Are American Workers Getting Shafted?

Think labor's share of America's economic output has been plunging? Think again.

Greedy capitalists have been helping themselves to an ever growing share of our economic output. The decline of labor unions and factory jobs, our dependence on cheap foreign labor, and businesses' growing "monopsony" power are shafting American workers.

The latest versions of these claims rely on data purporting to show that labor has been receiving a declining share of total economic output. This has become a widely accepted story, repeated in such outlets as The New York Times, The Wall Street Journal, and Bloomberg Opinion. Even a few market-friendly economists have repeated the tale.

But the downtrend is largely a myth. The confusion arises from a statistical artifact—the various ways measures of labor compensation and economic output, the numerator and denominator in this metric, have shifted seismically over the decades.

Drawing on published tables from the Bureau of Economic Analysis (BEA), the Commerce Department's official keeper of the National Income and Product Accounts, I reran the numbers. I also asked Robert Parker—who served at the BEA from 1970 to 2000, the last six years as the agency's chief statistician—to vet my approach. The results show a very different trend, with labor's share of output currently equal to or greater than four consecutive years in the mid-1990s.

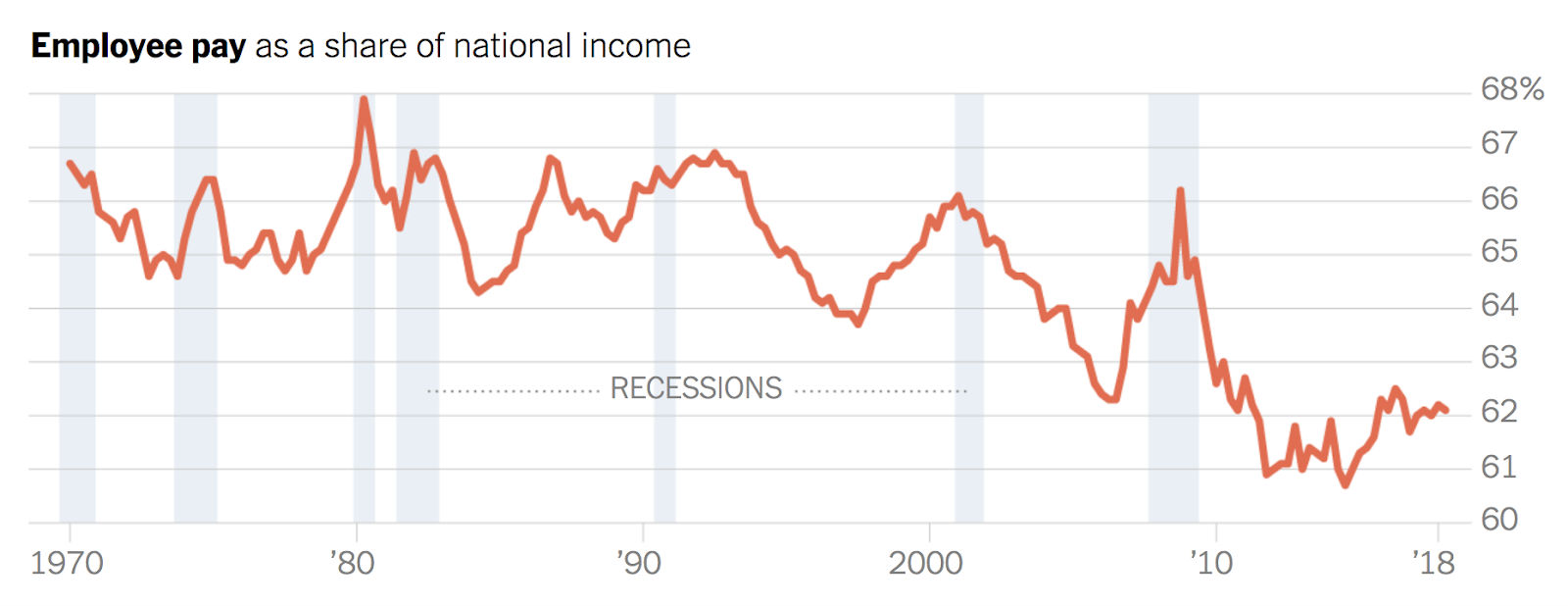

Ironically, in The New York Times, reporter Patricia Cohen runs distorted data that would throw doubt on her own narrative had a key part of the trendline not been cropped out. Under the label "Labor's Declining Share," the Times printed the following chart:

