What the Press Missed About Vanguard Founder's Fortune

John Bogle's life is a reminder that in capitalism you can make a fortune by saving your customers money.

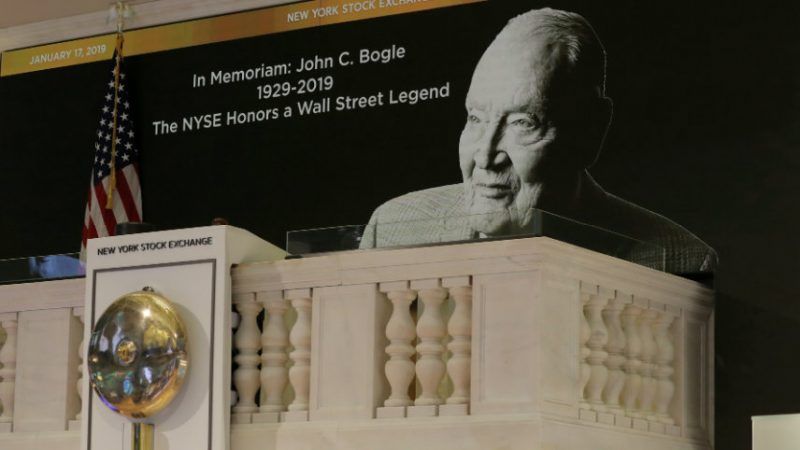

John Bogle, the founder of The Vanguard Group who died earlier this month at age 89, got rich by giving his mutual fund customers a better deal.

The obituaries seem to have missed that point, dwelling instead on the theory that if only Bogle had chosen to rip off his customers, he could have been even richer. That claim is highly speculative, and based on a fundamental misperception: a view of capitalism as a racket rather than as a system in which the incentives of entrepreneurs and customers sometimes align with results that are spectacularly rewarding for both.

The tone was set with a New York Times obituary. "Vanguard managed its indexed mutual funds at cost, charging investors fees that were far lower than those of virtually all of its rivals," the Times wrote. "Vanguard's consistent growth produced riches for Mr. Bogle, but not to the extent that another ownership structure might have done. For example, Edward C. Johnson III, the chairman of Fidelity Investments, has a net worth of $7.4 billion, according to Forbes. Mr. Bogle's net worth was generally estimated at $80 million last year."

In case anyone missed the point, the lead headline in Friday's Times business section read "Jack Bogle was no billionaire." That ran over an article crediting Bogle with "giving up his chance at great wealth by eschewing ownership of the company," and describing Bogle's $80 million as "small change by the standards of money management."

"Instead of making billions, helping millions," was the Times inside headline. An accompanying Times article described Bogle as someone "who didn't care about his own bottom line."

A Bloomberg columnist, Nir Kaissar, echoed this theme, calling Bogle's fortune "laughably small" compared with those of Blackstone Group founder Stephen Schwarzman or BlackRock CEO Larry Fink. "He should be a billionaire, but Jack Bogle chose to make others richer," is the headline one newspaper put over the column.

Sorry, but that's nonsense. Had Bogle pursued the conventional, high-fee approach to mutual fund management, it's quite possible he would have ended up not as a billionaire but in obscurity, just another mediocre retired executive from some forgettable fund firm.

Insisting otherwise, as the press storyline does, is like writing a story about the world's richest man, Jeff Bezos, and claiming that he could be even richer if he only charged everyone $15 for shipping and handling instead of offering free shipping to Prime customers. Or it'd be like claiming that Bezos could be even richer if he sold bestselling books at full price rather than discounting. It'd be like writing a story about Charles Schwab saying he could have been even richer if he only had charged full price retail commissions for stock trades rather than opening a discount online brokerage. It'd be like writing a story about McDonald's genius Ray Kroc saying he could have been even richer if he had sold Big Macs for $10 rather than at lower prices.

