Liberals Were Very Wrong About Tax Cuts. Again.

To be this wrong this often deserves recognition.

For those of you who survived the Great GOP Tax Cut Massacre, things are finally looking up. The unemployment rate fell to 3.6 percent last month, the lowest level since 1969. We've now experienced over a full year of unemployment at 4 percent or lower. The economy beat projections, adding another 263,000 jobs in April. Wages are rising.

It was Larry Summers, Bill Clinton's former treasury secretary and Barack Obama's White House economic adviser, who warned that tax reform would lead to over 10,000 dead Americans every year in December of 2017. Summers, considered a reasonable moderate by today's political standards, was just one of the many fearmongers.

The same month, after cautioning that passage of tax cuts would portend "Armageddon," then-House Minority Leader Nancy Pelosi explained that the 2017 Tax Cuts and Jobs Act (TCJA), a reform of corporate tax codes and a wide-ranging relief, was "the worst bill in the history of the United States Congress." Worse than the Fugitive Slave Act? Worse than the Espionage Act? Worse than congressional approval of the internment of Japanese Americans? That's a really bad bill.

The tenor of left-wing cable news and punditry was predictably panic-stricken. After asserting that the cuts wouldn't help create a single job, Bruce Bartlett told MSNBC that tax relief was "really akin to rape." Kurt Eichenwald tweeted that "America died tonight." "I'm a Depression historian," read the headline on a Washington Post op-ed. "The GOP tax bill is straight out of 1929," proclaimed the same writer. And so on.

None of this is even getting into the MSM's straight news coverage, which persistently (and falsely) painted the bill as a tax cut for the wealthy. "One-Third of Middle Class Families Could End up Paying More Under the GOP Tax Plan" noted Money magazine. An Associated Press headline read, "House Passes First Rewrite of Nation's Tax Laws in Three Decades, Providing Steep Tax Cuts for Businesses, the Wealthy." "Poor Americans Would Lose Billions Under Senate GOP Tax Bill" reported CNN. Yahoo News ran one piece after the next predicting doom.

The GOP tax cut's "unstated goal is to leave the poor and vulnerable in America without the support of their government," an ABC News "analyst" alleged. "It's not enough to give money to rich people. Apparently, Republicans want to kick the poor and middle class in the face, too," a columnist at Washington Post noted, leaning hard into two of the stalest canards about tax policy.

Of course, the notion that allowing Americans to keep more of their own money is tantamount to "giving" them something is just transparently specious. Does any liberal really maintain that government owns all your income, and anything you keep is a gift? Tax rates were not handed to us on Mount Sinai, they were cooked up by economists. In truth, you only "give" taxes, you never keep. And the government only spends.

In any event, the idea that the poor or middle class are being shaken down by the cuts was even more of a dishonest claim. As Chris Edwards of the Cato Institute has pointed out, the TCJA's largest percentage tax cuts went to the middle class. Even the liberal Tax Policy Center estimated that 65 percent Americans paid less last year (6 percent paid more) due to tax reform. More than 44 percent of Americans pay no federal income tax. (Though corporate taxes are also a tax on consumers, so cuts benefitted nearly everyone.)

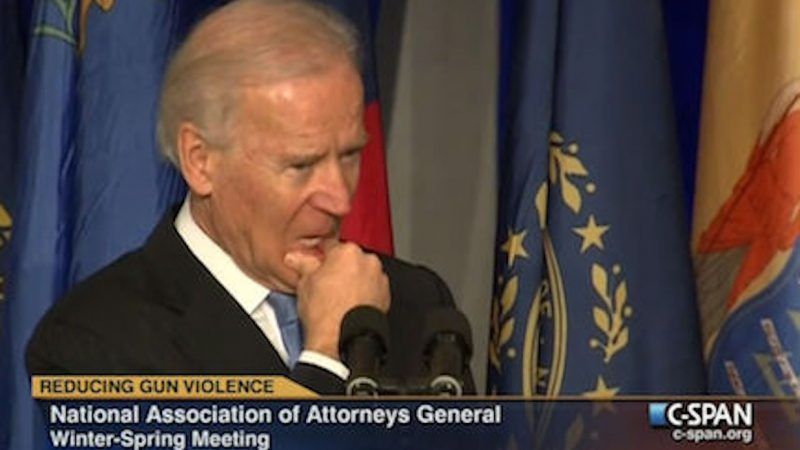

That hasn't stopped former vice president Joe Biden. "There's a $2 trillion tax cut last year. Did you feel it? Did you get anything from it? Of course not. Of course not. All of it went to folks at the top and corporations," the presidential hopeful claimed the other day. It's a fabrication.