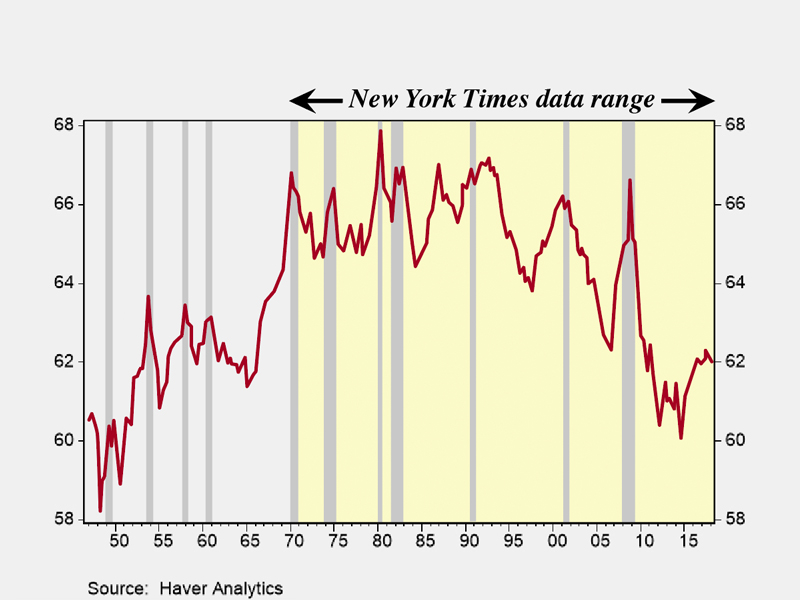

That does show a significant downtrend in the percentage of national income going to American labor. But what if we zoomed out? Here is how the chart looks with all the quarterly data provided by BEA, which start in 1947:

Notice that at the current 62 percent, labor's share of national income is generally equal to or higher than the years from 1947 through 1965, except during the aberrant periods of recession, when the ratio spikes because the denominator tends to fall faster than the numerator. Note also an even bigger spike during the Great Recession of 2008–09. Had our newspaper of record published the full version of this chart, Times reporter Cohen might have felt compelled to ask why labor's share is reverting back to levels following World War II—a period that progressives generally consider the glory decades of the American economy, when unions and factory work still accounted for a substantial share of employment and when cheap foreign labor was barely a factor.

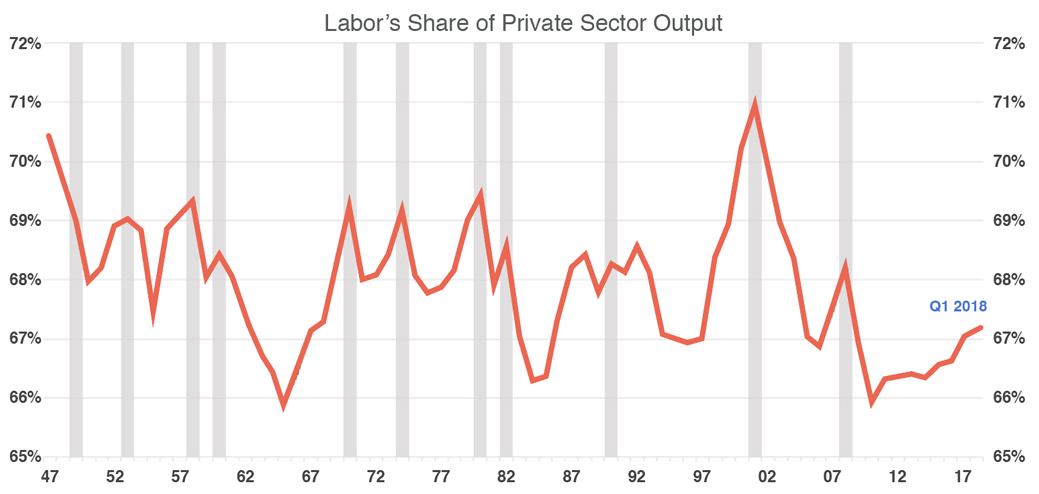

Tackling that mystery would be a waste of time, though, because there are further distortions and omissions. Here's a more accurate look at labor's share of private sector output, in which the data is expressed annually instead of quarterly (at the suggestion of Robert Parker), in order to smooth out intra-year volatility. The final data point is for the first quarter of 2018, the most recent available period:

