Debate: Should the Government Get Rid of Cash and Restrict Cryptocurrenices?

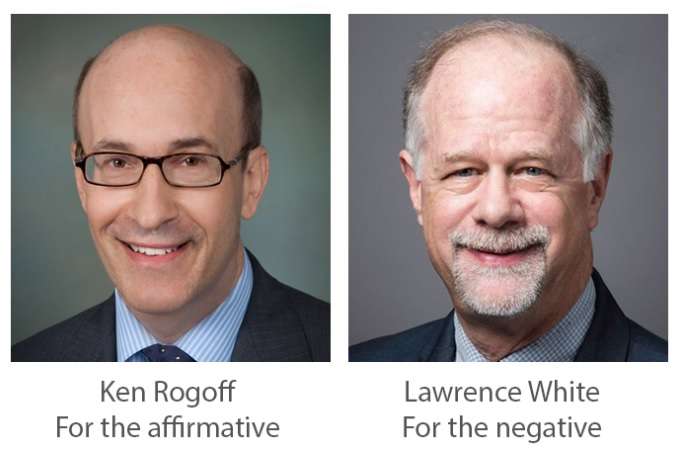

The next Reason/Soho Forum debate takes place in New York on December 3 and features Harvard's Ken Rogoff and GMU's Larry White.

"Governments of the advanced industrial economies should phase out the use of paper money in the form of large-denomination notes and sharply restrict the use of cryptocurrencies."

That's the resolution under discussion at the next Reason/Soho Forum debate, which takes place on Monday, December 3, at New York's Subculture Theater. Reason is a proud sponsor of the Soho Forum, a monthly Oxford-style debate series moderated by Gene Epstein. In an Oxford-style debate, the audience is polled before and after the participants make their cases and the winner is the person who sways more people to his or her side.

Tickets cost between $12 and $24 and include a buffet of light snacks and a cash bar serving soft drinks, beer, and wine. Each debate pulls around 200 or more people and each is released as a Reason video and podcast. For a full archive, go here.

All tickets must be purchased online and in advance. Go here to buy.

Here's more information about the debaters:

For the affirmative:

Kenneth Rogoff is Thomas D. Cabot Professor at Harvard University. From 2001–2003, Rogoff served as Chief Economist at the International Monetary Fund. His widely-cited 2009 book with Carmen Reinhart, This Time Is Different: Eight Centuries of Financial Folly, shows the remarkable quantitative similarities across time and countries in the run-up and the aftermath of severe financial crises. Rogoff is also known for his seminal work on exchange rates and on central bank independence. Rogoff's 2016 book The Curse of Cash looks at the past, present and future of currency from standardized coinage to cryptocurrencies. His monthly syndicated column on global economic issues is published in over 50 countries.

For the negative:

Lawrence H. White is Professor of Economics at George Mason University. He is a Senior Fellow of the Cato Institute and a Distinguished Senior Fellow of the Mercatus Center. His latest books are The Clash of Economic Ideas (Cambridge University Press, 2012) and (as co-editor) Renewing the Search for a Monetary Constitution (Cato Institute, 2015). Best known for his work on market-based monetary systems, White is also author of Free Banking in Britain (1984; 2nd ed. 1995), Competition and Currency (1989), and The Theory of Monetary Institutions (1999). His research has appeared in the American Economic Review, the Journal of Money, Credit, and Banking, and other leading economics journals.

And here are more details about the event:

Cash bar opens at 5:45pm

Event starts at 6:30pm

Subculture Theater

45 Bleecker St

NY, 10012Seating must be reserved in advance.

Moderated by Soho Forum Director Gene Epstein.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Doesn't seem like a fair fight.

"Kenneth Rogoff is Thomas D. Cabot Professor at Harvard University."

So, Liawatha's friend. I'll bet he articulates his Marxism very well.

Why... why would the government "restrict" the use of cryptocurrencies? They seem to restrict themselves quite nicely.

Cash bar opens 45 min before the debate starts... should be a lively crowd.

Since we're asking stupid questions...

Next Reason/Soho Forum debate: Should the Government Clap the People in Irons, and Send Them to the Mines?

Arguing in the affirmative, Dick Cheney representing the American Enterprise Institute.

Just saw an ad for the new Vice movie portraying Dick Cheney as some sort of badass. Seems weird to have it as a Christmas movie. But I suppose if Die Hard can be a Christmas movie, so can Vice (potentially)

Some of the arguments for banning cash are unbelievable. It is not just that cash is used by criminals. It is that if cash were banned the government could enforce a negative interest rate and force people to spend money to stimulate the economy. I am not kidding. Keynesian economists have orgasms at the thought of banning cash.

The idea of negative interest rates was raised some years ago. Any money held in a bank account would be vulnerable. So yeah, I see it. Next recession, watch.

Negative interest rates are already being encouraged by the Fed.

It's called inflation.