Whenever you hear people bellowing about the wealthy benefitting most from across-the-board tax cuts, they always leave out the fact that wealthy pay the vast majority of income taxes: The top 20 percent of income earners paid over 95 percent of individual income taxes in 2017, the top 10 percent paid 81 percent and the top 0.1 percent paid nearly a quarter of all federal income taxes.

Supply-side economics isn't a panacea. We're racking up debt and continuing spending as if it doesn't matter. Not all the underlying numbers are positive. There are thousands of economic unknowns that can't be quantified or computed by economists, which is why the central planners and technocrats are almost always wrong. And yes, when the recession finally comes, as it always does, liberals will once again blame tax cuts and deregulation. But to be this wrong this often deserves recognition.

COPYRIGHT 2019 CREATORS.COM

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

First.

And Biden's Working Class Zero shtick is wearing thin so fucking quickly that I have already resumed photoshopping AOC's head onto pron.

And in summary, first.

You should not peak before 3 am.

You mean the back of her head, right?

The twist is it’s not a photoshop.

I already read this on The Federalist which is still better for cellular smart telephone browsing than Reason, despite the update. However, me no touch the comments there. Too spicy for me.

I'm sorry..to elaborate how fucking fatuous is it that Biden acts like the former VP isn't one of the people at the top.

Really... the nicest thing I can say about Biden was that he had the maturity and shame to drop out following his plagiarism back when chicks dug Van Halen.

So he's wrong and a fucking twat. And Ronnie James Dio is dead. There's a trade I'd like to arrange

I only dig chicks who dig Van Halen, so i get laid like once every five years.

There are no such thing as "Liberals" in the USA.

Lefties hate constitutional and civil rights and laissez-faire economic policy.

Well, Conservatarians are the actual liberals. But anyone associated with the D party is definitely not. Not even Tulsi

She surfs though, and 7/11.8 so definitely would*.

*as long as she digs Van Halen (see above)

My tax rate went up after the tax plan went into effect. That's because I got a significant salary increase when our business started booming.

Every silver lining has a cloud has a silver lining with an investment opportunity or potential for economic growth.

Of course the Democrats are wrong about tax cuts. They always are.

Some people were also wrong in that the tax cuts would drive huge deficits. Total tax revenue was relatively flat between 2017 and 2018 on a dollar basis. Which also shows that, at least in the short term, tax cuts do offset the apparent lack of revenue with revenue based on growth.

Now we just need some reduction in size of government and we'll be doing pretty OK.

Even restricting the uncontrolled growth of government makes leftists wail like a banshee.

Let's slash the military budget and see who screams

Let's just hold everything steady and see who screams.

"Let’s slash the military budget and see who screams."

The Euros. They'll have to pay for their own defense, and have to cut their socialist polices to do so.

They’ll have to pay for their own defense

Defense against what?

China and Russia, with joy.

Yeah.

They always claim any reduction in some previously planned rate of increase in spending on any government program is a "spending cut".

They assume spending has to increase and anyone saying no is accused of slashing aid to the poor.

Tax revenues should be (and usually do) go up every year due to inflation and population growth. The fact that tax revenue declined on a per-capita basis means that growth does not offset tax cuts.

Of course . Population growth is no guarantee of higher production and inflation isn't a guarantee of higher nominal taxes either -- it depends on the source. The cut was supposed to reduce revenues by at least 1.5TT over 10 years, and yet we're left to play the counterfactual game yet again because they didn't fall.

Growth is what matters and that is exactly what we are finally seeing again.

How much income tax are the 1 million or so new illegal aliens paying in exactly? They ARE counted in population, though, so they have an impact on any per capita measurement.

I'm looking for revenue statistics per tax unit (households filing income taxes).

Personally, we took it on the chin in losing SALT deductions (own homes in 3 states, income taxes in two...my wife has moved to our retirement home already while I am still working and living in our "city" house, but that's probably gonna be sold before the end of this year). But the increased standard deduction and not having to pay AMT for the first time in many years offset that and we had small reduction (22% down to 20.5% effective federal income tax rate).

"Total tax revenue was relatively flat between 2017 and 2018 on a dollar basis"

As Alpaca notes below, tax revenue increases every year because of inflation, population growth and the general expansion of the economy. Tax revenues have increased around 45 of the last 50 years. They increase during both economic expansions and recessions. The only time exception is immediately after a major economic shock, and then they just reset lower before starting to climb again.