The time from 1947 to 1965 is now higher compared to later decades, with the entire historical range pretty well captured from 1947's high of 70.4 percent to 1965's low of 65.9 percent. Labor's current share, at 67.1 percent, is on the low side of that range, but it is equal to or greater than the years from 1994 to 1997. At the current level, the recent trend looks cyclical, as labor's share slowly climbs back from the 2010 low of 65.9 percent hit in the wake of the Great Recession's 10 percent unemployment rate in late 2009.

The false alarm about labor's plummeting share can be avoided by adjusting for components in the data that have skewed the trend. Failing to make those adjustments would be like concluding that a country has a soaring mortality rate when the median age of its population has doubled from 30 to 60.

Among the flaws in the Times' chart, there is the use of national income in the denominator, which introduces two distortions in the trend. First, it includes the government, which should be excluded, since this story concerns the capitalist private sector. (Recall the words in the Times headline: "Paychecks Lag as Profits Soar.") Second, by starting with national rather than domestic income, it includes the distorting effects of inflows and outflows from foreign countries. The BEA shifted three decades ago to reporting gross domestic product rather than gross national product, making the change to avoid that very problem. In the numerator, the Times errs by including compensation of government workers, and by excluding a significant part of private compensation that comes from the self-employed.

The denominator of our ratio begins with what the BEA calls "net domestic product" and "net domestic income," and then takes out the portion attributed to all levels of government, in order to isolate private sector net domestic product and private sector net domestic income.

By looking at net rather than gross domestic product and net rather than gross domestic income, we avoid the distortion that mars the widely cited data on labor's share released by the Bureau of Labor Statistics (BLS). The difference between gross and net is equal to the "consumption of fixed capital," or depreciation: the BEA's measure of "the decline in the value of the stock of fixed assets due to physical deterioration, normal obsolescence, and accidental damage."

Capital consumption has been taking a much larger bite than it used to because business has been investing far more than it once did in equipment and software rather than in structures (factories, offices, stores); and equipment and software depreciate much faster than structures. Since capitalists must keep replenishing their capital just to maintain the same level of output, net rather than gross measures belong in the denominator. Instead, the BLS uses gross measures, which helps create the illusion of a downtrend in labor's share.

Finally, our denominator takes an average for each year of private sector net domestic income and net domestic product, since each is using different sources to measure the same concept. This follows the example of the BEA, which takes a simple average of gross domestic income and gross domestic product,

The numerator of the ratio starts with total compensation—wages, salaries, and benefits—and (unlike the Times) takes out the compensation of government employees. It also includes a key component that tends to boost the 1950s and '60s, along with the present period: income of the millions of self-employed, recorded as "proprietor's income" by the BEA. The Times omitted that, but the BLS adds it to the numerator. Until 2001, the bureau had assumed that 85 percent of proprietor's income had gone to labor compensation (and the rest to proprietor's profits), but since then it cut this to less than half, for reasons that seem dubious. Instead, this calculation assumes a consistent 80 percent from 1947 to the present.

Of course, this exercise does not address widening inequality of pay. Our numerator of total private sector compensation commingles the high-paid labor of lawyers with that of fast-food workers. But when it comes to the issue at hand, skeptics are invited to scrutinize every line from the BEA tables used to produce this chart.

If unbiased data from the Bureau of Economic Analysis cannot validate a clear downtrend in labor's share, how valid can that downtrend be?

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"Are American workers getting shafted?"

In order to answer the question, should we not turn to our resident genius, Ellis Wyatt?

........."you just don't understand the constitution"...........something, something, something, 9th...."

You didn't bold anything there. IMPOSTER

No snorts either.

damn....have to do better next time.