Trump threw a hissy fit when the Fed raised rates

They've just defended another increase, and more in the near term

It's hard to get out of the box they were placed in.

If interest rates return to normal too quickly, the stock market will suffer a MAJOR crash, since demand for stock has been greatly inflated by abandoning interest-bearing investments.

Inflation is a sort of negative interest rate.

Just by saving your money, you lose it.

Cash bar opens at 5:45pm

Cash bar... how typical.

They also accept Ether, Dash, and Ripple. You can fuck right off with that Tron bullshit though.

The good news is, if they do accept cryptocurrencies, the drinks will get cheaper and cheaper as the minutes tick by.

I can't imagine why people are still taking crypto for stuff like this: https://purse.io/shop

They give you a discount at Amazon if you give them cryptocurrency. That makes a lot of sense if crypto were steadily increasing in value against the dollar, but it hasn't been doing that since January.

Which is why it SUCKS as a currency!

it's totally unbacked. The ONLY reason to accept it is speculation -- higher prices in the future.

Crypoo has intentional DEflaton, FAR greater than what killed the gold standard.

But it's not gummint, so anti-gummint goobers have sold their souls for ... smoke and mirrors

Get rid of cash?

Hell no.

In theory, it would need a constitutional amendment. In theory. When the dollar was taken off the silver standard, the courts allowed it though, even though that violates the same constitution which states, from Article I, Section 8, "Congress shall have Power?to coin Money, regulate the Value thereof, and of foreign Coin." And from Section 10, "no state?shall make any Thing but gold and silver Coin a Tender in Payment of Debts."

No worries, they are just regulating the value thereof down to zero. All nice and constitutional.

And the states have not / cannot / will not make anything other than gold or silver a tender, because the states allow nothing as tender; fully abdicated to the feds long ago.

Now go take your pills, and watch some mainstream news until you get sleepy. There's a good lad.

Debate: Should the Government Get Rid of Cash and Restrict Cryptocurrenices Its Own Fiscal House In Order Before Continuing With Its Bullshit?

I'd like to print my own currency.

There's nothing to prevent you from creating your own currency. The Constitution prohibits states from doing so but not people:

Article 1, Section 10, Clause 1

"No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts;?"

Surprisingly, in Oberlin - OBERLIN - you can earn and spend 'Obie bucks' at local shops.

Presumably they are unaware they are being anti-government. But then again, these are likely earned by attending BLM rallies, drum circles, and sporting 'i'm With Her buttons. So, super woke!

Educate yourself

Left - Right = Zero

Haha! My daughter went to school there. Just because it is a card does not mean it isn't an alternate currency.

And thanks for pointing out yet another way to avoid govt - gift cards and debit cards.

And F you for playing.

Right-wing goober caught in a lie -- switches to new (and crazier) lies -- FAILS to support his claim that DEBIT CARDS ARE ANTI-GOVERNMENT ... AND A NEW CURRENCY!!

Hahaha then yoyur fuckup is even more humiiliating

(snort) Does it use dollars? Is a written check, in dollars, a "new currency?"

"new (and crazier) iies."

I shall assume you're a conservative (or think you are)

Almost certainly a Trumpster. (sincere apology if not)

(boldface in defense of aggression)

"Lawrence White for the negative"

Arguing the correct side but does Westworld know that James Delos is moonlighting?

Cryptocurrency is nothing more than a money laundering operation devised by the far right's main handlers, Vladimir Putin and Julian Assange. It's how the bigots process their funds. Any libertarian who defends their ability to conduct such transactions with ease is an embarrassment and an accomplice to racial hate.

Yeah, so what's your point?

The pointy is that crypto is fucking stupid ... as a currency ... without Rev's hyperbole

It's TOTALLy unbacked. The ONLY reason anyone would accept it is PURE speculation -- higher prices in the future, though MASSIVE deflation ... much worse than what killed the gold standard.

It's appeal to low intelligence libertarians and conservatives is .... hysterical -- since they've always opposed pure fiat currency.

But THIS is not GUMMINT fiat, so anti-gummint goobers swallow it and humiliate themselves. Yet again.

Not bad. A-

I could see getting rid of cash, but there goes your rationale for regulating crypto. Does the government have the right to regulate the little bytes and bits of electronic data that constitute my "money" just because that store of value is denominated in dollars? Does the government claim the right to control the very concept of a dollar? If I keep all my money in the form of pre-paid Visa cards and Walmart gift certificates, can the government still seize my money? Because you know the idea of a cashless society is the idea of an electronic ankle monitor on your money. Your name goes on a list and all of a sudden your cards don't work. Passport, driver's license, debit card, credit cards, library cards and birthday cards - all useless except to set off an alarm bell on your location when you try to use one.

How about gold and silver?

Killed by deflation. But stupidly replaced. Friedman has the only sane replacement.

The Law of Supply and Demand says rtgart prices rise and fall to keep supply and demand in balance.

