Trillion-Dollar Deficits Are Back and Here to Stay

The Congressional Budget Office is about to release a report. Spoiler alert: It won't be pretty.

Budget-watchers have been predicting the return of trillion-dollar deficits for months. That forecast will likely become offical—or as official as these things can ever be—later this week, when the Congressional Budget Office (CBO) releases its annual outlook for revenue and spending.

The 2018 Budget and Economic Outlook will be the CBO's first major assessment of the federal government's fiscal trajectory since December's sweeping tax bill and February's two-year budget deal, which shattered spending caps and boosted federal outlays by more than $400 billion. Either of those developments would have been likely to increase future deficits, but together they'll be like adding cocaine to your morning coffee. Even under the sunniest set of assumptions, the tax bill will add between $1 trillion and $1.5 trillion to the deficit over the next decade; the spending plan tacked on another $320 billion.

That means trillion-dollar deficits are the "new normal," says Stan Collender, author of The Guide to the Federal Budget, in a new column at Forbes. It fact, the deficit is likely to push well above the $1 trillion in future years.

Because the CBO can only make projections based on current law, its outlook will include the phase-out of some tax cuts in the middle of the next decade. That means the CBO will be forecasting higher revenue levels near the end of its 10-year forecast, even though it's politically unlikely that those phaseouts will be allowed to occur, Collender explains.

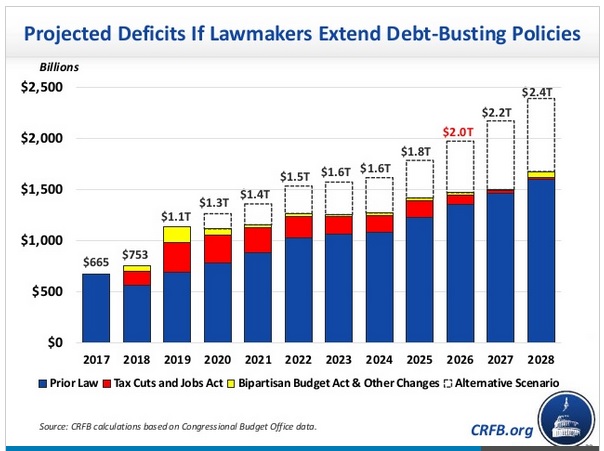

For much of the same reason, other independent analysts, such as the Committee for a Responsible Federal Budget, are already saying the deficit could push toward (or even past) the $2 trillion threshold by the end of the 2020s.

President Donald Trump and congressional Republicans are likely to use a well-worn page of their playbook to remind everyone that trillion-dollar deficits happened under Barack Obama too. This is true, of course, but there key differences between the years 2008–2012 and today. Those four years of trillion-dollar deficits happened during and immediately after the so-called Great Recession, which cratered tax revenues and saw increased government spending on a variety of mostly ill-conceived and generally wasteful efforts to stimulate the economy or bail out certain industries.

Today, unemployment is less than 4 percent and the economy has been humming along with hardly a hiccup for several consecutive years. Government coffers should be full to the brim, or at least they shouldn't be running dry.

It's also true that the White House's official budget projects a mere $363 billion deficit in 2028. But getting to that level requires Congress to enact more than $1 trillion in spending cuts over the next decade—something that seems well beyond the realm of fantasy and nearing the border of complete political impossibility. While some members of Congress care about reducing deficits, it is now clear that the Republican majority in both chambers and the Republican in the White House have little interest in being responsible stewards of the federal purse. And the Democrats aren't exactly offering a fiscally responsible alternative.

Keep in mind that all these projections include the underlying assumption that the economy will continue to grow for the next decade. What happens if there's another recession?

"If the economic outlook doesn't turn out to be as rosy as the White House is promising, the very high Trump era federal budget deficits will be even higher," says Collender.

Within a few years, we might be wishing for the return of merely trillion-dollar deficits.

Show Comments (67)