It is a major fail if revenue is flat. It is a colossal fail if revenue is flat during strong economic growth. That combination is virtually unknown, and indicates just how much the Republicans had sabotaged the federal budget. Democrats are wrong about what? Everyone knew a few trillion dollars of pure debt on the nation's credit card would juice the economy in the short term. Everyone knew it would lead to monster deficits - the red ink growing even in the midst of a roaring economy, when typically it falls.

When the sugar-high wears off on this binge of debt, we'll have to face the bill. Of course today's Republican party is too short-term irresponsible to see that far ahead....

Yes, the economic indicators are good, but they were not bad before the cut. The economy was doing very good and there was no reason to stimulate it with a tax cut. The fact is we borrowed money for the tax cut and we went deeper into debt. Congress did not really cut taxes they deferred them. The average person did not even notice this tax cut, hence its unpopularity.

See data at the link above. Revenues were flat between 2017 and 2018. Revenues fell as a portion of GDP, true, but because GDP grew.

At least in the short term, the deficit growth is tied to spending growth, not revenue reduction.

The fact is we borrowed money for the tax cut

We?

I didn't borrow shit. The government borrowed money, despite continually setting new records for taxes collected, because they will always spend as much as they can possibly get away with.

-jcr

+102

+1

“Yes, the economic indicators are good, but they were not bad before the cut.”

True or not, it’s irrelevant, that’s not what this article is about. You’re deliberately reframing its point to suit your argument. The Democrats weren’t saying that things were fine and that we didn’t need tax cuts, they were saying:

“tax reform would lead to over 10,000 dead Americans every year”

“passage of tax cuts would portend "Armageddon,"”

"the worst bill in the history of the United States Congress."

“tax relief was "really akin to rape."”

“"Poor Americans Would Lose Billions Under Senate GOP Tax Bill"

“Republicans want to kick the poor and middle class in the face, too,"

And they were wrong as fuck. Again.

No, we borrowed money to spend. The cut itself didn't cost anything. But if you assume that it's the government's money to begin with, then you can play games about what the cut "cost." It isn't.

Pure sophistry from someone as addicted to free stuff as the most cliched welfare queen. I'm betting NotAnotherSkippy doesn't raise a peep when GOP candidates give their bullshit "promises" tax cuts will magically pay for themselves. I bet he beamed with happiness as Republican primary candidates sought to out-bid each other on more debt : four trillion, six trillion, ten trillion.

Yeah, somebody's grandchildren will have to pay for all this partytime, but I don't get the impression NotAnotherSkippy cares. My guess? A proforma pious remark on "spending" at occasional intervals exhausts whatever vestige of responsibility he feels due. Not a serious remark. Not a substantive remark. Just something thrown off for hypocrisy's sake - then party on.....

No, we borrowed money to pay for the spending that followed the tax cut. Congress could have cut spending at any time, but they have instead chosen to increase spending instead. Tax cuts are not "spending" to be paid for. Spending needs to be paid for.

“The fact is we borrowed money for the tax cut . . . .”

NO, NO, NO, COMPLETELY WRONG! We borrowed money to continue our COMPLETELY OUT OF CONTROL SPENDING! When the deficit goes up by $600 Billion while Federal tax revenues are rising, the problem is NOT the tax cuts. The problem is that we are spending WAY TOO FUCKING MUCH!

Can we stop calling them liberals? They are devout statists, so are nothing of the sort.

They are leftists, if you want to be more specific and say progressives, then so be it.

I'm with you on "liberals", but it seems to be a losing battle.

I've got a problem with "progressive" since it seems to imply moving in a good direction. Just like "liberal", leftists have completely debased a word. Much as I dislike the left right spectrum, in dealing with the general population, "left" seems the safest choice of what to call the socialist nanny staters.

I'm OK with progressive because, as an appellation, it does function as a reliable identifier of their political and moral views. IOW by and large, and in reference to them, it means what it has always meant.

Also, because 'progress' most broadly speaking is always going to be in the eyes of the beholder. As a political banner it has no more inherent meaning than 'America First.'

The DoI was progress to the revolutionaries, to monarchists it is a woeful mistake. That so many progressives are proving to be enemies of the Constitution likewise confirms the fundamental aristocratic bent of their ideals.

I'd love to make "Regressives" a meme, but it's probably too subtle to catch on.

