 5 years, revenues might catch up and eliminate the deficit even without making actual cuts. Just agree that the level of spending we have today is enough--enough is enough!--and hold fast for a few years.

Or, heaven forbid, shrink the size of the federal government to those bad old days of 1998. You know, when the economy was terrible. (sarcasm)

A simple five step process will nearly eliminate the national debt in short order: 1. End Social Security. 2. End Medicare 3. End Medicaid, 4. End all welfare benefits, and Finally - - -4. Cut all military spending. I will be running for President in 2024.

Someone will pay for it, both domestically and abroad. But don't fool yourself into believing that the burden will be shared equally.

The future of the US depends largely on who gets stuck with the bill and whose government handouts will get cut the most, and that's up in the air.

When empires stop expanding, they turn to cannibalism

To me the real debate is who you want doing things.

Social security, for example. This is essentially an annuity. Yes, yes, I know SS is technically an insurance program. But conceptually, SS is like an annuity payment for life. Does the Federal government have to do this, or can private enterprise do it better? The answer is obvious: Private enterprise, hands down. The hang-up has always been guaranteeing payments when the shit hits the fan. People want 100% security. I would too. You can pretty much get that with a 3.3% withdrawal rate on a 60/40 portfolio in low cost index funds. That withdrawal rate even assumes an average real rate of return of just 2% annually, which is WAY below the historical average. That is just math.

When you get right down to it, I just don't trust the Federal government with retirement security. Why? Because in just 14 years from now, everyone will take a 24% benefit haircut if nothing is done with SS. To me, the politicians have had their turn with annuity payments and they really suck at it. They fucking spent the money. At least with private enterprise, that money would have been set aside and not spent.

SS payouts should simply be linked to financial solvency of the fund.

More importantly, however, Social Security, Medicare, and Medicaid should all be strongly means tested; meaning: you get nothing unless you are (1) incapable of working, and (2) have no significant income or assets anymore. They should be programs of last resort, not universal benefits. In addition, the taxes paying for them should be cut accordingly, benefits should be cut to a minimum necessary, and payouts should be scaled according to available funds.

(I think people who claim any such means tested emergency benefits from the government should also lose their right to vote, since there is an irreconcilable conflict between voting and demanding money from the government.)

NOYB2, I am not 100% sure I agree. Why? I think the form of these programs (SS, Medicare, Medicaid) must surely change, but the function of these programs must be addressed in a meaningful way.

Note...I am not opposed to means testing per se. But my attitude is that if you pay in, you take out. Pay in more, take out more. That is the problem I see with doing away with the SS income cap. If I am a millionaire, I would pay SS taxes on much more of my income....therefore, I should expect a significantly higher benefit. That is the hurdle to just knocking out the income cap.

To me, it makes perfect sense to transition SS into an annuity program, run by private industry. The math is the math. It is a perfectly implementable libertarian-oriented solution.

Medicare/Medicaid are tougher, but I agree with your general point that a Federal government administered program should the the last, last, last, last program of resort after all private, local, and state programs have been exhausted.

"Social security, for example. This is essentially an annuity. Yes, yes, I know SS is technically an insurance program. But conceptually, SS is like an annuity payment for life."

No. It's NOTHING LIKE THAT AT ALL.

Due to the way SS is constructed, current SS taxes are used to pay for current beneficiaries as they are collected. "Your money" was already spent. It was not "invested" nor is it even "your money" anymore, it's just taxes collected.

When you become eligible for SS, you are not getting back "your money", but rather you are getting paid from the taxes collected from the younger people who are still working and paying the tax.

Meanwhile, everyone is just hoping that they live long enough to collect and that the program doesn't collapse under the weight of its Ponzi Scheme mechanisms (see Social Security: The Most Successful Ponzi Scheme in History)

"Social Security is exactly what it claims to be: A mandatory transfer payment system under which current workers are taxed on their incomes to pay benefits, with no promises of huge returns. By design, that means a certain amount of wealth transfer, with richer workers subsidizing poorer ones. That might rankle, but it's not fraud."

The fact-checkers dodge the Ponzi Scheme label by semantics, but they cannot dispute the fact that in 1945, there were almost 42 workers paying in to SS, while today there are 2.9 and dropping (projections by 2030, there will be only 2.0). The average SS check is $1,373.81 (2016), which at today's combined 12.4% SS tax rate requires the 2.9 workers to make a combined $132,949.35 annually.

mpercy...Yes, yes. I got all that. To the average American, conceptually and functionally, SS is an annuity payment that they paid into for ~50 years. That is the reality of how they see it. It is time to transition this program.

