Man, This CBO Report About 'Unprecedented' Debt Levels Is a Bummer

The national debt will hit 140 percent of GDP before the end of the 2040s, and that's the optimistic scenario.

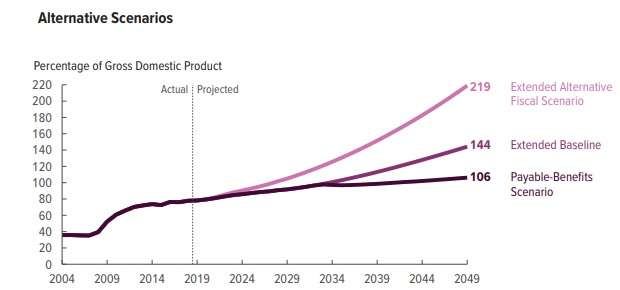

The national debt will hit "unprecedented levels" in the coming decades, soaring well above the record highs set during World War II and reaching nearly one-and-a-half times the size of the entire U.S. economy by 2049, the Congressional Budget Office (CBO) projected in a report released Tuesday.

And that's the optimistic view.

The CBO says the national debt will hit 144 percent of gross domestic product (GDP), a rough estimate for the overall size of a country's economic output, within 30 years, even if planned spending cuts materialize next year and even if Congress repeals the 2017 tax cuts in 2026, as planned. Neither of those developments should be treated as a sure bet—and, indeed, Republicans have admitted that the planned expiration of those tax cuts was nothing more than a gimmick designed to favorably influence the CBO's analysis of the Tax Cuts and Jobs Act.

(Actually, the numbers are worse. That's because the CBO is looking only at debt held by the public, which excludes the portion of the national debt that's held as internal loans between different parts of the federal government. For the CBO's purposes, the current national debt is about 78 percent of America's GDP, though including government-held debt puts the figure above 100 percent already.)

If current tax and spending policies remain in place, the national debt will soar to 219 percent of GDP by 2049, the CBO estimates.

The CBO's projections assume that Social Security and Medicare benefits are paid in full, even if there are insufficient resources in the trust funds associated with each program. On the current trajectories and under current law, however, both programs would have to institute benefit cuts within the next two decades. Social Security is on pace to hit insolvency in the mid-2030s, at which point benefits would be reduced by about 20 percent. One of the trust funds within Medicare is on track to become insolvent and unable to pay out full benefits by 2026, according to the programs' trustees.

If those programs are limited to paying out only what they take-in, it would reduce the long-term deficit to merely 106 percent of GDP, according to the CBO.

Under any of those scenarios, it should be obvious that the national debt is becoming a major crisis for the United States—although you wouldn't know it by surveying the current political climate, which is almost completely devoid of deficit hawks. Republicans seemingly stopped caring about the size of the national debt as soon as President Donald Trump was elected, and a whole slew of Democrats are now seeking the White House while promising to spend billions or trillions more—often without any coherent plan for how to pay for their agendas, which translates into an implicit promise of higher deficits and more debt.

"The prospect of such large deficits over many years, and the high and rising debt that would result, poses substantial risks for the nation and presents policymakers with significant challenges," said CBO director Phillip Swagel in a statement.

As the national debt climbs, so too will annual budget deficits. The current year's projected deficit of 4.2 percent of GDP will increase to 8.7 percent by 2049 if current policies are followed—in other words, if the tax cuts are allowed to expire and planned spending cuts occur. Under the alternative scenario, in which the national debt hits 219 percent of GDP, America would be running annual budget deficits of more than 15 percent of GDP by the end of the 2040s.

And, sure, 2049 might sound like a long way off. But it's really not. It's as far into the future as the fall of the Berlin Wall is in the past. If the CBO's projections are accurate, it means the national debt will roughly double between now and the time when most millennials will be retiring.

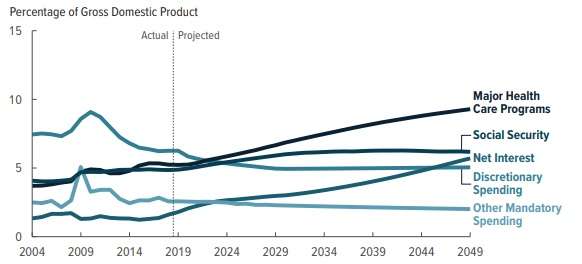

One of the major problems created by the growing mountain of debt is paying for it. That might sound obvious enough, but one of the major drivers of the long-term debt problem is the interest on the debt itself, according to the CBO's projections. Discretionary spending is expected to be mostly flat—actually, it's likely to decline a little—relative to GDP over the next three decades, but the growing cost of the debt and the increasing cost of entitlement programs are real problems.