Part of the confusion comes from conflating two aspects of Bogle's approach with Vanguard. One was low fees, largely made possible by index funds rather than active management. Another was ownership structure, in which the fund company was owned by the shareholders rather than by Bogle himself or some publicly traded firm. The low fees aren't totally unrelated to the ownership structure, but they aren't entirely dependent on it, either.

Bogle himself has acknowledged publicly that the low-cost approach was not in tension with his firm's commercial success but the reason for it. "Vanguard has proven to be both a commercial success and an artistic success," he said in 2008 at George Washington University Law School. "How did we earn that commercial success? By our artistic success, which I define as providing superior investment returns to our shareholders." He wrote that Vanguard was "the low-cost provider," and that low cost "is the key to superior returns."

Even Fidelity is now offering low-cost index funds, and Fink's BlackRock is behind the iShares exchange traded funds, many of which also offer index-linked returns at low cost.

Perhaps if Bogle had realized he was giving up $10 billion by adopting a mutual structure when he set up Vanguard, he would have done it differently at the time. Once such a decision is made, it is hard to undo.

In an event, $80 million isn't nothing, especially for someone with six children and lifelong health problems who didn't start out rich and who gave a lot of money away to charity. It's a reminder that in capitalism you can make a fortune by saving your customers money.

Ira Stoll is editor of FutureOfCapitalism.com and author of JFK, Conservative.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

For libertarians this is obvious. For the typical journalist, not so much.

RIP John Bogle.

Ahh yes, the old "Libertarian" sure-fire model.

It's so obvious.

One just need follow the formula for guaranteed business success.

Oh, except for when others, like ones competitors, start turning to crony-capitalsim, securing political favoritism and special-interest legislation, giving them an edge, forcing others to start doing the exact same, spending more on lobbying to secure more favorable legislation, in stark contrast to supposed "Libertarian" ideology, leading to the exact system of corporate corruptocracy we currently exist in.

Oh, plus this:

Bogle was no "Libertarian".

Bogle was influenced by the works of Economist Paul Samuelson, a Keynesian adherent (a market economy will often experience inefficient macroeconomic outcomes in the form of economic recessions, which can be solved/mitigated by GOVERNMENT economic policy responses).

Bogle voted for Bill Clinton, for Barack Obama in 2008 and 2012,and for Hillary Clinton in 2016.

He supported the Volcker rule and tighter rules on money market funds, and was critical of the US government's lack of regulation of the financial sector.

Bogle said the current system in the US had "gotten out of balance", and advocated for "taxes to discourage short-term speculation, limits on leverage, transparency for financial derivatives, stricter punishments for financial crimes, and a unified fiduciary standard for all money managers.

Bogle was no "Libertarian".

Bogle was influenced by the works of Economist Paul Samuelson, a Keynesian adherent (a market economy will often experience inefficient macroeconomic outcomes in the form of economic recessions, which can be solved/mitigated by GOVERNMENT economic policy responses).

Bogle voted for Bill Clinton, for Barack Obama in 2008 and 2012,and for Hillary Clinton in 2016.

He supported the Volcker rule and tighter rules on money market funds, and was critical of the US government's lack of regulation of the financial sector.

Bogle said the current system in the US had "gotten out of balance", and advocated for "taxes to discourage short-term speculation, limits on leverage, transparency for financial derivatives, stricter punishments for financial crimes, and a unified fiduciary standard for all money managers.

Ahh yes, the old "Libertarian" sure-fire model.

It's so obvious.

One just need follow the formula for guaranteed business success.

Oh, except for when others, like ones competitors, start turning to crony-capitalsim, securing political favoritism and special-interest legislation, giving them an edge, forcing others to start doing the exact same, spending more on lobbying to secure more favorable legislation, in stark contrast to supposed "Libertarian" ideology, leading to the exact system of corporate corruptocracy we currently exist in.

The system of corporate corruptocracy isn't a direct result of Libertarians. It's a direct result of big corporations getting cozy with government institutions, often in a symbiotic relationship. This happens far more often under philosophies of government that insist that governments should "do the right thing, and regulate companies!!!"