We have a track record of Washington DC politicians managing SS for 70 years. The results are in. Retirees in 14 years are going to take a benefits haircut. That does not sound like good management to me, mpercy. That kind of performance makes me believe they fucked up, bigly. Politicians drew up the rules, and then failed to deliver. Gen Xers and beyond are going to pay the price. As a GenXer, I know that is coming (the haircut), and am planning for it. But I am not happy about it at all.

Say what you will about POTUS Reagan, but at least he actually did something to improve viability of the program.

My larger point is that private enterprise handles annuity payments also. They are more efficient and less costly. Privatizing SS effectively removes power from the Federal government and places it back with the individual. Mathematically, it would work far better for the 'annuitant'.

The math is the math. There has not been a 30-year historical period in the last 150 years where a balanced portfolio (60/40) of low cost index funds would have had a terminal value of zero with a 3.3% annual withdrawal rate. You can Monte Carlo the shit of the data; those results hold up over tens of thousands of simulations.

Even if idiots wanted to keep it government run and guaranteed, all they need to do to be on the level is invest the funds in REAL investments.

If they took saaay 50% of the funds and invested them in the ENTIRE stock market (so no picking winners or losers) and high grade corporate bonds, it would be solvent immediately. It's the fact that the funds make essentially zero real rate of return that makes it not work. If they were making even 4-5% returns a year, which they could do by investing less than all the funds in real investments and keeping much of it in worthless government debt, it would be fine forever.

Since we aren't seeing any of the effects of huge deficits, how are you going to convince anyone to cut spending?

We aren't seeing any inflation. We aren't seeing high interest rates, indeed, about a quarter of the world's debt has a negative interest rate https://www.washingtonpost.com/business/negative-interest-rates/2019/11/01/fca350e0-fcaf-11e9-9e02-1d45cb3dfa8f_story.html , indication deflation.

While the GOP is horrid despite their 'talk,' am I the only one who read this article to come across as Obama didn't grow the debt (which he did $10T at least) and that Clinton somehow balanced our budget? Because both are comical.

c'mon now, Clinton deserves all the credit in the world for happening to be POTUS during both the inflation of the dotcom bubble and a period where the demographics were hugely favorable in terms of SS cashflow. it was his skill!

don't forget the rebranding of the Soviet Union and subsequent "peace dividend".

To lower debt/gdp, consider transitioning to a decentralized form of Edgar Feige's 0.3% APT tax[1,2] on dollar liquidity flows[3,4], where tax proceeds are apportioned to local governments and bubble up to State and Federal levels after local fiscal issues are addressed (including price inflation). Besides saving $800 billion/year, it raises net profits, raises net wages, lowers prices and unilaterally addresses tax havens[5,6]. This enables local governments to lower property taxes, lower education taxes and limits excessive state and federal spending of our tax dollars. That's the stimulus we need for business and job creation in our local communities, along with less red tape to start and operate those going concerns.

As an aside, FY2017, FICA 15.3% withholding collected around $1.1 Trillion for SS/Medicare and paid out $939 billion[7,8]. Eliminating FICA contributions does not improve our fiscal condition one iota, but it does negatively impact senior citizens, today and the current and future generation in their old age, tomorrow.

[1] Alternative Proposals Reform, May 11 2005 | Video | C-SPAN

[2] Taxation for the 21ST Century: Automated Payment Transaction (APT) Tax | SSRN

[3] Intraday Liquidity Flows | FRBNY

[4] Worldwide Currency Usage & Trends | SWIFT

[5] The Spider's Web - Britain's Second Empire | Youtube

[6] [PDF] The Treasure Islands | Nicholas Shaxson

[7] Key Elements of US Tax System | The Tax Policy Briefing Book | Tax Policy Center

https://www.taxpolicycenter.org/briefing-book/what-are-major-federal-payroll-taxes-and-how-much-money-do-they-raise

[8] Social Security Ran a $44 Billion Surplus in 2017 -- So, Why Is the Program in Trouble? | Motley Fool | 2018

easy way to lower property taxes...shut down medicaid and end teacher's unions..will work pretty quick and cut my bill in half or more

That's true and there's no doubting that. They are contributing factors. In a broader sense:

The main drivers of national debt are guns & butter spending. We're dishing out $1.25 trillion on national security[1] and over $1 trillion on welfare[2]. The Pentagon and HUD haven't passed an audit in decades so the public does not know where trillions of dollars have gone[3].

[1] Making Sense of the $1.25 Trillion National Security State Budget| POGO | 2019

[2] CRS Report: Welfare Spending The Largest Item In The Federal Budget | Sessions | 2012

[3] Dr. Mark Skidmore – $21 Trillion Missing from US Federal Budget | Youtube

Let's end teachers' unions and turn your children into idiots like you.

https://www.Blogger.com

It’s not just Grandma who we are murdering. The entire populations of El Salvador, Guatemala, Honduras, and about 30 other countries need to come here or they will all be murdered. Those who came here illegally must be given free health care, free college, and every other government entitlement program we have. Celebrity Biography

Well if we are going bankrupt who better to lead us through one that Mr. Trump as POTUS?