This is also one area in which there is a tremendous amount of uncertainty in the CBO's projections. If the interest on the national debt increases—as many observers believe it will at some point, as it becomes increasingly obvious that America has more debt than it can afford—the overall cost of paying down the debt will grow.

The CBO assumes that the interest rate on the debt will never rise above 4.2 percent—well below rates paid as recently as the 1990s. "Many economists believe rising debt will raise interest rates," says Brian Riedl, a senior fellow at the Manhattan Institute, and the author of a plan to hold the debt in check at barely less than 100 percent of GDP. He estimates that every 1 percent rise in interest rates would add $13 trillion in interest costs over 30 years.

"So there is massive interest rate risk in these projections," he says. "Rising rates will bury us."

The national debt is "a glaring vulnerability" for America's long-term national security, warned Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget, in an op-ed published this week. If China were to sell-off a sizable portion of the U.S. Treasury bonds it owns—and it owns more than $1 trillion of them—the resulting shake-up could easily trigger a rise in interest rates. Even just a 1 percent increase would cost the United States more next year than we currently spend on the entire U.S. Army, MacGuineas pointed out.

"We don't know whether China will go as far as to weaponize their Treasury holdings," she added, somewhat ominously. "Maybe they won't. Or maybe they will wait until we are in a recession, or until they want to invade Taiwan."

And if the debt crisis could arrive at any moment, well, there's no need to wait until the CBO's projections turn into reality. The debt crisis is already here. Congress, and Trump, should start acting accordingly.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Every time it hit a peak, it got better. But it’s different this time, for reasons.

But there was an obvious reason for past peaks in debt. Not anymore.

The reason is the same, more money was spent than came in.

The excuses vary.

There's an obvious reason for this peak as well: the welfare state. The difference this time is that all of that debt is to pay people to not work whereas previous episodes were to pay people to protect us from other people who wanted to kill us.

Welfare state and perpetual wars. But don't you guys think that an increasing debt is a destabilizing force? It just seems like the government doesn't even care about their own future anymore, only the present. At least in the past there was some semblance of sustainability.

The people responsible have their escape plans in place. They'll be in their gated compounds in Uruguay when the collapse happens.

Hope you don't live next to Luis Suarez when the famine hits.

FTFY

So, the Forever War is free?

Just imagine a world where money wasn't pouring into medical care and innovation. Incentivizing the care of human health makes the world a better place. Pouring the money into tanks or ships is such a waste in a perfect world.

What world is that? Oh, you think welfare actually pays for research and innovation as opposed to a Ponzi scheme?

Well, killing off people does tend to decrease their long term healthcare costs...

On the flip side, I don't thin a week goes by where my parents have less than one doctor visits, neither has a debilitating condition. But Medicare makes it easy to get checked for everything under the sun.

If your tank money went to promoting early care to prevent elder care, maybe that's a net zero.

Of course it’s a destabilizing force. Destabilizing America is the entire agenda of the left and the democratic party they’ve completely hijacked. Do sone research on Alinsky, Cloward, and Piven.

""At least in the past there was some semblance of sustainability.""

1960s? 1970s? 1980?

Technically, the only part of the Civil war debt that was for that, was the South's part of it, and that got repudiated. The Union paid people to go attack somebody else. (That's so whether or not you think the cause was just.)

If current tax and spending policies remain in place, the national debt will soar to 219 percent of GDP by 2049, the CBO estimates.

LOL.

Green New Deal, Free Healthcare and Free College, meet the CBO.

Do you plan to do anything about the current debt level before you enact the GND, Universal Healthcare, or Free College?

An important question that will not be asked at the dem debates.

They have what are known as pay-fors for their plans, which are more or less plausible (mostly less). You can bitch all you want about Democrats spending money, but Republicans don't even bother to pay for their spending, and they spend more, and they spend on utterly useless crap.

(R)=(D). (D)=(R).

Simple doesn't mean true.

That's what she said.

Simple doesn’t mean true.

But “democrats are good and republicans are bad “ demonstrates complexity in thinking.

As I've said many times before, I'm just as surprised as you are.

There is no "pay for" for the GND. Nor for Medicare for All. Nor for free tuition. Don't pretend that your innumeracy changes that.

Sure. What did Occasional Cortex say? Just print money?

Everyone proselytizing the Warren and Sanders plans at exactly this. Why do yall make this hard. Just double the money printing! What could possibly go wrong?

Warren would just steal from the "tippy top" of the rich. Which will eventually become the "tippy top" 49% of voters.

Tony, democrats don't pay for anything. So just stop with your bullshit. And if your pals had any fiscal restraint, we would have seen it when they ran the table during Obama's first term.

