Philadelphia's Soda Tax Just Killed a Grocery Store

Shoprite owner says he's lost 25 percent of his business since the soda tax made sugary drinks significantly more expensive.

A grocery store in West Philadelphia will close in March, and the store's owner says the city's soda tax is to blame.

Jeff Brown, who owns several Shoprite stores in the Philadelphia area, says his location in Haverford has seen a 23 percent decline in sales since the soda tax was implemented in 2016. The tax adds about $1 to a two-liter bottle of soda, and more than $2 to a six-pack of cans. It applies not just to sodas but to sports drinks, juices, and other sweetened beverages.

The store's impending closure means that residents of the area will have one fewer option for buying soda, yes, but also milk, eggs, vegetables, and other essentials.

"I built these stores to help people live healthier, longer lives," Brown tells Philly.com. "This is taking a success and destroying it."

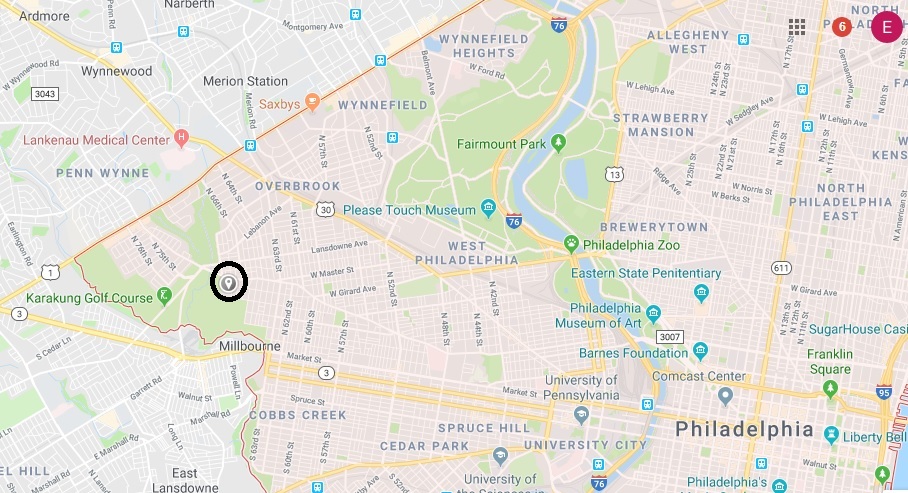

The location of Brown's grocery store is a significant part of the story—and demonstrates an important problem with the city's soda tax. On the map below, I've highlighted the location of the soon-to-be-closed Shoprite within the city limits of Philadelphia, which is shaded red.

As you can see, customers with cars who might have previously shopped at Brown's store could easily dodge the soda tax by driving to the west or south and leaving the city. Or if they already lived across city lines, they may have stopped coming into Philadelphia and found an alternative grocery store.

This isn't just a hypothetical. A report published last year by Catalina, a market research firm, found that soda sales inside Philadelphia city limits have fallen by 55 percent since January 1, when the tax took effect; sales outside the city have grown by 38 percent.

The city seems to have little sympathy for Brown's plight—or for that of his employees or customers. In a statement to Philadelphia's CBS affiliate, a spokesman for Mayor Jim Kenny (who championed the soda tax's passage) said Brown was trying to "scapegoat" the tax as a justification for closing his doors, and argued that "the tax has not had any impact on sales." To bolster that second point, the mayor's office also pointed to a Harvard study released last year that he said showed the soda tax did not reduce overall sales at Philadelphia-based chain stores.

But that's a little misleading. For one thing, what the Harvard study actually found was that beverage sales at Philadelphia grocery stores had fallen by 57 percent since the soda tax was imposed, but that stores' bottom lines were not hurt because most were passing 100 percent of the higher costs on to consumers.

For another, it's disingenuous for the mayor's office to claim that the tax had no impact on sales when the very point of the tax is to impact sales—under the premise that people in the city will be healthier if they purchase and consume fewer sugary drinks. This is a little bit like President Donald Trump's advisers claiming that consumers aren't noticing the higher prices created by tariffs. If that's true, then the underlying policy has already failed. Both tariffs and soda taxes are meant to alter consumers' behavior, and they cannot do that if consumers don't notice the costs.

It's also worth noting that the Harvard study was bankrolled by Bloomberg Philanthropies, a nonprofit connected to former New York City mayor (and first ballot entrant into the Nanny State Hall of Shame) Michael Bloomberg that has advocated for the Philadelphia soda tax and similar taxes in other cities.

There are, of course, myriad reasons why a particular business might fail. Maybe Brown's store was already on the rocks before the tax came along. But it seems reasonable to think that the combination of the tax itself and his store's location, so close to the tax-free suburbs, was a significant blow. For the mayor's office to suggest otherwise adds insult to injury—and demonstrates, yet again, that Kenney is committed to blaming the victims for his own failed policy.

Show Comments (30)