That's pretty good

Everyone forgets that the Great Depression of the 1930s was preceded by the Roaring 20s, another time of an unprecedented economic boom. More importantly, everyone overlooks how the Federal Reserve's policies of monetary inflation lead to the boom and bust cycles we've experienced over the last century.

Boom and bust cycles don't have anything to do with CENTRAL banks. They are a consequence of banks. Even the one kind of recession that is not driven by banking - the 'excess inventory' type of recession - is usually precipitated by banks driving that excess by funding it during the boom.

Here's a list of 'booms and busts' during the 'free banking' era in the US after the 2nd Bank of US and before the Fed: 1836/7; 1839-42; 1845/6; 1847/8; 1853/4; 1857; 1860/1; 1865-67; 1869/70; 1873-79; 1882-85; 1887; 1890; 1893/4; 1896; 1900; 1903/4; 1907; 1910/11; 1913/4 (the Federal Reserve Act was signed during this one).

At core the issue re banking/money is that we humans suck at expecting/projecting the future. But we have a big inclination to shove costs/risks into the future while bringing back the benefits to today. Rather than actually try to figure any of this out in Hayekian terms, we far prefer to side with one side or the other - creditor v debtor in the particular circumstance of the time - and let the boom/bust be the way we conduct war on the other.

Sorry - that list is of the 'bust' side of events. The booms would be some time frame in between those busts.

And explain how the great recession of 1920 was fixed without keynesian nonsense?

Seriously if "banks" extending credit too much was the problem (and it is by the way the prime driver either through banks or central banks) for recessions..easy solution...two types of deposits..demand which can't be lent out and hence can't be lost in bad investment decisions and time deposits which are not insured and can be lost by the bank but return interest similar to a mutual fund. That way there are no "runs" on the banks and credit can only be from savings not thin air. Then the normal regulation mechanism of savings versus investment is allowed to take place and you don't get massive bubbles and male investments...

You can always tell a nutjob because they truly believe the only recession ever was 1920. The cause of that one was actually a very simple excess inventory one. A massive drop in post-war military spending (completely expected everywhere - and as always leads to a recession as factories are retooled for different stuff) - and a massive drop in food exports/prices (unexpected because it was a combo of big reductions in demand from the influenza deaths and restoring food production in Europe as soldiers there returned to farming).

That 1920 farm sector depression was actually significantly effected by the END of farm price supports (which is a very statist 'Keynesian' distortion) during World War 1. Those, in combo with the banks lending massive amounts now that they had both a Fed backstop AND govt war debt to serve as the reserves, had jacked up the price of land - cuz banks - and farmers in their usual overreach re land prices had to overproduce in order to pay back their loans. That jacking up of the price of land also forced ranch land into farm land at the marginal areas - and a major part of the 20's bubble was a speculative land bubble. That plowing of prairie also broke up the soil which 10 years later - with a drought and a 'windier' weather cycle - turned into the Dust Bowl. 1920 did not end quickly in the entire prairie region which was in a recession/depression from the early 20's until WW2.

easy solution

If it was easy, it would have already been done. Easily. It's not easy. Because in fact there is almost no consumer demand for time-deposits - only for demand-deposits. And there is no profit - only losses - for banks in demand-deposits if they have to be 100% reserved. And the other FACT is that neoclassical marginalist economics has a fetish about the importance of 'capital'. In large part because it ignores land and assumes economic rent is 'earned' (and therefore has to be financed). And in smaller part because it chooses to ignore that labor actually finances itself. There is no 'normal market-based regulation' of the connection between 'savings' and 'investment'. That is a figment of neoclassical/marginalist economics. Say's Law is the way it works in classical economics - and that doesn't work with banks or any 'intermediary' -- only with coinage or commodity money.

HOW I BECOME A FULL MEMBER OF ILUMINATI

I am Alex by name. as the going says, money is powerful in human beings life and money rules the world.I'm from a poor family in which I found it hard to feed my family

During the end of 2006 and the early part of 2007, I was suffering from a terrible depression that led me to start thinking about suicide.All Around that time I was talking to some people on a few forums about my problems. One of those people helped me learn a little bit about iluminati I suffered before I became a millionaire via the help of iluminati.I knew here in US promised to help me give email which I emailed told them I want become a member and be protected.They accept my application and I was initiated after my initiation. I was given first money of $2,000.000.00 US Dollars and on monthly basis am now paid $20,000.00 USDollars for working for the hood. Please if you are tired of poverty and you want to change your status or you are already weathy and you need protection of life,wealth,properties and family member please come and join the help iluminati now and get what you need. Please note that joining is free of charge you don't pay any dine to become member and to contact us here is

our directly email iluminatihood123@gmail.com mobile number +13092795479 join one join all

Wow...reason magazine believes deficit spending raises real income in the short term? Really? Keynsian economics works? What BS.