The real solution is to get rid of all progressives, including RINOs.

"get rid of"

What? Shitlord just wants to buy the progressives all beautiful houses in the Swiss Alps and move them over there. What's the problem?

You'll take a nice train ride to the airport.

Wrong side of the aisle.

Would that solution be final though?

and they spend on utterly useless crap.

That's a ironic when talking about the Green New Deal.

That’s a horrible thing to say about my tax cut.

Vast majority of the spending increase in the cbo report is for programs already in place, programs largely passed by democrats. But you knew that tony.

""and they spend on utterly useless crap.""

If we draw down our defense commitments like NATO, we could reduce spending on the military. But watch the left freak out if Trump talks about pulling out of NATO.

Whenever forced to choose between being socially liberal and fiscally conservative, Reason always selects fiscally convenient.

Start the drumbeat non-stop on entitlement spending--the proximal cause of all of this debt--and I may start listening to you. Continue caterwauling about defense spending and tax cuts and I won't.

Why? Military spending on the War on Terra is a yuge part of the national debt.

Agreed that the tax cut contributed zilch to the debt. Govt revenues went up, as usual when taxes are cut.

It's actually a small part. But okay.

"Yuge" or "small" are subjective. It's hundreds of billions of dollars. It's significant. And what is worse is that the wars of aggression we spend so lavishly on do nothing to make our lives better here, arguably threaten our domestic freedom by militarizing domestic governance, and make the international security situation worse. Our level of military spending and foreign aggression is clearly way out of line with libertarian aspirations.

Yawn.

Who cares about projections that go beyond the end of the world?

Do you have a firm date for the end of the world?

Less than 12 years is the current 97% consensus.

I'll take 15 years for a 88% consensus, but not a dollar more.

How can the seas rise 1500 meters in the next 100 years if there are only 12 years left?

Comet strike?

Mr. Boehm, if you took a dollar from your left hand and lent it to your right hand, how much debt would you have incurred as a total person? Please stop counting intra-agency federal debt in the debt totals!

Spend that dollar once it gets to your right hand and get back to me.

That only is debt neutral if Agency A, after borrowing from Agency B, does not spend the money. In other words, not likely.

So the federal government is just men in a burlap sack trading hats for a living.

Guess who pays back the "inter-agency" debt -- the US taxpayer.

I facepalmed so hard after reading this comment I think I injured myself.

Comparing national debt to GDP makes little sense. Debt is one value that carries over from year to year. GDP is measured per annum. They are actually not measured in the same units: dollars per year is not the same as simply dollars.

It's just shorthand for how many years worth of debt is built up. But GDP is dumb to use as a comparison since it includes annual govt spending.

Debt is for suckers and thinking about it is so last century!

Spend, spend, spend! Free shit for everyone, everywhere, all the time. Start a few more Forever Wars, too! The wisest Latina of all says the world will end in 12 more years, so in the words of the old song from Prince, party like it’s 1999.

And if the extinction event in 12 years turns out to be as apocalyptic as Y2K was, not too worry: the government will just print more and more cash. Don’t laugh...it worked for Maduro.

Hmm, what do you think the end will look like for ol' Nicky boy? Strung up on a lamp post like Mussolini? Found in a dirty spider hole like Saddam? Just desaparecido?

Fly out with a plane full of gold bars.

Lamp post.

Yet people keep buying this debt, so they must think it a good risk. The interest rate is in part an indicator of how good a risk they think it is.

Yeah, you can always soak the US taxpayer, and print more. And if the economy tanks stocks will lose a lot more.

Many institutions buy this debt because they are obligated to do so.

How interesting that none of the politicians haven't thought of spending less which would drive down the debt. Now that would mean that more citizens would have to be more responsible in their spending also and not depend upon the government to be their parents and support them. It also would mean that politicians could not buy votes with taxpayers money as many of the politicians are doing with the promise of free this, free that, free everything even free toilette paper to clean their a*@ with.

the only thing voters agree on cutting is foreign aid, which is about 1.2% of annual spending.

1.2% of discretionary spending.

Just print more money, duh. AOC.

GDP is the wrong measure, because it includes government spending. GDP - govt spending is about 19T - 4T, or 15T bucks. So the 22T federal debt is already 147% of available GDP.

But that's the wrong measure too, since people only stand for about 3T in taxation per year. Which puts the 22T federal debt at 733% of federal income.

And that's not counting unfunded promises for Socialist Security or Medicare.

The usual measure for this is the "Private Product Remaining" or PPR.