"Progressive" expresses the connection between their policies now and in the Teddy Roosevelt/Woodrow Wilson era. E.g., back then the racism was overt, and the minimum wage was intended to force blacks out of the job market, under the assumption that this would prevent them breeding. Now, they claim that the exact same policy will have the opposite effect, because "We want to put more people on welfare to help us harvest their votes" is much too honest.

Those who could actually benefit from reading this article will never see it. The Narrative prevails, resoundingly.

And, as the article notes, 44% [Mittens used 47%, close enough] did indeed not see a change in their taxes because they pay the same: $0.00.

2017 effective tax rate 11.38%

2018 effective tax rate 7.25% (~9% if I had not had a kid in 2018)

Mr Touchy-feely is not content with creeping on any females nearby, he want to get all touchy-feely with our wallets.

Holy shit. I'm envious.

Envious of the effective tax rate or Mr. Touchy Feely?

It's both for me.

If you're envious of someone else's effective tax rate, you're probably not thinking through the implications fully.

"who warned that tax reform would lead to over 10,000 dead Americans every year in December of 2017"

It's so cute when they try threats. But they're always too incompetent to pull off

Low unemployment is bad for Democrats who want people dependent on daddy government.

Citizens without government dependency are dangerous and radical. People shouldn't be allowed autonomy over their life choices and must be made to fall in line and show government the proper respect!

Assertion: If forced to maintain a given federal tax revenue, tariff income is preferable to personal income tax.

Discuss.

I see logic to taxing on ability to pay. I see no logic in taxing on preferences for goods and/or on where goods are sourced.

I see no logic in taxing on preferences for goods and/or on where goods are sourced.

So, if I enslave a bunch of people and manage to win a government contract you're cool with it as long as your portion is only being collected based on your ability to pay?

Income tax discourages saving (taken before you can save it). Tariffs encourage saving to avoid paying consumption tax.

Tariffs protect local jobs by allowing for inefficient local production. Secondary effect of this might be reduced exports, especially if trading partners match the tariff.

Looking at marginal federal tax revenue from the application of tariffs is similar to how the FairTax would work if passed into law.

"Does any liberal really maintain that government owns all your income, and anything you keep is a gift?"

Liberals? No. Leftists? You bet.

Perfectly trumpian. Just make it up up as you go along.

"Perfectly trumpian. Just make it up up as you go along."

You and that hag lost. Grow up and get over it.

The donor class toady Harsanyi trots out the approved GOP corporate fascist talking point to catapult dishonest propaganda again.

The 44% who don't pay federal taxes should praise Trump and the GOP for giving corporations big tax cuts because corporations only pass taxes on to the consumer anyway.

Yes. This is what this fraud actually trotted out.

The gaslighting is trumpian.

We are being told all the corporation's and their CEOs lowered their prices on their products in relation to the percentage of taxes they don't have to pay any more.

Your corporate fascist cronyism sucks Harsanyi.

"Your corporate fascist cronyism sucks Harsanyi."

A visit from one more fucking lefty ignoramus.

Fuck off and die.

It's always a good day when someone reminds me of the farcical character that is Kurt "I don't know how those tentacles got there" Eichenwald.

He completely forgets to actually offer evidence that the left was wrong. Did the middle class get a tax cut out of this? Did they end up paying less? Did the vast majority of the tax cuts affect corporations and wealthy instead of middle-class and poor? This is what the left was arguing, and this is what I've seen from reading various articles on this. Just like the "booming" economy and low unemployment rate, the figures neglect reality - that the economic gains of the past decade have largely not been felt by the middle class, and inequality in this country has expanded, while spending has skyrocketed and debts ballooned. The GOP cut $2 trillion in taxes while increasing spending, and their own accountants, CBO, told them the tax cut would add billions to the deficit. How does that make them correct?

You mean besides this:

So aside from being completely wrong, you were right.

And while you don't think the economy is booming, no doubt you thought the stimulus "saved" 6 million jobs. The fact is that incomes are rising faster for the lower quintile than the highest, so as for your inequality canard, well, it's old. But keep gaslighting, it's all you've got left.

The left is also arguing that because your tax refund was smaller than last year, you obviously had a tax increase! When of course the change to withholding schedule meant that they got their tax cut over time rather than in a lump sum. But they got a tax cut nonetheless, as I'm certain that most people had a smaller total tax bill even if their refund was smaller.

I always try to keep our withholding set so that I have the maximum tax bill on April 15th without owing any penalties. Why should I give the government a free loan? It helps if you set aside the money to pay the bill, though.

For many low-income people who have difficulty putting any money aside, a refund is necessary to pay their tax preparer.