I read one of Bogle's books (Common Sense on Mutual Funds) many years ago, when I was just starting to invest. While I don't tend to invest in index funds, I always pay attention to fees and their impact on actual returns.

One of his suggestions, which as far as I know he never implemented, was the idea of draconian sales fees for investments held for less than 10 years. The notion was that short term investors (who usually completely miss the notion of what a mutual fund is for) drive up costs and interfere with the fund's ability to execute their strategies.

Had he done this, the press would now be writing about what a corrupt, greedy thief he was.

Mr. Bogle, whom I met one time, got vastly richer through his "invention" and promotion of low cost funds than he would have by being just another run-of-the-mill big fee ripoff mutual fund. The "gimmick" grew Vanguard to either the largest or second largest fund in the country. The "gimmick" attracted tens of thousands of customers that Vanguard would not otherwise have had. Many of us can retire comfortably because of Mr. Bogle, which is more than one can say for those who put all their eggs in the social security basket.

I don't put much stock in the psychological studies but they do claim that individual happiness vs income maxes out in the 100-200k range. I think it is true that there are diminishing returns at some point. You may be happier with a million a year but not by much.

Bogle got to do what he liked and live on his own terms. He brought wealth and financial security to himself, and many others. Good work RIP.

"Instead of making billions, helping millions," was the Times inside headline. An accompanying Times article described Bogle as someone "who didn't care about his own bottom line."

For what shall it profit a man, if he shall gain the whole world, and lose his own soul? What's the going rate on souls? The guy did what he wanted to do and seemed to be happy doing it - how is that not caring about his own bottom line? Economics isn't just about dollars and cents and money is just a tool to get what you want.

But it's the NYT, their bubble doesn't let them see the outside world.

Yeah, most economists are dumb like that. No, a businessman does not care only about profits. Psychic profits, maybe. But each person has his or her own scale of values, and maximizing profit falls somewhere on that value scale.

It's kind of odd, seeing that the NYT and it's readers rail against profit and celebrate non-profit activities. Shouldn't they be celebrating his compassion for his fellow citizens? He actually combined both, making him a multifaceted hero.

On the other hand, if you live modestly, you can do an order of magnitude more charitable work/giving with an income of $1M/year than with an income of $100K/year.

Where did you get that number? The actual studies show that 4 million is the magic number. Individual happiness goes down if you are worth more than that.

Don't recall where. It was annual income not net worth. I don't think the numbers are all that important anyway because it is too much an individual thing to just pin a number on.

I can guarantee you that happiness does not max out at a $200K income.

I think the point of the happiness income curve idea is that once you are at the point that you have enough for a comfortable life and some extra the incremental additional happiness gets smaller per dollar.

The idea is if you make say $200 k and go to $250k you may be happier but the increase of happiness is less than when you went from $50k to $100k.

Yeah, its not money per se that makes you happy, its financial stability. Depending on your lifestyle and tastes (and where you live) financial stability might come at less than 40k a year, or for others 4 million a year might not be enough

There have been multiple studies that showed the same approximate thing, basically once in the $100K-200K a year range, your income has nothing to do with your happiness.

Everybody knows that the best things in life really are free... Finding your true love, having awesome kids, doing what you like for work, etc etc etc. BUT having to worry about buying groceries or paying the electric bill is horrible too.

So once you're there, at a statistical level, it seems to not improve happiness anymore. Obviously individual results will vary! Also, having a $4 million net worth (which I think is what you meant above) actually falls half way in line with somebody who makes a $100-200K a year and invests reasonably well.

Shhhh! [whisper] Don't say that too loudly! Democrats (and other Statist Social Engineers) will take that study, and make sure that *everyone* makes $100-200k. They'll most likely do this by inflation, and overlook the fact that once they are finished, nothing will have changed, except for the poor souls who were on the caboose of the inflation train churning through the economy!) [/whisper]

Mr. Bogle and Vanguard (great atari game) were very helpful RIP

That would be like claimi that the world's richest man, Jeff Bezos, could be even richer if he only charged everyone $15 for shipping and handling instead of offering free shipping to Prime customers. It'd be like writing a story about Charles Schwab saying he could have been even richer if he only had charged full price retail commissions for stock trades rather than opening a discount online brokerage. It'd be like writing a story about McDonald's genius Ray Kroc saying he could have been even richer if he had sold Big Macs for $10 rather than at lower prices, writes Ira Stoll.