Ellis Wyatt? Never heard of him. He writes for Reason?

I'm guessing he was Robby's genius friend up until an accident in a chem lab resulted in Ellis' total and permanent hair loss. Wyatt blamed Robby and his gorgeous coiff for the mishap and has been his sworn enemy ever since.

Anyway, I figure it's probably something like that...

Figures don't lie, but liars figure.

I figure I'd be lying if I told you that leggy liars with nice figures are not appealing.

If those charts used 0% to 100% on the vertical axis instead of 65% to 72 %, those peaks and valleys would sure smooth out.

Why would they want to do something reasonable like that? Why not make a 3% change look huge and scary when you can.

"Of course, this exercise does not address widening inequality of pay. " Which is why it doesn't address the BIG economic issue, that the top 20% of the economic distribution are swallowing up a majority of the rewards of economic growth, which is why we see the embrace of Trumpian national socialism on the right and Bernie-ite socialism on the left, with us free-market types left in a shriveling center.

Widening inequality of pay is the biggest non-issue of all time.

Who cares if someone can take care of their 'needs' 100,000,000 times over if you can also take care of your needs.

The question is how much work are you doing to meet your needs, and by any metric it's significantly less than at any time throughout virtually all of history for pretty much everyone.

That is no way to foment class warfare, comrade.

I tell that to people, and they are indignant. And then they watch KUWTK, having no problems with non-productive buffoons making tens of millions.

Lies, damn lies, and statistics.

None, of that's relevatory. Plenty of economists have pointed out that the actual total compensation hasn't declined. However, healthcare and other costs have bloomed, so that the effect has been a "stagnant" wage. However, that stagnant has a qualifier. Generally speaking minority and women's pay has increased and white males pay has decreased.

So, there are multiple moving parts to the story.

Yup.

More than one moving part makes is a little difficult for people that call themselves journalist these days.

The costs that have bloomed are largely the government regulated or subsidized goods and services (healthcare, higher education, particular agricultural segments, etc.)

Meanwhile just about everything else has gotten substantially cheaper (computers, cell phones) and/or fancier (televisions, automobiles.)

I don't think the problem is actually greedy capitalists; To the extent the money isn't going to labor, it's not going to capital, either.

It's being intercepted by greedy management. That's the real problem: Administrative bloat, and management refusing to disgorge profits to stockholders.

Unless you're going to start your own company, the normal way to become a "capitalist" is to buy stock in an existing company. But owning stock no longer delivers to you the profits of the company you own part of, because management doesn't distribute the profits. It expends most of them paying itself, and retains the rest in the company.

It's a massive failure of fiduciary duty, IMO.

I don't have the figures but I was under the impression there's been a dramatic increase in stock buybacks recently and that's why the market has done so well.

Stock buybacks are similar to dividends, but not identical. If management is paid in stock options, dividends don't benefit them, but stock buybacks do benefit them. So....

This 100%.

Nowhere in that 'total compensation' is there even a mention of stock options. That form of compensation took off in the early 1990's after Congress forced FASB to withdraw their proposed method of accounting for their issuance. They essentially became free lottery tickets and have completely perverted compensation itself for senior executives and more pervasively in tech. Everything about them now encourages fraudulent accounting, fraudulent use of financial leverage, mismanagement of companies to encourage volatility rather than old-fashioned 'growth/ROI' - compounded by subsidized interest rates that distort the earnings multiples on financial assets.

The double-taxing of dividends - and the encouragement of a short-term casino/speculation v a long-term investment mindset in the financial markets - along with the complete abdication of corporate governance by both index investing and HFT - also mean that the agents are gaming everything for their own benefit. At least re those principals who aren't wealthy enough to control the companies they own and who are naive enough to think that all capital/savings are treated equally.

re: "owning stock no longer delivers to you the profits of the company"

Objection - assumes facts not in evidence. In addition, it's at least half wrong. Companies have two primary ways of distributing profits back to shareholders. One is to take the profits, divide up by the number of shares and pay out a dividend. Everyone gets their money (whether they need it right now or not) and everyone has to pay taxes on the dividend (regardless of their current tax situation). Note that having paid out the dividend, the company now has less cash, therefore less total assets which means less equity per share. Share price goes down by the amount necessary to keep total value pre-dividend equal to total value post-dividend + value of dividend. Paying out a dividend also requires rather a lot of careful accounting and recordkeeping, all overhead that pulls further assets out of the company.