I fear that the fact that many low-income people use a tax preparer says something sinister about our education system since most poor people's taxes are so simple.

Yes I agree. Hallelujah. Pass the collection plate. Tax cuts are good.

But when the fuck are we ever going to get a spending cut?

I'd be happy if we just held spending steady for about 5 years. Without real cuts, holding steady for 5 years would tend to give revenues a chance to catch up to spending or at least close the gap.

2004 revenues $1.880T 1999 spending $1.701T

2005 revenues $2.153T 2000 spending $1.789T

2006 revenues $2.406T 2001 spending $1.862T

2007 revenues $2.568T 2002 spending $2.010T

2008 revenues $2.524T 2003 spending $2.159T

2009 revenues $2.105T 2004 spending $2.292T

2010 revenues $2.162T 2005 spending $2.472T

2011 revenues $2.303T 2006 spending $2.655T

2012 revenues $2.450T 2007 spending $2.728T

2013 revenues $2.775T 2008 spending $2.982T

2014 revenues $3.021T 2009 spending $3.517T

2015 revenues $3.249T 2010 spending $3.457T

2016 revenues $3.335T 2011 spending $3.603T

[…] View Article Here Taxes – Reason.com […]

But remember that most people are morons who do not know the difference between their tax bill and their tax refund. Biggest mistake of implementing the 2017 changes was automatically re-adjusting withholdings for most people. If anything, withholdings should have been increased, so the sheeple would have gotten HUGE refunds last month.

From a PR stance, probably. However, I'd rather keep more of my money than let the government keep it interest free.

Contrary to Harsanyi's false assertion, the bulk of the tax cut benefits flow to the top, not the middle or any lower class.

Here's how some republicans summarized the tax cut bill:

“My donors are basically saying, ‘Get it done or don’t ever call me again.’” Rep. Chris Collins (R-NY)

“The financial contributions will stop” if the GOP failed to pass its tax cuts. Sen. Lindsey Graham (R-SC)

“Fundamentally the bill has been mislabeled. From a truth in advertising standpoint, it would have been a lot simpler if we just acknowledged reality on this bill, which is it’s fundamentally a corporate tax reduction and restructuring bill, period.” Rep. Mark Sanford (R-SC)

“The most excited group out there are big CEOs, about our tax plan.” Trump National Economic Director Gary Cohn

According to then Trump budget director Mick Mulvaney, the tax bill won't pay for itself as claimed. Instead, the tax cuts will boost national debt by nearly $2 trillion, despite long-standing republican rhetoric that tax cuts pay for themselves by generating higher economic growth. Mulvaney acknowledged to Congress this year that the administration’s lowered its revenue projections by $1.8 trillion over the next ten years due solely to the effects of the tax cut.

Republican Senator Marco Rubio, in a recent interview with The Economist, admitted that the tax cut package his Party recently passed has not benefited American workers. Rubio said that there’s no evidence that any of that tax cut money is trickling down to workers.

Basically, the 2017 tax cuts amount to a redistribution of wealth to the top from below. And, over the years it will add a at least trillion of two to the federal debt, so much of the mirage is being fueled by debt and future generations will pay.

And, in my case, my taxes increased because I live in the hated state of California and Trump nailed that and other blue states as hard as he could. In view of that, the 2017 tax law has created more polarization, which is damaging to society and liberal democracy. Mr. Harsanyi is surprisingly uninformed about what is going on with the tax law because he is a hard core ideologue and, as the insightful investigative journalist Seymour Hersh once pondered: "Is there anything more dangerous than ideologue who doesn't know he's wrong?"

"Basically, the 2017 tax cuts amount to a redistribution of wealth to the top from below."

Nope. Tax cuts are not a redistribution of wealth.

Tax cut are a reduction in the prior rate of redistribution from those who are net taxpayers to those who are net tax receivers.

And by net taxpayers I mean those who federal tax payments on an absolute dollar basis are more than the absolute dollar value of demonstrable, direct government services they have individually received calculated on a user fee basis.

We disagree.

The tax cuts in fact redistributed wealth from those at the bottom to the top. That is how the cited republicans saw it. That is what the data shows has happened in reality. That is how Trump himself saw it, when a few hours after signing the bill into law, told the rich folks at Mar-A-Lago “You all just got a lot richer.”

Your reference to "net taxpayers" as you define them is not persuasive. That definition is deeply flawed. It omits the value of everything government does indirectly that allows people to accumulate wealth including providing public education for the workforce, and infrastructure (roads, clean water, mass sanitation, etc.), courts, law enforcement that all businesses rely on.