It's all about the money with those greedy capitalists - never mind those humble public servants that go into office with nothing and come out multi-millionaires, they're only doing it for pure and noble and selfless reasons. And look at the many charities, non-profits, NGO's, community activists and do-gooder groups that are run by volunteers, nobody thinks about the size of the paychecks there!

Well, no one looks at the paychecks of non-profit employees, unless it's something "horrible" like the NRA.

Vanguard (great atari game)

Good record company too.

Thanks, Ira.

Having billions is really a curse. Because you can't take it with you, and everyone else around you is spending all their time trying to figure out how to get you to part with it. Including your children, who are constantly scheming as they await your expiration, and whom you will likely despise. It's really pointless to make so much money. Honestly I feel sorry for them.

Not if you did what you loved to get there!

I'm known some fabulously wealthy people, and some of them very much had the problems you mention. Others didn't have them at all, and were just living an amazing life. None of these people were billionaires (okay, one actually was), but were in the 10s of millions, which is plenty enough for greedy family to step in.

Capitalism is the only way to get the competition and innovation needed to create the kind of value for consumers that Jack Bogle did.

But keep in mind it wasn't actually Jack Bogle that created those returns for investors. It was American capitalism providing average 9.8% returns over 89 years (S&P 500 1928 - 2016). What Nobles contribution was is to both make consumers capital more readily available to corporations, and what he's mainly being lauded for, making those returns available to consumers at the lowest possible costs.

The government also deserves some credit, in one of the Nixon Administration's only accomplishments the SEC announced rules allowing brokerages to set their own commissions in 1973.

"The government also deserves some credit, in one of the Nixon Administration's only accomplishments the SEC announced rules allowing brokerages to set their own commissions in 1973."

II'd forgotten that, and it's not easy to find reference to it with a simple search.

I recall the wailing, gnashing of teeth and the tearing of hair reported among brokers who were quite certain they'd have to take side jobs flipping burgers to survive.

Remember at the same time, banks could not set interest rates paid on deposits. That's why they gave out toasters to attract customers.

Jamie Dimon of J.P. Morgan fame once said to me (no shit), "If the government won't let us charge for the seat in our restaurant, then we'll charge for the linens. And if they don't let us charge for the linens, then we'll charge for the silverware." Et cetera, et cetera.

"...Bezos could be even richer if he sold bestselling books at full price rather than discounting."

I once read a great article about early meetings Bezos had with book publishers (can't find it now). He essentially broke the math down and showed them that they would generate more revenue if they lowered the prices slightly. Apparently they where way more interested in margins than profit. Let's check in and see how that's working out of them shall we?

"Amazon is a negative influence on today's publishing industry," Tim Godfray, chief executive of the Booksellers Association, told a panel at the London Book Fair. "Amazon has got so big it is now not competing but destroying the competition."

This was also a big thing that Valve/Steam did. Most game distributors just slapped a $50 price tag on their games and sold them to big stores until something new was put on the shelf. And they felt if someone really wanted to buy the game 2 years from now, they might as well pay the full $50 for it.

It took 3-4 years of Valve showing these publishers that they could get a whole second year of sales just by cutting the price in half, and stimulate demand for game servers and DLC by having a game's life last longer.

What is interesting is that this isn't a new economic theory. Marketers have long known that people have different price sensitivities. While most people will buy a cheap product, some people would be willing to pay much more, and more will pay much less. This discovery among the game community (largely with Steam's help) is why you have first day DLCs, and followup DLC as well as early access, and GOTY discounts.