I stopped worrying about debt levels. After all, if you know about them, you can prepare for it and even prosper.

im stresting on comments and reply but good article

Once you've gone over the edge of the cliff, you might as well enjoy the few seconds of zero G. That's where we are now; We went straight from "not urgent yet" to "to late to do anything about it", and now a crash is inevitable.

The ugly part of it is, as the economy improves, interest rates inevitably go up, which raises the cost of debt service. And we're past the point where an improving economy increases the cost of debt service more than it increases revenues: We can't grow our way out of the debt anymore.

The goal now should not be to pay down the debt, or even stop accumulating it, because THAT is politically impossible. The goal should be to try to manage things so that the inevitable crash is as survivable as possible. Try to end up 2nd world rather than 3rd.

That means, since the crash is going to result in our foreign trade deficit going to zero whether or not we like it, we need to become more self sufficient, so we won't NEED the imports nobody will trade for our money anymore.

IOW, much as you hate it, Trump is actually doing the right thing by pursuing national self-sufficiency.

If China sells off a significant amount of US Treasuries ....

Reminds me a bit of The Iron Bank in GoT.

Eric,

How much would S.Sec. payments need to be reduced in the payable benefits scenario?

[…] the Congressional Budget Office projected that the national debt-to-GDP ratio will soon hit “unprecedented levels” despite the previous near-decade of economic growth. So, who will be the one to point out […]

[…] the Congressional Budget Office projected that the national debt-to-GDP ratio will soon hit “unprecedented levels” despite the previous near-decade of economic growth. So, who will be the one to point out […]

[…] the Congressional Budget Office projected that the national debt-to-GDP ratio will soon hit “unprecedented levels” despite the previous near-decade of economic growth. So, who will be the one to point out […]

[…] lawmakers ‘that would make our country less safe.’” (Fox News) . UNPRECEDENTED DEBT: Reason reports, “The national debt will hit ‘unprecedented levels’ in the coming decades, soaring well above […]

I doubt China will dump their Treasuries - it would hurt them too much. Japan's debt-to-GDP is much higher than the scary projections for the USA in this article - so perhaps we need to learn more. I mention Japan because they have not experienced the widely predicted hyperinflation (yet). The USA may well end up feeling the pain of too much federal debt - but it will show up in the form of harmful inflation. Progressives like Bernie and AOC will push the MMT theory as hard as they can - but we must remember that the MMT crowd still has no coherent explanation on what might cause harmful inflation, how to prevent it, or fix it if it happens.

Ron Paul finally accepted years ago that we're doomed. People are too fucking dumb to deal with this shit until it explodes. The only question is how to deal with it when it does.

If we have smart people in charge at the time, we may be able to moderately inflate our way out of debt by fucking our creditors. Think 5-10% inflation a-la 70s and early 80s. The real value of the debt would plummet PDQ in such a scenario. But there's always the Wiemar option too. We'll just have to see how it all goes. For the smart folks out there, make sure you have at least a few bucks in gold/silver, and a shit ton of pantry items. IMO one doesn't need to go full on prepper, but going half assed prepper is a very reasonable thing to do.

[…] got a plan to beat ISIS Install a puppet leader who’d lead them into insolvency Hmm…who could we […]

[…] got a plan to beat ISIS Install a puppet leader who’d lead them into insolvency Hmm…who could we […]

[…] got a plan to beat ISIS Install a puppet leader who’dlead them into insolvency Hmm…who could we […]

[…] got a plan to beat ISIS Install a puppet leader who’d lead them into insolvency Hmm…who could we […]

im stresting on comments and reply but good article

The reason is the same, more money was spent than came in.

The excuses vary

im really really good with this text ????????

[…] a report like the one published by the nonpartisan Congressional Budget Office (CBO), in which it estimates that the national debt is careening toward “unprecedented […]

[…] like the one published by the nonpartisan Congressional Budget Office (CBO), in which it estimates that the national debt is careening toward “unprecedented […]

[…] a report like the one published by the nonpartisan Congressional Budget Office (CBO), in which it estimates that the national debt is careening toward “unprecedented […]

[…] like the one published by the nonpartisan Congressional Budget Office (CBO), in which it estimates that the national debt is careening toward “unprecedented […]

[…] stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

[…] stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

[…] stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

[…] stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

[…] stay in place, the government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

[…] that the federal government will add another $11.6 trillion to the deficit over the next decade. By 2049, the national debt will be more than one and a half times the size of the entire U.S. economy, […]

That was interesting

http://asmehr.ir/page.aspx?%D8%AA%D8%AD%D8%B5%DB%8C%D9%84%20%D8%AF%D8%B1%20%D8%AA%D8%B1%DA%A9%DB%8C%D9%87