How do tax cuts redistribute wealth? Oh right, they don't. Your definition of what "government does indirectly" is deeply flawed because it can only do so by taking resources from the productive private sector. No doubt this is the point where you will claim that the entitlement state, which IS a massive redistribution of wealth, makes us all richer.

Taxes redistribute wealth. My definition is spot on. We disagree.

Go back to DailyKos, you cretin.

It is long past time the high earners living in FL, TX, and TN stopped subsidizing the high earners living in CA, NY, and NJ

Or perhaps you can explain how it was "fair" that someone living in Austin or Nashville making $300K should owe $20K more in Federal Tax than someone living in Bridgeport or Fresno

Tell you what. I'll go when I get kicked off of this site. Your inability to handle reality like an adult reflects your immaturity and intellectual weakness, not mine.

Since you are reduced to a mindless, blithering insult by calling me a cretin, how about this proposition for the sake of civility and mutual respect: I will ignore you and you ignore me.

After your insult, I have no interest in anything you have to say to me and I won't respond because I won't engage with insulting, disrespectful people like you.

I found this response uncompelling, personally. If your skin is that thin and your arguments that weak, what are you even doing?

I wasn't speaking to you. I could not care less what you find compelling. If you are OK with people insulting and attacking you, that's your business and of no concern to me. I just won't participate in it or tolerate it. Using or endorsing personal insults and/or attacks are evidence that people who engage that way have weak or irrational arguments. That applies to you. You cannot rationally justify insults or attacks. One astute observer put it this way: Ad hominem attack? Your argument must be really strong!

So, in the name of adult maturity and social civility, I'll offer you the same I offered the insulter above: You ignore me and I'll do the same with you. That way I won't waste any more of my time. I don't care about your time.

Sure thing, buddy. You're doing a hell of a job ignoring both of us right now. The corollary is, of course, that if one must work this hard to find an ad hominem to justify "ignoring" the argument their position must not be that strong either.

In the name of adult maturity and well-adjustedness, I'd like to know your position on the tax discrepancy shown above. I think it's more likely that you simply don't have an answer to that and that your initial calculus was mistaken. That's ok; we all make mistakes. Really. And whether or not you care about my time (why even add that?) it's worth pointing out that open-mindedness to others' positions provides an avenue to correcting mistaken ideas we each may hold.

""the bulk of the tax cut benefits flow to the top, not the middle or any lower class."

This will be true of any income tax cut, since the middle and lower class pay tiny fractions of income taxes. When the top 20% of households pay 95% of the taxes collected, a fair case can be made that only the rich are paying income taxes, and any cut will benefit them the most if you simply look at dollars kept.

If we completely eliminated all federal income taxes, progressives would still complain that the rich got a bigger tax cut.

The truth is that the Bush tax cuts added millions of people into the category of paying "zero or negative" federal income taxes, pushing that group well over 40% of all households. I'm not sure about Trump tax cuts, but expect the same.

You argue: "This will be true of any income tax cut, since the middle and lower class pay tiny fractions of income taxes."

That is not true. Congress can set a tax law up just about any way it wants. It can pass a new tax cut law that decreases taxes for all taxpayers with a gross income of ~$70,000 or less. That will not affect the top ~20% of income earners because no tax benefit will redistribute to the top.

Assuming it happened, maybe the reason that Bush tax cuts added millions of people into the category of paying “zero or negative” federal income taxes, pushing that group well over 40% of all households, is that real wage increases have been mostly stagnant for most wage earners since the 1960s, while income of all sources for the wealthy have skyrocketed. Maybe 40% of households do not earn enough to be able to both pay federal income taxes and keep up with the rising cost of living. Those 40% do pay taxes, e.g., gas taxes, state taxes, sales taxes, property taxes, etc., I suspect the net tax burden for that 40% is proportionally higher than what most wealthy pay on all of their income sources. Just look at how little Trump paid for years, i.e., none at all most of the time for which we have data. The loopholes for the wealthy and big companies are massive and under the Trump tax cut, increasing.

"Seymour Hersh once pondered: “Is there anything more dangerous than ideologue who doesn’t know he’s wrong?”"

...says the Dunning-Kruger spokesperson?

No says the facts.

Has Congress made the poor/middle-class tax-cuts permanent yet? Have they made the upper-class tax-cuts temporary yet?

If the answer to both of those is "no", then per the law yes, lower/middle-class households will be paying more taxes in eight years while the upper-class will still be enjoying their tax-breaks.