con't

con't

The second technique to distribute profits back to shareholders is, indeed, to retain the profits in the company. That sounds contradictory but it's not. It is a technique that allows far greater choice. Companies that retain cash have greater assets, therefore higher share prices. Those shareholders who need cash can sell some of their shares. Those shareholders who want to recognize taxable income can do so on their own timescale. And while the stockbroker does usually take a fee for handling the transaction for it, in aggregate it's on a par with and maybe a little less than the accounting overhead of a mass dividend distribution.

You have a point about CEOs overpaying themselves but you're wrong about the economic consequences of asset retention.

You're wrong about that decision being basically neutral. The decision is based almost entirely on tax consequences (both the double taxation of dividends and the non-taxation of unrealized appreciation) and on putting the interests of agents ahead of principals (exec pay is driven far more by size of company than by ROI/performance).

I don't believe I ever said that the decision was neutral. In fact, I specifically mentioned some of the tax advantages to shareholders of the retained assets approach (though you are correct that there are other potential tax advantages to the shareholders as well).

I'm not sure that I agree with your point about executive pay, however. Most of the studies I've read do match your assessment that size of the company matters - and probably a lot more than it should. But those studies don't measure size by assets. Most of the studies I've seen ranked company size by annual sales. That metric is unchanged by a decision to pay dividends or not.

Democrats prove their exinimic ignorance when they shout rage at incomes not following productivity growth. Productivity growth is split among a multitude of factors: profit, income, employee costs (benefits and regulation costs), and price to consumer. Democratic policies have grown the costs of employment by immense bounds since the late 1960s which has essentially taken away the possible growth of incomes. ACA is a glaring example. Diversity management to avoid lawsuits another. Democrats can't bitch about incomes when it is their regulations and forced benefits which take away from that pie.

Economic . . Stupid phone

Great point. Democrats are so illiterate on economics that they cannot register that out of total sales for a company, all their regulations have costs taken from that pie.

I think top executive pay is too high for what companies get in return but executives want to cash out early so they want golden parachutes before they take those jobs.

If government stayed out of business more, executives could take less up front and know their future will also get them large returns. As it stands now, you never know how bad government will fuck you in the future.

" Productivity growth is split among a multitude of factors: profit, income, employee costs (benefits and regulation costs), and price to consumer."

One of the drivers of productivity growth is increasing investment in automation.

If auto plant productivity increases because the company installs more robots there's no reason labor should "get a share" because they did not produce that productivity increase - the machines did.

Of course the idea that labor is somehow "entitled" to some certain fixed percentage of income, wealth, etc as if they had some sort of "property right" claim to it is nonsense to begin with. The relative value of any activity is subject to the laws of supply and demand and those factors are always in flux and always have been. No one is "entitled" to any particular outcome and no one owes anyone else any particular outcome.

More of this and less Robby, please.

Wouldn't you need to compare net domestic product/income to net personal income? And specifically, you are then discounting major expenses that are typically subsidized by employers (e.g. health insurance and pensions)?

The BLS has already published charts that exclude government employees in addition to other sectors that you neglected to exclude.

Of course, this exercise does not address widening inequality of pay. Our numerator of total private sector compensation commingles the high-paid labor of lawyers with that of fast-food workers.

In other words, it's meaningless game-playing that doesn't address any real issue. Thank you for your candor.

^^You have to take a look sector by sector. You also have to look at medians, not means.

'There are lies, damned lies.. and then there are statistics!' .... At 69 and retired, my gut tells me that the average worker has lost out in buying power, security, and job opportunity. Very simply, I rented a one bedroom apartment, had a 10 year old car, had medical and dental coverage, ate well, smoked, drank and partied on my relatively low salary at Goodyear, 40 years ago.

