The Market Says Climate Change Is Happening

When money is on the line, it is hard to find parties willing to bet against the scientific consensus on climate change.

Markets are superb at turning what participants believe to be facts into prices. An intriguing new National Bureau of Economic Research study on market expectations about climate change looks at the price trends of Chicago Mercantile Exchange (CME) weather futures contracts.

"The evidence shows that financial markets fully incorporate climate model projections," conclude Columbia University's agricultural and resource economist Wolfram Schlenker and sustainable development researcher Charles Taylor. "We find that the market has been accurately pricing in climate change, largely in line with global climate models, and that this began occurring at least since the early 2000s when the weather futures markets were formed."

In 2001, the CME created a weather futures market enabling traders to hedge against losses stemming from fluctuations in the weather. As the researchers explain, the predominant contracts are based on heating and cooling degree days, which are indexed to 65 degrees Fahrenheit and encompass eight cities scattered across the United States. Cooling degree days (CDD) measure by how much and for how long temperatures exceed 65 degrees and thus require cooling. Conversely, heating degree days (HDD) measure by how much and for how long temperature fall below 65 degrees and thus require heating. The CDDs are traded for the months of May, June, July, August, and September, and the HDDs are traded for the months of November, December, January, February, and March. The payoff of these contracts is based on the cumulative difference between the daily temperature and 65 degrees Fahrenheit during a certain period of time, usually one month.

The notional value of weather futures and options traded on the CME in the last year adds up to more than $360 million, according to the Wall Street Journal. Over the counter trading values are much larger.

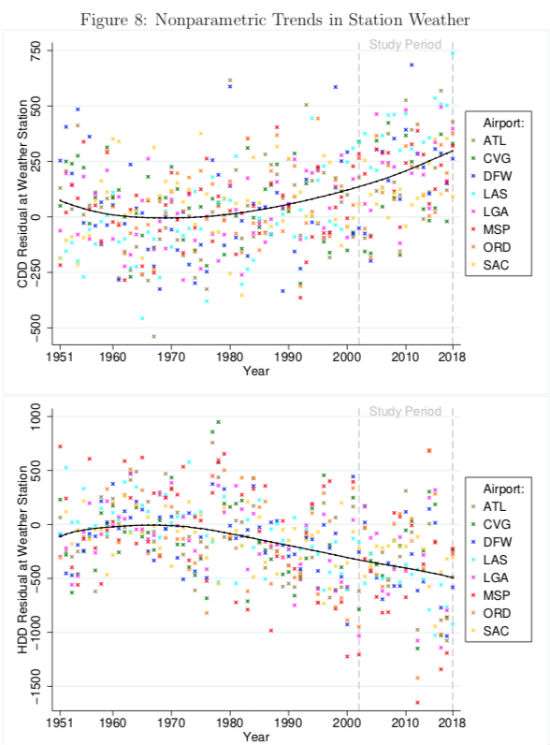

To get a handle on what the weather futures market is saying about climate change trends and the accuracy of the climate model projections, Schlenker and Taylor compared the price trends, actual temperature trends at the eight cities to which HDD and CDD contracts are linked, and the projections made in 2006 by climate models aggregated at Coupled Model Intercomparison Project (CMIP5) archive. They also try to take into account the effects on prices of weather fluctuations that correlate with various ocean oscillation indices such as the El Nino-Southern Oscillation and the North Atlantic Oscillation.

"We find that market expectations as measured by futures prices when weather outcomes are unknown have been trending at the same rate as temperature forecasts in the CMIP5 archive," they write. "All find significant warming, i.e., an increase in cooling degree days in summer and a decrease in heating degree days in winter. Predictions of climate models have materialized, at least on average, validating model forecasts, and financial speculators with money on the line have fully internalized these forecasts."

Basically, futures prices are reflecting the model predictions that there will be fewer cold days and more hot days as a result of man-made climate change.

In addition, the researchers report that "market expectations have been trending up smoothly in line with climate model predictions and do not seem to respond to year-to-year fluctuation in weather outcomes. In other words, market participants do not myopically update based on weather outcomes in the previous year, but proactively anticipate a warming climate."

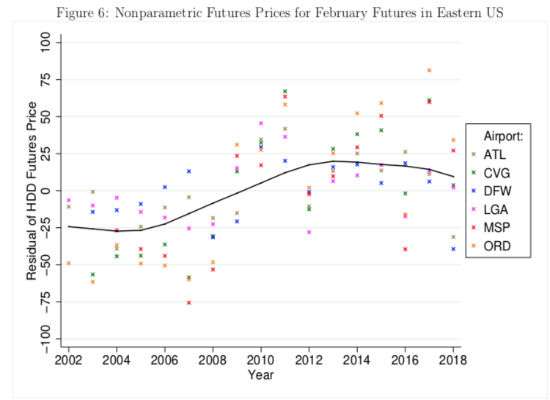

One interesting wrinkle is that contrary to model projections made back in 2006, recent February contracts for eastern U.S. cities indicate that traders believe that that month will see an increase in HDDs. This tracks new studies that suggest that a warming Arctic region will destablize the jet stream and result in more frigid polar vortex outbreaks during that month.

Of course, this is only one study, but economic liberals should consider seriously their conclusion with respect to what the weather market is saying about the reality of man-made climate change.

"There are also policy implications of our findings, especially since some politicians still question the existence and extent of climate change," they observe. "Anyone doubting the observed warming trend can make a significant profit by betting against it in weather markets. However, the observed annual trend in futures prices shows that the supposedly-efficient financial markets agree that the climate is warming. At least so far, climate models have been very accurate in predicting the average warming trend that's been observed across the US. When money is on the line, it is hard to find parties willing to bet against the scientific consensus."

Show Comments (414)