Ignoring the timeline literally written into the law so that you can argue "I'm feeling better now, so stopping chemotherapy was the right choice" is, how did you put it... "a dishonest claim".

“I’m feeling better now, so stopping chemotherapy was the right choice”

And by "feeling better" I mean my pulse oxygen level is above 96.4% for the first time in 40 yrs.!

Seriously, at some point you've got to admit you've got large malignant masses in multiple systems and the most effective drug you've got at combating the problem in your 200 yr. old patient is cisplatin.

I have no idea what that means.

Not noting that it was team red offered just that (the middle class cuts) and team blue rejected it is, how are we putting it, "a dishonest claim." Of course you can also explain why it is just and proper that those who are more productive should not only may more, but disproportionately too.

Darn it, I'm going to have to agree with a Reason article. It's right though. The left focused on April refunds even though that's a stupid way to assess a tax plan. It always smelled like they were trying to ignore that people were paying lower taxes. So that was stupid and it is coming back to bite.

The best argument all along was that we are limited in how much debt we can have. The argument against deficits and debts has always been hysterical and based on bad reasoning. We always knew that having deficits and debts was not necessarily bad. But the GOP said it was super bad until Trump came along and now it is completely ignored. Some on the left pointed out that while it would be ok to increase the deficit it should be in a way that helps people and infrastructure so - an investment in the future. Instead, we are driving the deficit up so that the wealthy can buy up real estate. At some point things will crash and we will not be able to prime the economy with deficit spending. We all see this coming a mile away. We are going to have to raise taxes. Trump knows he will be out of office when this happens. Again. We all know this and can predict it but no one wants to talk about it.

Heraclitus

May.10.2019 at 12:08 pm

"...The best argument all along was that we are limited in how much debt we can have..."

Which interested lefty ignoramuses like you not at all until someone with an (R) ended up in the White House.

Fuck off, lefty ignoramus.

Most of you idiots are probably working or lower-middle class. Did your life improve noticeably because of the Trump tax cuts? What about the Bush tax cuts?

I suppose since the president has an (R) after his name, the cosmically humongous federal deficit and national debt are completely irrelevant for now.

My god are you people horrible.

Tony

May.10.2019 at 1:12 pm

"Most of you idiots are probably working or lower-middle class. Did your life improve noticeably because of the Trump tax cuts? What about the Bush tax cuts?"

Yes, you fucking lefty ignoramus, my wallet is much better off as a result of tax cuts.

Please leave us horrible people to ourselves, and don't ever look back. PLEASE

"Did your life improve noticeably because of the Trump tax cuts? What about the Bush tax cuts?"

A bit, yes. My paycheck is noticeably bigger.

"I suppose since the president has an (R) after his name, the cosmically humongous federal deficit and national debt are completely irrelevant for now."

No, the State (read: government) is still doomed. The dollar will fall, eventually. (You can delay the effects of the laws of Economics, but you cannot make them go away.)

"My god are you people horrible."

So you're complaining that we are all tribalists? That's a bit rich coming from you.

BTW, Trump is a lying, evil, stupid charlatan.

-An Economist who is also an An-Cap

"My god are you people horrible."

the difference between supporting 35 or 37 percent top tax rate makes someone horrible. Got it.

Tony is pretty sassy today. As usual he is totally insane, but it's fun to see him get a little bit more excited than his usual "you people" routine.

Never change, Tony*

*actually do change and become a libertarian

Tony, I realize you are an unprincipled hack, so I don't expect you to understand. I live in CA and my taxes went up last year, and I'm middle class and rent with roommates. But I still support the tax cuts because it's not a matter of me personally benefiting.

I mean, personally speaking, it would be in my financial best interest to vote to steal all of your money and give it to me, like you would want to do, but that is immoral, despite its potential to 'improve my life'

I simply expect more from libertarians than Grover Norquist cynicism. He's not a well man, and it's highly unlikely that he's the best economic thinker in history, which is something you'd have to concede if you buy all this tax cut bullshit.

One has to regard Grover Norquist as the greatest thinker of all time in order to disagree with taxation and/or favor less tax confiscation. Hmm. I wonder how many people would read that and accept it at face value. I really don’t find it particularly convincing.

No, you have to assume he's the greatest economist ever since he's the one who came up with this insane bullshit you people all believe.

There's nothing wrong with being in favor of lower taxes and fewer government services, but try defending your ideas on the merits and not because you are an ignorant cultist who is simply against taxes because grunt grunt taxes bad grunt.