Allowing for a better than average salary.. Say $15 p/h, I doubt I could still do so on that $2400 ( say $1800 after taxes). I doubt I could afford a 1 bedroom apartment at say $1300 a month, with $100 utilities, gasoline $150 a month, registration, car insurance and maintenance of $200 a month(?), food, $300 a month,. and we haven't even touched on medical and dental.. presuming your employer even offers it... Forget going out drinking or a carton of cigarettes at $70 or movies at $20, etc... How soon authors forget.

How soon authors forget.

Most of them are too young to remember.

It is important to look at all sides of a debate, and slice and dice numbers different ways to get different pictures of things. Numbers are easy to coax into saying what you want if you try hard enough.

I think your personal example is probably about right though. I think there are 3 main reasons for this in 1st world countries.

1. Automation had legitimately reduced the need for low/mid skilled labor in many ways. Only so many people have the capabilities to move up the food chain into higher skilled work.

2. The work that hasn't been automated has largely been outsourced.

3. Since #1 and #2 weren't bad enough for the working class, we've also changed immigration policies to allow in more unskilled people into 1st world nations.

All this amounts to less demand/excess supply of low/medium skilled labor in 1st world economies. Which matches up about perfectly with the statistics. The lowest end of labor has essentially seen no real net pay increase, but because others further up the income distribution chain HAVE seen pretty solid pay raises, it has driven up cost of living. That rent/mortgage has gone up a LOT for most people as a share of their pay, excess regulation has driven up medical and other things.

So it's definitely a tough spot in that lowest quintile right now. You can not be in favor of doing anything about it, AKA messing with the market, but I do find it odd how many libertarians won't even acknowledge that it's kind of a rough thing for lots of people.

We've also embedded a particular work ethic in our economy - without the ability to 'drop out' and still survive.

There's a lot of truth to the notion that people tend to be Type A's (live to work) or Type B's (work to live) - and most people are actually B's. They mainly value off-work stuff like family/leisure/hobbies/etc. They will be motivated to work only up to the point where they meet their first two levels of Maslow-type needs - and then will prefer to withdraw their labor from work and spend time with family/etc.

Virtually everyone at the top (owning property or making mgmt/org decisions or in govt/church/academia/etc as well) is a Type A. Their work itself gives them the recognition they want. The work itself meets the higher-level of Maslow-type needs. Because the work itself is what motivates them, they will be the ones who work hard and tend to succeed more at work. And they will tend to resent Type B's precisely because they are different and don't care much about A's status/recognition/centrality.

Since A's are in position to make the rules, they can tilt the field so that the B's have to work increasingly harder just to get to that survival point - which can be compounded by colluding with the other A's in other types of org (eg govt). A's love to compete - with each other - to be king of the mountain. But they can all find common ground in suppressing the B's and making sure everything in society is run by A's rules.

This applies to both the producing side of our lives and the consuming side. All advertising/PR is designed to psychologically move us down the Maslow hierarchy. So that this/that good becomes 'needed' for physiological/safety/belonging reasons - and it then raises the threshold of how much we have to work in order to acquire it. And the more we understand the human brain, the more effective that manipulation becomes.

"Since A's are in position to make the rules, they can tilt the field so that the B's have to work increasingly harder just to get to that survival point - which can be compounded by colluding with the other A's in other types of org (eg govt). A's love to compete - with each other - to be king of the mountain. But they can all find common ground in suppressing the B's and making sure everything in society is run by A's rules"

An interesting spin on things. I can't say I've ever thought about it quite from that angle. I can see there possibly being some truth in it though.

Well said, vek.

"1. Automation had legitimately reduced the need for low/mid skilled labor in many ways. Only so many people have the capabilities to move up the food chain into higher skilled work."

There's also this: moving up the food chain, even getting a foot in the door to have a chance, is now contingent on opposite virtues than what are primarily proclaimed.

Hard work has minimal impact in the corporate world. Indeed, it can be a negative. Gregariousness, obedience, and mediocrity are in demand. One may work 12 hours a day and be less productive than another who works 6 hours a day, but the "hard" worker is the one who's there longer, smiles and affirms what management says, doesn't volunteer innovation, and has a blandly typical personality.

Intelligence matters very little, but degrees do. To be middle class, rather than upper or lower, one must be above all else a drone.