Allowing for public debt at any level is the problem. It is corrosive and eats at a societies integrity, work ethic, morals and just creates bubbles that demand more and more debt. It also is a tax on the future generations the ultimate "baby boomer" fu.

We have two concurrent economies..one that is productive and increases living standards...it is the free market. The second is a crony state which just builds bubbles and does not encourage productive innovation just raises prices. Look at education and healthcare and the military...the prices only go up and up.

Will we have a debt crisis? Hard to say as long as we have the worlds reserve currency and a "bernanke" type at the helm of the Fed. The real solution is to drastically downsize the federal govt (make public sector unions illegal would be a good start) AND have a debt jubilee. The Fed can just forgive the debt about to roll over and the bond holders take a big haircut on student loans and other local govt debt. Make SS means tested and eliminate both medicare and medicaid. End foreign intervention. And lastly shut down the Fed and go back to a gold standard. Watch the greatest economic growth in history with the greatest innovation...

Glad I'll be dead before the bottom falls out.

Sorry – that list is of the ‘bust’ side of events. The booms would be some time frame in between those busts.

Google pay 350$ reliably my last pay check was $45000 working 9 hours out of consistently on the web. My increasingly youthful kinfolk mate has been averaging 19k all through continuous months and he works around 24 hours reliably. I can't trust in howdirect it was once I attempted it out.This is my essential concern.for more info visit any tab this site Thanks a lot ......... Read More

This doesn't have squat to do with Trump. We're right on line with the CBO's projections from 2016, all you're seeing here is the debt that was already baked in back then.

Sure, it would have been nice if Trump had made more of an effort to restrain spending. But he actually did try his first year in office, and the response was a bipartisan veto proof majority in Congress ordering spending increases.

Probably the last chance to stave off an eventual debt crisis came back during Bush the Younger's second term. When TARP was enacted, it was all over but the waiting: Our government had officially committed to ballooning deficits and eventual crisis.

Democracies just can't exhibit spending restraint once borrowing to pay for current spending is on the table. It's just not something democracy is structurally capable of.

Correction: most Americans claim to believe the debt and deficit are important.

When you look at their actions, however, it becomes apparent that this is a non-issue.

Best-case scenario, it's a real belief, but not a motivating belief. Like the conservatives that say "yeah, global warming is real. But we shouldn't do anything about it."

If 'doomsday' is in store, the response to too-long deficit spending will play only a small part. The once-in-a-generation Trump presidency has coincided with what is now a 30-year delayed (at least since the collapse of USSR) rejection of socialism.

Here in America in the 2020's it is hoped that the Democrat party will collapse to irrelevancy.

We'll either reject socialism, or demonstrate that Venezuela going down the tubes was no fluke. The only thing keeping the country going is the free part of the economy.

And the biggest question that nobody is asking ... where is all the money?

This guy makes a lucid argument that the Communist Party of China currently controls ~ $30,000,000,000,000 (that's trillion) in western assets - conjured out of the ether with their brilliant dual currency scheme:

https://deep-throat-ipo.blogspot.com/

If you go back the full 5 years, you will find a staggering amount of forensic detail. The unanswered question, if he is correct, is 'what is their end game'?

"assets-conjured out of the ether..." China and the USA are BOTH Monetarily Sovereign.

So, what should common people like me do? Buy gold bars and put em in a vault?

Why everyone is confused just join at home online job .This is really good opurtunity for home mom just join this website and Earn money by monthly check .So u cant be miss and join this site as soon as posible.... Read more

Google pay 350$ reliably my last pay check was $45000 working 9 hours out of consistently on the web. My increasingly youthful kinfolk mate has been averaging 19k all through continuous months and he works around 24 hours reliably.=…. VIST THIS SITE >>==>> Click it here

Fuck off, shreek

Thanks to Obama's policies, FIFY

Obama received a smoking ruin and handed Trump a booming economy, which he promptly took credit for.

That hood must be cutting off your oxygen, nazipig

The Failed Obozo is the _only_ US President to not see annual GDP of 3%. Booming what? #turnOffCNN

"Thanks to Obama’s policies, FIFY"

Bullshit.

That lying POS started with an economy in shambles, which should have been a golden opportunity for record growth.

His 'stimulus' programs managed to keep growth down to what we're seeing now with the economy at record highs, and nearly no room to grow.

And we still get dimbulbs like this to pimp for that lying POS.

GeneS is a typical progressive NPC

Faith alone