Demand for money is not controllable. But its Supply is.

So do the obvious, Increase or reduce the supply of money to match the demand for money.

A simple example uis to adjust the money supply to equal forecast demand -- adjusted for errors in prior forecasts.

Stable prices -- always within a range of 1% or so from demand. Forever.

At the pub I was. Told the story of how, when my son wanted to enlist I suggested to try the reserves, first. Mentioned how glad I was that my boy was not therefore canon fodder in the never ending war.

Ole boy gets offended. Told me to shut up. Said he supported the troops. I told him to fuck off, that supporting the troops meant keeping them safe at home, and suggested that if he wanted me to shut up then he was welcome to try to make me.

Decided at that time to pay my bill and go home. But jesus fucking christ on a cracker, what is wrong with these people?

Not all conservatives are so totally crazy. Nor all genuine patriots.

Lemon aid stands hardest hit.

Lemon aid stands hardest hit.

Not hookers?

My response, from the corner of No Way and Hell No Ave...

And there's no such thing as a cryprtoCURRENCY.

The most helpful and productive thing government could do about monetary matters would be to eliminate the Fed and then get the hell out of the way.

"The most helpful and productive thing government could do about monetary matters..."

Which is why that will never ever happen.

Thank God!

Then what?

As Friedman has proven, we cannot maintain stable prices without something like the Fed. They'd have no discretion, so one may say eliminating the Fed's current mission. The gold standard FAILED to maintain stable prices, from the dawn of the Industrial Revolution -- as proven when silver had to be added, which still failed.

No, the only to maintain stable prices is to increase the supply of money in tandem with the demand for money, By definition. The Law of Supply and Demand says that prices rise or fall, to keep Supply and Demand in balance, So ... if they're always IN balance .....ta da!

Technically, the price of money would vary within a very thin range, never more than 1-2% above or below the starting point. Friedman has the only way to do that .. and no other way is even possible, The Demand for money is not controllable.. The Supply obviously is, but we're doing it wrong.

Example. Friedman's Fed (or its successor) would increase the money supply to match the forecast demand, with corrections every 3 months, If the supply increased by 1% this quarter, reduce the next quarter's target by 1% -- always just a hair away from absolute balance. There has never been anything that came close to being so obvious.

And obviously not as wacky as TOTALLY unbacked Bitcoin!

.

It's the Fed's control of interest rates that is a problem, not greenbacks.

Both. Which is why both must end.

"Governments ... should _____ and _____"

Conjunctive resolutions are messy. The debater arguing in the negative need only demonstrate one conjunct is flawed.

The original need only demonstrate why both are necessary, hardly an unusual tactic, since that's his very point!

Bitcoin is a fraud for suckers of the the anti-gummint mentality. The same people who were suckered by gold-backed currency, now worship money backed by NOTHING. Absolutely nothing!

But it's; not gummint hey chant

Bitcoin is totally worthless as a currency ... because merchants take it ONLY to make profits in the future.

But as some of us recall from Economics 101, a constantly rising price of of money is called ... deflation. The rising price means a LOSS in buying power from holding it. So the only reason to accept Bitcoin is, by definition, speculation.

And Bitcoin;s sharp deflation is far worse than the deflation which destroyed the gold standard, which Milton Friedman killed with one simple question, "Do we want stable prices or a stable money supply?" PRICES, duh. Which gold totally failed to provide for centuries, when the Industrial Revolution caused the Demand for Gold to increase much faster than the Supply, As proven by silver having to be added, which still failed to stem deflation which lasted into the early 20th century.

Incredibly, Friedman was the first economist to realize that the Law of Supply and Demand applies to the price of ,.. MONEY! Duh!. It's just that simple. And he still has the only solution which acknowledges that elementary fact.

You now know more than Reason's costly debate.

You're welcome.

The U.S. currency is backed by the "full faith and credit" of the U.S. Government which is pretty close to nothing.

Now be honest and cite my ENTIRE reason.

Bitcoin's deflation is infinitely worse than what killed the gold standard,, which was best expressed by Friedman. "Do we want a stable money supply or stable prices?"

Obviously, prices.

Get rid of cash to stop crime.

Get rid of guns to stop crime.

Get rid of drugs to stop crime.

Get rid of privacy to stop crime.

Kenneth Rogoff is an elitist who sees cash as a facilitator of crime because of the privacy it offers transactions. And us peasants use privacy as an excuse to hide our evil acts. Fuck him and his dystopian dream.

The Sinister Side of Cash: https://goo.gl/fQKUWe

Get rid of people to stop crime.

Bank of America ATM in Texas mistakenly spits out $100 bills, customers can keep it

State of Ohio now takes Bitcoin to pay some taxes!

https://preview.tinyurl.com/yaqtlspg

What about other states?

Yes! Fuck the poor!

Literally? They appreciate it more.

Or so I'm told.