There is such a thing as finding the optimum pricing though... I work in the entertainment industry, music to be precise, and over the last several years there have been billions left on the table. It was essentially bad negotiating on the part of the major labels, not wanting to look backwards thinking like they did with the transition to downloads, they signed off on horrible deals. They're now becoming more assertive with YouTube/Streaming companies... And magically people don't have a problem with paying more.

If you give something away for free, OF COURSE consumers will prefer that. But finding the optimum spot that maximizes revenue is what it's really all about.

"...not wanting to look backwards thinking like they did with the transition to downloads..."

I'm not sure that's entirely accurate. Much like the book publishers, they didn't foresee the transition to digital distribution coming. But, I don't think their concern was the appearance 'of backwards thinking'. Much like Amazons Kindle Direct Self-Publishing platform, the digital music platforms where cutting them off from their consumers and they panicked. I'm not saying they didn't leave money on the table, I'm sure they did. They whole digital transformation has been a great lesson in the power of the consumer in a free market. If companies don't keep up with consumer preferences, they will be destroyed by the company that gives the consumer what they want.

I won't go into details, but I have intimate first hand knowledge about the early days of digital downloads, from pre-iTunes era all the way until now.

The labels didn't see the digital transition happening, and handled it all very badly in the late 90s/early 2000s. Savvy people and the press at large mocked them for this relentlessly. Once streaming started to become a viable thing, they straight up accepted horrible terms from these companies... And from first hand accounts of execs, in many cases it was because they didn't want to "seem dumb" like they did with downloads. They didn't want to miss the boat again, and look stupid again, so they signed bad deals many knew were bad at the time. That's straight from the horses mouth.

Things like unlimited ad based on demand streaming never should have happened, nor should YouTube in the way it has. It was a bad business move. Things don't need to be completely restrictive, but many nuanced details of how things have gone down have cost the industry billions. As I said they're finally getting around to rectifying some of this stuff recently, and more will happen in the future.

My point however still stands:

Selling 1 million widgets at a profit of $1 each IS NOT better than selling 500,000 widgets at $3 profit per, or even selling 100 million widgets at $.01 profit per! Every market has an optimum pricing point for maximum profit, and that isn't always the price point that benefits the most consumers. Sometimes it is, sometimes it isn't. Often times businesses in the same industry will employ both ends of the extreme, which is fine. Finding that optimum point is the hardest thing to do in many ways!

Bogle made it possible for any worker to own a part of corporate America. He helped make possible what Leftists claim they want to do and never do. RIP.

So the Times, etc., talk about what would have happened in an alternate universe where Vanguard did business differently?

The media can't even manage to get it right about what actually *did* happen in the past, much less what *could* have happened but didn't.

Never met the man myself but there's many stories of crew that met him over the years. Many of them met him in the galley during lunch. I've heard he was fond of brown bagging lunch. You were more than welcome to sit down, eat and chat. Definitely not your typical CEO.

Bogle made a fortune by allowing blue collar, white collar and blue bloods alike to invest. Leave it to the press to poo poo is pauper CEO fortune.

There's also a fundamental observation to be missed in there about S&P 500 index funds outperforming the stock pickers over long periods of time.

500 different companies each pursuing their own best interests outperform the best and brightest minds our society has to offer over time--even when the stock pickers are as motivated by their own potential gains as they could possibly be. How is that possible? It's almost as if an invisible hand were guiding them!

The fundamental conceit of central planning is exposed by that quantifiable fact. If our best and brightest can't outperform a stupid index despite the motivation of their personal participation in the proceeds, then why would we trust government officials to plan our economy?

The government by itself creates nothing.

Only people do that.

Charles Krauthammer, not a commentator I admired, said one thing I found particularly insightful. He said journalism would always be left-leaning, because bright kids with instincts for business and free-market competition would start companies, while journalism would draw kids with neither. If that's true, we'll be cursed with anti-capitalistic journalism in perpetuity.