That is, the majority of professions don't really require any skill beyond being unobjectional and broadly social. The great thing about mediocrity is it is so non-threatening.

And it is precisely the progressiveness of corporatism that leads there. Requirements for licensing stifle independent initiative, HR culture stifles innovation and nonconformity, litigation stifles risk taking. I dare say that Home Depot and Coke and such depend on very few people that offer any actual ability beyond repetitive motions that could be performed by almost anybody. Further, these corps are self-perpetuating - the quality of the drones does not matter, nor that of higher management. The brand makes money and insulates all but the highest up from their own incompetence.

Pretty much. In a well oiled machine, AKA major corporation, you really just need drones that can do a half assed job exactly as described in the manual for that position.

I knew a retired telecom executive vice president who was so incompetent I wouldn't hire him to be a janitor... But he SEEMED smart when you first talked to him, and he was personable. He made it pretty high up the food chain for somebody who couldn't cut it working at a McDonalds! That guy was what REALLY made me realize how fucked major corporations are, and that they totally deserved the rep of being filled with incompetent morons.

Forgetfulness or bullshit? Cut through the tribal babble and labor's share is shrinking to where it was 50 years ago, erasing all the gains since then. Let's compare labor's share with 1900, and show fantasmagoricak growth!.

This is why progressives keep kicking our ass, while our bobbleheads nod like ... bobbleheads.

What difference does it make as long as plastic straws are prohibited. It's for our own good.

Labor and capital income shares, may not accurately reflect either the distribution of income in general, or even the distribution between "bosses" and "workers." Remember, CEO pay counts as labor income and employee retirement gains count as capital income. If workers' retirement benefits get squeezed while wealthy investors flourish, then the capital income distribution is diverging. If CEO salaries skyrocket at the same time that entry-level wages have actually lost ground, then labor income is getting more unequal.

Policies aimed at promoting a large sector of employee-owned businesses, are probably the best tool we have to limit the inequality of both labor and capital incomes.

An actual interesting article! Nice!

It definitely seems to be a better way to slice/dice the numbers versus the way the lefties did it. There is value in looking at these things from all angles though. Even if you don't want to mess with the way things are going on their own, it can be useful to know the true facts, and some of the implications. Like it or not people have a sense of "fairness" that comes into play in our dealings. Those experiments that showed people would rather receive nothing than allow somebody else to receive an unfair portion of money for instance. It's not logical, but it's what most people do.

I think the kick to the balls the working class has legitimately taken in many ways, both because of inevitable technological progress and government policy, is surely a big part of the Trump/Sanders appeal.

Time to rein-in the Robber Barons, starting with SiliValley, and their like-minded corporate counterparts on the S&P-500.

Tribal snark. Labor's share is declinng to where it was 50 years ago, erasing all the gains since then. Sing along with me, "Don't worry. Be happy."

It's actually an ignorance of elementary arithmetic. so we see yet another tribal hissy fit between the left and right. Average and median wages have been declining since the 1986 Tax Reform Act began punishing the employers who create jobs with the best wages and benefits. Now do the math.

If only one worker's $80,000 job disappears, and $55,000 is the best available, then average and median wages decline and the rich have a higher share of what's left .. even if NOBODY else has a wage decline. We need over 10 decimal places to see it, but the arithmetic is maybe junior high,

For decades, fiscal conservatives have been babbling nonsense like this, from a genuine desire to oppose greater government. But anti-gummint gooberism keeps getting its ass kicked by progressives, in the court of public opinion.

Watch closely. It's only the right that babbles about the size of government, with catch phrases like limited government and shrinking government. The left is not so stupid. They talk only about perceived benefits of their policies.

"Sell the sizzle, not the steak" is now rocket science. How do we restore the libertarianism of the 70s and 80s? Before we forgot what sizzle even is.

MCM Millie Monogrammed Flap Crossbody Bag In Black

Shop http://www.mcmbackpacksoutletonline.com Cheap MCM Backpacks Outlet Store and Buy MCM Millie Monogrammed Flap Crossbody Bag In Black, Save Big Discount, Fast Delivery and Free Shipping...

http://www.mcmbackpacksoutleto.....black.html