Tony

May.12.2019 at 2:14 am

"No, you have to assume he’s the greatest economist ever since he’s the one who came up with this insane bullshit you people all believe."

Well, I guess we should believe this since fucking lefty ignoramus says so.

Fuck off.

I remember the old Tony, the somewhat introspective and less angry Tony from many years ago. Your ideas were still wrong, but you really worked at defending them. It's like you've given up.

All you've done here is double down on an absurd statement and then chase it with a declaration that you are entirely without principle. You're literally the only one in all of the 100+ comments here citing Grover. You're the only one conflating a desire to shift responsibilities away from centralized institutions with the actions (modulo the motivations for those actions) of one man, culminating in a reduction to illiterate grunting, seemingly in an attempt to discredit the whole affair. That's not defending your ideas on their merits. That's not arguing in good faith. That's proving once again that all the people who respond to you with nothing but vitriol are, frankly, probably right.

I don't know what you get out of this, but at this point it seems like it should be embarrassing for you. If this is just honest trolling, I'm sure you have your reasons. If it's not, may God have mercy on you.

Yeah I got $50 dollars a week extra in my paycheck and have used it to accelerate pay down of debt. Between lower amounts of interest paid and the extra weekly pay I am looking to add a thousand or so in the short term.

The third most read article is on cholesterol, from last September? How did that happen?

And since when do old articles have the comments closed? They used to be open forever.

It’s an upgrade.

[…] Read the entire article at Reason. […]

Liberals of both parties see increasing taxes as natural as fish swimming...as long as there is loopholes so they and their cronies can jump through.

Well this was just a steaming pile of nonsense. "Oh yeah it added 2 trillion but but but...it was ok!"

Worthless.

"Well this was just a steaming pile of nonsense. “Oh yeah it added 2 trillion but but but…it was ok!”"

Yes, tax cuts are good. Spending cuts are too.

But as a lefty imbecile, you never cared about debt before, so your comments and opinions are, indeed, worthless.

Here's some whataboutism...

The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure. It is a sign that the U.S. Government can’t pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government’s reckless fiscal policies.

My friend, the ranking member of the Senate Budget Committee, likes to remind us that it took 42 Presidents 224 years to run up only $1 trillion of foreign-held debt. This administration did more than that in just 5 years. Now, there is nothing wrong with borrowing from foreign countries. But we must remember that the more we depend on foreign nations to lend us money, the more our economic security is tied to the whims of foreign leaders whose interests might not be aligned with ours.

Increasing America’s debt weakens us domestically and internationally. Leadership means that “the buck stops here.” Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.

I therefore intend to oppose the effort to increase America’s debt limit.

That was then Senator Obama...

Then when he was President, he said "hold my beer" and racked up $9.3 trillion in debt under his administration.

Principles on revenue and spending mean jack to either major party.

BTW, my company sells luxury goods. Given the confusion (yes, those who buy our products can confuse 'refunds' with 'tax liabilities' - Buffett *is* proof wealth does not buy intelligence), our sales fell off pretty drastically in April, but whoa, Nelly, May is going to make up for it.

Pretty sure those who assumed to owe Q4 taxes are surprised and not thrilled with the tax-folks adapting to the new rates. We got a refund, would have preferred not to loan the IRS interest-free money.

Trump is the biggest loser of wealth in American history.

So you're right, not even inheriting hundreds of millions of dollars buys intelligence.

Tony

May.12.2019 at 2:16 am

"Trump is the biggest loser of wealth in American history."

Bullshit claim from lefty ignoramus who has no idea what "wealth" means.

Care to offer a cite so we can all laugh at you?

"So you’re right, not even inheriting hundreds of millions of dollars buys intelligence.'

Comment by drunk; drunk has no idea what that means and no one else does either.

Fuck off, drunk scumbag.

[…] Oh, and those tax cuts the left was so very wrong about are one key reason […]

Note to foreign readers: Harsanyl is NOT reason staff, but a republican mercantilist writer for the looter press. Use of the word "liberal" to refer to intellectuals of the even-more-looter persuasion is a meme invented by Republicans when they were defeated in 1932 after Dems copied the Liberal Party prohibition repeal plank.

What is the looter press? They steal money somehow? Are they subsidized by coerced dollars?

Seriously, I don’t understand what you mean.

The Trump tax bill did increase my taxes. It certainly increases the national debt. Nobody knows what the maximal amount of debt we can tolerate is, but there is a limit. This article is not informative.

[…] Read more on Reason.com […]