The only real antidote for this, that I can think of, is if we someday were to include in our grade school, middle school and high school curricula some information for our kids about how our economy works. Crazy idea.

http://www.mesalary.com

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here..... http://www.mesalary.com

I Make Money At H0me.Let's start work offered by Google!!Yes,this is definitely the most financially rewarding Job I've had . Last Monday I bought a great Lotus Elan after I been earning $9534 this-last/5 weeks and-a little over, $10k last month . . I started this four months/ago and immediately started to bring home minimum $97 per/hr ?

. Heres what I've been doing,??.....HEAR>>

wwww.GeoSalary.com

I'm impressed to see your site. You did a great job on this site. I love all dogs. And Thank you for sharing this information.

https://centralmenus.com

Start making more money weekly. This is a valuable part time work foreveryone. The best part work from comfort of your house and get paidfrom $100-$2k each week.Start today and have your first cash at theend of this week. I work through this link, go to tech tab for work detail...........>>>>>> http://www.Mesalary.com

? I quit working my desk job and now,,,I 'm making $97/Hr working from home by doing this simple online home jobz.i earn $15 thousands a month by working online 3 Hour par day.i recommended you try it.you will lose nothing.just try it out on the following website and earn daily?go to this site home media tech tab for more detail thank you

HERE...........> http://www.Mesalary.com? 🙂

I wonder, do the Editors/Publishers at reason.com READ anything of depth and importance, or simply publish "articles" just after quickly seeing words like "capitalism" in their subheadlines?

THIS HELPS OUTLINE THE MASSIVE, GRAND FAILURES OF SUPPOSED "LIBERTARIANISM".

IN NEO-LIBERTARIANISM, IGNORANCE REIGNS KING.

Bogle was no "Libertarian".

Bogle was influenced by the works of Economist Paul Samuelson, a Keynesian adherent (a market economy will often experience inefficient macroeconomic outcomes in the form of economic recessions, which can be solved/mitigated by GOVERNMENT economic policy responses).

Bogle voted for Bill Clinton, for Barack Obama in 2008 and 2012,and for Hillary Clinton in 2016.

He supported the Volcker rule and tighter rules on money market funds, and was critical of the US government's lack of regulation of the financial sector.

Bogle said the current system in the US had "gotten out of balance", and advocated for "taxes to discourage short-term speculation, limits on leverage, transparency for financial derivatives, stricter punishments for financial crimes, and a unified fiduciary standard for all money managers.

I wonder, do the Editors/Publishers at reason.com READ anything of depth and importance, or simply publish "articles" just after quickly seeing words like "capitalism" in their subheadlines?

THIS HELPS OUTLINE THE MASSIVE, GRAND FAILURES OF SUPPOSED "LIBERTARIANISM".

IN NEO-LIBERTARIANISM, IGNORANCE REIGNS KING.

Bogle was no "Libertarian".

Bogle was influenced by the works of Economist Paul Samuelson, a Keynesian adherent (a market economy will often experience inefficient macroeconomic outcomes in the form of economic recessions, which can be solved/mitigated by GOVERNMENT economic policy responses).

Bogle voted for Bill Clinton, for Barack Obama in 2008 and 2012,and for Hillary Clinton in 2016.

He supported the Volcker rule and tighter rules on money market funds, and was critical of the US government's lack of regulation of the financial sector.

Bogle said the current system in the US had "gotten out of balance", and advocated for "taxes to discourage short-term speculation, limits on leverage, transparency for financial derivatives, stricter punishments for financial crimes, and a unified fiduciary standard for all money managers.

You're missing something simpler relative to the company Jack built and it's a fundamental truth to most great companies. Start with a foundational principle of integrity and treat your people well - with empathy and compassion - and empower them to treat your clients the same way. Jack's greatest legacy is the fine company he built; made up of great and loyal employees that look after their clients brilliantly, transparently and truthfully. It's a tried and true formula and Jack perfected it. He made plenty of money; enough for him and he slept well at night. When the interests of your company completely align with the interests of your employees and your clients, you have something truly golden.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you......

http://www.geosalary.com

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here..... http://www.payshd.com

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here..... http://www.payshd.com

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here...2citypays.com